- Home

- »

- Next Generation Technologies

- »

-

Predictive Maintenance Market Size, Industry Report, 2033GVR Report cover

![Predictive Maintenance Market Size, Share & Trends Report]()

Predictive Maintenance Market (2026 - 2033) Size, Share & Trends Analysis Report By Component, By Solution, By Services, By Deployment, By Enterprise Size, By Monitoring Technique, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-834-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Predictive Maintenance Market Summary

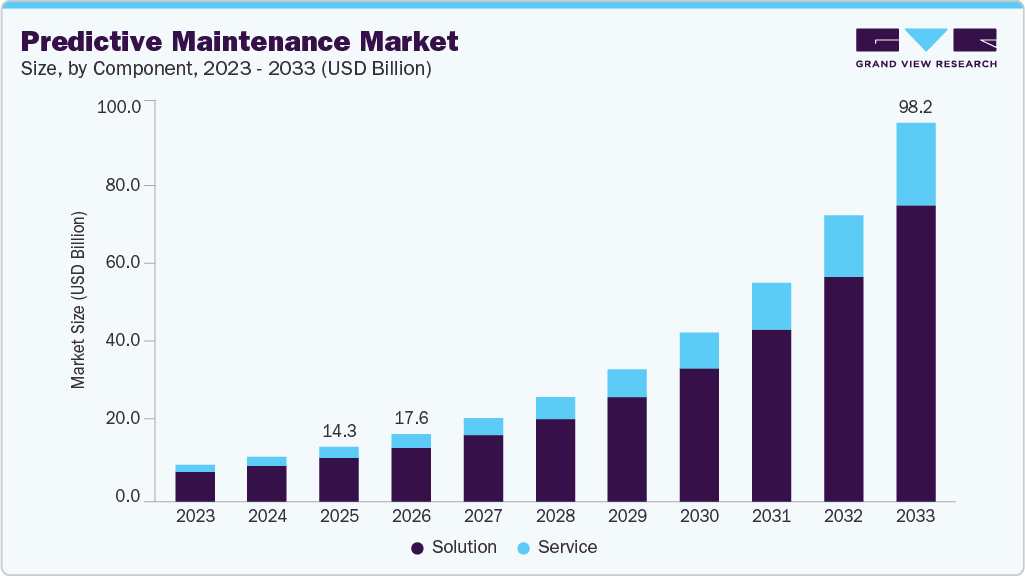

The global predictive maintenance market size was estimated at USD 14.29 billion in 2025 and is projected to reach USD 98.16 billion by 2033, growing at a CAGR of 27.9% from 2026 to 2033. The market is driven by the increasing adoption of Industry 4.0 technologies and the growing need to minimize unplanned equipment downtime across sectors such as manufacturing, energy, transportation, and utilities.

Key Market Trends & Insights

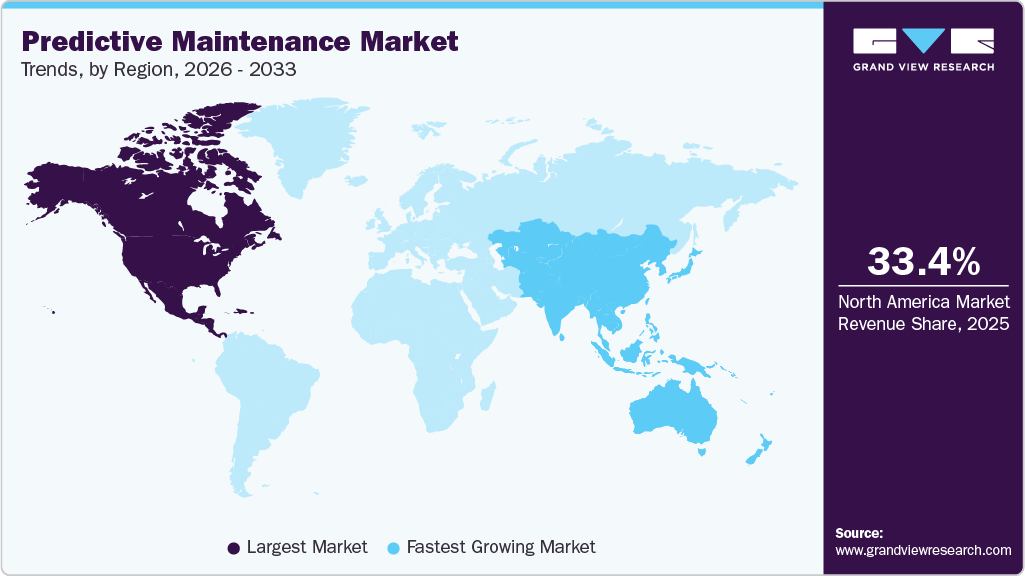

- North America predictive maintenance dominated the global market with the largest revenue share of 33.4% in 2025.

