- Home

- »

- Next Generation Technologies

- »

-

Smart Energy Market Size And Share Analysis Report, 2030GVR Report cover

![Smart Energy Market Size, Share & Trends Report]()

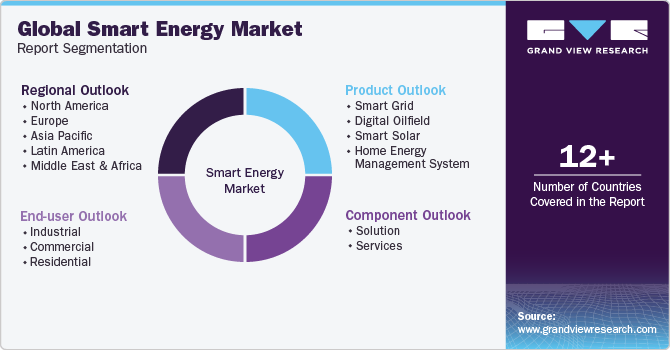

Smart Energy Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Smart Grid, Digital Oilfield, Smart Solar, Home Energy Management System), By Component, By End-user (Industrial, Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-169-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Energy Market Summary

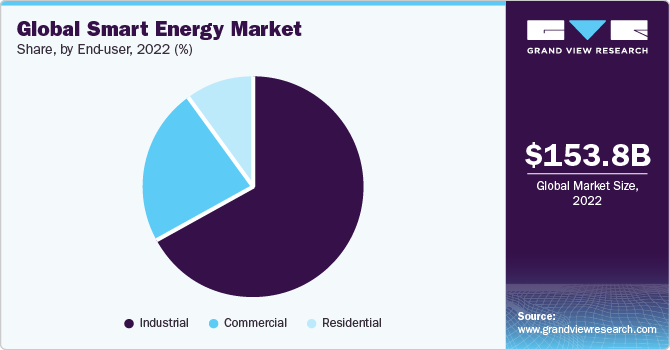

The global smart energy market was estimated at USD 153.80 billion in 2022 and is projected to reach USD 316.37 billion by 2030, growing at a CAGR of 9.6% from 2023 to 2030. Smart energy is a sustainable, economically viable, and secure energy infrastructure that emphasizes the advancement of renewable energy sources while keeping production costs to a minimum.

Key Market Trends & Insights

- North America dominated the market in 2022 with over 38% of the global revenue.

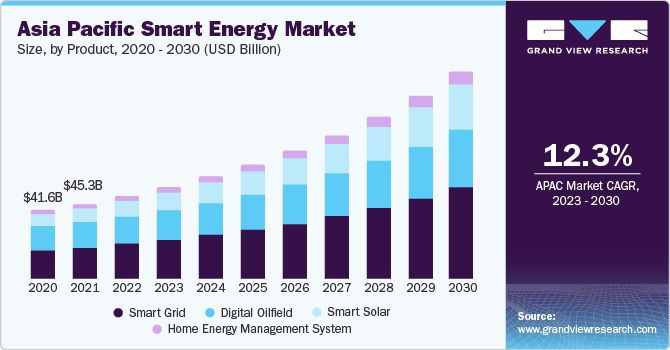

- Asia Pacific is anticipated to be the fastest-growing region with a CAGR of 12.3% during the forecast period.

- By product, the smart grid segment led the market in 2022 with over 41% of the global revenue.

- By component, the solution segment held the largest revenue share, accounting for over 74% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 153.80 billion

- 2030 Projected Market Size: USD 316.37 billion

- CAGR (2023-2030): 9.6%

- North America: Largest market in 2022

This intelligent energy system encompasses smart electricity, gas, and heat grids. Additionally, the adoption of intelligent energy systems has the potential to reduce the reliance on traditional fossil fuels. Substantial investments in smart grid technology significantly propels the growth of the market. The installation of smart energy requires various hardware and software components, such as instrumentation, network infrastructure, and network management software.

The global market is expected to experience significant growth owing to a notable increase in demand for dependable power solutions that can effectively support large-scale manufacturing processes. This surge in demand is driven by the commercial and industrial sectors, which are actively investing in new and advanced power sources. Notably, these investments are intended to address the energy needs of substantial data centers and telecommunications firms. By adopting new and efficient power solutions, these sectors aim to enhance the reliability and sustainability of their energy infrastructure.

Furthermore, the rising global concern among governments regarding the challenges posed by growing global warming is expected to drive an increased demand for solar energy. Governments in various countries are tackling this concern by introducing new rebates and incentive programs specifically designed to encourage the adoption of smart energy technologies, with a focus on smart solar solutions. These initiatives by governments are aimed at encouraging both residential and industrial sectors to invest in and install smart energy technologies.

End-user Insights

The industrial segment held the largest revenue share of over 66% in 2022, owing to a substantial demand for smart energy solutions within energy-intensive industrial sectors due to intensive manufacturing processes and operations. As a result, there is a significant demand for these solutions to optimize energy usage, reduce costs, and enhance overall operational efficiency. Smart energy technologies enhance overall operational efficiency by delivering insights into energy consumption patterns and enabling predictive maintenance.

The commercial segment is predicted to foresee significant growth in the forecast period. The commercial sector comprises all enterprises other than those involved in manufacturing and transportation. Smart energy technologies find extensive applications in commercial buildings, including offices, schools, hospitals, warehouses, police stations, shopping malls, hotels, information technology enterprises, and banks. The versatility of these solutions in addressing diverse energy needs within the commercial sector contributes significantly to their widespread adoption.

