- Home

- »

- IT Services & Applications

- »

-

SoC As A Service Market Size, Share & Growth Report, 2030GVR Report cover

![SoC As A Service Market Size, Share & Trends Report]()

SoC As A Service Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Prevention Service, Detection Service, Incident Response Service), By Offering, By Enterprise Size, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-393-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

SoC As A Service Market Summary

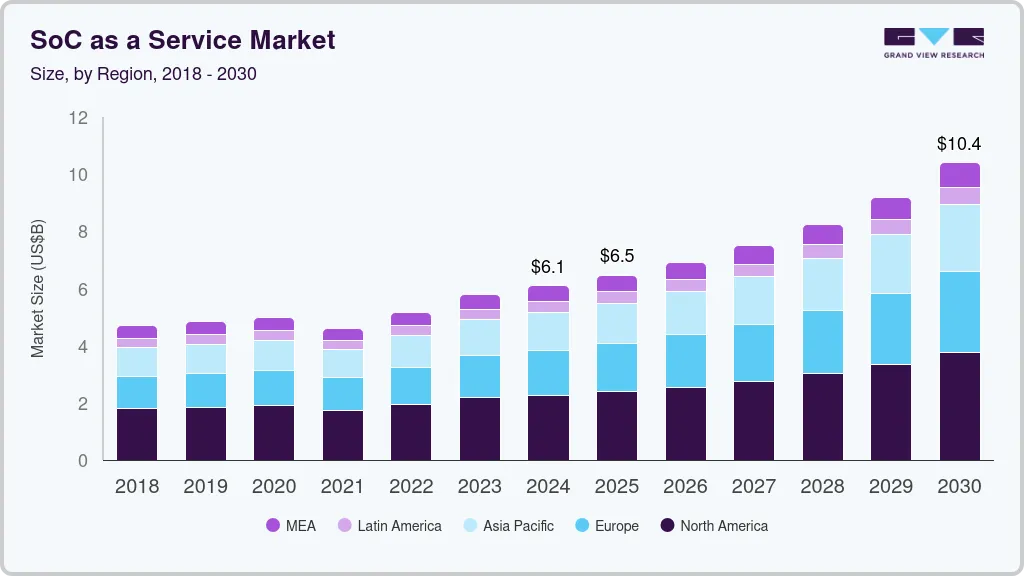

The global SoC As A Service market size was estimated at USD 5.80 billion in 2023 and is projected to reach USD 10.39 billion by 2030, growing at a CAGR of 9.3% from 2024 to 2030. The market is expanding rapidly due to the escalating complexity of cyber threats and the imperative for robust security measures across diverse industries.

Key Market Trends & Insights

- The North America SoC as a service market held the largest share of over 37% in 2023.

- The SoC as a service market in Asia Pacific is expected to grow significantly at a CAGR of around 10% from 2024 to 2030.

- The SoC as a service market in Europe is expected to grow significantly at a CAGR of 10.5% from 2024 to 2030.

- Based on application, the endpoint security segment held a market share of over 30% in 2023.

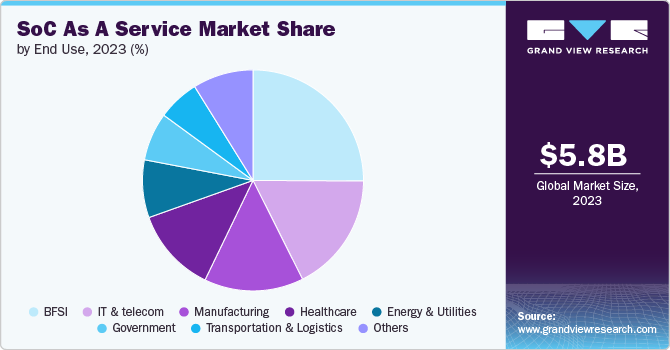

- In terms of end use, the BFSI segment accounted for the largest market share of over 25% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.80 Billion