- The predictive maintenance industry in the U.S. is expected to grow significantly over the forecast period.

- By component, solution led the market and held the largest revenue share of 80.1% in 2025.

- By deployment, the on-premise segment led the market and held the largest revenue share in 2025.

- By end use, the aerospace & defense segment is expected to expand significantly over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 14.29 Billion

- 2033 Projected Market Size: USD 98.16 Billion

- CAGR (2026-2033): 27.9%

- North America: Largest market in 2025

Predictive maintenance leverages advanced technologies, including IoT sensors, machine learning, and data analytics, to monitor equipment conditions in real-time and predict potential failures before they occur. This proactive approach minimizes unplanned downtime, reduces maintenance costs, and extends the lifespan of critical assets, making it highly attractive to industries such as manufacturing, energy, transportation, and utilities. Companies are increasingly adopting predictive maintenance solutions to enhance productivity and ensure business continuity, particularly in sectors where equipment reliability is crucial.

In addition, the rapid adoption of Industry 4.0 initiatives and digital transformation strategies also contributes to the growth of the predictive maintenance industry. As manufacturers and industrial organizations integrate smart factories and connected devices, the demand for predictive maintenance solutions that can analyze large volumes of real-time data continues to rise. The integration of AI, cloud computing, and edge computing enables more accurate and timely predictions, allowing organizations to make informed maintenance decisions.

Moreover, regulatory compliance and safety standards in industries such as oil and gas, aerospace, and automotive further encourage the adoption of predictive maintenance technologies to prevent accidents, reduce operational risks, and maintain adherence to stringent safety protocols. For instance, in August 2025, Brazil’s power transmission company, Eletrobras, announced a collaboration with C3 AI to implement the C3 AI Grid Intelligence platform across its transmission network. This initiative leverages artificial intelligence to detect equipment faults and network irregularities in real time, enabling proactive maintenance and improved operational efficiency.

Component Insights

The solution segment dominated the market and accounted for the revenue share of 80.1% in 2025 due to the increasing adoption of integrated analytics platforms that combine IoT, AI, and machine learning for real-time asset monitoring. Organizations are investing in comprehensive predictive maintenance solutions that offer data collection, condition monitoring, and failure prediction in a single ecosystem.

The services segment is anticipated to grow at a significant CAGR during the forecast period, owing to the increasing demand for implementation, integration, and consulting services that help organizations deploy and optimize predictive maintenance systems. As enterprises adopt advanced technologies such as IoT, AI, and machine learning, they often rely on specialized service providers to configure predictive maintenance solutions, integrate them with existing enterprise systems, and ensure seamless data flow between operational technology (OT) and information technology (IT) layers. These services are crucial for organizations with complex asset structures or legacy systems that require customized setups to fully leverage predictive analytics.

Solution Insights

The integrated segment dominated the market, accounting for the largest revenue share in 2025, as organizations increasingly seek unified platforms that combine data acquisition, real-time monitoring, analytics, and visualization within a single ecosystem. Unlike standalone tools, integrated solutions streamline predictive maintenance workflows by consolidating IoT sensor data, machine learning algorithms, and enterprise asset management systems into one cohesive interface. This integration enables seamless communication between devices and systems, providing operators with a holistic view of equipment health and performance.

The standalone segment is anticipated to grow at a significant CAGR during the forecast period, driven by the growing demand from organizations seeking targeted, cost-effective tools for specific maintenance applications. Unlike integrated systems, standalone predictive maintenance solutions are designed to address particular functions such as vibration analysis, thermal imaging, or condition monitoring without requiring extensive integration across enterprise systems.

Services Insights

The integration and deployment segment dominated the market and accounted for the largest revenue share in 2025. The shift toward geographically distributed operations and remote monitoring has increased the demand for professional services. Integration and deployment providers help set up remote monitoring systems, cloud-based analytics, and connected devices across multiple locations, enabling consistent predictive maintenance performance worldwide.

