- Home

- »

- Next Generation Technologies

- »

-

Energy Management Systems Market, Industry Report, 2033GVR Report cover

![Energy Management Systems Market Size, Share & Trends Report]()

Energy Management Systems Market (2026 - 2033) Size, Share & Trends Analysis Report By System, By Component (Hardware, Software, Services), By Deployment (On-Premises, Cloud), By Vertical (Manufacturing, Healthcare, Retail, Residential), By Region, And Segment Forecasts

- Report ID: 978-1-68038-666-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Energy Management Systems Market Summary

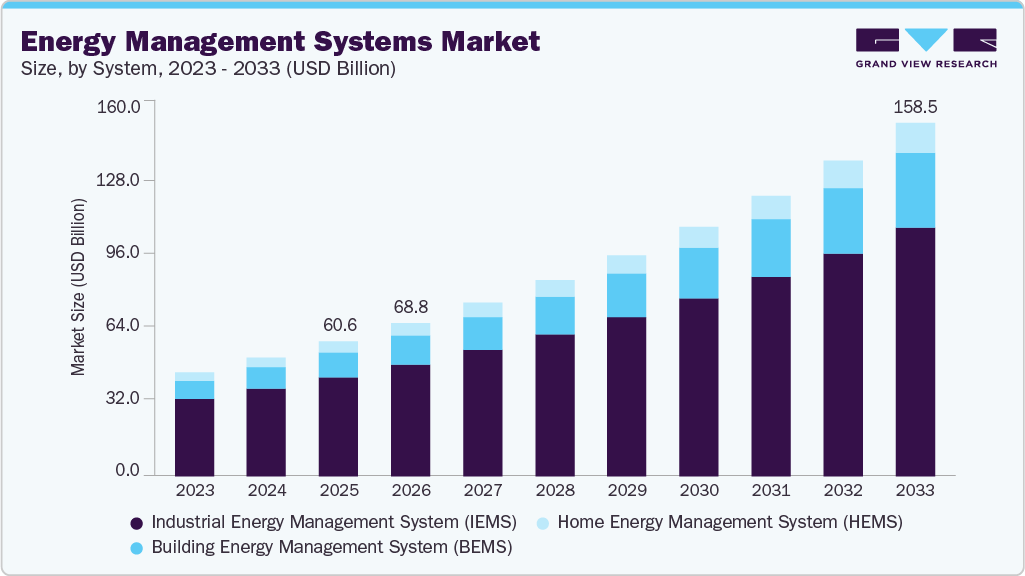

The global energy management systems market size was estimated at USD 60.61 billion in 2025 and is projected to reach USD 158.55 billion by 2033, growing at a CAGR of 12.7% from 2026 to 2033. The growing integration of renewable energy sources is driving demand for energy management systems, as organizations seek to efficiently balance variable power generation with consumption.

