- Home

- »

- Medical Devices

- »

-

Smart Inhalers Market Size & Share, Industry Report, 2033GVR Report cover

![Smart Inhalers Market Size, Share & Trends Report]()

Smart Inhalers Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Dry Powdered Inhalers, Metered Dose Inhalers), By Indication (Asthma, Pulmonary Disease), By Distribution Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-993-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Inhalers Market Summary

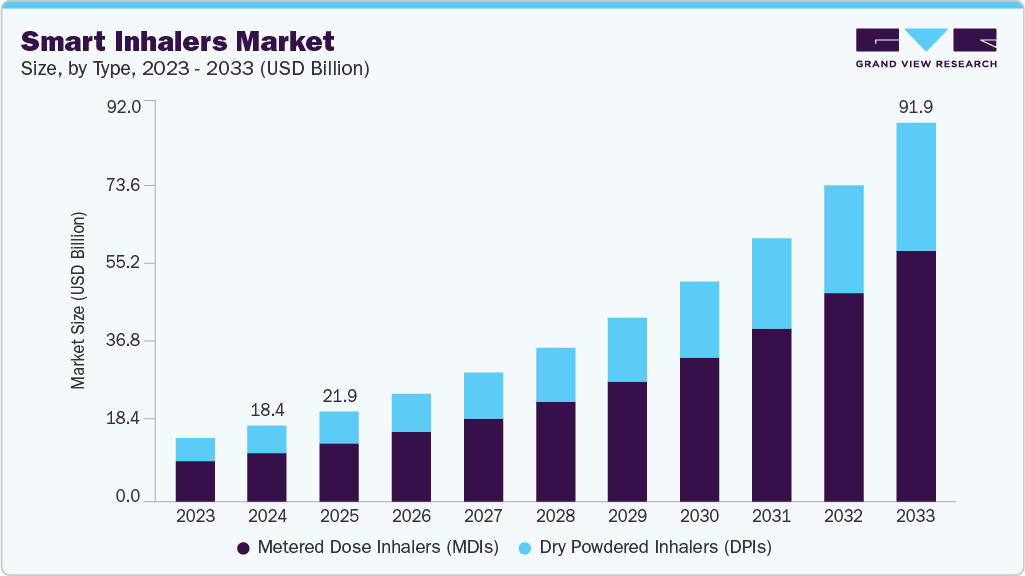

The global smart inhalers market size was estimated at USD 18.4 billion in 2024 and is projected to reach USD 91.9 billion by 2033, growing at a CAGR of 19.6% from 2025 to 2033. The rising prevalence of chronic respiratory diseases (CRDs) globally, the development of technologically advanced products, and the growing adoption of digital solutions in the healthcare sector are expected to contribute to the market's growth.