The training and consulting segment is expected to grow at a significant CAGR over the forecast period, owing to the increasing need for strategic alignment and continuous improvement. Organizations are recognizing that merely deploying predictive maintenance technologies is not enough, they need guidance to align maintenance strategies with broader business objectives such as cost reduction, sustainability, and operational efficiency. Consulting services help companies design customized predictive maintenance roadmaps, benchmark performance metrics, and implement best practices, ensuring that maintenance initiatives deliver tangible business value.

Deployment Insights

The on-premise segment dominated the market and accounted for the largest revenue share in 2025 due to organizations’ preference for control, security, and data privacy. Many industries, such as oil & gas, utilities, and aerospace, handle highly sensitive operational data and critical infrastructure, where cloud-based solutions may raise concerns around cybersecurity, regulatory compliance, or data sovereignty. On-premise predictive maintenance systems allow companies to retain complete control over their data, implement strict access policies, and meet industry-specific regulatory requirements, making this deployment model attractive for risk-averse enterprises.

The cloud segment is expected to grow at a significant CAGR over the forecast period due to its ability to provide scalability, flexibility, and remote accessibility. Cloud-based predictive maintenance solutions allow organizations to collect, store, and analyze vast amounts of equipment data from multiple locations without investing heavily in on-site IT infrastructure. This deployment model enables companies to scale their predictive maintenance operations quickly as their asset base grows, making it particularly attractive for large enterprises and organizations with geographically dispersed facilities.

Enterprise Size Insights

The large enterprises segment dominated the market and accounted for the largest revenue share in 2025. Regulatory compliance, safety, and sustainability goals drive large enterprises to invest in predictive maintenance. Industries such as oil & gas, aerospace, energy, and utilities face strict safety standards and environmental regulations. Predictive maintenance enables proactive monitoring of critical equipment, reducing the risk of failures, accidents, and environmental incidents. Large enterprises also benefit from centralized monitoring and standardized maintenance strategies, ensuring consistent compliance and optimized performance across their global operations.

The small & medium enterprises segment is expected to grow at a significant CAGR during the forecast period due to the increasing affordability and accessibility of predictive maintenance solutions. Historically, these solutions were cost-prohibitive for smaller organizations, but the advent of cloud-based predictive maintenance platforms and scalable subscription models has lowered entry barriers. SMEs can now implement advanced monitoring tools without incurring heavy upfront investments in hardware or IT infrastructure, enabling them to improve equipment uptime and reduce maintenance costs while staying competitive with larger enterprises.

Monitoring Technique Insights

The vibration monitoring segment dominated the market and accounted for the largest revenue share in 2025 due to the advancement in sensor technology and IoT integration. Modern vibration sensors are more compact, sensitive, and capable of transmitting real-time data to cloud-based analytics platforms. This connectivity allows continuous monitoring without manual inspections, making vibration monitoring more practical and cost-effective, even for complex or remote installations.

The oil analysis segment is expected to grow at a significant CAGR during the forecast period, owing to industry-specific regulatory and environmental compliance pressures. Sectors such as power generation, marine, and heavy manufacturing are increasingly required to monitor lubricant conditions to avoid equipment failures and minimize environmental impact from oil leaks or improper disposal. Predictive oil analysis enables organizations to meet these compliance standards while minimizing downtime and enhancing overall operational efficiency.