- 2030 Projected Market Size: USD 10.39 Billion

- CAGR (2024-2030): 9.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

SOC (security operations center) as a Service involves outsourcing security operations, including threat detection, incident response, and continuous monitoring, to specialized third-party providers. SOC as a Service offers a cost-effective Prevention Services, allowing organizations to leverage expert threat detection, incident response, and compliance management without the substantial investment in infrastructure and staffing required for an in-house SOC.Key drivers include the rising frequency and sophistication of cyberattacks, cost efficiencies from reduced infrastructure investments, regulatory compliance demands, and a shortage of skilled cybersecurity professionals. However, challenges like data privacy concerns, integration issues, and scalability remain. Leading players include IBM, Cisco, AT&T Cybersecurity, and Palo Alto Networks. Emerging trends such as AI and machine learning for threat detection, cloud-based SOC Prevention Servicess, SIEM integration, and zero trust security frameworks are driving innovation. The increasing emphasis on cybersecurity, regulatory compliance, and the need for real-time threat intelligence are driving this growth.

The SOC (security operations center) as a service market is experiencing significant advancements through trends and innovations that enhance its effectiveness and adaptability. AI and machine learning are at the forefront, leveraging advanced analytics for proactive threat detection and automated response, enabling faster and more accurate identification of potential security breaches. Integration with Security Information and Event Management (SIEM) systems is also critical, as it enhances SOC capabilities by providing comprehensive visibility and correlation of security events across the network. This integration ensures that SOC services can effectively analyze vast amounts of data to detect and respond to threats more efficiently. Furthermore, the implementation of zero trust security principles is gaining traction, emphasizing stringent access controls and continuous monitoring to ensure that no user or system is trusted by default, regardless of its location. This approach minimizes the risk of insider threats and lateral movement within the network. Together, these trends and innovations are driving the evolution of SOC as a Service, making it a robust and adaptive Prevention Services to modern cybersecurity challenges.

Service Insights

The incident response services segment accounted for the largest market share of over 42% in 2023. The rise in cyber threats, such as ransomware, phishing, and advanced persistent threats (APTs), has made robust incident response capabilities essential. Organizations face a growing number of complex attacks that traditional security measures cannot adequately address. High-profile breaches, often making headlines, highlight the devastating impacts on affected organizations, including financial losses, reputational damage, and operational disruptions. These incidents underscore the critical need for specialized incident response services that can swiftly and effectively manage and mitigate the consequences of cyberattacks. As a result, businesses are increasingly turning to these services to bolster their defenses and ensure rapid recovery from incidents, driving the growth of the Incident Response Services segment within the SOC (security operations center) as a Service market.

The prevention services segment is expected to grow at a CAGR of around 10% during the forecast period. Stringent regulatory frameworks, such as GDPR, HIPAA, and ISO 27001, mandate organizations to implement robust preventative measures to safeguard sensitive data and ensure compliance. These regulations require continuous monitoring, proactive threat detection, and detailed reporting to protect against data breaches and cyber threats. Compliance mandates compel organizations to invest in prevention services to avoid penalties and maintain regulatory adherence. The need for ongoing monitoring and compliance reporting ensures that organizations are constantly vigilant and prepared against potential cyber threats, making prevention services an integral part of their cybersecurity strategy.

Offering Insights

The co-managed segment accounted for the largest market share of over 56% in 2023. These services enable organizations to customize cybersecurity solutions according to their unique needs, blending their internal expertise with external support. This tailored approach ensures that companies can address specific security challenges effectively while maintaining oversight and control over critical functions. By adopting a co-managed model, organizations benefit from a shared responsibility framework where they can manage routine tasks and decision-making processes internally while leveraging the advanced capabilities and specialized knowledge of third-party providers for more complex and resource-intensive tasks. This balance enhances operational efficiency, optimizes resource utilization, and allows for a more agile and responsive security posture. Consequently, co-managed SOC services provide organizations with the flexibility to adapt their security strategies while ensuring comprehensive protection against evolving threats.

