- Home

- »

- Homecare & Decor

- »

-

Smart Furniture Market Size & Share, Industry Report, 2030GVR Report cover

![Smart Furniture Market Size, Share & Trends Report]()

Smart Furniture Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Smart Table, Smart Desks, Smart Chairs, Others), By Application (Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-660-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Furniture Market Summary

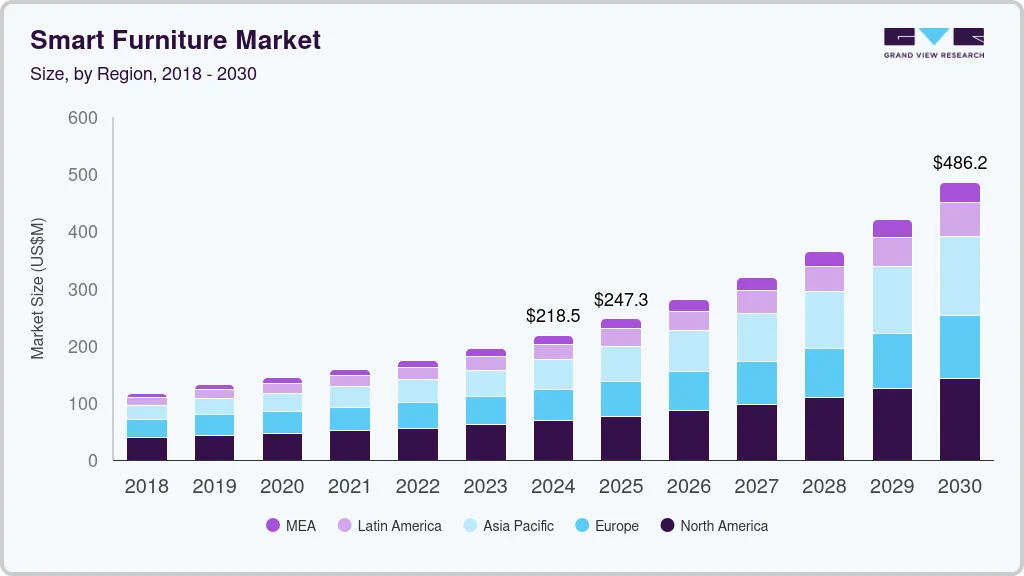

The global smart furniture market size was estimated at USD 218.5 million in 2024 and is projected to reach USD 486.2 million by 2030, growing at a CAGR of 14.5% from 2025 to 2030. Major factors promoting the market growth include the rise in the adoption of tech-savvy workspaces across corporate offices catering to IT, research, and laboratories, coupled with the demand for optimized and functional work furniture among work-from-home professionals.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Australia is expected to register the highest CAGR from 2025 to 2030.

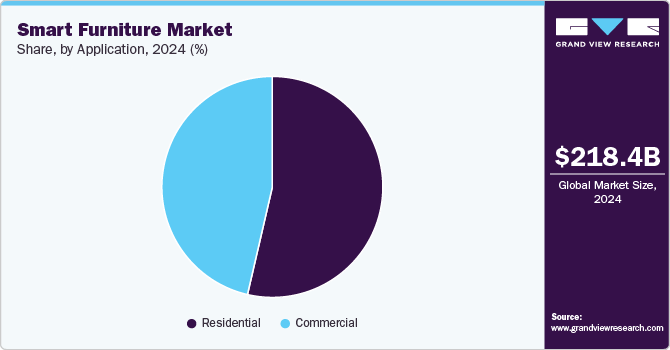

- In terms of segment, residential accounted for a revenue of USD 133.5 million in 2024.

- Residential is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 218.5 Million

- 2030 Projected Market Size: USD 486.2 Million

- CAGR (2025-2030): 14.5%

- North America: Largest market in 2024

.

Key Market Highlights:

- North America dominated the global smart furniture market, accounting for the largest revenue share of 31.4% in 2024.

- In 2024, the U.S. dominated the smart furniture market, capturing the largest revenue share of 78.4% in North America.

- By Product, the smart desks segment dominated the market for smart furniture and accounted for the largest revenue share of 34.0% in 2024.

- By Application, the residential segment dominated the market for smart furniture in 2024.

The lifestyle of consumers in urban areas is changing significantly due to increased disposable income. Luxurious and technically integrated products are gradually becoming a part of their life, which is comforting the lives of professionals and workaholics. Owing to this, the demand for smart furniture is growing consistently. In addition, consumers’ increasing disposable income has elevated the significance of an individual’s social status, encouraging spending on smart products, including smart furniture.

