- Home

- »

- Electronic & Electrical

- »

-

Smart Home Appliances Market Size & Share Report, 2030GVR Report cover

![Smart Home Appliances Market Size, Share & Trend Report]()

Smart Home Appliances Market (2023 - 2030) Size, Share & Trend Analysis Report By Product (Smart Washing Machines, Smart Air Purifiers, Smart TV, Others), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-944-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Home Appliances Market Summary

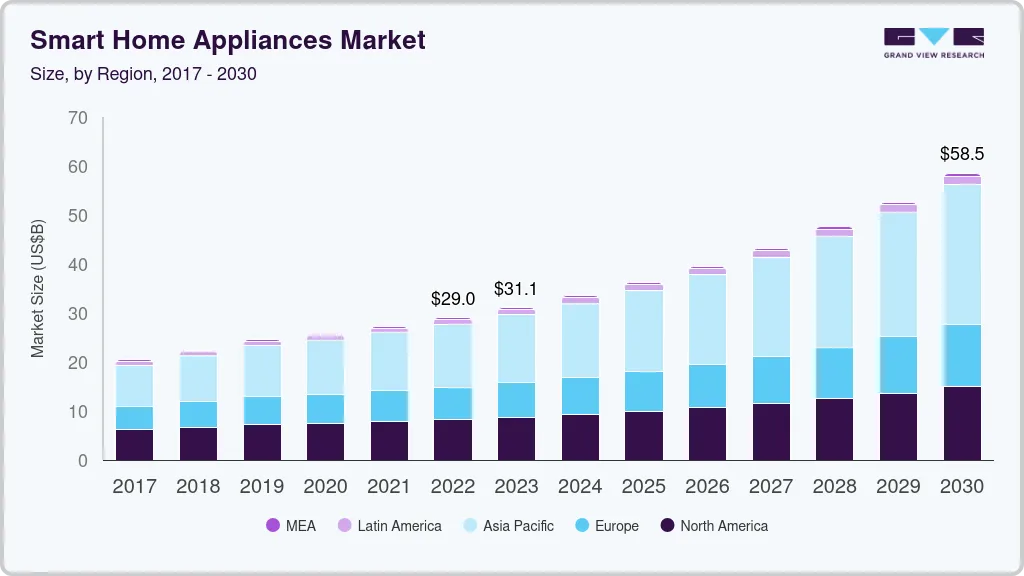

The global smart home appliances market size was estimated at USD 29,034.6 million in 2022 and is projected to reach USD 58,506.6 million by 2030, growing at a CAGR of 9.2% from 2023 to 2030. Product demand is being driven by factors such as the growing penetration of smart homes, rising home improvement projects, and rapid developments in IT and wireless communication.

Key Market Trends & Insights

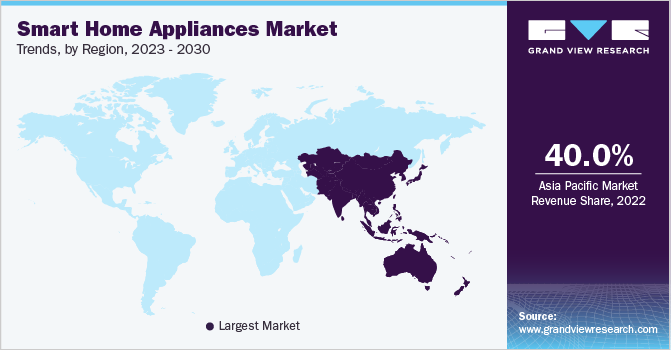

- The Asia Pacific region dominated the market with a share of more than 40% in 2022.

- North America is projected to expand at a CAGR of 7.7% over the forecast period.

- By product, the smart washing machines segment accounted for a market share of 35.3% in 2022.

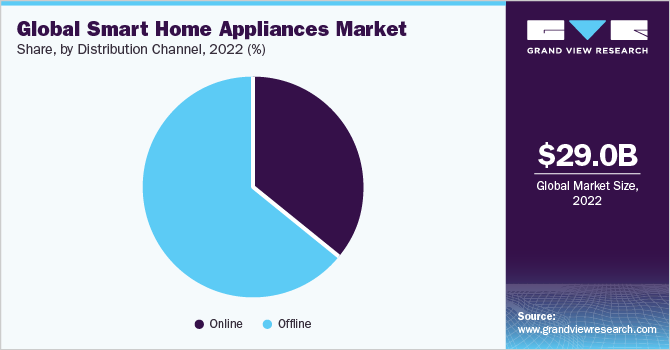

- By distribution channel, the offline segment held the largest share of 63.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 29,034.6 Million

- 2030 Projected Market Size: USD 58,506.6 Million

- CAGR (2023-2030): 9.2%

- Asia Pacific: Largest market in 2022

The rising home improvement projects in Western countries are paving the way for different smart products for residential applications. The increasing spending on home improvement projects or home remodeling is also boosting the product demand, owing to surging home and mortgage prices.

