- Home

- »

- Next Generation Technologies

- »

-

Smart Parcel Locker Market Size, Industry Report, 2033GVR Report cover

![Smart Parcel Locker Market Size, Share & Trends Report]()

Smart Parcel Locker Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Deployment Type (Indoor, Outdoor), By Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-668-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Parcel Locker Market Summary

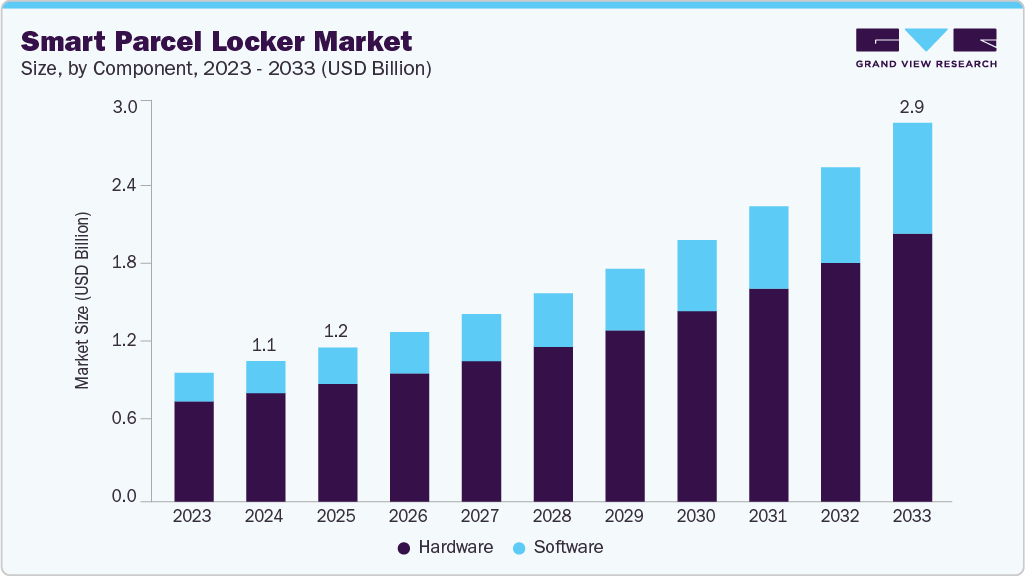

The global smart parcel locker market size was estimated at USD 1.08 billion in 2024 and is projected to reach USD 2.90 billion by 2033, growing at a CAGR of 11.9% from 2025 to 2033. The smart parcel locker industry has been primarily driven by the rapid expansion of e-commerce, growing consumer expectations for convenient last-mile delivery, and increased package volumes across urban and residential areas.

Key Market Trends & Insights

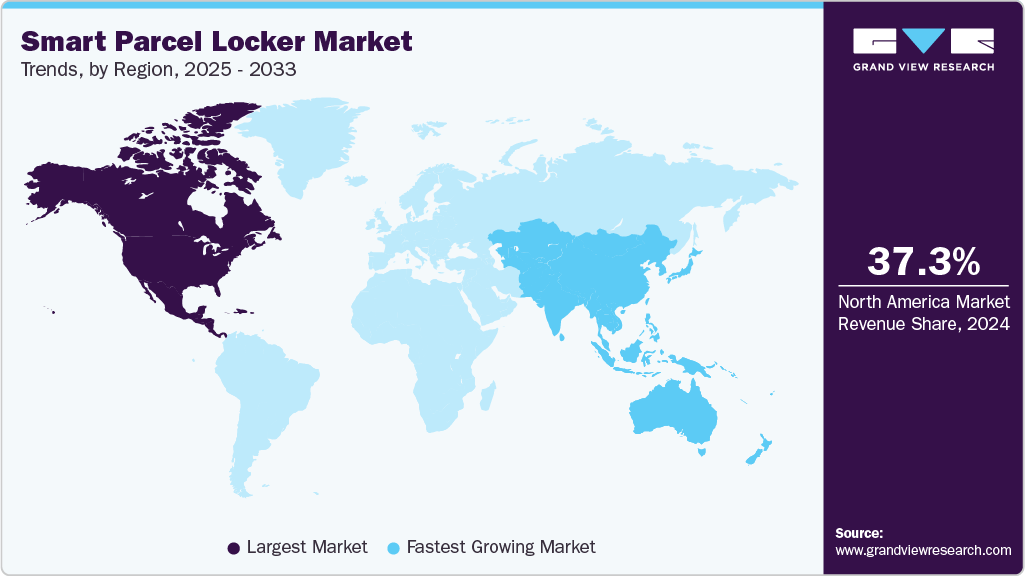

- North America dominated the smart parcel locker industry and accounted for a share of 37.3% in 2024.