Key Market Trends & Insights

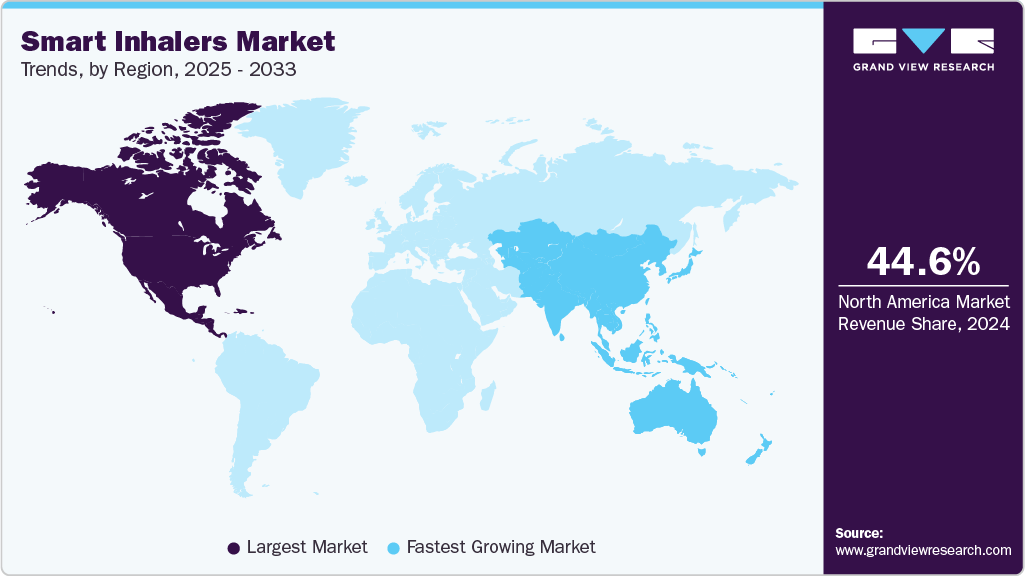

- North America dominated the global smart inhalers market and accounted for a 44.64% share in 2024.

- The smart inhalers industry in the U.S. has seen significant growth over the forecast period, owing to the rising prevalence of asthma and COPD.

- By type, the Metered Dose Inhalers (MDIs) segment dominated the market with the largest revenue share of 64.19% in 2024.

- By indication, the Chronic Obstructive Pulmonary Disease (COPD) segment dominated the market with the largest share in 2024.

- By distribution channel, the hospital pharmacies segment dominated the smart inhalers industry with the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.4 Billion

- 2033 Projected Market Size: USD 91.9 Billion

- CAGR (2025-2033): 19.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to estimates from the American Lung Association, in 2022, 11.7 million people, or 4.6% of adults, reported a diagnosis of COPD, including chronic bronchitis and emphysema. In addition, the WHO estimates that potentially fatal respiratory diseases, including COPD, lung cancer, and tuberculosis, will account for about one in five deaths worldwide by 2030.The increasing focus on developing smart inhalers and a rise in initiatives by key market players for R&D efforts drive the demand for smart inhalers. In addition, more companies are integrating digital technologies into their product offerings to enhance medication effectiveness and the management of asthma and COPD. For instance, in April 2022, Aptar Pharma, a market player, introduced HeroTracker Sense, a chronic respiratory digital e-health solution that converts a conventional metered dose inhaler into a smart inhaler.

Moreover, various research studies highlighting the benefits of adopting smart inhalers, such as assisting patients in treatment adherence and controlling symptoms, also contribute to the market growth. For instance, a 2020 Cleveland Clinic study discovered that patients with COPD using the Propeller company’s smart inhalers had a noticeably lower risk of being admitted to the hospital, with a nearly 35% drop in visits compared to the prior year.

Furthermore, increasing adoption of digital health technologies and connected devices is enabling better patient adherence, remote monitoring, and personalized treatment plans. Integration of Bluetooth and sensor-based technologies allows healthcare providers to track inhaler usage and optimize therapy outcomes. Supportive government initiatives, growing awareness about disease management, and collaborations between pharmaceutical companies and tech firms are further accelerating market expansion. In addition, the shift toward value-based care is encouraging the adoption of smart inhalers.