Regional Insights

North America dominated the market in 2022, accounting for over 38% share of the global revenue owing to a substantial increase in government incentives and support for smart energy initiatives. The rapid growth of smart grids in North America has contributed substantially to its market growth. These intelligent grid systems, coupled with a broader trend towards energy transition, have enhanced the efficiency and sustainability of energy distribution networks. Additionally, the region's focus on ensuring higher energy quality aligns with the growing anticipations for reliable and advanced energy services. This emphasis on quality further strengthens North America's position in the global market.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region is marked by rapid economic growth and industrial development. The increasing energy demands associated with economic expansion have propelled the adoption of smart energy solutions to ensure efficient and sustainable energy use. Furthermore, ongoing urbanization and infrastructure development in many countries in the region have spurred the demand for smart energy solutions. For instance, in June 2021, the Electricity Generating Authority of Thailand (EGAT) announced the undertaking of initiatives related to optimizing the demand and supply balance on the Thai power grid. The project is expected to be delivered by Hitachi, Ltd, as the system vendor, and build a demand response system design for Chulalongkorn University, including efforts to build a smart grid system that can strengthen increased penetration of renewables.

Product Insights

The smart grid segment led the market in 2022, accounting for over 41% share of the global revenue. The smart grid functions as a digital technology facilitating bidirectional communication between utility providers and consumers while also assisting in transmission line sensing. The intelligent grid is a comprehensive system comprising controllers, computers, automation, state-of-the-art instrumentation operations, and innovative technologies. It enhances problem detection and enables network self-healing through the application of technologies such as state estimation. Additionally, the smart grid incorporates the next-generation transmission and distribution infrastructure designed to handle bidirectional energy flows seamlessly.

The smart solar segment is estimated to grow significantly over the forecast period. The increasing awareness and concern for environmental sustainability have prompted a surge in demand for renewable energy sources, with solar power being a prominent and accessible alternative. Furthermore, advancements in smart solar technologies, including improved efficiency, grid integration, and monitoring capabilities, have contributed to its widespread adoption. Moreover, governments worldwide have been introducing supportive policies and incentives to encourage the installation of smart solar systems, further boosting the market share.

Component Insights

The solution segment led the market in 2022, accounting for over 74% share of the global revenue. The increasing complexity of energy management and the need for integrated and comprehensive solutions have driven the demand for smart energy solutions. These solutions often encompass a range of technologies, software platforms, and analytics that collectively optimize energy usage, enhance efficiency, and enable effective monitoring and control. Furthermore, the rising focus on sustainability and regulatory standards to reduce carbon footprints has driven the adoption of smart energy solutions as an effective option for achieving energy efficiency and environmental goals.

The services segment is estimated to grow considerably over the forecast period. Companies and utilities need expert assistance in integrating smart energy solutions into their existing infrastructure. The services in the market study include consulting, system integration, maintenance, and support services. These services play a crucial role in ensuring the seamless operation and continuous improvement of smart energy solutions. Consulting services help clients strategize and plan their smart energy initiatives, while system integration services ensure the smooth incorporation of new technologies into existing systems.

Key Companies & Market Share Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in February 2023, Itron Inc. partnered with SEW, a prominent provider of cloud-based software solutions for the water and energy industries. The partnership intends to develop new solutions that use Itron's OpenWay Riva IoT solution, comprising smart electricity meters and other smart grid technologies. Additionally, it would provide utilities with useful insights into their clients' energy usage and help them manage their energy consumption.

Key Smart Energy Companies:

- ABB

- General Electric Company

- Holley Technology Ltd.

- Honeywell International Inc.

- Iskraemeco Group

- Itron Inc.

- Landis+Gyr.

- Schneider Electric

- Sensus

- Siemens

Smart Energy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 166.41 billion

Revenue forecast in 2030

USD 316.37 billion

Growth rate

CAGR of 9.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, component, end-user, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil Mexico; Kingdom of Saudi Arabia (KSA); United Arab Emirates (UAE); South Africa

Key companies profiled

ABB; General Electric Company; Holley Technology Ltd.; Honeywell International Inc.; Iskraemeco Group; Itron Inc.; Landis+Gyr.; Schneider Electric; Sensus; Siemens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Energy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart energy market report based on product, component, end-user, and region.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Smart Grid

-

Digital Oilfield

-

Smart Solar

-

Home Energy Management System

-

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Smart Meters

-

Data And Device Management

-

PV Monitoring

-

Smart Energy Storage

-

Others

-

-

Services

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart energy market size was estimated at USD 153.80 billion in 2022 and is expected to reach USD 166.41 billion in 2023.

b. The global smart energy market is expected to grow at a compound annual growth rate of 9.6% from 2023 to 2030 to reach USD 316.37 billion by 2030.

b. North America dominated the smart energy market with a share of 38.8% in 2022 owing to a substantial increase in government incentives and support for smart energy initiatives. The rapid growth of smart grids in North America has contributed substantially to its market growth.

b. Some key players operating in the smart energy market include ABB; General Electric Company; Holley Technology Ltd.; Honeywell International Inc.; Iskraemeco Group; Itron Inc.; Landis+Gyr.; Schneider Electric; Sensus; Siemens.

b. Key factors that are driving the smart energy market growth include rising concern among governments worldwide regarding rising global warming challenges.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.