The COVID-19 pandemic impacted the market severely. Consumers are still grappling to come to terms with the socio-economic impact of the pandemic. However, the industry is likely to recover over the forecast timeframe, given the rising popularity of online/e-commerce sales.Many consumers have been taking steps to renovate or completely remodel their houses. Many companies have witnessed a boom in remodeling projects during the pandemic.

As the industry continues to thrive, brands are paying special attention to their target audience and have been reshaping their marketing strategies to attract customer attention. With the coronavirus pandemic, most of the brands operating in the market had to switch to social media and online marketing to reach a wider customer base - platforms such as Facebook, YouTube, and Instagram offer major opportunities for digital ad campaigns.

Technological innovations incorporated into homes are supplementing the market growthManufacturers are continuously developing and modifying smart home appliances to cater to the easy lifestyles of tech-savvy consumers Furthermore, brands have been developing smart automation and hi-tech features for smart homes. Digital smart dials, and voice-controlled lighting with programmable features with AI-driven features are likely to attract millennial customers.

On the other hand, high costs involved in technological innovations, that can lead to higher overall product costs may have a negative impact on market growth. However, the rising inclination of consumers for smart home appliances in emerging economies like China and India and the increased purchasing power of consumers will be key demand driving force.

Key Brands are offering a wide range of products keeping in mind the millennial and Gen-Z generations, resulting in a plethora of opportunities in the market. In May 2021, Whirlpool Corporation partnered with VTEX, a multinational tech company that provides global, fully integrated end-to-end commerce solutions, to play a key role in improving Whirlpool’s digital commerce strategy.

Product Insights

The smart washing machines segment accounted for a market share of 35.3% in 2022 and is expected to hold a significant position throughout the forecast years. The primary factor driving the segment is people are becoming more aware of the new technologies, adoption of smart devices in homes has significantly increased. Furthermore, people’s changing lifestyles, increasing per capita income, and the rising need to save overall costs on energy consumption, are likely to boost product demand.

However, the smart air purifiers segment is expected to grow at the fastest rate of 10.2% between 2023 and 2030. Smart air purifiers are becoming an essential part of smart homes, as people are becoming more conscious about their health and the environment, they live in.Smart air purifiers are also gaining popularity over conventional air purifiers due to their extra capabilities that offer consumers a high level of flexibility and convenience. These devices are more efficient as they feature touch-sensitive controls, real-time air quality detection and reporting, voice control, and Wi-Fi capabilities.

Distribution Channel Insights

The offline segment held the largest share of 63.9% in 2022. the availability of an in-store associate/expert, assistance on product specifications, and the consumer can physically examine the product are some of the factors popularizing the sales of smart home appliances through the retail channel.

However, online segment is projected to experience the fastest growth over the forecast period, owing to the rapid expansion of e-commerce and budding digitalization, particularly across developing countries such as India and China. Additionally, the growing popularity of online shopping and smart and connected devices among millennials as well as the young population is also boosting the online sale of smart home appliances worldwide. Moreover, factors such as effortlessness associated with online transactions, a busy lifestyle, and the flexibility of shopping at any time from any place are driving the online sale of smart home appliances.

Regional Insights

The Asia Pacific region dominated the market with a share of more than 40% in 2022 and is estimated to grow at a fastest CAGR of 10.5% over the forecast period. This is attributed to the growing implementation of cloud-based services, increasing internet penetration, rising per capita income of the regional population, escalating adoption of smartphones, changing lifestyles, surging awareness about personal health, and continuous launch of government policies encouraging digitalization.Moreover, the growing investments from global players in the region and the increasing demand from developing economies such as China and India for advanced technologies are other key factors driving the growth of the market in Asia Pacific.

North America is projected to expand at a CAGR of 7.7% over the forecast period.North America is estimated to be the dominating region in the global Internet of Things (IoT) market, owing to its well-developed Information Communication Technology (ICT) infrastructure and the huge number of connected devices adoptions. According to the International Monetary Fund World Economic Outlook 2021, North America is one of the leading economies of the world and is projected to reach a cumulative GDP of approximately $26.8 trillion by the end of 2021. Additionally, the deep-rooted technology structure and economic strength offer a strong platform for the growth of the market in the region.

Key Companies & Market Share Insights

The smart home appliances market is characterized by the presence of several well-established players, such as Whirlpool Corporation; LG Electronics; BSH Hausgeräte GmbH; and Samsung Electronics Co. Ltd. These players account for considerable shares in the market and have a strong presence across the globe. The market also consists of small- to mid-sized players who offer a selected range of smart home appliances and mostly serve regional customers.

