- Home

- »

- Next Generation Technologies

- »

-

Social Business Intelligence Market, Industry Report, 2033GVR Report cover

![Social Business Intelligence Market Size, Share & Trend Report]()

Social Business Intelligence Market (2025 - 2033) Size, Share & Trend Analysis Report By Component (Solution, Services), By Business Function (Sales and Marketing, Customer Service/Support, Operations, Finance), By End Use, By Region, And Segment Forecast

- Report ID: GVR-4-68040-666-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Social Business Intelligence Market Summary

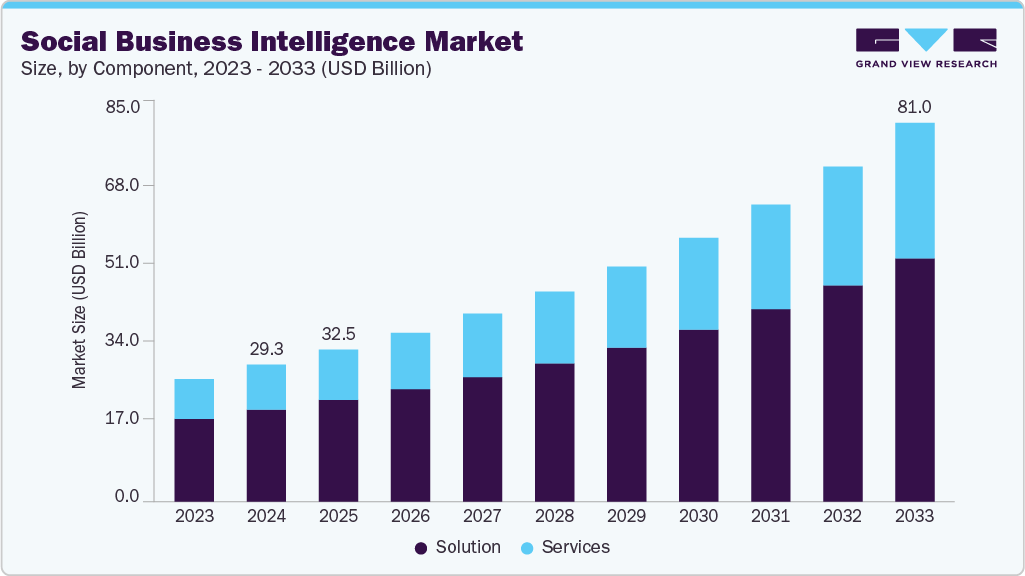

The global social business intelligence market size was estimated at USD 29,327.2 million in 2024 and is projected to reach USD 81,051.5 million by 2033, growing at a CAGR of 12.1% from 2025 to 2033. Companies are increasingly embedding AI and machine learning into social business intelligence (SBI) platforms to automate sentiment analysis, detect patterns in consumer behavior, and provide predictive insights.