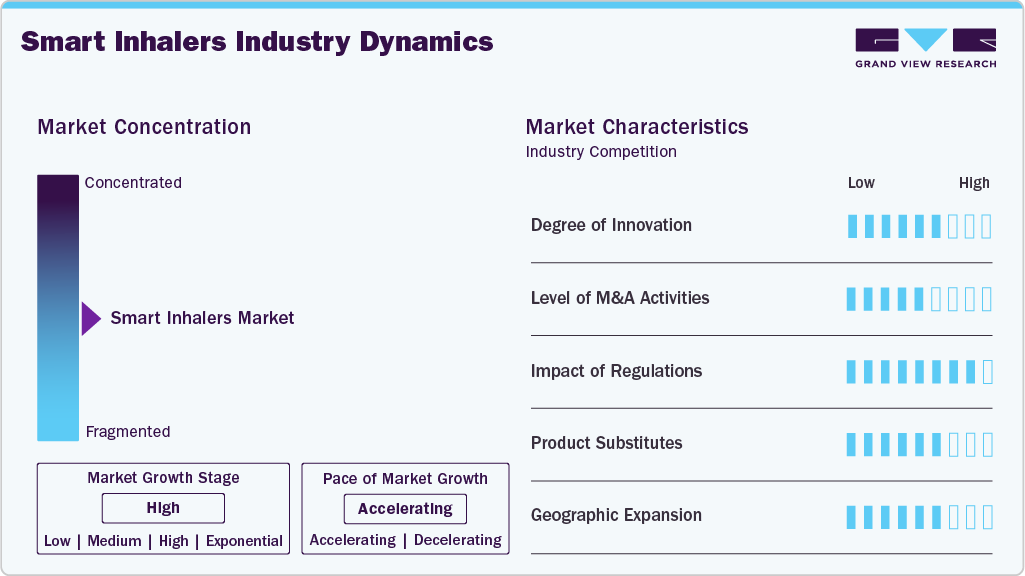

Market Concentration & Characteristics

The industry growth is high, at an accelerating pace. The smart inhalers industry is characterized by the increasing prevalence of respiratory diseases, the aging population, increasing initiatives by government and private organizations to increase awareness about respiratory diseases, and increasing innovation and product launches by players.

The smart inhaler industry is characterized by a high degree of innovation as industry players develop innovative solutions such as inhalers with sensors, trackers, connectivity features, and integrated digital platforms to gain better health insights into patient health. Increasing efforts to develop such technologies are increasing the opportunity for future innovations in the industry. For instance, in July 2023, Teva UK launched the GoResp Digihaler system for asthma and COPD patients in the UK. This inhaler device contains in-built sensors that detect and record the patient’s data, used in further consulting and treatment.

Key players are implementing strategic initiatives, such as mergers and acquisitions, to strengthen their industry presence. In November 2020, AptarGroup, Inc. acquired Cohero Health, Inc. to expand its respiratory disease management portfolio. The acquisition significantly contributed to the company’s digital portfolio and increased its ability to offer diagnostics solutions in the respiratory disease category.

The industry is characterized by a medium degree of regulatory impact. Regulations ensure the safety and efficiency of devices, which significantly improves their performance and thus increases their adoption. However, a stringent regulatory framework might impact the cost and development time of the devices, increasing inconvenience for industry players and healthcare systems.

Industry players increasingly focus on geographic expansion to capture untapped markets. The growth of healthcare sectors in developing regions offers significant opportunities for market players. In addition, the rising awareness of respiratory diseases and the growing acceptance of technologically advanced devices are creating further expansion opportunities for these companies. By entering new markets and regions, players aim to broaden their reach and capitalize on emerging opportunities in the global respiratory devices market.

Type Insights

Based on type, the market is segmented into dry powdered inhalers (DPIs) and metered dose inhalers (MDIs). The MDIs segment accounted for the largest revenue share of 64.2% in 2024. MDIs gained popularity as they are easy and efficient to use in short spray bursts of a fixed dose, which the patient themselves generally administers through inhalation. In September 2022, OzUK Limited, the UK-based research lab, partnered with H&T Presspart to bring generic MDIs for traditional COPD/Asthma applications into the market for H&T Presspart's clients.

The dry powdered inhalers (DPIs) segment is expected to grow at a CAGR of 18.8% over the forecast period. The segment growth is attributed to the growing concerns over the environmental impact of inhaler devices that use chlorofluorocarbons as propellants, making DPIs a preferred choice over pressurized MDIs and nebulizers for treating respiratory illnesses. Moreover, the increasing demand for dry-powered inhalers encourages market players to develop advanced and effective ones. For instance, in June 2021, Glenmark Pharma announced the launch of its Tiotropium Bromide Dry Powder Inhaler under the brand name Tiogiva for COPD in the UK.

Indication Insights

Based on indication, the market is segmented into COPD, asthma, and others. COPD accounted for the largest revenue share in 2024, attributed to the prevalence of the disease globally. According to the Forum of International Respiratory Societies (FIRS) September 2021 report, COPD is the predominant non-infectious lung disease worldwide, affecting around 300 million individuals, or about 4% of the global population.