Key Market Trends & Insights

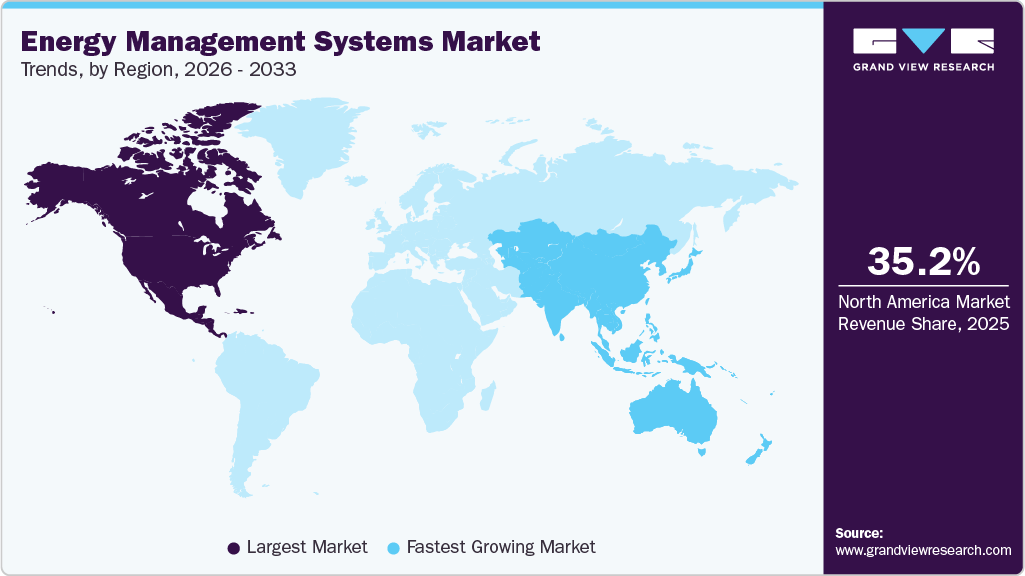

- North America Energy Management Systems (EMS) industry dominated the global market with the largest revenue share of 35.2% in 2025.

- The Energy Management Systems (EMS) industry in the U.S. led the North American market and held the largest revenue share in 2025.

- By system, the industrial energy management system (IEMS) segment led the market and held the largest revenue share of 73.6% in 2025.

- By component, the hardware segment held the dominant position in the market and accounted for the largest revenue share of 64.4% in 2025.

- By deployment, the cloud segment held the leading position in the market and accounted for the largest revenue share of 57.8% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 60.61 Billion

- 2033 Projected Market Size: USD 158.55 Billion

- CAGR (2026-2033): 12.7%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Energy Management Systems (EMS) platforms help monitor and optimize energy from solar, wind, and other renewables in real time. Advanced analytics and predictive algorithms allow for better load management and cost savings. This trend is accelerating EMS adoption in industrial, commercial, and utility sectors.The increased management of energy use in public, industrial, and commercial sector organizations has increased the demand for energy management systems (EMS). Furthermore, the rapid pace of digitization in the energy landscape and the significant shift in electrification are expected to increase the demand for energy management systems over the forecast period. The growing need for an efficient and reliable integrated technology platform for controlling, monitoring, and optimizing available energy sources is a crucial factor contributing to market growth. The high rate of commercializing innovative products, coupled with technological advancements, is anticipated to pave the way for future investments in the sector.

The EMS is an integrated information technology-aided analytical tool used across various platforms to achieve energy efficiency through process optimization of individual components in the system. These systems are expected to gain significant prominence in the next few years because of the growing requirements in industrial sectors and manufacturing and power & energy enterprises for real-time monitoring and assessment of energy consumption patterns.

EMS is experiencing significant growth due to increasing demand for energy efficiency and sustainability. Rising electricity costs are pushing industries, commercial sectors, and households to adopt EMS for better control over energy consumption. Government regulations and policies, such as carbon reduction targets and green building standards, further fuel adoption, mainly in the U.S. and Europe. The integration of smart meters, IoT devices, and real-time data analytics within EMS is enhancing operational efficiency. In addition, growing investments in renewable energy sources, such as solar and wind, are driving the need for advanced EMS to optimize energy storage and distribution.

Increasing awareness of environmental, social, and governance (ESG) practices is encouraging businesses to adopt EMS to enhance their sustainability profiles. Technological advancements, such as cloud-based platforms and AI-powered energy forecasting, are enabling better scalability and decision-making for EMS users. Utility companies are also promoting EMS adoption through demand response programs, incentivizing consumers to optimize energy use during peak hours. In addition, the push toward electric vehicles (EVs) and the need for efficient energy management in charging infrastructure are contributing to the market’s expansion.

System Insights

The Industrial energy management system (IEMS) segment led the market in 2025, accounting for over 73.6% share of the global revenue. Rising awareness about energy consumption, efficiency, and demand control is driving the growth of the IEMS segment. With the increasing emphasis on reducing carbon emissions and improving sustainability, companies across various industries are adopting energy management solutions to optimize their energy usage and reduce operating costs. Integrating industrial energy consumption systems helps energy-intensive industries increase profits by lowering energy costs. As a result, the industrial energy management systems segment is expanding rapidly, driven by the need for energy efficiency and the adoption of energy management solutions in various industries.

The Building Energy Management System (BEMS) segment is predicted to foresee significant growth in the forecast years due to the increasing focus on smart and energy-efficient buildings. Stricter building codes and sustainability mandates, such as LEED and Energy Star certifications, are driving the demand for BEMS solutions. The rising adoption of IoT-enabled sensors and automated controls is enhancing the ability of BEMS to monitor and optimize energy usage in real-time. With the growing demand for remote work and hybrid offices, companies are leveraging BEMS to reduce energy costs by managing heating, ventilation, and air conditioning systems efficiently.