Key Market Trends & Insights

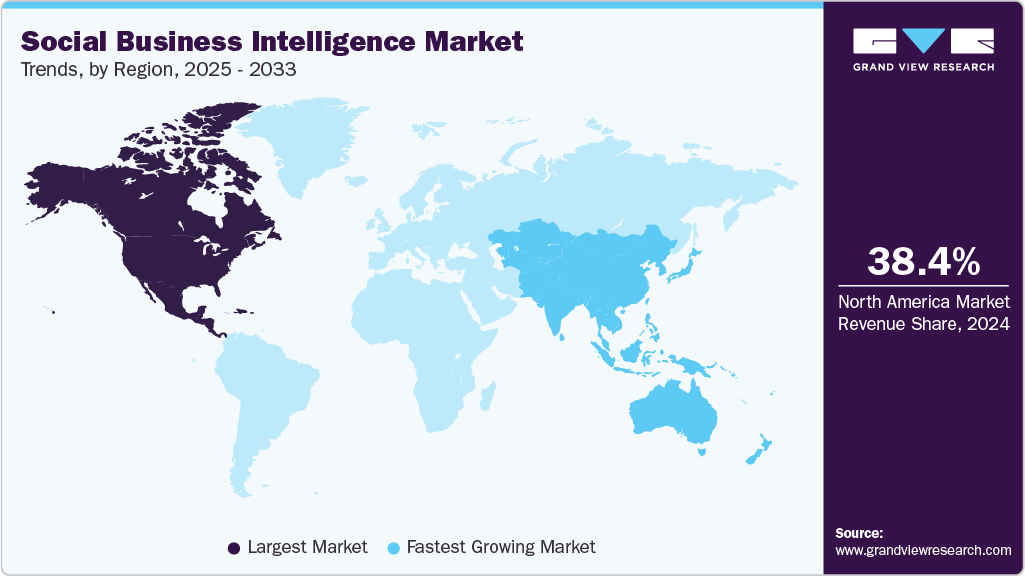

- North America dominated the global social business intelligence market with the largest revenue share of 38.4% in 2024.

- The social business intelligence market in the U.S. accounted for the largest revenue share in North America in 2024.

- By component, the solution segment led the market with the largest revenue share of 67.2% in 2024.

- By business function, the finance segment led the market with the largest revenue share of 26.82% in 2024.

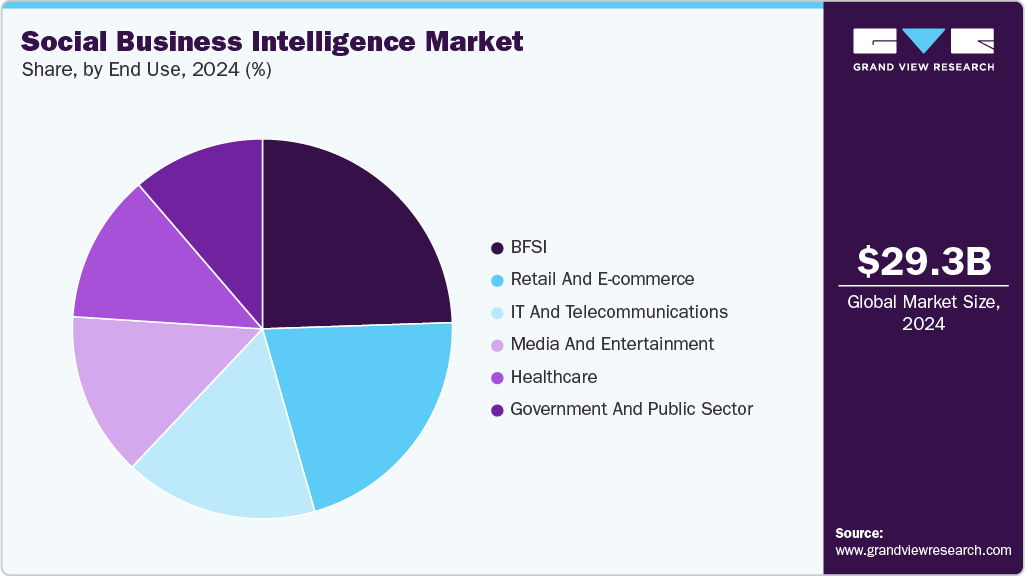

- By end use, the retail and e-commerce segment is expected to grow at the fastest CAGR of 13.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 29,327.2 Million

- 2033 Projected Market Size: USD 81,051.5 Million

- CAGR (2025-2033): 12.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

The global social business intelligence industry is utilizing these technologies to enable faster decision-making and a deeper understanding of brand perception across industries. Organizations are moving toward platforms that unify multiple data sources into a single interface. This includes integrating social media data, internal operations, and enterprise systems. The goal is to reduce reliance on multiple tools and fragmented workflows. Businesses want seamless access to insights without switching between applications. These unified platforms often combine business intelligence with automation and AI capabilities. They enable users to generate reports, analyze trends, and take action within the same environment. For instance, in June 2025, Amazon Web Services, Inc. announced the launch of Q Business Suite (QBS), a unified platform that merges QuickSight, Q Business, and Q Apps to offer AI-driven business intelligence, workflow automation, and seamless integration with tools such as Salesforce and Outlook. This move strengthens Amazon's position in the business application space by addressing fragmented workflows and enabling real-time, agentic decision-making.Businesses are moving beyond individual targeting to focus on understanding group dynamics within digital communities. Social platforms now serve as hubs of collective opinion, where shared interests shape purchasing behavior. This shift is driving demand for tools that can capture the tone and sentiment of entire conversations, not just isolated comments. Social business intelligence solutions are adapting to analyze community-level trends in real time. Companies want insights that show cultural context and group identity rather than generalized demographics. This trend supports more relevant, trust-based engagement and smarter decision-making. For instance, in June 2025, Reddit Inc., a U.S.-based social media and online discussion platform, launched two AI-powered tools, Reddit Insihts and Conversation Summary Add-ons, under its Community Intelligence brand to help advertisers tap into real-time user sentiment and authentic community feedback. These tools aim to enhance campaign relevance and credibility by turning Reddit’s vast content into actionable social business intelligence.

