- Home

- »

- Next Generation Technologies

- »

-

SMS Firewall Market Size, Share & Trends Report, 2030GVR Report cover

![SMS Firewall Market Size, Share & Trends Report]()

SMS Firewall Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (SMS Firewall Platform, Services), By SMS Type (A2P Messaging, P2P Messaging), By Deployment Mode (On-premise, Cloud), By SMS Traffic, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-154-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

SMS Firewall Market Summary

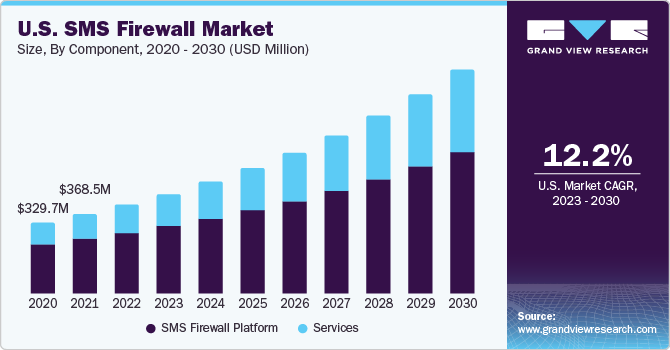

The global SMS firewall market size was estimated at USD 2.46 billion in 2022 and is projected to reach USD 5.44 billion by 2030, growing at a CAGR of 10.5% from 2023 to 2030. Factors such as the increasing threats to mobile messaging services, rising grey route SMS traffic, and the growing number of mobile subscribers are expected to drive market growth.

Key Market Trends & Insights

- Asia Pacific dominated the market with a revenue share of 29.6% in 2022.

- North America is anticipated to grow at the fastest CAGR of 13.1% over the forecast period.

- Based on component, the SMS firewall platform segment held the largest revenue share of 68.3% in 2022.

- In terms of SMS type, the A2P messaging segment held the largest revenue share of 74.1% in 2022.

- Based on SMS traffic, the national traffic segment held the largest revenue share of 85.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.46 Billion

- 2030 Projected Market Size: USD 5.44 Billion

- CAGR (2023-2030): 10.5%

- Asia Pacific: Largest market in 2022

- North America: Fastest growing market

Moreover, the benefits of SMS firewalls, such as revenue monetization and fraud prevention, are driving the market demand. The COVID-19 pandemic had a positive impact on the global market. The restrictions imposed due to the pandemic resulted in a surge in internet activity as individuals began to allocate more time to engage with social media platforms and other online services.As a direct consequence of this altered behavior, a notable escalation in total SMS Type-to-Person (A2P) messaging volumes was observed. During the pandemic, SMS became a vital communication channel for governmental and private entities. Its usage has significantly increased as a means of disseminating essential information. According to Anam Technologies Ltd, during the pandemic, there had been a noteworthy growth in international A2P SMS, with a recorded increase of approximately 30% across several markets.

The sudden shift in people's daily routines during the pandemic, coupled with the emergence of new lifestyle patterns, has brought about notable changes in message traffic types. This shift was accompanied by the rise of new brands that catered to the evolving needs of individuals in their adjusted lifestyles. Notably, brands associated with online education and fitness class apps experienced prominence and increased visibility. Moreover, there was a significant upsurge in the frequency of notifications and transactional messages as businesses implemented updates and notification programs to keep their customers informed about relevant changes considering the new circumstances.

Numerous mobile network operators (MNOs) are encountering substantial financial losses due to the prevalence of grey routes and fraudulent messaging schemes. Although there has been a decline in overall grey-route traffic, it still represents a significant portion of the A2P messaging traffic. A2P and Machine-to-Machine (M2M) messaging are lucrative revenue streams for mobile operators. Still, their vulnerability to fraudulent activities enables fraudsters to inundate their networks with unsolicited text messages, causing operators to miss out on valuable termination fees. As the sophistication of messaging security attacks continues to increase, MNOS must adopt innovative solutions, such as SMS firewalls that leverage machine learning and advanced analytics. These technologies can effectively detect and prevent security attacks while safeguarding the interests of enterprise customers and end subscribers.