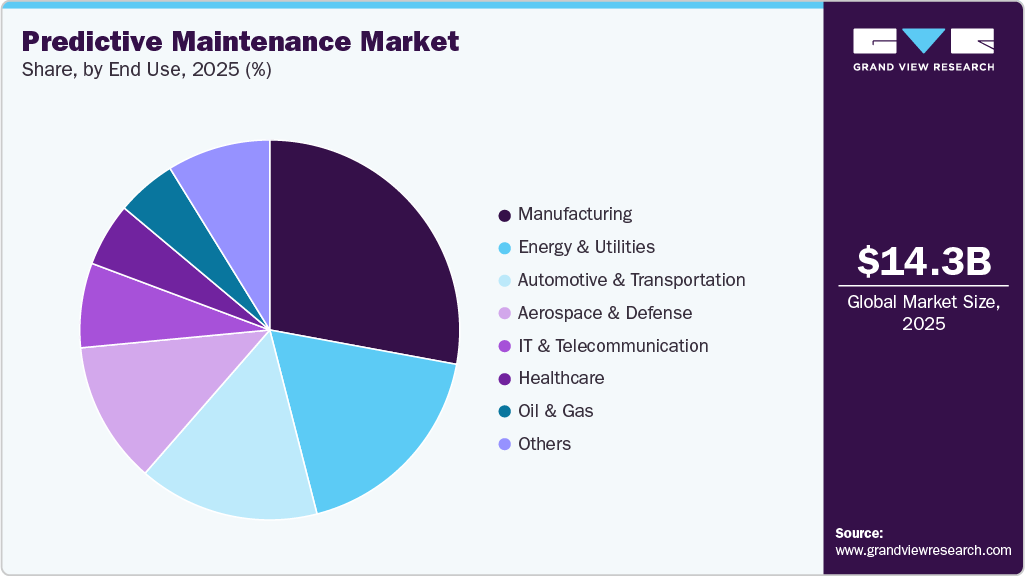

End Use Insights

The manufacturing segment dominated the market and accounted for the largest revenue share in 2025 due to the adoption of Industry 4.0 technologies. Smart factories are increasingly implementing IoT sensors, AI analytics, and connected devices to monitor the health of machines in real time. Predictive maintenance integrates seamlessly with these technologies, providing actionable insights that improve operational efficiency, reduce scrap and rework, and enhance overall equipment effectiveness (OEE).

The aerospace & defense segment is expected to grow at a significant CAGR over the forecast period due to the critical need for safety, reliability, and mission readiness. Aircraft, spacecraft, and defense equipment are subject to extreme operating conditions, and unplanned failures can have catastrophic consequences. Predictive maintenance enables aerospace and defense organizations to monitor the health of engines, avionics, and critical mechanical systems in real time, detect anomalies early, and schedule maintenance proactively, ensuring operational continuity and compliance with strict safety standards.

Regional Insights

The predictive maintenance market in North America dominated the global market with the largest revenue share of 33.4% in 2025, driven by the rapid adoption of Industry 4.0 and smart factory initiatives. Manufacturing and industrial companies are investing heavily in IoT, AI, and cloud-based analytics to monitor equipment health, optimize operations, and reduce unplanned downtime, which is accelerating the deployment of predictive maintenance solutions across multiple sectors.

U.S. Predictive Maintenance Market Trends

The predictive maintenance market in the U.S. is expected to grow significantly at a CAGR of 25.6% from 2026 to 2033 driven by the focus on reducing operational costs in energy and manufacturing sectors. Utilities and large manufacturers are leveraging predictive maintenance to prevent expensive equipment failures, optimize maintenance schedules, and improve energy efficiency, particularly in power plants and heavy industrial facilities.

Europe Predictive Maintenance Market Trends

The predictive maintenance market in Europe is anticipated to register considerable growth from 2026 to 2033 due to stringent environmental and safety regulations across industries such as automotive, aerospace, and energy. Companies are adopting predictive maintenance to ensure compliance while maintaining operational efficiency and reducing the risk of costly equipment failures.

The UK predictive maintenance market is expected to grow rapidly in the coming years owing to the growing adoption of cloud-based predictive maintenance platforms among SMEs. Smaller organizations are increasingly able to access advanced maintenance solutions without heavy upfront investments, enabling proactive equipment monitoring and operational resilience.

The Germany predictive maintenance market held a substantial market share in 2025, driven by the integration of predictive maintenance within the country’s advanced manufacturing and automotive sectors, particularly in “Industry 4.0” smart factories. Real-time monitoring and AI-driven insights allow manufacturers to enhance productivity, reduce machine downtime, and maintain global competitiveness.

Asia Pacific Predictive Maintenance Industry Trends

Asia Pacific held a significant share in the global market in 2025, due to rapid industrialization and infrastructure development, particularly in emerging economies. The growing number of manufacturing plants, energy projects, and transportation networks is increasing demand for predictive maintenance solutions to ensure uninterrupted operations and reduce maintenance costs.

The Japan predictive maintenance market is expected to grow rapidly in the coming years driven by highly automated production facilities and a strong focus on operational efficiency. Japanese companies are adopting predictive maintenance to maintain precision in manufacturing, reduce downtime, and extend the life of critical machinery in sectors such as electronics, automotive, and heavy machinery.

The China predictive maintenance market held a substantial market share in 2025, due to government-led smart manufacturing initiatives and industrial modernization programs. Large-scale adoption of IoT, AI, and industrial analytics across factories and utilities is driving demand for predictive maintenance solutions that improve asset reliability and reduce operational losses.