According to the data from the World Bank's World Integrated Trade Solution (WITS) platform, China exported USD 1.28 billion worth of wooden office furniture in 2023, totaling 24.3 million items. This large-scale export activity highlights the strong global demand for office furniture, including in commercial and home office settings. It also provides a foundation for the potential adoption of smart furniture, as traditional office furniture buyers may increasingly seek products with integrated technology and enhanced functionality.

According to the Personal Income and Outlays report published by the Bureau of Economic Analysis, the increase of USD 191.6 billion (0.9%) in the U.S. Disposable Personal Income (DPI) in February 2025 reflects higher consumer spending power after taxes. This rise in disposable income enables more consumers to afford premium and innovative products, such as smart furniture, which often comes at a higher price point. As consumers prioritize comfort, convenience, and technology integration in their homes and offices, the smart furniture market benefits from this enhanced purchasing capacity. Higher DPI directly supports demand for advanced, connected furniture solutions, accelerating market growth in North America, which has already led to the adoption of smart furniture.

Product Insights

The smart desks segment dominated the market for smart furniture and accounted for the largest revenue share of 34.0% in 2024. There is increasing demand for ergonomic solutions and personalized comfort in both home and office environments, driven by heightened awareness of health and productivity benefits. Smart desks offer height adjustability, built-in charging ports, wireless connectivity, and IoT integration, making them highly attractive to modern consumers and businesses. The rise of remote work, ongoing office renovations, and a focus on employee well-being further fuel this demand. Additionally, rising disposable incomes and rapid adoption of advanced technologies in workplaces support the expansion of the smart desk market. Growing awareness of the health benefits of adjustable workspaces and the need for integrated device management are driving adoption.

The smart table segment is anticipated to exhibit the fastest CAGR of 15.6% over the forecast period, reflecting robust consumer interest and technological advancements. As more sectors, including healthcare, education, and retail, adopt smart tables for interactive and collaborative purposes, the segment’s growth is expected to accelerate even further. Smart table offers advanced features such as wireless charging, built-in speakers, touch controls, and IoT connectivity, which enhance convenience and user experience. Rising consumer demand for multifunctional and space-saving furniture, especially in urban and compact living environments, is also driving growth. Increased disposable income and the popularity of smart home ecosystems make consumers more willing to invest in innovative, tech-enabled tables. Additionally, integrating AI and voice assistants further boosts the appeal and utility of smart tables compared to traditional furniture types. The shift toward remote and hybrid work also boosts demand, as people seek functional and technology-integrated solutions for their living and working spaces.

Application Insights

The residential segment dominated the market for smart furniture in 2024. The increasing integration of IoT (Internet of Things) devices in homes has created a demand for furniture that can seamlessly connect and interact with these systems, enhancing convenience and automation. Consumers are looking for a cohesive smart home ecosystem where furniture plays an integral role. Smart furniture is often designed with a contemporary aesthetic to complement modern interiors, making it an attractive option for homeowners upgrading their living spaces with stylish and functional pieces.

The commercial application segment is expected to witness strong growth in the smart furniture market due to the increasing adoption of smart technologies in offices, hotels, and public spaces. Businesses are investing in smart desks, meeting tables, and seating solutions to improve employee comfort, productivity, and space efficiency. With the rise of hybrid and flexible work environments, there is a growing demand for connected and ergonomic office furniture. Features such as height adjustability, built-in power outlets, and wireless charging make smart furniture ideal for modern workplaces. Companies are also focusing more on employee wellness, leading to higher demand for furniture that supports better posture and movement. Smart furniture enhances guest experience in hospitality by offering convenience and personalized settings. Additionally, there is a need for energy-efficient and tech-integrated office environments that support the use of smart solutions. As more organizations prioritize digital transformation, the commercial segment will continue growing steadily.

Regional Insights

North America dominated the global smart furniture market, accounting for the largest revenue share of 31.4% in 2024. Several key factors drive this growth. The region has a high adoption rate of advanced technologies and smart home solutions, which supports the demand for smart furniture. Increasing consumer preference for convenience, comfort, and connected lifestyles also plays a major role. In addition, strong purchasing power and rising awareness of smart and ergonomic furniture benefits contribute to market growth. The growing remote work trend has also increased the demand for smart office furniture. Moreover, smart city projects and energy-efficient living initiatives encourage using multifunctional smart furniture. A strong retail infrastructure and high internet penetration further support online sales and marketing

U.S. Smart Furniture Market Trends

In 2024, the U.S. dominated the smart furniture market, capturing the largest revenue share of 78.4% in North America.This strong position is attributed to the presence of advanced technology infrastructure and growing interest in smart home and office solutions. American consumers are highly receptive to new technologies that offer comfort, convenience, and connectivity. Government support for energy-efficient and smart infrastructure further boosts adoption. The widespread availability of high-speed internet supports the integration of connected furniture systems.

