- Home

- »

- Electronic & Electrical

- »

-

Smart Ceiling Fans Market Size, Share, Global Industry Report, 2025GVR Report cover

![Smart Ceiling Fans Market Size, Share & Trends Report]()

Smart Ceiling Fans Market (2019 - 2025) Size, Share & Trends Analysis Report By Application (Residential, Commercial), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-393-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global smart ceiling fans market size was valued at USD 698.4 million in 2018. Rising consumer preference for convenient products along with the rapid adoption of advanced technology is expected to drive the market. Furthermore, high demand for technologically advanced products, especially from millennial consumers coupled with easy access to a wide range of products is expected to positively affect market growth.

Changing consumer lifestyle and rising inclination for convenience and the latest technology are some of the major factors driving the demand for smart ceiling fans. Rising adoption of smart household appliances including smart ceiling fans that can be controlled through internet and smartphones, is anticipated to drive the growth.

Smart fans have a wireless connection, advanced cooling functions, and automatic temperature control among other features. Consumers can effortlessly operate these products by downloading the compatible app including Google Assistant and Alexa on their mobile phones and connecting them through Bluetooth or Wi-Fi. The consumers can maintain appropriate humidity, ventilation, and keep the air free from dust and aerial microorganisms with the help of these fans. The advanced features such as climate control and energy-efficiency have been encouraging consumers to opt for these products.

Rising adoption of smart ceiling fans with LED lights in innovative styles and designs is anticipated to drive innovation in the market. The manufactures have been emphasizing on technological advancements and innovative styles to cater to consumer demand. For instance, the introduction of bladeless ceiling fan has been gaining significant popularity in modern homes. However, the relatively high price of smart fans compared to their conventional counterparts is expected to hamper the smart ceiling fans market growth.

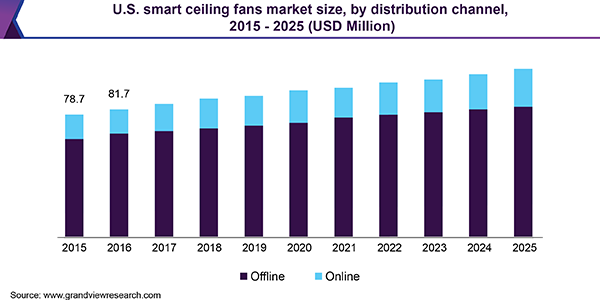

Distribution Channel Insights

Offline distribution channel accounted for the largest market share of more than 80% in 2018. Consumer preference for brick and mortar distribution channels, especially the specialty stores, due to the provision of detail instructions about installation and after-sale services by the professionals, is anticipated to fuel the segment growth. Furthermore, the easy availability of compatible product accessories has been attracting buyers to purchase from these channels.

Online distribution channel segment is anticipated to expand at a CAGR of more than 6% from 2019 to 2025. Rising spending on e-commerce for purchasing home appliances among the middle-income population due to the rising use of smartphones and the internet is anticipated to drive the segment growth. In addition, growth of online retailers, especially company-owned shopping portals, such as Ottomate International, Orient Electric Limited, and LG Electronics among others is expected to speed up online sales in the upcoming years.

Application Insights

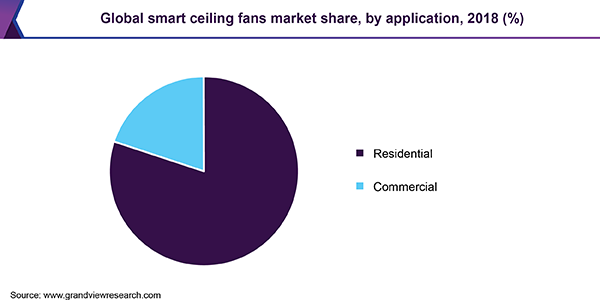

Residential application held the largest share of the smart ceiling fans market, accounting for more than 80% of revenue share. Rising adoption of smart devices has been boosting the product demand from the residential sector. Furthermore, rising demand for silent and energy-saving fans is driving the segment growth. Consumers opt for these products as they complement the modern and smart homes. These products offer room-specific climate. In March 2019, Ottomate International, launched Ottomate Smart Fan, which enables Bluetooth mesh connectivity. The Otto mode of the product allows it to adjust the airflow automatically by sensing the climate conditions of a particular room.

Commercial segment is expected to witness the fastest CAGR of 5.5% from 2019 to 2025, due to rising demand for products with energy-efficiency and automatic temperature control features. The advanced technology makes it easy to control multiple fans at the same time. Therefore, the application of the product is expected to witness a significant rise in commercial buildings including manufacturing facilities, offices, and malls. Over the past few years, manufacturers have been launching products to expand their reach to this sector. For instance, in May 2019, Delta T, LLC’s Big Ass Fans introduced Powerfoil D suitable for harsh industrial environments.

Regional Insights

In 2018, Asia Pacific led the market, contributed to more than 60% of the global revenue share. Rise in middle-class population in the developing countries, including China, Bangladesh, India, and Indonesia is driving the regional demand for premium home appliances. Additionally, hot climate South Asian countries is expected to promote the use of smart cooling devices, including smart ceiling fans.

Over the past few years, the key market participants have been expanding their business in this region to cater to the rising product demand. For instance, in May 2019, LG Electronics entered the smart fan industry in India by launching its The Fan. It is compatible with Amazon Alexa and LG SmartThinQ and is also equipped with the mosquito away feature.

Key Companies & Market Share Insights

Key market participants include Hunter Fan Company; Orient Electric; Delta T, LLC; Ottomate International; Minka Lighting Inc.; Modern Form; Fanimation; OCECO; Havells India Ltd.; and CG Power and Industrial Solutions Limited. Over the past few years, the companies have been investing in product innovation o gain a competitive advantage. For instance, in October 2018, Orient Electric, a CK Birla group company, collaborated with Tata Elxsi to improve product performance and design. In another development, Orient Electric launched an energy-efficient Orient Ecogale ceiling fan under its Eco-series range, which consumes 32-watt power compared to the 70-watt power consumed by the fans operating on an induction motor.

Smart Ceiling Fans Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 770.2 million

Revenue forecast in 2025

USD 993.6 million

Growth Rate

CAGR of 5.2% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; China; India; Brazil; South Africa

Key companies profiled

Hunter Fan Company; Orient Electric; Delta T, LLC; Ottomate International; Minka Lighting Inc.; Modern Form; Fanimation; OCECO; Havells India Ltd.; CG Power and Industrial Solutions Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global smart ceiling fans market based on application, distribution channel, and region:

-

Application Outlook (Revenue, USD Million, 2015 - 2025)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Offline

-

Online

-

-

Region Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart ceiling fans market size was estimated at USD 733.2 million in 2019 and is expected to reach USD 770.2 million in 2020.

b. The global smart ceiling fans market is expected to grow at a compound annual growth rate of 5.17% from 2019 to 2025 to reach USD 993.6 million by 2025.

b. Asia Pacific dominated the smart ceiling fans market with a share of 61.4% in 2019. This is attributable to rise in middle-class population in the developing countries and hot climate South Asian countries is expected to promote the use of smart cooling devices, including smart ceiling fans.

b. Some key players operating in the smart ceiling fans market include Hunter Fan Company; Orient Electric; Delta T, LLC; Ottomate International; Minka Lighting Inc.; Modern Form; Fanimation; OCECO; Havells India Ltd.; and CG Power and Industrial Solutions Limited.

b. Key factors that are driving the market growth include rising consumer preference for convenient products along with the rapid adoption of advanced technology and smart household appliances.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.