The impact of these established players on the market is quite high, as most of them have vast distribution networks across the globe to reach their large customer base. The key players operating in the market are focusing on strategic initiatives such as product launches, acquisitions, sponsorships, collaborations, participation in events, and business expansions to drive revenue growth and reinforce their position in the global market.:

-

In April 2022, Xiaomi Corporation introduced the Redmi Smart TV A58. The device features a 4K display with over 1 billion colors, and a 95.4% screen-to-bezel ratio is made possible by the ultra-thin bezel. The device has MIUI TV, allowing users to operate other smart home devices from the TV.

-

In October 2021, Panasonic Corporation announced the debut of 24 new washing machine models ahead of the holiday season, expanding its home appliance market. The latest versions, which are packed with high-tech features, provide consumers with increased comfort and convenience in their daily lives.

-

In March 2021, Haier Group in India, launched a new line of front-loading fully automatic washing machines has been introduced. The company claims that its newly announced Super Drum Series washing machine series has the industry's first ever largest drum. The new washing machine line features a 525mm super drum that gives clothing more area while also increasing washing efficiency and intensity. As a result, wrinkles are reduced, and users may load and unload clothing more rapidly.

Some of the key players operating in the global smart home appliances market include:

-

Whirlpool Corporation

-

LG Electronics

-

Haier Group

-

Samsung Electronics Co. Ltd

-

Panasonic Corporation

-

BSH Hausgeräte GmbH

-

Electrolux AB

-

Koninklijke Philips N.V

-

GE Appliances

-

Xiaomi Corporation

Recent Developments

-

In June 2023, GE Profile™ launched the UltraFast Combo, an all-in-one laundry solution that utilizes ventless heat pump technology. The new combination of washer and dryer eliminates the laborious task of transferring the load from the washer to the dryer.

-

In June 2023, SmartThings announced new features for SmartThings Energy. The upgrades encourage individuals to take action on their energy consumption, save money, and gain incentives while contributing to a more sustainable future.

-

In April 2023, Samsung Electronics Co., Ltd. announced SmartThings Station, an affordable smart home hub and fast charging pad. It offers users to automate different aspects of their home environment with quick setup and compatibility with a wide range of smart home products.

-

In January 2023, the Home Connectivity Alliance (HCA) announced the HCA 1.0 interface specification at the Consumer Electronics Show in Las Vegas. Through this specification, consumers will be able to connect any device with any app and pave the path for more energy-efficient solutions.

Smart Home Appliances Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 31.11 billion

Revenue forecast in 2030

USD 58.51 billion

Growth rate

CAGR of 9.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East and Africa

Country scope

U.S.; U.K.; India; China; Japan; Brazil; South Africa

Key companies profiled

Whirlpool Corporation; LG Electronics; Haier Group; Samsung Electronics Co. Ltd; Panasonic Corporation ; BSH Hausgeräte GmbH; Electrolux AB; Koninklijke Philips N.V; GE Appliances; Xiaomi Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

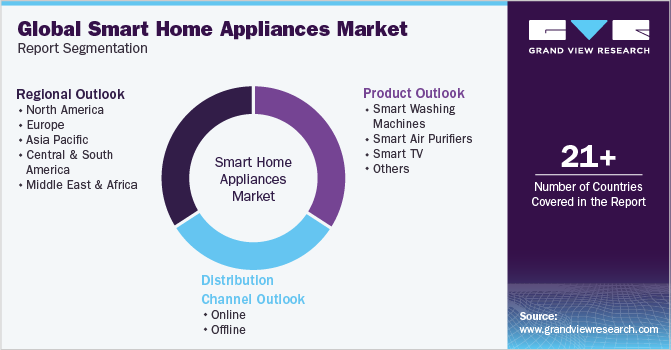

Global Smart Home Appliances Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global smart home appliances market report on the basis of product, distribution channel and region.

-

Product Outlook (Revenue, USD Billion; 2017 - 2030)

-

Smart Washing Machines

-

Smart Air Purifiers

-

Smart TV

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion; 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion; 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the smart home appliances market include Samsung, BSH, GE, Whirlpool, LG, Electrolux, Panasonic, Miele & Cie, Philips, IRobot, Ecovacs, Neato, Haier, Midea, Hisense.

b. Key factors that are driving the market growth included growing penetration of smart homes particularly in developing as well as developed regions, rising prominence for home improvement projects in western countries, increasing spending on home improvement projects or home remodeling, and rapid developments and advancements in the IT infrastructure and wireless communication.

b. The smart home appliances market size was estimated at USD 29.03 billion in 2022 and is expected to reach USD 31.11 billion in 2023.

b. The smart home appliances market is expected to grow at a compound annual growth rate of 9.2% from 2023 to 2030 to reach USD 58.51 billion by 2030.

b. Asia Pacific region dominated the smart home appliances market with a share of 44.07% in 2022. This is attributable to the increasing internet penetration and technological advancements in developing economies such as China and India is anticipated to fuel the regional product demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.