The asthma segment is anticipated to grow at a significant CAGR over the forecast period due to the increasing prevalence of asthma. According to data from the Centers for Disease Control and Prevention (CDC), approximately 7.7% of the U.S. population, equating to around 24.96 million, had asthma in 2021. This high prevalence is expected to drive demand for smart inhalers and other innovative solutions, contributing to market growth.

Distribution Channel Insights

The hospital pharmacies segment held the largest revenue share in 2024. Hospital pharmacies offer better flexibility, comfort, and convenience for purchasing smart inhalers for hospitalized patients. Moreover, hospitals are witnessing a higher concentration of patients owing to the increasing incidence of chronic respiratory illnesses, which are the primary user groups for smart inhalers. Thus, it becomes convenient for patients to purchase smart inhalers from nearby hospital pharmacies, contributing to the segment's growth.

The online pharmacies segment is expected to grow at the fastest CAGR over the forecast period. The growth is due to its convenience, wider product availability, and competitive pricing. The shift to online shopping has been accelerated by the COVID-19 pandemic, making it a preferred option for many consumers. In addition, online pharmacies provide extensive product information and user reviews, aiding informed decision-making. Their integration with digital health platforms enhances prescription management and user experience, contributing to the segment growth.

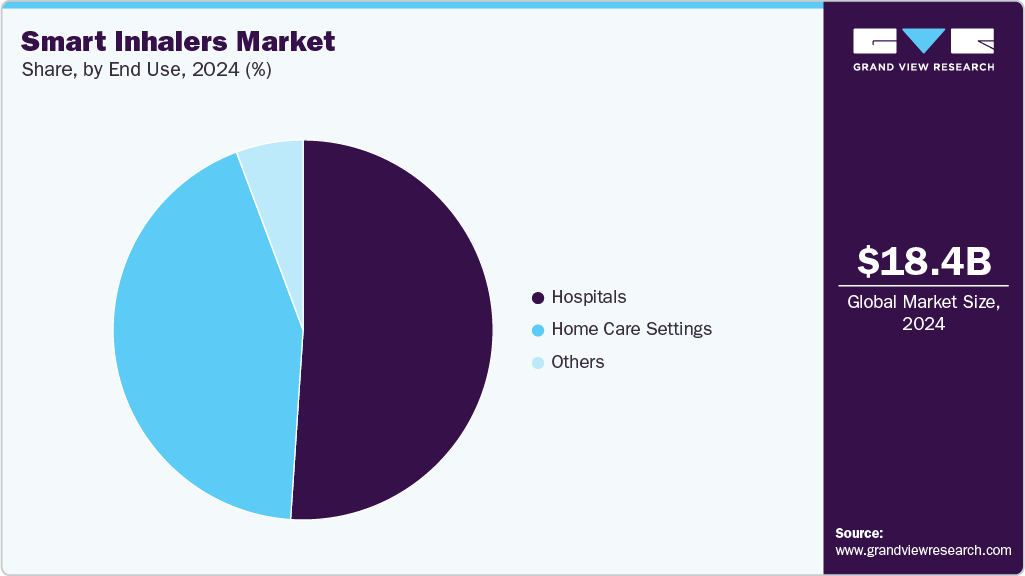

End Use Insights

Hospitals accounted for the largest revenue share in 2024. Rapid advancements in healthcare infrastructure, expanding public-private partnerships, and better access to healthcare services are all expected to impact the hospital segment significantly. Similarly, hospitals are the early adopters of smart inhaler technology as they deal with patients with various respiratory diseases. Moreover, the increasing patient pool further pushes the hospitals to maintain a high stock of various smart inhalers to meet the demands of different patients.