- The U.S. smart parcel locker market held a dominant position in the region in 2024.

- By component, the hardware segment dominated the market in 2024 and accounted for the largest share of 77.1%.

- By deployment type, the outdoor segment is expected to grow at the fastest CAGR of 12.8% during the forecast period.

- By application, the commercial/corporate offices segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.08 Billion

- 2033 Projected Market Size: USD 2.90 Billion

- CAGR (2025-2033): 11.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The continued growth of global e-commerce has been a fundamental driver for the adoption of smart parcel lockers. As online shopping becomes a dominant retail channel, the volume of parcel deliveries has surged, especially in urban and suburban areas. Retailers and logistics providers are pressured to optimize last-mile delivery, reduce failed delivery attempts, and enhance consumer convenience. Smart parcel lockers provide a secure, self-service solution that allows 24/7 access for package pickup and returns, significantly easing operational burdens and improving customer satisfaction. This alignment with e-commerce logistics needs is expected to sustain long-term demand.

Advancements in technology have significantly enhanced the functionality, security, and versatility of smart parcel lockers. Smart parcel lockers are now integrated with Internet of Things (IoT) capabilities, cloud-based software, mobile applications, and AI-powered analytics to enhance usability and operational efficiency. Automated notification systems, real-time tracking, facial recognition, and multi-language interfaces have been implemented to improve user interaction and security. Moreover, integrating APIs with e-commerce and logistics platforms has enabled more seamless delivery and return processes.

Smart parcel lockers are increasingly positioned as core components in smart city and urban logistics ecosystems. Municipal governments invest in urban infrastructure that reduces traffic congestion, carbon emissions, and delivery inefficiencies. As part of these initiatives, public-access locker hubs are installed in transit stations, parking garages, and residential neighborhoods. These lockers support sustainable last-mile delivery by enabling consolidated drop-offs and reducing door-to-door delivery traffic. Public-private partnerships have been instrumental in accelerating this trend across the globe.

High initial deployment costs and complex installation requirements have posed challenges for small-scale adopters. Concerns around system interoperability, data security, and vandalism have also hindered broader acceptance. In addition, limited consumer awareness in emerging markets and resistance from traditional delivery service providers have slowed down large-scale implementation. These factors and logistical and regulatory hurdles have hindered the market's growth in some regions.

Component Insights

The hardware segment dominated the market in 2024 and accounted for the largest share of 77.1%. Smart parcel locker systems depend on comprehensive hardware components to deliver secure and efficient package management. Commonly integrated elements include durable materials like reinforced steel for structural integrity, CCTV and pinhole cameras for surveillance, sensors for monitoring locker status, temperature control units for handling perishable items, touchscreen interfaces for user interaction, and reliable power supply systems to ensure continuous operation. The hardware segment’s growth is driven by rising demand for secure, durable, and modular locker systems across various end-use sectors. Increasing package volumes from e-commerce, residential deliveries, and BOPIS models have intensified the need for robust physical infrastructure capable of withstanding high usage and diverse environmental conditions.

The software segment is expected to witness the fastest CAGR over the forecast period. Smart parcel lockers are equipped with dedicated software components that enable intelligent functionality and provide seamless user interactions.This software manages and controls smart parcel locker systems, facilitating package delivery and retrieval through digital interfaces. It handles tasks such as user authentication, locker assignment, package tracking, and notification delivery.

Deployment Type Insights

The indoor segment held the largest market in 2024. Increasing installations of smart parcel lockers in residential complexes, office buildings, retail centers, and universities primarily drive the segment growth. These locations offer secure, climate-controlled environments that enhance locker durability and reduce maintenance costs. Indoor lockers are particularly favored in high-density urban developments where real estate is limited and controlled access is essential. Their integration into existing infrastructure, such as apartment lobbies or commercial foyers, makes deployment more cost-effective and logistically feasible. Moreover, indoor systems are often customized with user-friendly interfaces, access control mechanisms, and real-time tracking features, aligning well with evolving consumer expectations for secure and convenient package handling.

The outdoor segment is expected to grow at the fastest CAGR of 12.8% during the forecast period. The segment’s growth is expected to be fueled by rising demand for 24/7 access, contactless deliveries, and last-mile fulfillment in public spaces. These units are increasingly deployed at transit hubs, curbside pickup zones, shopping malls, and parking facilities to provide maximum convenience and accessibility. Advancements in weather-resistant materials, anti-theft technologies, solar-powered systems, and remote monitoring capabilities further support growth.