Component Insights

The hardware segment accounted for the largest market revenue share in 2025 due to the increasing deployment of advanced sensors, controllers, and smart meters essential for energy monitoring and automation. The adoption of HVAC controllers, lighting control systems, and energy metering devices is rising across commercial, industrial, and residential buildings to enhance energy efficiency. Growing investments in infrastructure and retrofitting projects are driving the demand for hardware components, especially in developed regions such as the U.S. and Europe. In addition, the shift toward IoT-enabled devices and edge computing solutions is further boosting the need for robust hardware for real-time data collection and processing.

The software segment is expected to showcase significant growth over the forecast period due to the increasing demand for data analytics and predictive tools that help optimize energy usage. Cloud-based energy management platforms are gaining traction, enabling remote monitoring and control, which is vital for large facilities and distributed assets. Integration with AI and machine learning allows software solutions to provide actionable insights, such as forecasting energy demand and automating systems based on real-time conditions. As companies aim to meet sustainability goals and regulatory compliance, energy management software plays a key role in tracking carbon footprints and generating reports.

Deployment Insights

The cloud segment accounted for the largest revenue share in 2025 due to the growing preference for scalable, flexible, and cost-efficient energy management solutions. Cloud-based platforms allow organizations to monitor and control energy systems remotely, which is especially beneficial for enterprises managing multiple locations or distributed energy assets. The seamless integration of IoT devices with cloud infrastructure enhances real-time data processing, predictive analytics, and automation capabilities. Businesses are increasingly adopting cloud solutions to meet regulatory requirements and sustainability goals while reducing operational expenses by minimizing the need for on-site infrastructure.

The on-premises segment continues to be favored by organizations that require full control over their energy data and system infrastructure. Companies adopt on-premises solutions to meet strict internal security policies and ensure sensitive operational information remains within their facilities. These deployments enable real-time monitoring and management of energy consumption without reliance on external networks. Industries with complex operational environments prefer on-premises systems due to their high customization potential and seamless integration with existing equipment. This approach supports consistent performance, even in locations with limited cloud connectivity.

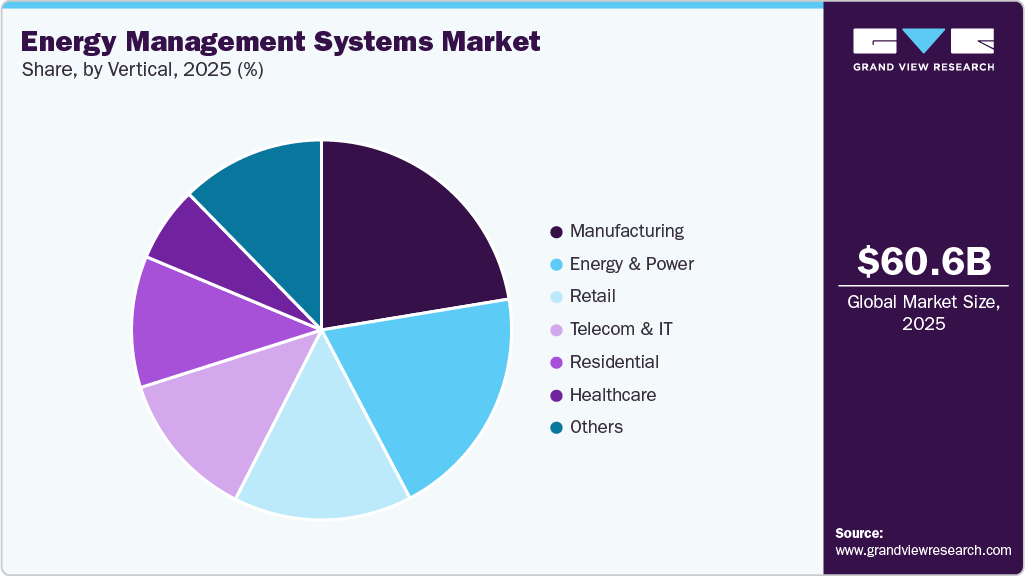

Vertical Insights

The manufacturing segment accounted for the largest market revenue share in 2025 due to its high energy consumption and the growing need to optimize operational efficiency. Manufacturers are increasingly adopting EMS to monitor and reduce energy usage across production lines, HVAC systems, and lighting, which directly impacts profitability. The rising focus on sustainability and carbon footprint reduction is pushing industries to implement EMS solutions that support compliance with environmental regulations. In addition, manufacturing facilities rely on EMS for predictive maintenance, minimizing equipment downtime, and ensuring continuous production.

