- Home

- »

- Electronic Devices

- »

-

Smart Demand Response Market Size & Share Report, 2030GVR Report cover

![Smart Demand Response Market Size, Share & Trends Report]()

Smart Demand Response Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Residential, Commercial, Industrial), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-694-3

- Number of Report Pages: 86

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Demand Response Market Summary

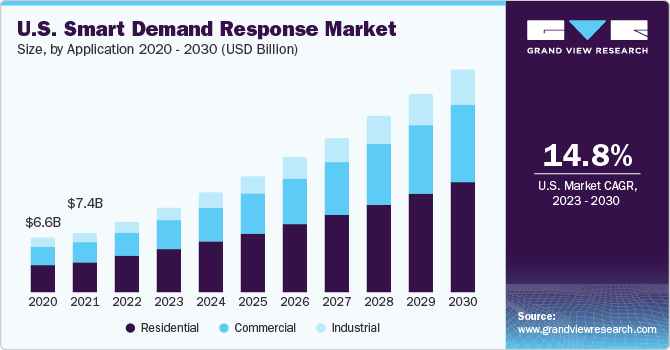

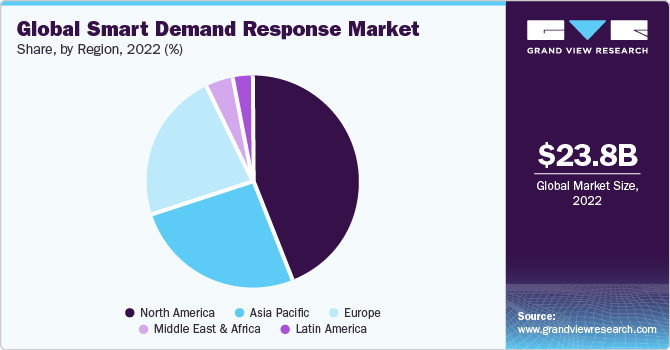

The global smart demand response market size was estimated at USD 23.81 billion in 2022 and is projected to reach USD 88.79 billion by 2030, growing at a CAGR of 17.4% from 2023 to 2030. Advancements in technology in the utility vertical and the introduction of regulatory frameworks are expected to increase smart grid deployment, which is estimated to drive industry growth.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 43.8% in 2022.

- Asia Pacific is expected to register the fastest CAGR of 21.0% during the forecast period.

- By application, the industrial segment projected to grow at a CAGR of 18.3% over the forecast period.

- By application, the residential segment accounted for the largest revenue share of around 52.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 23.81 Billion

- 2030 Projected Market Size: USD 88.79 Billion

- CAGR (2023–2030): 17.4%

- North America: Largest market in 2022

Growing smart grid roll-outs enhances customer energy management systems, integration of renewable energy, and automation in transmission and distribution (T&D) systems. Favorable DR programs and policies are expected to accelerate growth. Leadership in Energy and Environmental Design (LEED) is also expected to boost revenue over the forecast period. For instance, the U.S. Green Building Council announced a LEED DR Pilot program to encourage demand response participation. Building owners can earn additional LEED credits if they implement fully automated solutions.

Intelligent metering and advanced ICT DSM solutions for energy management in buildings appear to be an opportunity to exploit renewable energy resources, achieve energy savings, and encourage customers’ participation in the ecosystem.

Application Insights

Based on application, the market is segmented into residential, commercial, and industrial. The residential segment accounted for the largest revenue share of around 52.0% in 2022. There is a growing need to improve energy efficiency and reduce carbon emissions in residential buildings. Smart demand response solutions allow homeowners to manage their energy usage better, optimize consumption during peak demand periods, and contribute to grid stability and sustainability.

For residential customers, demand response (DR) programs entail direct load control of the larger appliances at home6, which includes water heaters, pool pumps, and air conditioning systems. The growing use of distributed generation, particularly from residential consumers, helps maximize the DR potential.

Intelligent buildings are expected to participate in DR programs to protect the electrical grid during high peak energy demand. Reducing loads during high-cost periods is expected to reduce electricity bills, proving advantageous to consumers.

The industrial segment is estimated to register the fastest CAGR of 18.3% over the forecast period. The rise of smart grids and the integration of distributed energy resources (DERs) are driving the adoption of smart demand response in the industrial sector. Smart grids enable bidirectional communication and control between utilities and industrial consumers, allowing for more precise monitoring and management of energy consumption. Integrating DERs, such as energy storage systems and electric vehicle charging stations, further enhances the flexibility and responsiveness of industrial demand response, as these assets can be utilized to store excess energy or adjust consumption patterns based on grid conditions.

Furthermore, increasing developments for commercial demand response can be attributed to the growing need for utilities to manage peak requirements and hardware technology improvements, including control equipment and metering.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 43.8% in 2022. There is a growing need to manage electricity demand and address peak load challenges. As energy consumption rises, utilities seek innovative solutions to balance supply and demand, reduce strain on the grid, and avoid potential blackouts or disruptions. In California, buildings are expected to contribute to the highest peak load. The Demand Response Research Center (DRRC) focuses on commercial and residential applications of technologies for dynamic peak load reduction with different response durations.

