- Home

- »

- Next Generation Technologies

- »

-

Smart Pole Market Size, Share & Analysis Report, 2030GVR Report cover

![Smart Pole Market Size, Share & Trends Report]()

Smart Pole Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Hardware, By Installation Type, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-920-3

- Number of Report Pages: 148

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global smart pole market size was valued at USD 8.90 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 20.8% from 2023 to 2030. The market growth can be attributed to the ability of smart poles to prevent accidents and traffic jams, the growing need for energy-efficient streetlights, and rising government initiatives for the development of smart cities. Additionally, the integration of air quality monitoring systems, surveillance cameras, wireless sensor networks, traffic management systems, and transport management systems in smart poles have contributed to the demand. The growing adoption of AI and IoT for enhancing the performance of these systems is expected to further accelerate market growth.

Governments of various countries are focused on developing their cities by providing smart poles with Wi-Fi access and charging points. For instance, in February 2021, the City of Hampton in Virginia announced the installation of technologically-advanced light poles under its digital transformation project. These poles use green technology such as solar power to provide energy for Wi-Fi access and charging ports. The smart poles are also equipped with security cameras to provide a live video feed to the police of nearby areas. Such initiatives bode well for the growth of the market.

Several governments are realizing the importance of upgrading public infrastructure by adopting the latest technologies and deploying innovative systems that can improve the quality of life for citizens. They are continually identifying new areas of improvement in technologies under smart city projects. Moreover, numerous companies around the world are focused on enhancing their product portfolios to support smart city initiatives. In July 2021, Signify Holding announced the acquisition of Telensa Holding Ltd., a company that provides control systems and wireless monitoring for smart cities. This acquisition enabled Signify Holding to serve a broad group of customers by making smart city infrastructure products affordable to cities.

Many governments are emphasizing the enhancement of their existing lighting infrastructure by implementing energy-efficient lighting systems. For instance, in June 2021, Cochin Smart Mission Ltd. (CSML) announced its Smart Mission project involving the replacement of existing streetlights with energy-efficient lights controlled by its command center. Under the project, CSML aims to install 3,000 streetlights, including those used on connected roads. Moreover, many authorities have been conducting smart lighting programs to upgrade their existing lighting infrastructure with energy-efficient lighting. For instance, in June 2021, New York Power Authority (NYPA) announced its partnership with the Town of Bethel to install 176 energy-efficient streetlights and replace 500,000 streetlights across the state under the New York Power Authority’s Smart Street Lighting NY program.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has led to an economic slowdown in countries worldwide. The operations of numerous construction and development projects were also disrupted, thereby negatively impacting the growth of the smart pole market. For instance, the governments of the U.S. and China announced the shutdown of their construction and infrastructure activities during the pandemic to arrest the spread of the virus. However, as restrictions are relaxed worldwide, the market is expected to witness significant growth over the forecast period.

Components Insights

The hardware segment dominated the market in 2022 and accounted for a share of more than 57.3% of the global revenue. Numerous smart poles installed worldwide are equipped with cameras and air quality sensors to measure the rising pollution levels. Several mobile technology providers are striking partnerships with alternative energy system providers to design and sell efficient poles that support video analytics, intelligent lighting, and Wi-Fi access points. Such partnerships help create growth opportunities for the vendors of cameras and air quality sensors to develop innovative products for smart poles. For instance, in March 2021, Nokia, a mobile technology provider, announced a reseller agreement with ClearWorld, a solar lighting provider, to sell ClearWorld’s smart poles equipped with cameras and sensors to U.S. cities and military bases.

The service segment is anticipated to register the fastest growth over the forecast period. Some companies in the market perform the task of installing smart poles in a facility or city and carry out the integration of different systems. Many utility companies are signing contracts with private companies to deliver smart poles featuring streetlights, traffic management systems, and air quality monitoring sensors. For instance, in August 2021, Mainova deployed a smart pole developed by Australian company Ligman Evolve in Frankfurt, Germany. The smart pole was deployed to light up the streets during hours of darkness and provide 5G data coverage in surrounding areas. Such initiatives bode well for the growth of the segment.