Europe Smart Furniture Market Trends

The European smart furniture market is growing steadily due to several important factors. Expanding the real estate and construction sectors is driving demand for new and innovative furniture solutions. Increasing adoption of smart home technologies across European households has created a strong environment for smart furniture integration, especially in urban areas with tech-savvy consumers. Rising focus on energy efficiency and sustainability encourages the use of smart furniture that helps reduce energy consumption. Europe’s aging population also boosts demand for smart furniture with health monitoring and assistance features. Countries such as Germany and the UK lead the market with strong manufacturing capabilities, government support, and high consumer adoption rates. Additionally, the growth of e-commerce platforms makes smart furniture more accessible to consumers. Innovations in AI, IoT, and multifunctional designs further enhance the appeal of smart furniture.

The UK smart furniture market is experiencing steady growth due to increasing demand in both commercial and residential sectors. Rising adoption of smart technologies in offices is driving commercial demand, particularly for ergonomic and connected furniture. Residential applications are also expanding as consumers seek comfort, space efficiency, and tech integration at home. The remote working trend has further boosted interest in multifunctional smart home furniture. Increasing awareness of wellness and productivity benefits is influencing buying behavior.

Asia Pacific Smart Furniture Market Trends

The Asia Pacific smart furniture market is projected to grow at the fastest rate globally, with a CAGR of 17.3% from 2025 to 2030. This rapid growth is driven by rising urbanization and increasing disposable incomes across emerging economies. Smart city initiatives and expanding real estate sectors create strong demand for innovative home and office solutions. Consumers are more interested in space-saving and multifunctional furniture, especially in densely populated cities. The growing tech-savvy population is more inclined to adopt IoT-enabled and AI-integrated products. Businesses invest in smart office environments in the commercial sector to enhance productivity and employee well-being. Government support for digital infrastructure is further accelerating adoption. Additionally, a young demographic with lifestyle-focused preferences is fueling demand. Local manufacturers are also innovating to offer affordable smart furniture options.

In 2024, China held the largest share of the Asia Pacific smart furniture market, accounting for 41.6%. This dominance is attributed to China’s strong manufacturing capabilities and large-scale production infrastructure. The country benefits from a mature supply chain and cost-effective labor, enabling competitive pricing and wide product availability. Rising income levels and changing lifestyle preferences influence consumer spending on home and office upgrades. Additionally, government initiatives promoting digital living environments are accelerating adoption.

Key Smart Furniture Company Insights

The market for smart furniture is fragmented in nature owing to the presence of a large number of regional as well as international players. Some of the prominent players in the smart furniture market include:

-

Inter IKEA Holding B.V. is a global furniture brand that offers a wide range of furniture, including smart furniture. The company offers home automation products such as ROGNAN Robotic Furniture, Smart Lighting Solutions, and many more.

-

Sleep Number Corporation is a wellness technology company that designs innovative smart beds. The company offers a range of smart beds that monitor sleep data, provide personalized sleep insights, and can automatically adjust to a person's needs.

Key Smart Furniture Companies:

The following are the leading companies in the smart furniture market. These companies collectively hold the largest market share and dictate industry trends.

- Inter Ikea Systems B.V.

- Sobro

- Sleep Number Corporation

- Hi-Interiors srl

- Krini Furniture Pvt Ltd

- Herman Miller, Inc.

- Desktronik

- Nitz Engineering GmbH

- Steelcase Inc

Recent Developments

-

In April 2023, Sleep Number launched its next-gen smart beds and Lifestyle Furniture, featuring AI and sensors to personalize sleep and monitor health data. The furniture includes ambient lighting, speakers, and support features, creating an optimized sleep environment. These innovations enhance sleep quality and support health across all life stages.

-

In May 2022, Steelcase Inc. signed a definitive agreement to acquire HALCON, a Minnesota-based wood furniture manufacturer. The move enhanced Steelcase’s wood product portfolio with premium design and craftsmanship. It aimed to better serve A+D professionals and workplace customers.

Smart Furniture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 247.27 billion

Revenue forecast in 2030

USD 486.15 billion

Growth Rate

CAGR of 14.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil.

Key companies profiled

Inter Ikea Systems B.V.; Sobro; Sleep Number Corporation; Hi-Interiors srl; Krini Furniture Pvt Ltd; Herman Miller, Inc.; Desktronik; Nitz Engineering GmbH; Steelcase Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Furniture Market Report Segmentation

This report forecasts revenue growth at global levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart furniture market report based on product, application, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Table

-

Smart Desks

-

Smart Chairs

-

Others (sofa, benches)

-

-

Application (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.