- Home

- »

- Electronic Devices

- »

-

Smart Lock Market Size And Share, Industry Report, 2030GVR Report cover

![Smart Lock Market Size, Share & Trends Report]()

Smart Lock Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application, By Protocol (Bluetooth, Wi-Fi, Z-Wave, Zigbee), By Authentication Method, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-138-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Lock Market Summary

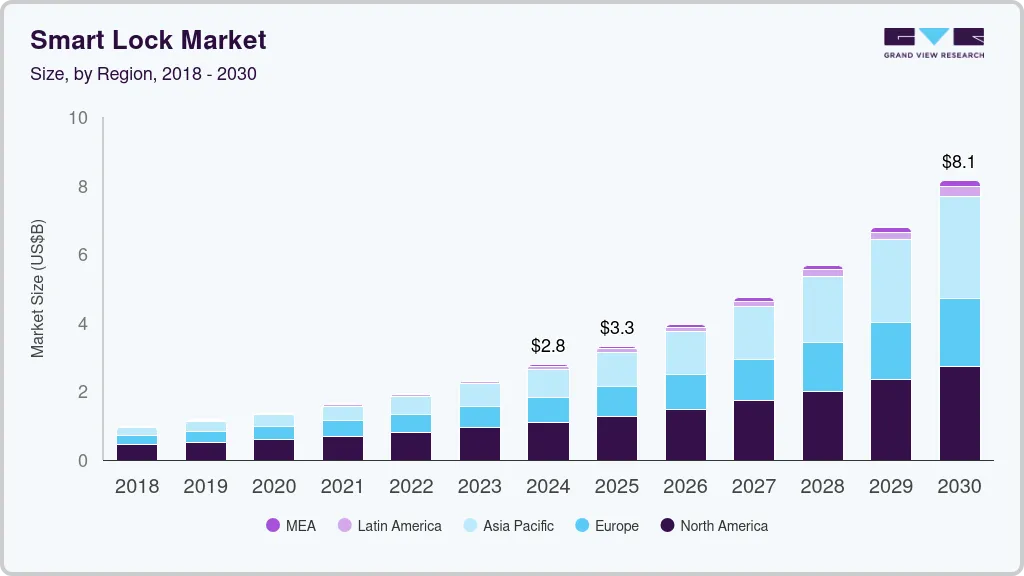

The global smart lock market size was estimated at USD 2,770.1 million in 2024 and is projected to reach USD 8,136.9 million by 2030, growing at a CAGR of 19.7% from 2025 to 2030. The market growth is largely driven by the rising adoption and advancements in connected home devices and smart home technology, driving the shift towards digitalization in both residential and commercial sectors.

Key Market Trends & Insights

- North America dominated the smart lock market with the largest revenue share of 39.49% in 2024.

- The smart lock market in the U.S. accounted for the largest revenue share of 81% in 2024.

- Based on application, the residential segment accounted for the largest market revenue share in 2024.

- Based on authentication method, the smartphone-based segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,770.1 Million

- 2030 Projected Market Size: USD 8,136.9 Million

- CAGR (2025-2030): 19.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the increasing demand from consumers for secure, easy-to-use, and integrated solutions for their homes and businesses is positioning smart locks as the preferred modern access control system. These factors further accelerate the adoption of smart lock solutions, further boosting the smart lock industry expansion. The increasing focus on home automation and digital security, which are integral to the growing adoption of smart home devices worldwide, is a key driver in the smart lock industry expansion. Consumers are increasingly choosing keyless entry systems for their convenience, as they eliminate the need for physical keys and offer features such as remote access and real-time notifications. In commercial applications, smart locks are also enhancing security protocols with advanced features such as mobile app integration, geo-fencing, and voice control, making them attractive for businesses looking to streamline access control, thereby expanding the overall market growth.

Moreover, a growing integration of advanced biometric technologies, such as facial recognition and fingerprint scanning, is propelling the smart lock industry's growth. These features enhance security and convenience by offering highly personalized and secure access, allowing users to unlock doors with a simple scan. In addition, the rise of voice-activated smart locks, integrated with platforms like Amazon Alexa, Google Assistant, and Apple HomeKit, is transforming how consumers interact with their smart homes. The growing demand for voice-controlled devices is expected to drive the adoption of smart locks in both residential and commercial markets.

Furthermore, energy harvesting technologies are expected to play a significant role in reducing dependency on batteries, further enhancing sustainability. With the growing number of smart home installations, smart locks are expected to be integrated with other home automation devices, such as security cameras, thermostats, and lighting systems, creating a seamless and interconnected smart home experience. As consumer demand for smarter, more secure, and more efficient living environments continues to rise, the smart lock industry is poised for significant innovation and expansion in the coming years.