Hardware Insights

The controller segment dominated the market in 2022 and accounted for a share of more than 29.3% of the global revenue. Smart pole technology makes use of control devices to efficiently control light and other features based on parameters such as occupancy, temperature, and amount of natural light. Numerous companies are focused on developing and innovating connected lighting solutions. For instance, in March 2021, Tvilight, a wireless lighting controller provider, announced the addition of OpenSky IoT devices to its portfolio of wireless outdoor light controllers. OpenSky IoT streetlight controllers are built on the next-generation 3GPP Cat M1 and NB-IoT global telecom standards. The controllers not only provide flexible and economical lighting but also monitor the tasks carried out by users. These factors are expected to drive the growth of the segment.

The communication device segment is expected to register the fastest growth over the forecast period. The growth of the segment can be attributed to the increasing need for awareness, comfort, and safety on the streets. All functions of a smart pole can be monitored, accessed, and remotely controlled through various communication technologies. They are designed to host multiple components and devices, such as air quality sensors, cameras, Wi-Fi access points, digital billboards, electronic call boxes, and electric vehicle charging points. Most of these IoT-enabled devices communicate through the IoT gateway. Thus, the rising demand for communication devices is expected to boost the growth of this segment.

Installation Type Insights

The retrofit installation segment dominated the market in 2022 and accounted for a share of more than 59.3% of the global revenue, attributed to the smart city initiatives pursued by various governments. These initiatives aim to replace existing lights with energy-efficient lights and install digital signages, security cameras, Wi-Fi hotspots, and environmental monitoring systems on existing light poles. For instance, in October 2021, the City Council of Essex announced its plan to replace 10,000 old-style streetlights with LED lights under the LED Replacement Program, which would benefit both residents and the environment. Moreover, governments prefer retrofitting street poles by equipping them with sensor technology or upgrading them with IoT applications to achieve cost savings with equal benefits.

The new installation segment is expected to register the fastest growth over the forecast period. The growth of this segment can be attributed to the increasing government initiatives toward the installation of smart poles in developed countries such as the U.S., U.K., France, and Germany to provide better web connectivity on the streets. In addition, market players such as ELKO EP, E.ON SE, and Signify Holdings are emphasizing the development of smart poles equipped with surveillance cameras, air quality sensors, and optional electric vehicle chargers. New installations would allow governments and companies worldwide to support the latest features in smart poles.

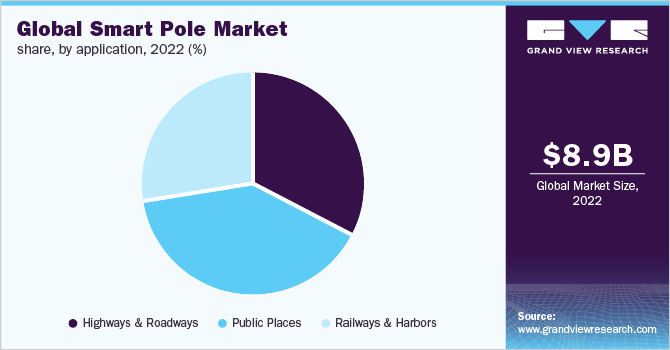

Application Insights

The public places segment dominated the market in 2022 and accounted for a share of more than 40.1% of the global revenue. Smart poles offer various features such as security cameras, announcement speakers, internet connectivity, and charging points to help tourists and visitors in public spaces. The use of solar-powered smart poles is further expected to encourage the installation of smart poles in public parks, beaches, and tourist sites to prevent overcrowding. For instance, in May 2021, Artificial Intelligence (AI)-powered smart poles were deployed in the Algarve region of Portugal to determine whether or not the beach is fully occupied. Additionally, increasing crime rates have compelled governments in various regions to employ surveillance cameras on smart poles at public parks, fuel stations, and national parks.

The highways and roadways segment is anticipated to register the highest growth over the forecast period. The growing number of smart roads being developed across the globe is expected to emerge as one of the major factors driving the growth of the segment. In countries such as India, transport authorities are installing SmartLife poles on hairpin bends and sharp turns to avoid accidents on blind turns. These poles use electromagnetic waves and radar sensors to determine the speed of vehicles and alert drivers about cars coming from the opposite direction.