The residential segment is projected to experience significant CAGR in the coming years due to the increasing adoption of smart home technologies and energy-efficient solutions. Rising energy costs are prompting homeowners to invest in EMS that optimizes the use of HVAC systems, lighting, and appliances. Governments and utility companies are offering incentives and rebates for adopting energy-saving technologies, further driving demand in the residential sector. The integration of solar panels, battery storage, and electric vehicle (EV) chargers is also boosting the need for advanced EMS to manage energy consumption effectively.

Regional Insights

North America Energy Management Systems (EMS) industry dominated globally with a revenue share of over 35.2% in 2025, driven by the early adoption of smart energy management systems in the U.S. and Canada. The region's advanced infrastructure and a strong focus on energy efficiency initiatives have positioned it as a leader in EMS deployment. Government regulations, such as energy efficiency standards and carbon emission targets, along with incentives for adopting smart technologies, have further accelerated market growth. High investments in IoT, cloud platforms, and smart grids are enabling businesses and households to optimize energy consumption effectively.

U.S. Energy Management Systems Market Trends

The U.S. Energy Management Systems (EMS) industry is expected to grow in 2025 due to increasing regulatory pressure aimed at improving energy efficiency and reducing carbon emissions. Federal and state governments are implementing stricter energy efficiency standards, incentivizing both businesses and homeowners to adopt advanced energy management solutions. The rising costs of electricity are prompting organizations to seek effective ways to monitor and control their energy consumption, driving demand for EMS technologies. In addition, the growing integration of renewable energy sources, such as solar and wind, into the energy mix necessitates advanced energy management systems to optimize their use.

Europe Energy Management Systems Market Trends

The Energy Management Systems (EMS) industry in the Europe region is expected to witness significant growth over the forecast period. Stricter regulations regarding energy efficiency and carbon emissions, driven by the European Union's Green Deal and various national initiatives, are compelling businesses and residential sectors to adopt energy management solutions. The increasing integration of renewable energy sources into the grid, alongside investments in smart grid technologies, necessitates advanced EMS to ensure efficient energy distribution and usage. In addition, the rise in energy prices across Europe is pushing consumers and businesses to seek cost-effective solutions to manage their energy consumption.

Asia Pacific Energy Management Systems Market Trends

The Energy Management Systems (EMS) industry in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period due to rapid urbanization and industrialization, leading to increased energy demand. Countries such as China and India are investing heavily in infrastructure development and smart city initiatives, which are driving the need for advanced energy management solutions. The growing focus on sustainability and renewable energy adoption is prompting both governments and businesses to implement EMS to optimize energy consumption and reduce greenhouse gas emissions. In addition, supportive government policies and incentives aimed at enhancing energy efficiency are encouraging the adoption of EMS technologies across various sectors.

Key Energy Management Systems Company Insights

Some key players in the EMS market, such as Schneider Electric SE, Honeywell International Inc., Siemens AG, and ABB are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

Schneider Electric SE is a global leader in energy management and automation solutions, specializing in optimizing energy use across various sectors, including industrial, commercial, and residential markets. The company offers a wide range of EMS that integrate IoT technology, software, and services to enhance energy efficiency and sustainability. With a strong commitment to innovation, Schneider Electric SE focuses on developing smart solutions that enable businesses to monitor, control, and reduce energy consumption effectively.

-

ABB is a technology company that focuses on electrification and automation, providing solutions to enhance energy efficiency across various sectors. Known for its extensive portfolio, ABB offers advanced EMS that integrates seamlessly with its automation and control technologies, enabling real-time monitoring and management of energy consumption. The company emphasizes sustainability, aiming to help clients reduce their carbon footprints and meet regulatory compliance through smart energy solutions.

Key Energy Management Systems Companies:

The following are the leading companies in the energy management systems market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- C3.ai, Inc

- Cisco Systems, Inc.