Asia Pacific is expected to register the highest CAGR of 21.0% over the forecast period. It can be attributed to the growing adoption of smart meters in the region. Increasing penetration of the meters allows the homes to connect to the data on usage and price. Time-based electricity pricing options, enabled by the mass rollouts of such meters, are also expected to open new avenues for the region.

Key Companies & Market Share Insights

The smart demand response market is highly competitive, and the players are undertaking strategies such as forecast launches, acquisitions, and collaborations to increase their global reach. For instance, in March 2023, Leapfrog Power, Inc. and Resideo Technologies, Inc. joined forces to introduce a new customer demand response using Amazon Smart Thermostats in California. The Amazon Smart Thermostat is an ENERGY STAR-certified device that integrates with Alexa, enabling users to maintain a comfortable and energy-efficient home effortlessly. This collaboration enables customers to purchase the Amazon Smart Thermostat at a discounted price and seamlessly enroll in demand response programs offered by Resideo. Leap's platform streamlines and automates the process of accessing energy markets, allowing smart energy devices like smart thermostats to participate in these valuable grid programs readily. Some of the major participants in the global smart demand response market

-

ABB

-

Eaton

-

Enel X S.r.l.

-

General Electric

-

Honeywell International Inc.

-

Johnson Controls

-

Oracle Energy and Water

-

Siemens

-

Schneider Electric

-

Itron Inc.

Recent Developments

-

In February 2023, Tata Power collaborated with AutoGrid to launch an AI-powered smart energy management system aiming at behavioral demand response among Mumbai's residential, commercial, and industrial users. This program aims to resolve the problems related to high energy demand while assisting India's transition to renewable energy and Net Zero Goals. The program aims to involve 55,000 home clients and 6,000 major commercial and industrial clients.

-

In July 2022, CPower acquired the U.S. demand response division of Centrica. Centrica is a company that offers integrated energy solutions and specializes in commercial and industrial load management for customers in ISO-NE, NYISO, PJM, and ERCOT. With this acquisition, CPower aims to become the leading provider of grid flexibility and reliability in the U.S. by leveraging customer-powered distributed energy resources.

-

In June 2022, CPower launched four demand response programs across the country. These programs enhance the company's efforts in offering grid-balancing solutions during the summer season. CPower is already responsible for managing a distributed energy resource (DER) capacity of over 5.3 GW throughout the U.S. They connect the assets of nearly 2,000 customers at more than 12,000 locations, forming virtual power plants that cater to the grid's real-time supply requirements.

-

In May 2022, Virtual Peaker collaborated with FortisBC to launch its inaugural demand response pilot program in Canada. Utilizing Virtual Peaker's distributed energy resource management system (DERMS), utilities like FortisBC can effectively manage their distributed energy resources, including rooftop solar panels, residential battery storage systems, and electric vehicles (EVs). Utilities can tailor and expand their operations by implementing demand response software to accommodate the growing prevalence of renewable energy sources.

-

In March 2022, Itron Inc. and Emerson Electric Co. collaborated to offer reliable thermostats for Itron's Bring Your Device (BYOD) program. They have integrated Itron's advanced demand response platform, IntelliSOURCE, with Emerson's Sensi thermostats to create the DER Optimizer solution. This solution allows for the direct control and management of thermostats in BYOD and direct install initiatives. With the BYOD approach, retail Wi-Fi thermostats and other third-party devices can be easily integrated into utility companies' DR, DER, and energy efficiency programs.

Smart Demand Response Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 28.96 billion

Revenue forecast in 2030

USD 88.79 billion

Growth rate

CAGR of 17.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

ABB; Eaton; Enel X S.r.l.; General Electric; Honeywell International Inc.; Johnson Controls; Oracle Energy and Water; Siemens; Schneider Electric; Itron Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Demand Response Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart demand response market report based on application, and region:

-

Application Outlook (Revenue in USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart demand response market size was estimated at USD 23.81 billion in 2022 and is expected to reach USD 28.96 billion in 2023.

b. The global smart demand response market is expected to grow at a compound annual growth rate (CAGR) of 17.4% from 2023 to 2030 to reach USD 88.79 billion by 2030.

b. North America dominated the smart demand response market with a share of 43.8% in 2022. This is attributable to the increasing adoption of Advanced Metering Infrastructure (AMI) by utilities and government agencies in the region.

b. Some key players operating in the smart demand response market include ABB; Eaton; Enel X S.r.l.; General Electric; Honeywell International Inc.; Johnson Controls; Oracle; Siemens; Schneider Electric; and Itron Inc.

b. Key factors that are driving the market growth include the integration of electric vehicles in smart grids, rapid installation of smart meters, especially in the residential sector, and integration of Distributed Energy Resources (DER), and roll-out of smart grids, which has increased the application of Advanced Metering Infrastructure (AMI).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.