Moreover, key companies are constantly enhancing product features, incorporating advanced technologies such as biometrics and voice control. In addition, companies are targeting both residential and commercial sectors, offering tailored solutions for homes, offices, and other properties. For instance, in April 2024, Onity, Inc. (Honeywell International, Inc.) announced an advancement in IoT-based self-storage security, looking forward to integrating state-of-the-art sensors into the Passport locking solution. Such strategies by key companies are expected to drive the smart lock industry growth in the coming years.

Product Insights

The deadbolt segment led the market with the largest revenue share of 42.7% in 2024, owing to its enhanced security features and easy integration into existing door systems. Consumers appreciate the added convenience of keyless entry combined with the robustness of traditional locking mechanisms. Their growing popularity in both new construction and retrofitting projects, especially in North America and Europe, continues to drive demand. In addition, insurance incentives for enhanced home security and increased awareness of home safety contribute to their widespread adoption.

The level handler segment is expected to witness at the fastest CAGR of 21.2% from 2025 to 2030, driven by the growing demand from commercial and multi-residential buildings where high-frequency access and ADA compliance are essential. Their ergonomic design and ability to integrate with access control systems make them ideal for offices, hospitals, and public infrastructure. Businesses favor lever-handle smart locks for their ease of use, especially in high-traffic environments. Rising investments in smart infrastructure and the push toward touchless solutions post-COVID are further propelling this segment.

Application Insights

Based on application, the residential segment accounted for the largest market revenue share in 2024, owing to the increasing adoption of smart home ecosystems, rising awareness about home security, and the convenience of remote locking/unlocking. As more homeowners invest in IoT devices, smart locks are often one of the first upgrades. Real estate developments and the boom in short-term rentals like Airbnb also encourage adoption, where remote access and digital key sharing are valued features. Falling prices and availability through online retail channels have made these devices more accessible to the average homeowner.

The commercial segment is expected to witness at the fastest CAGR from 2025 to 2030, driven by the growing need for centralized security, employee access control, and audit trails. Businesses benefit from keyless solutions that can be managed remotely, offering flexibility for multiple users and locations. Integration with security and HR systems adds value, especially in sectors like banking, healthcare, and hospitality. The rise of co-working spaces and hybrid work models has further pushed businesses to adopt dynamic, scalable access management systems.

Protocol Insights

The Bluetooth segment accounted for the largest market share in 2024. Bluetooth-enabled smart locks are driven by their offline accessibility, low power consumption, and straightforward smartphone pairing. Users appreciate the balance of security and convenience, especially in residential and small business applications. These locks appeal to budget-conscious consumers who don’t want to rely on constant internet connectivity. The segment is also favored for temporary access sharing, like for service providers or guests, without exposing the lock to potential cyber threats from the internet.

The Wi-Fi segment is expected to witness at the fastest CAGR from 2025 to 2030. Wi-Fi smart locks are propelled by the demand for full remote access, integration with smart home ecosystems (such as Alexa, Google Home), and real-time alerts. Users value the ability to manage and monitor locks from anywhere, especially in vacation homes, rental properties, and for busy professionals. While these models consume more power, their feature-rich offerings-such as video doorbells and voice control-make them appealing for tech-savvy users. The growing expansion of smart cities and connected infrastructure continues to boost this segment.

Authentication Method Insights

Based on authentication method, the smartphone-based segment accounted for the largest market revenue share in 2024. Smartphone-based smart locks are surging due to the ubiquity of smartphones and user preference for centralized app-based control. These locks eliminate the need for physical keys or fobs, allowing access via mobile apps, geo-fencing, or virtual keys. Their popularity spans residential users, Airbnb hosts, and even office managers. Integration with other mobile-managed systems, such as smart thermostats or lighting, enhances their value in home automation ecosystems, making them highly desirable.

The biometric segment is expected to witness at the fastest CAGR from 2025 to 2030. Biometric smart locks are driven by the growing emphasis on high security and user-specific access control. Fingerprint, facial recognition, and even retina-based locks offer a level of authentication that cannot be duplicated or lost like traditional keys. These are increasingly favored in high-end residential properties, government buildings, and research facilities. As biometric technology becomes more affordable and accurate, adoption continues to rise, particularly in Asia-Pacific regions where tech-forward security is in demand.

Regional Insights

North America dominated the smart lock market with the largest revenue share of 39.49% in 2024, driven by a growing demand for home automation and security, as well as increased awareness of smart home technology. Consumers in this region prioritize convenience, advanced security features, and integration with other smart devices like thermostats and lighting. The adoption of smart locks is further fueled by high disposable income, a tech-savvy population, and the increasing trend of remote monitoring and control, making smart locks a popular choice for homeowners and businesses alike.