Regional Insights

Asia Pacific dominated the market in 2022 and accounted for a share of over 31.4% of the global revenue. The continued increasing deployment of smart poles in countries, such as China and India, is expected to contribute to the growth of the regional market. Governments of various Asian nations are increasingly investing in smart city projects in current days. For instance, in 2021, India invested USD 24.31 billion in the Smart City Mission Program to deploy big data, IoT, cloud computing, and other smart systems. The continued rollout of smart city projects bodes well for the growth of the regional market.

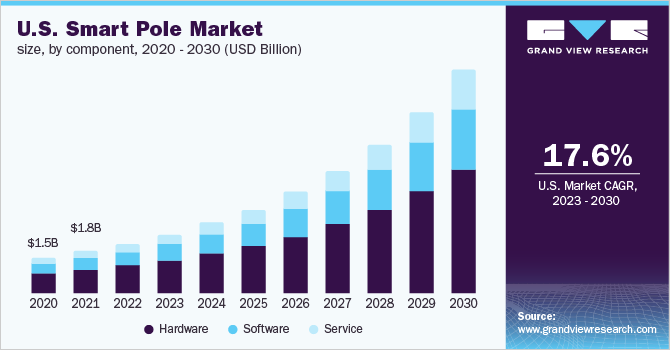

The North America region is expected to register significant CAGR over the forecast period. The aggressive deployment of connected streetlights in the region is expected to create growth opportunities for the market over the forecast period. Various cities in the U.S. have taken initiatives to install AI-powered smart poles that assist residents and business owners in emergency management situations. For instance, in July 2021, the U.S. City of Coral Gables announced that it had installed AI-powered smart pole from Ekin Spotter, a company that provides next-generation data analysis capabilities to assist the residents and business owners in an emergency situation and improve the traffic management capabilities. Such factors bode well for the regional market growth.

Key Companies & Market Share Insights

The market is highly fragmented. The key players are adopting various strategies, such as new product development, R&D, and strategic partnerships, to strengthen their position in the market. They are also offering software and products for smart poles as part of their efforts to establish a strong foothold in the market. Market players are particularly focusing on enhancing their product offerings in line with the evolving needs of end-users to stay competitive. For instance, in March 2021, Siklu, along with Schreder, announced the launch of SHUFFLE Wireless Backhaul, a wireless pole for smart infrastructure solutions. These smart poles provide security and safety solutions to keep public areas secured. Some of the prominent players operating in the global smart pole market are:

-

Cree, Inc.

-

Eaton

-

Echelon

-

General Electric

-

Siemens

-

Signify Holding

-

Silver Spring Networks, Inc.

-

Telensa

-

Wipro Limited

-

Zumtobel Group

Smart Pole Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.56 billion

Revenue forecast in 2030

USD 39.72 billion

Growth rate

CAGR of 20.8% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, hardware, installation type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil; Mexico

Key companies profiled

Cree, Inc.; Eaton; Echelon; General Electric; Siemens; Signify Holding; Silver Spring Networks, Inc.; Telensa; Wipro Limited; Zumtobel Group

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart pole market report based on component, hardware, installation type, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Service

-

-

Hardware Outlook (Revenue, USD Million, 2017 - 2030)

-

Lighting Lamp

-

Pole Bracket & Pole Body

-

Communication Device

-

Controller

-

Others

-

-

Installation Type Outlook (Revenue, USD Million, 2017 - 2030)

-

New Installation

-

Retrofit Installation

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Highways & Roadways

-

Public Places

-

Railways & Harbors

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global smart pole market size was estimated at USD 8.90 billion in 2022 and is expected to reach USD 10.55 billion in 2023.

b. The global smart pole market is expected to grow at a compound annual growth rate of 20.8% from 2023 to 2030 to reach USD 39.72 billion by 2030.

b. North America dominated the smart pole market with a share of 29.55% in 2022. This is attributable to the ongoing research and development activities in North America for the development of smart poles with electric vehicle chargers.

b. Some key players operating in the smart pole market include Cree, Inc.; Eaton; Echelon; GENERAL ELECTRIC COMPANY; Siemens; Signify Holdings; Silver Spring Networks, Inc, Telensa Limited; Wipro; and Zumtobel Group.

b. Key factors that are driving the smart pole market growth include the need for energy-efficient pole lighting systems and the increasing government initiatives for smart cities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."