- Home

- »

- Next Generation Technologies

- »

-

Smart Port Market Size And Share, Industry Report, 2030GVR Report cover

![Smart Port Market Size, Share & Trends Report]()

Smart Port Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Process Automation, Blockchain, IoT, AI), By Throughput Capacity (Extensively Busy, Moderately Busy, Scarcely Busy), By Type, By Region, And Segment Forecasts

- Report ID: 978-1-68038-872-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Port Market Summary

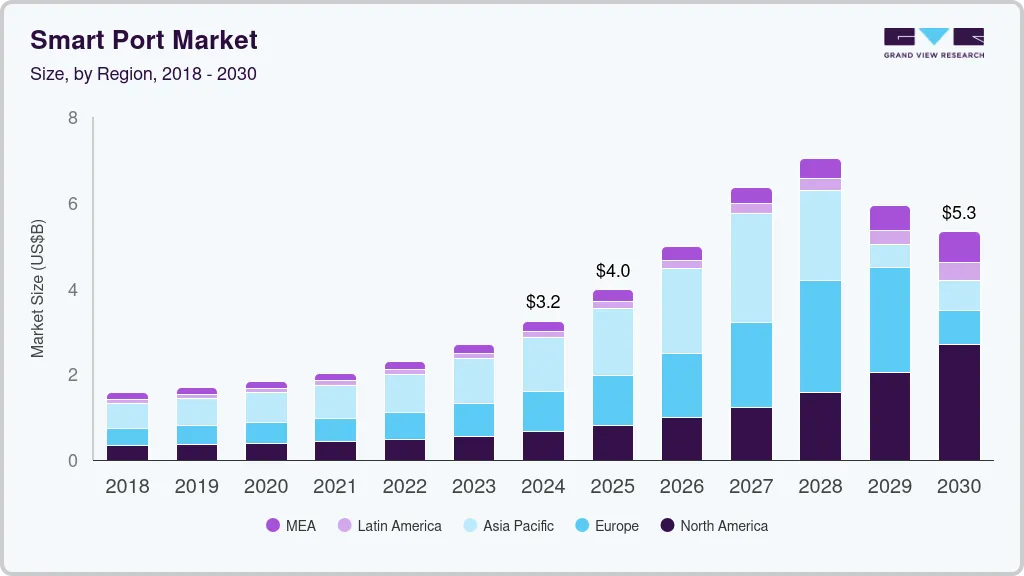

The global smart port market size was estimated at USD 3.24 billion in 2024 and is projected to reach USD 14.64 billion by 2030, growing at a CAGR of 29.8% from 2025 to 2030. The market growth is attributed to the increasing adoption of the Internet of Things (IoT) and Artificial Intelligence (AI) technologies, which are revolutionizing port operations.

Key Market Trends & Insights

- Asia Pacific smart port industry dominated the global market with the largest revenue share of 39.1% in 2024

- China's smart port market dominated the Asia Pacific at a revenue share in 2024

- By technology, the process automation segment dominated the market with the largest revenue share of 33.1% in 2024.

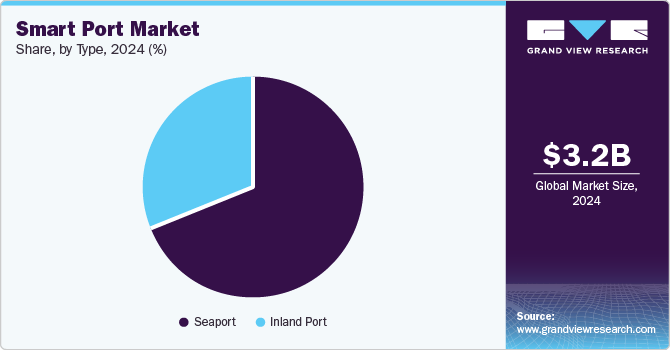

- By type, the seaport segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.24 Billion

- 2030 Projected Market Size: USD 14.64 Billion

- CAGR (2025 - 2030): 29.8%

- Asia Pacific: Largest market in 2024

These technologies enable real-time data collection, monitoring, and analysis, significantly enhancing port operations' efficiency and effectiveness. Furthermore, the rising demand for environmental sustainability is compelling ports to adopt smart solutions that reduce emissions and energy consumption.