U.S. Smart Lock Market Trends

The smart lock market in the U.S. accounted for the largest revenue share of 81% in North America in 2024, driven by the rapid adoption of connected devices and the growing trend of home automation. Consumers are increasingly focused on enhancing home security with smart, keyless entry systems. The trend toward DIY smart home installations, combined with strong demand for voice-controlled systems and mobile app integration, further boosts the smart lock industry. In addition, the rise in smart home technology integration, such as Alexa, Google Assistant, and Apple HomeKit, is contributing significantly to the market's expansion.

Europe Smart Lock Market Trends

The smart lock market in Europe is anticipated to grow at a significant CAGR during the forecast period, primarily driven by stringent security regulations and the increasing need for improved home and office security. The rise in urbanization, along with the demand for connected devices, is propelling the adoption of smart locks. European consumers are also attracted to the convenience and energy efficiency offered by these devices. The region is witnessing high growth in residential, commercial, and multi-family housing applications, with smart locks being integrated into both new constructions and renovation projects.

The UK smart lock market is anticipated to grow at a significant CAGR during the forecast period, driven by the growing trend of home automation and the desire for higher security and convenience. In addition, concerns over burglary and safety are encouraging homeowners and businesses to opt for keyless entry solutions. The UK’s adoption of connected devices, paired with its strong e-commerce and retail infrastructure, is expected to continue to fuel market growth.

The smart lock market in Germany is expected to grow at a substantial CAGR during the forecast period, driven by increasing awareness of digital security and the demand for technologically advanced, eco-friendly solutions. Germany’s highly developed infrastructure, coupled with its focus on innovation and sustainability, encourages the adoption of smart locks, particularly in residential and commercial buildings. The integration of smart locks with home automation systems is also becoming more common, with a strong preference for secure, privacy-focused solutions aligning with local consumer expectations.

Asia-Pacific Smart Lock Market Trends

The smart lock market in Asia-Pacific is expected to grow at the fastest CAGR of over 24% in 2024, driven by the increasing urbanization, rising disposable incomes, and technological advancements in countries like China, Japan, and India. The region's growing inclination toward smart homes, supported by government initiatives to promote digitalization, is driving the adoption of smart locks. In addition, as APAC becomes a manufacturing hub for smart lock components and systems, the affordability and availability of smart locks are making them more accessible to a broader consumer base.

The Japan smart lock market is gaining traction due to the country’s high-tech culture, rapid urbanization, and demand for convenience. The Japanese market places a strong emphasis on security, and the adoption of smart locks is driven by the increasing number of smart homes and connected buildings. The integration of smart locks with other IoT devices, such as home security cameras and lighting systems, is fueling growth. Moreover, Japan's aging population is likely to spur demand for easier-to-use, secure access solutions in both residential and commercial sectors.

The smart lock market in China accounted for the largest market revenue share in Asia Pacific in 2024, owing to the country's booming middle class, rapid urbanization, and high technological adoption rates. China is one of the largest markets for smart home devices, and smart locks are increasingly popular in residential, commercial, and rental properties. The push towards smart cities and the availability of affordable smart lock options, alongside strong domestic manufacturers, are key factors driving the market in China.

Key Smart Lock Company Insights

Some of the key players operating in the industry are Honeywell International, Inc., and Kwikset (ASSA ABLOY), among others.

-

Honeywell International, Inc. is a global technology and manufacturing company dedicated to creating advanced solutions across various industries and industry verticals, including aerospace, building automation, energy, sustainability, and industrial automation. The company’s solutions focus on enhancing efficiency and safety in commercial, defense, and industrial applications. The company focuses on integrating innovative technologies, such as Bluetooth and Wi-Fi, into its smart lock offerings, enhancing user convenience and security features.

-

Kwikset manufactures residential door locks and security products. The company provides user-friendly locking solutions, including Smart Lock, that integrate with modern home automation systems. The company is known for its innovative designs and commitment to quality. The company operates under ASSA ABLOY.

Avent Security and HavenLock, Inc. are some of the emerging market participants in the smart lock industry.

-

Avent Security manufactures smart door locks. The company specializes in fingerprint, passwords, and RF card hotel locks. The company also offers OEM services. Committed to competitive pricing, reliable manufacturing, and superior quality, the company has built a global market presence, serving thousands of households and projects worldwide. The company aims to enhance home security and support brand owners, wholesalers, and contractors with timely delivery and professional services.