The fully managed segment is expected to grow at a CAGR of around 10% during the forecast period. As organizations expand or face new challenges, fully managed services can quickly scale up to provide additional support and advanced tools without the complexities and costs associated with scaling internal operations. Moreover, these services offer the flexibility to adapt to evolving threat landscapes and shifting organizational needs. By leveraging up-to-date technologies and continuously evolving security practices, fully managed SOC services ensure that security measures remain effective against emerging threats. This dynamic approach allows organizations to maintain robust protection while focusing on their core business activities, making fully managed services a highly attractive option for businesses seeking adaptable and comprehensive cybersecurity solutions.

Enterprise Size Insights

The large enterprises held a market share of over 57% in 2023 and is expected to dominate the market by 2030. Large enterprises often operate across multiple regions and time zones, necessitating a SOC that delivers consistent and integrated security coverage worldwide. SOC services provide 24/7 monitoring and management, ensuring comprehensive protection across global operations and reducing the risk of security gaps. Additionally, these enterprises typically manage complex IT infrastructures, including hybrid and multi-cloud environments, which require specialized expertise to secure effectively. SOC services offer advanced capabilities to address these complexities, integrating security measures across diverse and distributed IT assets. This integration ensures seamless protection and management of intricate systems, enabling large enterprises to maintain robust security postures while focusing on their core business activities.

The SMEs segment is expected to grow at a CAGR of 11.6% over the forecast period. SMEs typically operate with constrained budgets for cybersecurity and often lack the financial resources to build and sustain an in-house SOC. SOC as a Service addresses this challenge by offering comprehensive security management at a fraction of the cost, providing advanced threat detection, monitoring, and response without the hefty investment in infrastructure and staffing. Additionally, subscription-based pricing models offer predictable monthly or annual fees, helping SMEs manage their cybersecurity expenses more effectively. This approach eliminates the need for large capital expenditures and allows SMEs to allocate resources more efficiently while ensuring robust protection against cyber threats. By leveraging these cost-effective solutions, SMEs can enhance their security posture without straining their budgets, making SOC as a Service an attractive option for smaller organizations.

Application Insights

The endpoint security segment held a market share of over 30% in 2023 and is expected to dominate the market by 2030. The shift to remote and hybrid work environments has increased the number of endpoints—such as laptops, smartphones, and tablets—connecting to corporate networks from diverse locations. This expanded endpoint exposure heightens the risk of cyber threats, making robust endpoint security solutions essential to protect these remote devices from potential attacks. Additionally, the adoption of Bring Your Own Device (BYOD) policies, where employees use personal devices for work purposes, introduces further security challenges. Personal devices accessing corporate data can be less controlled and more vulnerable to threats, requiring advanced security measures to ensure data protection and prevent unauthorized access. Together, these factors drive the demand for comprehensive endpoint security solutions integrated with SOC as a Service, providing effective protection in a more dispersed and complex IT environment.

The network security segment is expected to grow at a CAGR of 10.2% over the forecast period. The rising frequency and sophistication of cyber attacks such as Distributed Denial of Service (DDoS) attacks, advanced persistent threats (APTs), and zero-day vulnerabilities—demand advanced network security measures to protect against these evolving threats. These attacks exploit weaknesses in network infrastructure and communication protocols, making it essential to have robust and dynamic security solutions. The complexity of modern threat landscapes requires continuous monitoring, real-time threat detection, and adaptive response strategies to mitigate risks effectively. By leveraging these services, organizations can enhance their security posture and safeguard their network infrastructure from increasingly sophisticated cyber threats.