The growing technological innovation and ease of technology integration are increasing the uptake of smart technologies across all types of ports. National and international trade through maritime transport has increased dramatically over the years. Benefits such as lower transportation costs have resulted in the growing preference for marine transport. The rise in global trade activities worldwide has increased the burden on shipyards and decks. An increase in the number of operations has forced harbor authorities to embrace smart technologies and solutions for automating several harbor operations.

Technology Insights

The process automation segment dominated the market with the largest revenue share of 33.1% in 2024. This growth signifies the increasing reliance on technology to streamline and optimize various processes in industries such as manufacturing, logistics, and more. By automating repetitive and time-consuming tasks, companies can enhance efficiency, reduce operational costs, and improve overall productivity. Process automation also plays a crucial role in ensuring consistency and accuracy, minimizing human error, and allowing employees to focus on more strategic and value-added activities.

The Internet of things (loT) segment is expected to grow at the fastest CAGR of 30.0% over the forecast period. The segment growth is attributed to the ability to connect devices and facilitate data exchange, IoT has revolutionized various industries. With IoT, everyday devices are connected to the internet, allowing them to collect and exchange data without human intervention. This technology has applications in various fields, from smart homes and healthcare to industrial automation and smart cities.

Throughput Capacity

Extensively busy (above 18 million teu) dominated the market with the largest revenue share in 2024. With the increasing global trade and the need for faster, more reliable port operations, these busy ports are investing heavily in innovations like IoT, process automation, and smart infrastructure to stay competitive. These advancements not only streamline operations but also enhance safety, reduce costs, and minimize environmental impact. The dominance of extensively busy ports underscores the importance of technological adoption in meeting the demands of modern logistics and global trade.

Moderately busy (5-18 million teu) is expected to grow at the fastest CAGR over the forecast period. These ports are likely investing in advanced technologies and infrastructure to improve efficiency, reduce operational costs, and stay competitive. The emphasis on technological adoption, such as IoT, process automation, and smart port solutions, is crucial for managing the increasing cargo volumes and ensuring smooth operations. This growth also highlights the strategic importance of these ports in the global supply chain, as they play a vital role in facilitating trade and commerce. The continuous advancements and investments in these moderately busy ports will be key to their success and market dominance in the coming years.

Type Insights

The seaport segment dominated the market with the largest revenue share in 2024. As major hubs for international trade, seaports are critical for the efficient movement of goods globally. The increasing volume of maritime trade, coupled with advancements in technology, has significantly enhanced the operational efficiency and capacity of seaports.

Inland port is expected to grow at the fastest CAGR over the forecast period. Inland ports, located away from coastal areas and connected by rail, road, or river networks, are becoming increasingly important in the global supply chain. It helps alleviate congestion at seaports and facilitate efficient distribution of goods to and from hinterland regions. With advancements in transportation and logistics technologies, inland ports are better equipped to handle larger volumes of cargo, improve operational efficiency, and reduce overall transportation costs. Their strategic locations and connectivity make them vital hubs for trade and commerce, contributing to their anticipated growth.

Regional Insights

Asia Pacific smart port industry dominated the global market with the largest revenue share of 39.1% in 2024. This dominance is attributed to the region's rapid economic growth, extensive maritime trade activities, and significant investments in advanced port infrastructure. Countries such as China, Japan, and Singapore are leading the way in adopting innovative technologies such as IoT, AI, and process automation to enhance the efficiency, safety, and sustainability of their ports. These advancements are crucial for handling the massive cargo volumes and maintaining the competitiveness of ports in the region.

China Smart Port Market Trends

China's smart port market dominated the Asia Pacific at a revenue share in 2024, driven by growing demand for efficient and reliable port operations, the adoption of advanced technologies such as automation, big data analytics, and artificial intelligence, and the increasing focus on sustainability and reducing carbon emissions. Major ports like Shanghai and Singapore have implemented these technologies to enhance efficiency and reduce costs, contributing to China's leading position in the smart port market.