-

HavenLock, Inc. provides innovative residential security solutions. The company’s products are designed to enhance home safety and guarantee peace of mind by leveraging advanced technology and user-friendly designs. The company’s offerings are specifically tailored for residential use, ensuring that families can feel secure in their homes.

Key Smart Lock Companies:

The following are the leading companies in the smart lock market. These companies collectively hold the largest market share and dictate industry trends.

- August Home (ASSA ABLOY)

- Avent Security

- Cansec Systems Ltd.

- Danalock

- dormakaba International Holding AG

- FRIDAY Home

- Gate Labs

- HavenLock, Inc.

- Honeywell International Inc.

- Kwikset (ASSA ABLOY)

- RemoteLock

- MUL-T-LOCK TECHNOLOGIES LTD. (ASSA ABLOY)

- Nuki Home Solutions GmbH

- Onity, Inc. (Honeywell International, Inc.)

- Salto Systems, S.L.

- Schlage (Allegion Plc)

- SentriLock, LLC

- SMARTLOCK

- UniKey Technologies, Inc.

- Yale Locks (ASSA ABLOY)

- Zigbang Co., Ltd.

Recent Developments

-

In February 2025, Salto Systems introduced the XS4 One S Keypad, an advanced smart locking solution that integrates PIN code access control. This device supports multiple credentials, including PIN codes, smart keycards, and mobile access, offering a flexible and secure entry experience. Its backlit, capacitive touch-enabled keypad ensures intuitive operation, while Salto's BLUENet Wireless technology provides seamless online connectivity.

-

In January 2025, Onity, Inc. announced an integration partnership with Tenant, Inc. to enhance security and operational efficiency in the self-storage industry. Onity's Passport smart locks will now seamlessly integrate with Tenant, Inc.'s property management software, enabling self-storage facilities to issue mobile credentials to tenants.

-

In August 2024, Salto Systems, S.L. introduced IQ Mini, the company’s latest, compact wireless device designed to enhance access control solutions. The device was designed to utilize the company’s BlueNet technology to enable seamless integration with various systems and provide reliable wireless connectivity. The device was aimed at improving security in environments where space is limited.

Smart Lock Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,306.1 million

Revenue forecast in 2030

USD 8,136.9 million

Growth rate

CAGR of 19.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, protocol, authentication method, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

August Home (ASSA ABLOY); Avent Security; Cansec Systems Ltd.; Danalock; dormakaba International Holding AG; FRIDAY Home; Gate Labs; HavenLock, Inc.; Honeywell International Inc.; Kwikset (ASSA ABLOY); RemoteLock; MUL-T-LOCK TECHNOLOGIES LTD. (ASSA ABLOY); Nuki Home Solutions GmbH; Onity, Inc. (Honeywell International, Inc.); Salto Systems; S.L.; Schlage (Allegion Plc); SentriLock, LLC; SMARTLOCK; UniKey Technologies, Inc.; Yale Locks (ASSA ABLOY); Zigbang Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet exact research needs. Explore purchase options

Global Smart Lock Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart lock market report based on product, application, protocol, authentication method, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Deadbolt

-

Level Handlers

-

Padlock

-

Server Locks & Latches

-

Knob Locks

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Individual Household

-

Commonhold

-

-

Commercial

-

Hospitality

-

Healthcare

-

BFSI

-

Enterprise

-

Critical Infrastructure

-

Educational Institution

-

-

Industrial

-

Manufacturing

-

Energy & Utilities

-

Oil & Gas

-

-

Institutional & Government

-

Transportation & Logistics

-

Others

-

-

Protocol Outlook (Revenue, USD Million, 2018 - 2030)

-

Bluetooth

-

Wi-Fi

-

Z-Wave

-

Zigbee

-

Others

-

-

Authentication Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Keypad

-

Card Key

-

Touch-based

-

Key Fob

-

Smartphone-based

-

Biometric

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart lock market size was valued at USD 2,770.1 million in 2024 and is expected to reach USD 3,306.1 million in 2025.

b. The global smart lock market is expected to grow at a compound annual growth rate of 19.7% from 2025 to 2030 to reach USD 8,136.9 million by 2030.

b. The deadbolt segment registered the highest revenue share of over 42% in 2024 in the smart lock market and is expected to continue dominating the industry over the forecast period.

b. North America captured the largest share of over 39% in the smart lock market in 2024 and is expected to maintain its dominance over the forecast period.

b. The residential segment dominated the smart lock market with a revenue share of more than 46% in 2024. This is attributable to a rising number of new construction projects in the emerging economies along with the increasing adoption of smart security solutions across the sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.