Type Insights

The modular parcel locker segment dominated the market in 2024. Due to their scalability, flexibility, and ease of installation, modular parcel lockers are experiencing strong demand across residential, commercial, and retail environments. These lockers can be customized to accommodate varying package sizes and user volumes, making them ideal for high-traffic locations such as apartment complexes, office buildings, and shopping centers. The modular design allows operators to expand locker banks based on usage patterns and future growth, reducing upfront infrastructure costs.

The fresh food cooling locker segment is expected to witness the fastest CAGR over the forecast period. The surge in online grocery shopping and meal kit deliveries fuels this segment’s growth. These temperature-controlled units are designed to preserve the freshness and safety of perishable items during unattended delivery. Equipped with advanced refrigeration systems, real-time temperature monitoring, and alert capabilities, cooling lockers are increasingly deployed in urban residential complexes, supermarkets, and click-and-collect stations, thereby driving the segment’s growth.

Application Insights

The commercial/corporate offices segment dominated the market in 2024. The adoption of smart parcel lockers in commercial and corporate office environments is gaining momentum as businesses seek to enhance workplace efficiency and employee convenience. With the rise of hybrid work models and increased personal package deliveries to office locations, organizations are deploying secure locker systems to streamline mailroom operations and reduce administrative burden. These lockers provide contactless, self-service pickup for both personal and business-related deliveries, minimizing disruptions and improving security. In addition, companies are leveraging smart lockers to manage internal asset exchanges, such as IT equipment or confidential documents, thereby driving the segment’s growth.

The government & municipal buildings segment is expected to witness the fastest CAGR over the forecast period. Government and municipal buildings increasingly incorporate smart parcel lockers into their broader digital infrastructure and smart city initiatives. These lockers offer a secure and efficient method for distributing official documents, legal notices, and equipment across departments or directly to constituents. In addition, locker systems in government facilities are being used to streamline interdepartmental logistics and minimize manual handling.

Regional Insights

North America dominated the smart parcel locker industry and accounted for a share of 37.3% in 2024. High adoption rates in the U.S. and Canada are driven by well-established e-commerce infrastructure, increasing demand for contactless delivery, and widespread use of BOPIS (Buy Online, Pick Up In Store) services. The region also benefits from strong investments in parcel automation and extensive partnerships between retailers, logistics providers, and locker manufacturers.

U.S. Smart Parcel Locker Market Trends

The U.S. smart parcel locker market held a dominant position in the region in 2024, driven by mature retail ecosystems and advanced last-mile delivery networks. The U.S. market is characterized by rapid adoption of cloud-based locker software, biometric access, and modular configurations tailored to specific applications. Continued consumer preference for secure, self-service package pickup is expected to drive sustained market growth.

Europe Smart Parcel Locker Market Trends

Europe smart parcel locker market is expected to register a notable CAGR from 2025 to 2033. The region’s growth is supported by strong regulatory frameworks, eco-conscious delivery models, and growing consumer demand for sustainable last-mile solutions. Countries across Europe have embraced smart lockers as a means to reduce congestion and emissions in urban areas. The European market is poised for stable growth, driven by smart mobility projects and the increasing digitization of public infrastructure.

The UK smart parcel locker market is expected to grow at a significant CAGR from 2025 to 2033. The country's market growth can be attributed to the increasing use of smart parcel locker systems in retail, residential, and transportation sectors. Government initiatives to enhance smart infrastructure and reduce delivery-related emissions have further supported market development.

The Germany smart parcel locker market held a substantial market share in 2024. The country’s market growth is driven by its strong logistics sector, tech-savvy consumers, and focus on delivery efficiency. The country's emphasis on sustainability and contactless services has fueled interest in outdoor and temperature-controlled locker solutions. With continued investment in smart urban infrastructure, Germany remains a key market for smart locker innovation and expansion.

Asia Pacific Smart Parcel Locker Market Trends

The Asia Pacific smart parcel locker market is expected to grow at a CAGR of 13.1% during the forecast period.The region is witnessing rapid growth driven by its booming e-commerce sector, urbanization, and increasing investments in last-mile delivery infrastructure. Governments and logistics providers across key economies such as China, Japan, India, South Korea, and Australia actively deploy smart locker systems in residential, commercial, and transportation hubs.