Component Insights

Based on component, the market is segmented into SMS firewall platforms and services. The SMS firewall platform segment held the largest revenue share of 68.3% in 2022. The adoption of SMS firewall platforms is increasing owing to their benefits, such as proactive fraud prevention, SMS revenue monetization, and grey route SMS detection and prevention. For instance, after implementing a next-generation SMS firewall, the Brazilian telecommunication company TIM Brasil experienced a significant boost in monthly A2P SMS revenues, which doubled within a single quarter. Over six months after deployment, the mobile operator witnessed an impressive revenue uplift of over 250%. This substantial growth highlights the positive impact and potential of the next-generation SMS firewall in driving revenue generation for TIM Brasil.

The services segment is projected to grow at the fastest CAGR of 12.6% over the forecast period. To ensure the identification of grey traffic entering the network, utilizing a managed service rather than hosting is a preferable approach for enhancing network protection. It is primarily due to the ability of a managed service to maintain and update the necessary filtering rules consistently. By relying on a managed service, networks are likely to benefit from improved protection as the firewall remains up-to-date and effectively identifies any grey traffic attempting to penetrate the network.

SMS Type Insights

Based on SMS type, the market is segmented into A2P messaging, P2P messaging, and others. The A2P messaging segment held the largest revenue share of 74.1% in 2022. The A2P SMS market is experiencing remarkable growth and evolution over time. A comprehensive concept on its own, A2P SMS encompasses a diverse array of communication channels utilized for the delivery of marketing and transactional information or content. Both small-scale and large-scale enterprises heavily depend on this unidirectional messaging method to achieve two parallel goals: enhancing customer engagement and optimizing the customer experience. According to the Telecom Regulatory Authority of India, A2P traffic comprises approximately 40% of total SMS traffic in India.

The P2P segment is anticipated to register a CAGR of 6.2% over the forecast period. The widespread adoption of mobile devices and increasing access to affordable smartphones have led to a more extensive user base for P2P messaging. As more individuals gain access to mobile devices, the demand for P2P messaging services continues to grow. The benefits offered by P2P messaging are cost-effective communication, cross-platform compatibility, and multimedia messaging.

SMS Traffic Insights

Based on SMS traffic, the market is categorized into national and international segments. The national traffic segment held the largest revenue share of 85.0% in 2022. The volume of national or domestic SMS traffic is higher than the international traffic. Local or national signaling or SMS exchange, also known as signaling or SMPP (Short Message Peer-to-Peer) exchange within a country, is typically subject to stricter regulation and oversight. However, some mobile operators may still find it necessary to implement a firewall for this type of traffic to prevent any potential disruptions. SMS hubs, which act as intermediaries for SMS traffic between operators, often have their built-in SMS firewall functionality. Nevertheless, it is recommended that operators connected to SMS hubs establish their SMS firewall and employ their control logic to manage traffic originating from these hubs. By implementing their firewall on the operator side, they can enhance monitoring capabilities and ensure reliable protection against potential threats or anomalies.

The international traffic segment is anticipated to register the fastest CAGR of 15.4% during the forecast period. International SMS traffic is susceptible to various types of fraud that involve manipulating signaling transactions to deceive the receiving operator about the true originator of the SMS message. These fraudulent activities can result in financial losses for the operator. Therefore, it is essential to implement robust monitoring systems such as SMS firewalls to detect and prevent SMS fraud. By actively monitoring SMS fraud, operators can safeguard both their interests and the interests of their customers.

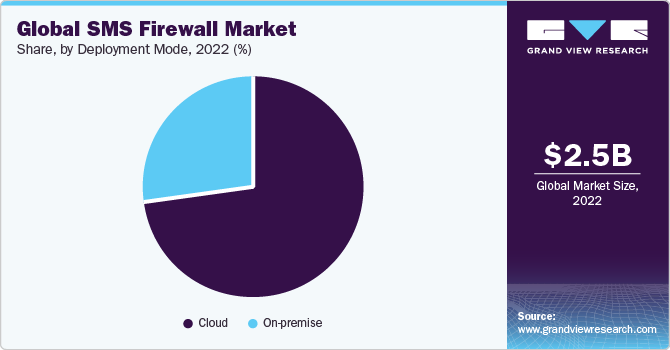

Deployment Mode Insights

Based on deployment, the market is segmented into cloud and on-premise. The cloud segment held the largest revenue share of 72.6% in 2022. Cloud-based firewalls offer easy deployment due to their software-defined nature, significantly reducing the time required compared to traditional firewalls. This streamlined deployment process minimizes disruptions to business operations. In addition, cloud-based firewalls are easier to maintain and upgrade, requiring fewer manual interventions. One of the key advantages of cloud-based firewalls is their scalability. As bandwidth needs grow, the cloud-based SMS firewall automatically adjusts and scales to handle the increased traffic volume. This flexibility allows organizations to focus on their core business activities without worrying about capacity constraints or performance issues.