End Use Insights

The BFSI segment accounted for the largest market share of over 25% in 2023. BFSI institutions are high-value targets for cybercriminals due to their handling of sensitive financial data and high-value transactions. The frequency and sophistication of attacks, such as fraud, ransomware, and data breaches, have surged, necessitating advanced security measures. SOC as a Service addresses these needs by offering sophisticated threat detection, real-time monitoring, and incident response capabilities. These services enable BFSI organizations to proactively identify and mitigate complex cyber threats, ensuring the security of critical financial data and systems. By leveraging SOC as a Service, BFSI institutions can enhance their ability to protect against evolving threats, maintain regulatory compliance, and safeguard their valuable assets and customer trust.

The IT & Telecom segment is expected to grow at a CAGR of around 11% over the forecast period. The expansion of IT and telecom infrastructures—encompassing cloud, hybrid, and multi-cloud environments—intensifies the need for comprehensive network security solutions. SOC as a Service provides the specialized expertise required to manage and protect these intricate and evolving networks effectively. These services address the challenges posed by diverse network architectures and ensure robust security across all components. Additionally, SOC services integrate seamlessly with existing IT and telecom systems, offering unified security management. This integration enhances overall network protection by consolidating security operations, improving visibility, and streamlining incident response. By leveraging SOC as a Service, IT and telecom organizations can effectively safeguard their complex infrastructures while maintaining operational efficiency and resilience against emerging cyber threats.

Regional Insights

The North America SoC as a service market held the largest share of over 37% in 2023. The growth of IT and cloud environments is a major driver for the market in North America. As IT infrastructures become more complex, with the expansion of cloud, hybrid, and multi-cloud setups, organizations face heightened security challenges. SOC as a Service addresses these challenges by offering specialized expertise to manage and protect diverse IT environments effectively. The increasing adoption of cloud services among North American enterprises further accelerates this demand. Organizations need cloud-native SOC solutions to secure data and applications hosted in the cloud, ensuring comprehensive protection against evolving threats. SOC services provide the advanced tools and capabilities required to safeguard cloud environments, offering real-time monitoring, threat detection, and incident response. By leveraging SOC as a Service, businesses can effectively secure their expanding and complex IT infrastructures, maintaining robust security and compliance across their entire network.

U.S. SoC as a Service Market Trends

The SoC as a service market in the U.S. is expected to grow significantly at a CAGR of 8.5% from 2024 to 2030. The country experiences a high volume of cyberattacks, including advanced ransomware, phishing schemes, and data breaches, which necessitates advanced security measures. U.S. organizations, especially in critical sectors such as finance, healthcare, and technology, are prime targets for cybercriminals due to the sensitive and valuable nature of their data. These industries handle substantial amounts of confidential information and financial assets, making them attractive targets for cyberattacks. As a result, there is a heightened demand for sophisticated SOC services to enhance threat detection, provide real-time monitoring, and ensure swift incident response.

Asia Pacific SoC as a Service Market Trends

The SoC as a service market in Asia Pacific is expected to grow significantly at a CAGR of around 10% from 2024 to 2030. As businesses in APAC increasingly adopt digital technologies like cloud computing, IoT, and big data, their IT infrastructures become more complex and expansive. This expansion introduces new security challenges, as traditional security measures may not be sufficient to protect diverse and dynamic environments. SOC as a Service addresses these challenges by offering advanced security solutions tailored to the complexities of modern IT networks. It provides comprehensive monitoring, threat detection, and incident response capabilities essential for safeguarding cloud environments, connected devices, and vast data streams. By leveraging SOC services, organizations can effectively manage and secure their evolving digital assets, ensuring robust protection against emerging cyber threats and maintaining operational integrity in a rapidly transforming technological landscape.

Europe SoC as a Service Market Trends

The SoC as a service market in Europe is expected to grow significantly at a CAGR of 10.5% from 2024 to 2030. As European enterprises continue to migrate to cloud environments, the demand for cloud-native SOC (Security Operations Center) solutions is growing. This migration involves moving data, applications, and services from traditional on-premises infrastructure to cloud-based platforms, which introduces new security challenges and requirements. Cloud environments are dynamic, scalable, and often involve multiple cloud providers, making traditional security approaches less effective.