North America Smart Port Market Trends

North America smart port industry held a considerable share in 2024. The region growth is attributed to the strong focus on technological advancements and innovation in port operations. Ports in North America are increasingly adopting IoT, AI, and automation to enhance efficiency, reduce costs, and improve sustainability. The strategic importance of ports such as those in Los Angeles, Long Beach, and New York/New Jersey also contributes to the substantial market share. These ports handle massive volumes of international trade and are crucial hubs in the global supply chain.

The U.S. smart port industry is expected to grow significantly over the forecast period. The country’s growth is attributed to the investments in advanced technologies such as IoT, AI, and automation. These innovations have enhanced operational efficiency, reduced costs, and improved sustainability, making U.S. ports more competitive globally.

Europe Smart Port Market Trends

Europe smart port industry is expected to grow at the fastest CAGR over the forecast period. The region growth is attributed to the focus on integrating cutting-edge technologies to optimize port operations. European ports have been at the forefront of adopting solutions such as blockchain, AI, and IoT to streamline logistics, enhance safety, and minimize environmental impact. The region's commitment to reducing carbon emissions and promoting sustainable development has been a key driver of this growth.

Key Smart Port Company Insights

Some key companies in the smart port market are Royal HaskoningDHV, ABB, Trelleborg Group, Accenture, and others. These employ various strategies to maintain a competitive edge, including the development of advanced technologies that integrate artificial intelligence, and Internet of Things (IoT) capabilities.

-

ABB, a Swiss multinational, is a leader in the smart ports market. The company leverages its expertise in automation, robotics, and digitalization to enhance port efficiency and sustainability. ABB's solutions, such as the ABB Ability Marine Pilot Control, focus on autonomous shipping and intelligent autopilot systems, which improve the productivity and safety of port operations.

-

Trelleborg Group specializes in engineered polymer solutions and has developed the SmartPort platform to address the challenges of modern port operations. Their SmartPort technologies connect port operations through data-driven insights, enabling better decision-making and operational efficiency. Key innovations include automated mooring systems like AutoMoor, which enhance safety and reduce berthing times, and SmartHook load monitoring systems for real-time mooring line data.

Key Smart Port Companies:

The following are the leading companies in the smart port market. These companies collectively hold the largest market share and dictate industry trends.

- Royal HaskoningDHV

- ABB

- Trelleborg Group

- Accenture

- Ramboll Group A/S

- Port Solutions Limited

- Awake.AI

- IBM

- Siemens

- General Electric Company

Recent Developments

-

In May 2022, Awake.AI unveiled its groundbreaking "Smart Port as a Service" platform, powered by Intel technology. This advanced solution leverages AI, edge computing, and 5G to enhance port operational efficiencies. Utilizing machine-learning models and sensors, it offers rseal-time insights into utilization rates and cargo flows while reducing emissions and optimizing port calls. Awake.AI also secured a tender to provide vessel schedule estimates for Finnish ports through Fintraffic Vessel Traffic Services, marking a significant milestone.

Smart Port Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.97 billion

Revenue forecast in 2030

USD 14.64 billion

Growth Rate

CAGR of 29.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, throughput capacity, type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Royal HaskoningDHV; ABB; Trelleborg Group; Accenture

Ramboll Group A/S; Port Solutions Limited; Awake.AI

IBM; Siemens; General Electric Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

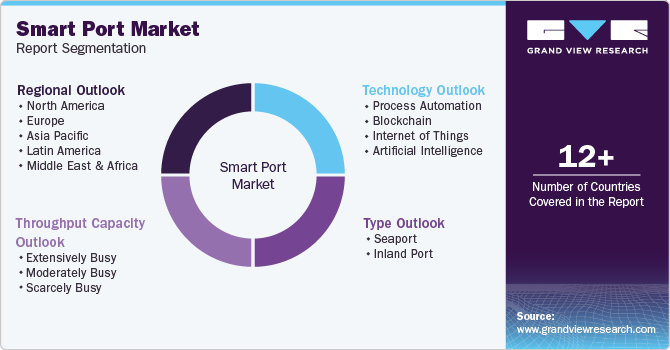

Global Smart Port Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart port market report based on technology, throughput capacity, type, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Process Automation

-

Blockchain

-

Internet of Things (IoT)

-

Artificial Intelligence (AI)

-

-

Throughput Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Extensively Busy

-

Moderately Busy

-

Scarcely Busy

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Seaport

-

Inland Port

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.