The on-premise segment is anticipated to register the fastest CAGR of 12.5% over the forecast period. On-premise SMS firewall offers complete control for organizations over their messaging infrastructure and security measures. They can customize and tailor the firewall configuration to meet their specific needs, ensuring compliance with internal policies and regulatory requirements. This level of control allows organizations to have a deeper understanding and oversight of their SMS traffic.

Regional Insights

Asia Pacific dominated the market with a revenue share of 29.6% in 2022 and is anticipated to grow at a significant CAGR over the forecast period. According to the GSM Association, Asia Pacific had 1.6 billion unique mobile subscribers with a 58% penetration rate. The region had 2.7 billion SIM connections in 2020. Factors such as a large base of mobile users, high penetration of business messages, and an increasing number of SMS subscribers are propelling market growth in the region.

North America is anticipated to grow at the fastest CAGR of 13.1% over the forecast period. A2P messaging is on the rise in North America. Businesses utilize A2P messaging for a variety of purposes, such as transactional alerts, appointment reminders, marketing campaigns, and customer engagement. A2P messaging offers an effective and direct communication channel for businesses to reach their customers.

Key Companies & Market Share Insights

The competitive landscape of the SMS firewall industry is fragmented, having several global as well as local SMS firewall platforms and service providers. The key participants are undertaking strategic initiatives such as collaboration, partnerships, expansion, and product launches. For instance, in December 2021, retail and wholesale messaging technology company HORISEN AG and global signaling-based firewall provider Cellusys joined forces to deliver a comprehensive SMS firewall solution. The partnership was targeted to enhance security and improve active monitoring capabilities by integrating Cellusys' signaling control technology with HORISEN's testing environment. This collaboration was expected to strengthen Cellusys' firewall development and management services by leveraging HORISEN's testing platform to provide more detailed and accurate monitoring.

Key SMS firewall Companies:

- BICS

- Cellusys

- Sinch

- Comviva

- Route Mobile Limited

- Infobip Ltd.

- Openmind Networks

- Mobileum

- HAUD SYSTEMS LTD

- AMD Telecom

SMS Firewall Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.71 billion

Revenue forecast in 2030

USD 5.44 billion

Growth rate

CAGR of 10.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, SMS type, SMS traffic, deployment mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK.; France; Italy; China; Japan; India; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

BICS; Cellusys; Sinch; Comviva; Route Mobile Limited; Infobip Ltd.; Openmind Networks; Mobileum; HAUD SYSTEMS LTD; AMD Telecom

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global SMS Firewall Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global SMS firewall market report based on component, SMS type, SMS traffic, deployment mode, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

SMS Firewall Platform

-

Services

-

-

SMS Type Outlook (Revenue, USD Million, 2018 - 2030)

-

A2P Messaging

-

P2P Messaging

-

Others

-

-

SMS Traffic Outlook (Revenue, USD Million, 2018 - 2030)

-

National Traffic

-

International Traffic

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global SMS firewall market size was estimated at USD 2.46 billion in 2022 and is expected to reach USD 2.71 billion in 2023.

b. The global SMS firewall market is expected to grow at a compound annual growth rate of 10.5% from 2023 to 2030 to reach USD 5.44 billion by 2030.

b. Asia Pacific dominated the SMS firewall market with a share of 29.9% in 2022. Factors such as a large base of mobile users, high penetration of business messages, and an increasing number of SMS subscribers are propelling market growth in the region.

b. Some key players operating in the SMS firewall market include BICS, Cellusys, Sinch, Comviva, Route Mobile Limited, Infobip ltd., Openmind Networks, Mobileum, HAUD SYSTEMS LTD, and AMD Telecom.

b. Factors such as the increasing mobile messaging threats & grey route SMS traffic and the rising mobile subscriber base are expected to drive market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.