The India smart parcel locker market is expected to grow at the fastest rate during the forecast period. The country's rapidly expanding online retail sector supports the market growth and rising consumer demand for contactless delivery. Major e-commerce platforms and logistics companies are exploring smart locker installations to address last-mile inefficiencies, particularly in metro and tier-1 cities.

The China smart parcel locker market held a substantial market share in 2024, driven by an extensive and mature locker network deployed across residential buildings, transit stations, and retail hubs. Driven by high e-commerce penetration and tech-driven logistics innovation, the country has implemented automated locker systems at scale to manage massive daily parcel volumes. Continued investment in smart cities and AI-enabled logistics is expected to further strengthen China’s dominance in the smart parcel locker ecosystem.

Key Smart Parcel Locker Company Insights

Some of the key companies in the smart parcel locker industry include Cisco Systems, Inc., Juniper Networks, Inc., and NEC Corporation, among others. These players dominate the market through comprehensive product portfolios, strategic partnerships, and strong global reach. Competition is driven by innovation in software-defined networking, cloud integration, and scalable service delivery models.

-

Parcel Pending LLC by Quadient is a prominent provider of package management solutions that serve residential, commercial, retail, and university properties. With nearly 72 million packages delivered annually, the company offers a comprehensive suite of solutions designed to simplify and secure the delivery and retrieval of packages and online orders.

-

Cleveron is a technology company specializing in the development and manufacturing of parcel delivery and robotic parcel lockers. Focusing on meeting the retail sector's specific needs, Cleveron designs automated locker solutions that enhance the efficiency of click-and-collect services for online orders. The company also provides software, maintenance, and reliable after-sales support that customers highly value.

Key Smart Parcel Locker Companies:

The following are the leading companies in the smart parcel locker market. These companies collectively hold the largest market share and dictate industry trends.

- Parcel Pending LLC (Quadient)

- Smartbox USA Inc.

- Gantner

- Meridian Kiosks

- Ricoh Group

- Pitney Bowes Inc.

- Cleveron

- Hollman, Inc.

- LUXER Corporation

- eLocker Ltd.

Recent Developments

-

In April 2025, Koloni, a prominent provider of smart locker software, partnered with Virtual.com, a transportation technology and pick-up and drop-off (PUDO) network, to launch North America’s fastest-growing and largest parcel locker network. This strategic collaboration aims to deploy over 5,000 locker locations across the U.S. and Canada within the next 12 months. The initiative is expected to offer carriers and local businesses access to a shared, scalable infrastructure designed to streamline deliveries, returns, and pickups.

-

In June 2024, Quadient unveiled Parcel Pending PLUS, its next-generation smart parcel locker solution. Powered by advanced, more robust software, this solution is designed to address the evolving demands of the dynamic multifamily housing sector. The solution introduces a range of new features, including enhanced real-time business intelligence tools for broader application use, improved operational efficiency, expanded capacity, added convenience for residents, and increased automation to streamline carrier workflows.

Smart Parcel Locker Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.18 billion

Revenue forecast in 2033

USD 2.90 billion

Growth rate

CAGR of 11.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment type, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Parcel Pending LLC (Quadient); Smartbox USA Inc.; Gantner; Meridian Kiosks; Ricoh Group; Pitney Bowes Inc.; Cleveron; Hollman, Inc.; LUXER Corporation; eLocker Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Parcel Locker Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart parcel locker market report based on component, deployment type, type, application, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

-

Deployment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Indoor

-

Outdoor

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Modular Parcel Lockers

-

Postal Lockers

-

Cooling Lockers for Fresh Food

-

Laundry Lockers

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial/Corporate Offices

-

Residential

-

Retail BOPIS

-

Government & Municipal Buildings

-

Universities and Colleges

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart parcel locker market size was estimated at USD 1.08 billion in 2024 and is expected to reach USD 1.18 billion in 2025.

b. The global smart parcel locker market is expected to grow at a compound annual growth rate of 11.9% from 2025 to 2033 to reach USD 2.90 billion by 2033.

b. The hardware segment dominated the market in 2024 and accounted for the largest share of 77.1%. The hardware segment’s growth is driven by rising demand for secure, durable, and modular locker systems across various end-use sectors.

b. Some key players operating in the smart parcel locker market include Parcel Pending LLC (Quadient), Smartbox USA Inc., Gantner, Meridian Kiosks, Ricoh Group, Pitney Bowes Inc., Cleveron, Hollman, Inc., LUXER Corporation, and eLocker Ltd.

b. The smart parcel locker market has been primarily driven by the rapid expansion of e-commerce, growing consumer expectations for convenient last-mile delivery, and increased package volumes across urban and residential areas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.