- GridPoint

- General Electric

- Honeywell International Inc.

- IBM Corporation

- Johnson Controls, Inc.

- Schneider Electric SE

- Siemens AG

Recent Developments

-

In September 2025, Honeywell International Inc. introduced the Ionic Modular All-in-One, a compact battery energy storage system for commercial and industrial use that combines flexible storage with advanced control and analytics to optimize energy costs and ensure grid stability. The system supports scalable power options from 250 kWh to 5 MWh, integrates cybersecurity protections, and can be managed onsite or remotely through Honeywell’s Energy Management platform.

-

In January 2025, ABB partnered with Edgecom Energy, a Toronto-based energy management startup, to integrate generative AI-driven capabilities into energy management solutions. This partnership enables industrial and commercial users to optimize power usage and reduce demand peaks. This partnership strengthens ABB’s digital energy portfolio by combining its Smart Power expertise with Edgecom’s AI Energy Copilot, supporting more efficient and sustainable energy operations.

-

In September 2024, Larsen & Toubro Limited's Power Transmission & Distribution (PT&D) business, through its Digital Energy Solutions (DES) division, secured a project to develop advanced energy management systems at Southern India's multiple state and regional load dispatch centers. This initiative enhances Larsen & Toubro Limited's DES's growing portfolio in intelligent grid modernization and digital solutions. The EMS will be installed in 12 control rooms at the Southern Regional Load Dispatch Centre and various State Load Dispatch Centers across Puducherry, Tamil Nadu, Andhra Pradesh, Kerala, and Telangana.

-

In June 2024, ABB launched ABB Ability OPTIMAX 6.4, the latest version of its digital energy management and optimization system designed to enhance the coordinated control of multiple industrial assets and processes. This upgrade aims to improve energy efficiency, reduce emissions, and support decarbonization efforts. Key enhancements include an AI module that forecasts load demand, energy generation, and pricing automatically, eliminating the need for manual input. These improvements significantly minimize day-ahead and intra-day nomination errors when supplying energy to the grid, helping operators avoid costly penalty payments.

-

In May 2024, Capgemini, an information technology services and consulting company provider, collaborated with Schneider Electric SE to enhance energy optimization through the Energy Command Center. This solution aims to accelerate organizations' efforts toward smarter and greener facility management and energy efficiency. The Energy Command Center is an integrated platform that enables centralized monitoring, control, and optimization of all energy-consuming assets, including data centers and critical environment rooms. Powered by advanced AI, ML, and IoT technologies, the platform measures and predicts key metrics such as energy intensity, asset health, renewable energy generation, and overall performance across all energy assets.

Energy Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 68.79 billion

Revenue forecast in 2033

USD 158.55 billion

Growth rate

CAGR of 12.7% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System, component, deployment, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Schneider Electric SE; Honeywell International Inc.; Siemens AG; Johnson Controls, Inc.; C3.ai, Inc.; GridPoint; General Electric; ABB; IBM Corporation; Cisco Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy Management Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global energy management systems market report based on system, component, deployment, vertical, and region.

-

System Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial energy management system (IEMS)

-

Building energy management system (BEMS)

-

Home energy management system (HEMS)

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On Premises

-

Cloud

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Energy & Power

-

Telecom & IT

-

Manufacturing

-

Retail

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global energy management systems market size was estimated at USD 53.26 billion in 2024 and is expected to reach USD 60.61 billion in 2025.

b. The global energy management systems market is expected to grow at a compound annual growth rate of 13.0% from 2025 to 2030 to reach USD 111.86 billion by 2030.

b. The hardware segment accounted for the largest market revenue share in 2024 due to the increasing deployment of advanced sensors, controllers, and smart meters essential for energy monitoring and automation.

b. Some key players operating in the energy management systems market include Honeywell Inc., Schneider Electric, Siemens AG, C3 Energy, General Electric Company, Emerson Process Management, Daikin Industries, Daintree Networks, Jones Sang LaSalle, Gridpoint Inc., Schneider Electric, Siemens AG, Honeywell International Inc., Elster Group GmbH, ABB, IBM, Toshiba Corporation, and Johnson’s Control International.

b. Key factors that are driving the market growth include improving energy efficiency, energy price volatility, and regulatory mandate and incentive program.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.