Key Predictive Maintenance Company Insights

Key players operating in the predictive maintenance industry are IBM Corporation, Microsoft Corporation, SAP SE, Siemens AG, and General Electric. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2025, Schneider Electric launched EcoCare Advanced+ for Electrical Distribution, offering 24/7 remote monitoring, AI-driven insights, and proactive, condition-based maintenance, along with priority access to service experts, to enhance operational efficiency, safety, and customer support.

-

In August 2025, Accenture partnered with Qatar Airways to transform the aviation industry through advanced artificial intelligence (AI) technologies. The collaboration has launched AI Skyways, a joint initiative aimed at boosting operational efficiency, enhancing customer experience, and strengthening overall airline performance. The program will accelerate the deployment of AI solutions across multiple aviation applications, including optimizing flight schedules, improving predictive maintenance, and delivering personalized customer interactions.

-

In June 2025, Siemens partnered with Sachsenmilch Leppersdorf GmbH in Germany to advance predictive maintenance in the food and beverage sector. Using its AI-powered Senseye Predictive Maintenance solution, Siemens is enabling early detection of equipment issues, such as the end of a pump’s service life, helping the milk processing plant maintain continuous operations year-round while adhering to strict quality standards. Following successful pilot results, Sachsenmilch plans to expand automation by integrating Senseye with SAP Plant Maintenance (SAP PM), marking a significant step toward more efficient, data-driven maintenance processes.

Key Predictive Maintenance Companies:

The following are the leading companies in the predictive maintenance market. These companies collectively hold the largest Market share and dictate industry trends.

- Accenture

- Cisco Systems, Inc.

- General Electric Company

- Honeywell International Inc.

- Hitachi, Ltd.

- IBM Corporation

- Microsoft

- PTC

- Robert Bosch GmbH

- Rockwell Automation

- SAP SE

- SAS Institute

- Schneider Electric SE

- Siemens

- Software GmbH

Predictive Maintenance Market Report Scope

Report Attribute

Details

Market size in 2026

USD 17.56 billion

Revenue forecast in 2033

USD 98.16 billion

Growth rate

CAGR of 27.9% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, solution, services, deployment, enterprise size,monitoring technique, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Accenture; Cisco Systems, Inc.; General Electric Company; Honeywell International Inc.; Hitachi, Ltd.; IBM Corporation; Microsoft; PTC; Robert Bosch GmbH; Rockwell Automation; SAP SE; SAS Institute; Schneider Electric SE; Siemens; Software GmbH

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Predictive Maintenance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the predictive maintenance market report based on component, solution, services, deployment, enterprise size, monitoring technique, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Integrated

-

Standalone

-

-

Services Outlook (Revenue, USD Billion, 2021 - 2033)

-

Integration and Deployment

-

Support & Maintenance

-

Training & Consulting

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Monitoring Technique Outlook (Revenue, USD Billion, 2021 - 2033)

-

Torque Monitoring

-

Vibration Monitoring

-

Oil Analysis

-

Thermography

-

Corrosion Monitoring

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Aerospace & Defense

-

Automotive & Transportation

-

Energy & Utilities

-

Healthcare

-

IT & Telecommunications

-

Manufacturing

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global predictive maintenance market size was estimated at USD 14.29 billion in 2025 and is expected to reach USD 17.56 billion in 2026.

b. The global predictive maintenance market is grow at a compound annual growth rate of 27.9% from 2026 to 2033 to reach USD 98.16 billion by 2033.

b. The rapid adoption of Industry 4.0 initiatives and digital transformation strategies also contributes to the growth in predictive maintenance industry. As manufacturers and industrial organizations integrate smart factories and connected devices, the demand for predictive maintenance solutions that can analyze large volumes of real-time data continues to rise. The integration of AI, cloud computing, and edge computing enables more accurate and timely predictions, allowing organizations to make informed maintenance decisions.

b. Key players operating in the predictive maintenance industry are IBM Corporation, Microsoft Corporation, SAP SE, Siemens AG, and General Electric.

b. The solution segment dominated the market and accounted for the revenue share of 80.1% in 2025 due to the increasing adoption of integrated analytics platforms that combine IoT, AI, and machine learning for real-time asset monitoring. Organizations are investing in comprehensive predictive maintenance solutions that offer data collection, condition monitoring, and failure prediction in a single ecosystem.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.