The home care settings segment is anticipated to grow at the fastest CAGR over the forecast period. The rising cost of hospital care, improved technology, an increasing focus on remote patient monitoring, and increasing telehealth integration have significantly shifted patients' preference to get treatment in home care settings rather than hospitals. The convenience of getting treatment in a home care setting further pushes its demand, which is expected to drive the segment's growth.

Regional Insights

North America smart inhalers industry dominated globally and accounted for 44.64% share in 2024. The developed healthcare infrastructure of the region, the increasing prevalence of COPD and asthma, and the adoption of advanced medical devices are the major contributors to the region's market growth. Similarly, the regulatory bodies are also supportive of the products or solutions that help to counter this increasing prevalence of respiratory diseases. For instance, in September 2021, Adherium Limited announced that the U.S. FDA 510(k) approved its Hailie Sensor. The sensor includes physiological steps for monitoring asthma and COPD medications in the U.S.

U.S. Smart Inhalers Market Trends

The smart inhaler industry in the U.S. is expected to grow at a significant CAGR over a forecast period. This growth is attributed to the increasing prevalence of chronic diseases, growing investments and focus on the development of new advanced products, and the growing geriatric population of the country. According to the Population Reference Bureau (PRB), the older population of the U.S. aged above 65 years is anticipated to increase by 47% from 58 million in 2022 to 82 million in 2050. This increasing geriatric population is more susceptible to the respiratory diseases. Smart inhalers empower this population to manage their health conditions and thus are expected to experience demand over the forecast period.

The smart inhalers industry in Canada is anticipated to grow at a significant rate owing to the high respiratory disease rate, increasing government support for chronic disease management, and increasing public awareness about the benefits of smart inhalers. According to the Asthma Canada 2021 Annual Report, asthma is the third most common chronic disease in the country, affecting more than 3.8 million Canadians. Moreover, asthma has an even higher prevalence in children, as more than 850,000 children in the country have asthma. This high prevalence of respiratory diseases in the country is anticipated to increase the demand for smart solutions such as smart inhalers, driving the market growth in the country.

Europe Smart Inhalers Market Trends

The smart inhalers industry in Europe is witnessing robust growth driven by the rising prevalence of respiratory conditions such as asthma and chronic obstructive pulmonary disease (COPD), coupled with increased focus on digital health and remote patient monitoring. The growing adoption of connected health technologies by healthcare providers is enabling real-time tracking of medication adherence, inhaler usage patterns, and respiratory health metrics. Regulatory support for digital therapeutics, favorable reimbursement policies in countries like Germany and the UK, and the emergence of AI-powered inhaler sensors are further fueling market expansion. Additionally, partnerships between pharmaceutical companies and health tech startups are fostering innovation in smart inhaler devices, improving patient engagement, and supporting better disease management outcomes across the region.

The smart inhalers industry in the UK is growing significantly owing to the rising prevalence of asthma and chronic obstructive pulmonary disease (COPD), coupled with the growing focus on improving patient adherence to treatment. The National Health Service (NHS) is increasingly adopting digital health technologies to enhance disease management and reduce healthcare costs, creating a favorable environment for smart inhaler integration. Advancements in sensor technology, Bluetooth connectivity, and real-time data analytics are enabling remote monitoring and personalized care, further boosting demand. Additionally, supportive government initiatives toward digital health adoption and the presence of leading pharmaceutical and medtech players in the UK are accelerating market expansion.

Asia Pacific Smart Inhalers Market Trends

The smart inhaler industry in Asia Pacific is anticipated to witness the fastest growth over the forecast period. The developing healthcare infrastructure, growing geriatric population base, growing prevalence of respiratory diseases, and increasing awareness about the benefits of using smart inhalers are some of the major factors contributing to the growth of the smart inhalers industry in the region. The increasing initiatives by government and private institutions to spread awareness about respiratory diseases are expected to propel the market growth. For instance, in May 2023, ALKEM launched an asthma awareness campaign on World Asthma Day 2023 to increase awareness about SMART treatment for asthma among patients and physicians through mega diagnostic camps, marathons and rallies.

