- Home

- »

- Homecare & Decor

- »

-

Smart Mattress Market Size, Share & Trends Report, 2030GVR Report cover

![Smart Mattress Market Size, Share & Trends Report]()

Smart Mattress Market (2024 - 2030) Size, Share & Trends Analysis Report By Raw Material (Innerspring, Latex, Memory Foam), By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-189-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Mattress Market Summary

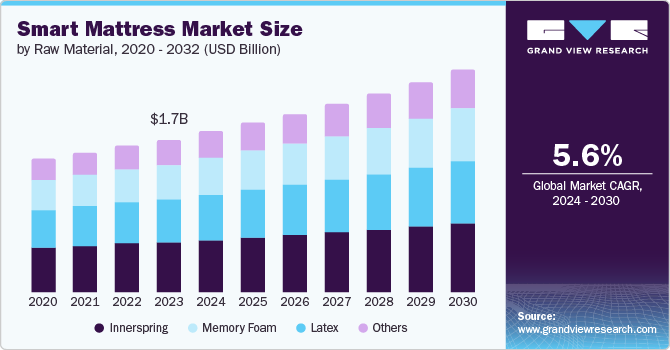

The global smart mattress market size was valued at USD 1.71 billion in 2023 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. An increase in demand for smart home technology for comfort and well-being is a major factor in the market growth.

Key Market Trends & Insights

- North America dominated the global smart mattress market in terms of revenue share of 66.7% in 2023.

- By product, innerspring segment dominated the market with a share of 32.6% in 2023.

- By application, the residential segment registered as the largest segment in terms of revenue share of 66.2% in 2023.

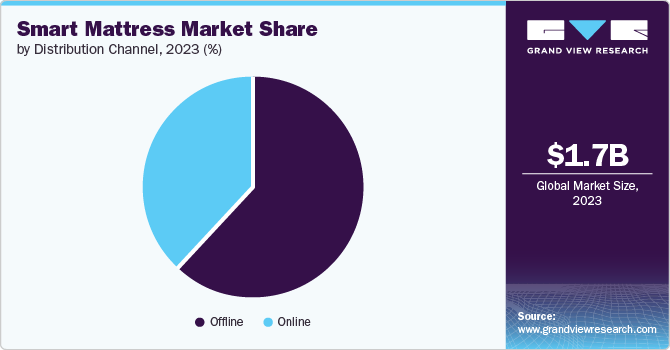

- By distribution channel, the offline segment dominated the smart mattresses market with a global share of 61.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.71 Billion

- 2030 Projected Market Size: USD 2.50 Billion

- CAGR (2024-2030): 5.6%

- North America: Largest market in 2023

The growing consumer interest in adopting new technologies and solutions for convenience and well-being has also largely influenced the market.

The increase in demand for smart beds in the hospitality sector, such as luxury hotels and healthcare organizations, has played an important role, which, in turn, positively impacts the industry growth. In addition, a rise in awareness of sleep quality and overall well-being in the population has triggered the need for quality products. As the young workforce grows in several countries, the stress levels of the young population have increased. Therefore, the smart mattress is designed with a technological approach to minimize stress levels and relay comfort without additional effort.

The mattress design is digitally enhanced to analyze breathing and heart rates, which helps calculate an individual's sleep time. It also provides an onboard heating system on cold nights with a feature of temperature and airflow control on demand. Smart mattresses are equipped with sensors and operable through mobile applications that analyze sleep patterns and offer personalized recommendations for better sleep.

Product Insights

The innerspring segment dominated the market with a share of 32.6% in 2023. The dominance is attributed to increased back problems associated with uncomfortable sleeping surfaces. Alongside this, the rise in consumer awareness has triggered a response in producers to produce premium goods that cater to technicalities linked with sleep patterns.

The memory foam segment is expected to witness the fastest CAGR of 5.4% from 2024 to 2030. The rise in acute back pain and memory foam's ability to comfort patients with back pain are contributing factors to the segment's growth. Besides, the use of eco-friendly and sustainable materials, advanced cooling technologies, and an increasing preference for online mattress purchases steer the demand effectively.

Application Insights

The residential segment registered as the largest segment in terms of revenue share of 66.2% in 2023. Factors attributed to the segment growth include awareness of the sleep cycle and patterns and benefits such as app control and personalized settings according to the individual's comfort. Other features, such as alarm setting and airflow control for better sleep and well-being, highlight the digitization here.

The commercial segment is anticipated to grow at the fastest CAGR of 6.5% during the forecast period. This growth can be attributed to the rise in demand for smart mattresses by hotels and hospitals to enhance customer experience and satisfaction. These institutions are widely adopting smart mattresses for the comfort of the users.