Key SoC As A Service Company Insights

Key players operating in the market include Check Point Software Technologies, IBM CORPORATION, Atos SE, Thales, Verizon, Fortinet Inc., Cloudflare, Inc., Arctic Wolf Networks, AT&T, NTT, Clearnetwork, Inc., ConnectWise, LLC., Teceze, Eventus Security, and Kaseya. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In July 2024, SonicWall launched a new Managed Security Services (MSS) offering in the EMEA region, supported by a 24x7 European Security Operations Center (SOC). This initiative aims to enhance cybersecurity for organizations by providing continuous monitoring, threat detection, and incident response services across Europe. The SOC will leverage SonicWall's advanced security technologies to deliver comprehensive, real-time protection against evolving cyber threats.

-

In May 2024, CrowdStrike expanded its Service Partners and Alliances program to enhance its Security Operations Center (SOC) capabilities. This initiative aims to leverage partnerships with other security and technology providers to deliver comprehensive, integrated solutions for threat detection and response. By collaborating with a broader network of partners, CrowdStrike seeks to strengthen its SOC offerings, providing more effective and adaptable cybersecurity solutions for its clients.

-

In March 2024, Fortinet introduced FortiGuard SOCaaS (Security Operations Center as a Service) integrations to enhance its SecOps capabilities. This new offering integrates Fortinet's advanced security technologies with comprehensive SOC services, providing organizations with real-time threat intelligence, automated responses, and seamless security management. The integration aims to streamline and strengthen security operations, ensuring more effective threat detection and response within a unified security framework.

SoC As A Service Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.09 billion

Revenue forecast in 2030

USD 10.39 billion

Growth Rate

CAGR of 9.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service, offering, enterprise size, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, Australia, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa.

Key companies profiled

Check Point Software Technologies; IBM CORPORATION; Atos SE; Thales; Verizon; Fortinet Inc.; Cloudflare, Inc.; Arctic Wolf Networks; AT&T; NTT; Clearnetwork, Inc.; ConnectWise, LLC.; Teceze; Eventus Security; Kaseya

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global SoC As A Service Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global SoC as a service market report based on service, offering, enterprise size, application, end use and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prevention Services

-

Detection Services

-

Incident Response Services

-

-

Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fully Managed

-

Co-managed

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Network Security

-

Cloud Security

-

Endpoint Security

-

Application Security

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Government

-

Manufacturing

-

Energy & Utilities

-

IT & telecom

-

Transportation & logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global SOC as a service market was valued at USD 5.80 billion in 2023 and is expected to reach USD 6.09 billion in 2024.

b. The global SOC as a service market is expected to grow at a compound annual growth rate of 9.32% from 2024 to 2030 to reach USD 10.39 billion by 2030.

b. The large enterprises segment held the largest revenue share of more than 57% in 2023 in the global SOC as a service market. Large enterprises often operate across multiple regions and time zones, necessitating a SOC that delivers consistent and integrated security coverage worldwide. SOC services provide 24/7 monitoring and management, ensuring comprehensive protection across global operations and reducing the risk of security gaps.

b. Key players operating in the SoC as a service Market include Check Point Software Technologies, IBM CORPORATION, Atos SE, Thales, Verizon, Fortinet Inc., Cloudflare, Inc., Arctic Wolf Networks, AT&T, NTT, Clearnetwork, Inc., ConnectWise, LLC., Teceze, Eventus Security, and Kaseya.

b. The SOC as a service market is expanding rapidly due to the escalating complexity of cyber threats and the imperative for robust security measures across diverse industries. SOC (security operations center) as a Service involves outsourcing security operations, including threat detection, incident response, and continuous monitoring, to specialized third-party providers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.