The smart inhalers industry in China held a significant market share in 2024. The high prevalence of respiratory diseases such as asthma and COPD, increasing focus on technological innovation in healthcare and air pollution leading to respiratory diseases are driving the market growth in the country. According to the WHO, China witnesses around 2 million mortalities each year due to air pollution. Moreover, this air pollution also contributes to increasing breathing problems, leading to respiratory diseases, which is expected to drive the market growth.

The smart inhaler industry in India is anticipated to witness lucrative growth over the forecast period. The rising prevalence of respiratory diseases, developing healthcare infrastructure, and growing affordability drive the smart inhaler market in India. India has witnessed a significant rise in respiratory diseases in the last few years, increasing the demand for medical devices such as inhalers. According to the Global Asthma Report 2022, over 35 million people in India suffer from asthma. This prevalence of respiratory diseases, coupled with the increasing affordability, is expected to drive market growth in India.

Key Smart Inhaler Company Insights

Key players in the market are employing new product development, partnerships, and mergers & acquisitions to expand their market share. Notable companies include COHERO Health Inc. (AptarGroup, Inc.), Adherium, Propeller Health (ResMed), Novartis AG, Teva Pharmaceuticals Industries Ltd., and 3M. These players are utilizing various approaches to gain a competitive edge. For instance, in August 2022, Adherium Limited, known for its respiratory eHealth and data management solutions, partnered with Trudell Medical Limited. This collaboration aims to serve COPD patients in the U.S. by combining Trudell's U.S. operations, Monaghan Medical, and Aetonix's aTouchAway platform with Adherium's Hailie sensors. The goal of this partnership is to evaluate COPD patients’ post-hospital discharge, reduce readmissions, and enhance patient outcomes.

Key Smart Inhaler Companies:

The following are the leading companies in the smart inhalers market. These companies collectively hold the largest market share and dictate industry trends.

- Presspart Verwaltungs GmbH.

- Personal Air Quality Systems Pvt Ltd

- COHERO Health Inc. (AptarGroup, Inc.)

- Cognita Labs

- adherium

- Amiko Digital Health Limited.

- Teva Pharmaceuticals Industries Ltd.

- Propeller Health (ResMed)

- Novartis AG

- Pneuma Respiratory Inc.

- 3M

- AireHealth, Inc.

- FindAir Sp. z o.o

Recent Developments

-

In April 2024, Adherium announced that it received FDA clearance for using its Hailie Smartinhaler with AstraZeneca’s Breztri and Airsupra inhalation devices. This clearance introduces real-time insights through data collection into inhaler technique and medication usage.

“By securing FDA clearance for our Smartinhaler with Airsupra and Breztri, we are bringing that vision to life, offering patients and healthcare providers a powerful tool in the fight against chronic respiratory diseases. This is just the beginning of our journey to transform respiratory care.”

-Adherium CEO Dr Paul Mastoridis

-

In April 2024, Bespak, a contract development and manufacturing organization (CDMO) specializing in inhaled drug-device products, and H&T Presspart, a dealer in inhaled delivery systems, partnered to expedite the shift from traditional pressurized Metered Dose Inhalers to more environmentally friendly alternatives using low GWP propellants.

“We are committed to leading the transition to low GWP propellants in pMDIs, and in collaboration with H&T Presspart, we are proud to be able to offer a unique combination of capabilities and expertise to support our customers to transition as efficiently as possible. This partnership is significant in that we can offer development with both sustainable propellant options within a matter of weeks, no matter what the customer’s stage of product development when they commence work with us. Our goal is to transition as many pMDI products as possible to meet the requirements of evolving global legislation, and we believe in working together across the industry to achieve this goal - which not only helps protect the planet, but also safeguards patient access to inhaler options.”

-Chris Hirst, CEO of Bespak

-

In March 2024, AstraZeneca Pharma India Limited and Mankind Pharma Limited agreed that Mankind exclusively distribute AstraZeneca's Symbicort, a combination of budesonide and formoterol fumarate dihydrate, in India.