Distribution Channel Insights

The offline segment dominated the smart mattresses market with a global share of 61.7% in 2023. This can be attributed to the worldwide growing number of retail outlets and the delivery timespan. Moreover, the nature of customer service offered by the retail outlets is better when compared with online platforms, which is one of the major growth factors for the offline outlets.

The online segment is likely to witness the fastest CAGR of 6.6% over the forecast period. The major factors contributing to the segment growth include the growing presence of smart home electronics on online platforms and cashback offers. The schemes and offers available on online platforms attract mainly the middle-income groups. The convenience of product delivery attracts customers to the e-commerce platforms.

Regional Insights

North America dominated the global smart mattress market in terms of revenue share of 66.7% in 2023. The major factors contributing to the growth of the market are the increasing consumer spending and the ready adoption of luxury products. Additionally, an increase in awareness of sleeping patterns on overall well-being has also impacted the demand for smart mattresses positively in this region.

U.S. Smart Mattress Market Trends

The U.S. is the most significant region in North America as the awareness is increasing about the sleep cycle and overall fitness, rise in disposable income and technological advancements play a large role in market growth. The rise in sleep disorders has caused individuals to look for solutions that drive them towards improving their sleep quality. With the growing adoption of smart home furniture, and smart beds, smart mattresses are also paving the way for effective solutions.

Europe Smart Mattress Market Trends

The Europe smart mattresses market held a share of 17.1% in 2023. The increase in disposable incomes and technological advancements, have fueled the market growth. The UK has been a significant market in Europe as the demand for smart mattresses grew because of factors such as an increase in disposable income, growing awareness, and ready adoption of smart home equipment. Besides, there has been a growing significance of consumer-centric products. For instance, memory foam and latex mattresses have become popular for their suitability for comfort and support. There is also an increasing focus on such aspects as eco-friendly materials and green production techniques.

Germany is one of the leading markets in Europe because of the demand for mattresses in the commercial business. The increasing demand for healthcare and hospitality services is a great prospect for the smart mattress market in Germany. Pricing is another factor that influences consumer decisions. The new market developments include multifunctional beds with height adjustment features and the electronic touch entices the buyers. Indeed, there is a rising trend of consumer preferences in commercial sectors for customized mattresses.

Asia Pacific Smart Mattress Market Trends

Asia Pacific has witnessed a rapid pace for the adoption of smart mattresses due to the increasing awareness about the benefits of smart mattresses. The growing demand for residential construction has triggered an equivalent growth in the sale of mattresses in the market. China, Japan, South Korea, India, and Australia could be regarded as the countries, with the highest volume of commercial and residential construction of real estate, leading to a rapid increase in the number of bedroom spaces in the countries.

China smart mattress market has been significant in the past few years owing to the demand is majorly influenced by factors such as increasing population, and an increase in awareness of the sleep cycle and patterns. The market is constantly expanding as the population of China is growing, followed by the rise in income levels, and the development of housing, and real estate.

Smart mattress market in India is projected to attain new heights due to the awareness about the benefits of smart mattresses. Indian consumers place a high value on functional mattresses because of the increase in sleep disorders among the general population.

Key Smart Mattress Company Insights

Some key companies in the smart mattresses market include Eight Sleep, Inc., Casper, and Tempur-Pedic. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Eight Sleep manufactures smart mattresses that use active grid technology for the comfort of the sleeper. The pod has many chambers that circulate water and control the water temperature through smartphones.

-

Casper is a mattress manufacturing company that produces high-quality mattresses designed for comfort and support. The company incorporates several materials to relieve pressure and zoned support for different body parts.

Key Smart Mattress Companies:

The following are the leading companies in the smart mattress market. These companies collectively hold the largest market share and dictate industry trends.

- Eight Sleep, Inc

- Casper

- Tempur-Pedic North America, LLC

- Simmons Beauty rest India (A VFI Group Brand)

- Rest (Responsive Surface Technology)

- Nectar

- Purple Innovation, LLC

- Sealy India

- Leesa Sleep

Recent Developments

-

In April 2023, Sleep Number introduced their next-generation smart beds and lifestyle furniture, sold separately which could be used together for individuals for better sleep.

-

In January 2023, Tempur-Pedic launched its new smart mattresses for premium bedding offerings as it is equipped with new and innovative product options.

Smart Mattress Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.80 billion

Revenue forecast in 2030

USD 2.50 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, South Africa

Key companies profiled

Eight Sleep, Inc; Casper; Tempur-Pedic North America, LLC; Simmons Beauty rest India (A VFI Group Brand); Rest (Responsive Surface Technology); Nectar; Purple Innovation, LLC; Sealy India; Leesa Sleep

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Mattress Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the smart mattresses market report based on raw material, application, distribution channel, and region.

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Innerspring

-

Latex

-

Memory foam

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.