“Mankind has always been steadfast in providing access to quality treatments to the deserving patients across the nation. In this regard, we are excited to partner with AstraZeneca to make their innovative therapy flagship brand Symbicort, a global standard in treating Asthma. Symbicort's dual mechanism of action and ease of use in a single inhaler can greatly help patients manage these conditions and improve their quality of life. Through our field forces’ extensive outreach, we hope to strengthen access across urban and rural markets. With our shared goal to enable better patient outcomes, I see this collaboration as strategic in more ways than one. We believe such credible partnerships that widen availability of globally established medicines in India exemplify our ethos of putting patients first while ensuring value.”

-Mr Atish Majumdar, Sr. President - Sales & Marketing, Mankind Pharma Limited

-

In September 2021, BreatheSuite received FDA clearance for its device, BreatheSuite Metered-Dose Inhaler (MDI) V1. This device turns the MDIs into smart inhalers by providing feedback and monitoring the inhaler techniques and adherence for people with COPD and asthma.

“By having a real-time way to digitally monitor and provide feedback to patients, we hope to enhance healthcare outcomes. Furthermore, having an objective measure of adherence and technique from each user with asthma and COPD will advance the sphere of knowledge regarding the effectiveness of inhaled medications.”

-Dr. Meshari F. Alwashmi, Chief Scientific Officer

-

In May 2020, AstraZeneca announced a partnership with Propeller Health to add smart features to its Symbicort inhaler, digitizing the treatment of COPD and asthma and increasing medication adherence.

-

In February 2022, AstraZeneca advances its Ambition Zero Carbon program by partnering with Honeywell to create next-generation respiratory inhalers.

-

For instance, in April 2020, Adherium Limited partnered with Planet Innovation to develop software and hardware for respiratory devices. This partnership strengthened Adherium's presence in COPD and asthma management by offering sensors created to provide the physiological data required to enable physician monitoring.

Smart Inhalers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.9 billion

Revenue forecast in 2033

USD 91.9 billion

Growth rate

CAGR of 19.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, indication, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Presspart Verwaltungs GmbH; Personal Air Quality Systems Pvt Ltd; COHERO Health Inc. (AptarGroup, Inc.); Cognita Labs; Adherium; Amiko Digital Health Limited; Teva Pharmaceuticals Industries Ltd; Propeller Health (ResMed); Novartis AG; Pneuma Respiratory Inc.; 3M; AireHealth, Inc.; FindAir Sp. z o.o

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Inhalers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart inhalers market report based on type, indication, distribution channel, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Dry Powdered Inhalers (DPIs)

-

Metered Dose Inhalers (MDIs)

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Asthma

-

COPD

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Homecare Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global smart inhalers market size was estimated at USD 18.4 billion in 2024 and is expected to reach USD 21.9 billion in 2025.

b. The global smart inhalers market is expected to grow at a compound annual growth rate of 19.6% from 2024 to 2033 to reach USD 91.9 billion by 2033.

b. North America dominated the market with a revenue share of 44.64% in 2024. The developed healthcare infrastructure of the region, the increasing prevalence of COPD and asthma, and the adoption of advanced medical devices are the major contributors to the region's market growth.

b. Key players operating in the smart inhalers market include Presspart Verwaltungs GmbH.; Personal Air Quality Systems Pvt Ltd; COHERO Health Inc. (AptarGroup, Inc.); Cognita Labs; adherium; Amiko Digital Health Limited.; Teva Pharmaceuticals Industries Ltd.; Propeller Health (ResMed); Novartis AG; Pneuma Respiratory Inc.; 3M; AireHealth, Inc.; FindAir Sp. z o.o

b. Key factors driving market growth include the rising incidence of chronic respiratory diseases (CRDs) such as bronchial asthma, chronic obstructive pulmonary disease (COPD), cystic fibrosis, lung disorders, and pulmonary hypertension (PH). In addition, improved clinical outcomes from smart inhalers and the increasing rate of tobacco smoking are contributing to the growth of the smart inhalers market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.