Companies are focusing more on user-generated content as a valuable source of insight. This content shows real customer experiences and unfiltered opinions across social platforms. It helps businesses understand how their offerings are perceived in everyday conversations. Insights drawn from user-generated content are often more candid and context-rich than those from structured feedback. Organizations are incorporating this data into marketing, customer service, and product planning. Social business intelligence tools are being developed to monitor and analyze these conversations at scale. Patterns in language, tone, and sentiment offer early indicators of shifting consumer preferences. Businesses can respond faster to emerging concerns or opportunities based on real-world input. This approach enhances relatability and builds trust with audiences. It also improves the accuracy and relevance of strategic decisions across departments.

Component Insights

The solution segment led the market with the largest revenue share of 67.2% in 2024. The growing demand for advanced analytics and visualization tools drives this. Businesses are investing in platforms that convert social data into actionable insights. These solutions help monitor sentiment, track trends, and guide strategic decisions. Integration with CRM and marketing platforms enhances their value across functions. Ease of deployment and scalability further support widespread adoption across industries. Cloud-based access and real-time reporting features are also key drivers for solution uptake. The ability to customize dashboards and automate insights gives these tools a clear advantage for business users.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. This growth is supported by rising demand for consulting, integration, and managed services. Organizations require expert guidance to implement and optimize social intelligence tools effectively. As platforms become more complex, businesses rely on service providers for training, customization, and maintenance. The need for continuous support and data management is pushing demand further. Service offerings also help companies align social insights with broader business objectives. Growth is particularly strong among enterprises undergoing digital transformation.

Business Function Insights

The finance segment accounted for the largest market revenue share in 2024, due to its need for real-time sentiment analysis and market monitoring. Financial institutions are increasingly using SBI tools to track public opinion, investor sentiment, and emerging risks. These insights support better forecasting, portfolio management, and decision-making. The ability to analyze discussions across platforms helps identify potential reputational threats early. Integration of SBI with trading algorithms and compliance systems adds further value. The sector’s emphasis on speed, accuracy, and data-driven strategy contributes to its dominant market position.

The sales and marketing function segment is anticipated to grow at the fastest CAGR during the forecast period. This growth is driven by the need to understand consumer sentiment, brand perception, and campaign effectiveness in real time. SBI tools help marketing teams track engagement, identify trends, and refine messaging strategies. Sales teams benefit from insights into customer behavior and competitor positioning. Integration with CRM systems enhances lead generation and targeting accuracy. As personalization and responsiveness become priorities, more organizations are investing in SBI for their sales and marketing activities.

End Use Insights

The BFSI accounted for the largest market revenue share in 2024, due to its reliance on real-time data and sentiment tracking. Financial institutions use SBI tools to monitor public perception, market shifts, and reputational risks. These insights help enhance investment strategies and customer engagement. The sector also benefits from improved fraud detection and regulatory compliance through social data analysis. Integration of SBI with internal systems supports better decision-making and faster response to emerging issues. The high volume of customer interactions and data-driven operations make BFSI a leading adopter of social intelligence solutions.

The retail and e-commerce segment is anticipated to grow at the fastest CAGR during the forecast period. Brands are utilizing SBI tools to track consumer sentiment, preferences, and real-time feedback across platforms. This helps in optimizing product offerings, pricing strategies, and promotional campaigns. The ability to monitor trends and competitor activity enhances market responsiveness. Personalization and customer engagement are also being improved through social insights. As online shopping and digital interaction expand, retailers are increasingly investing in social intelligence to stay competitive.

Regional Insights

North America dominated the social business intelligence market with the largest revenue share of 38.4% in 2024. This dominance is supported by the early adoption of advanced analytics and the widespread use of digital marketing tools. Organizations across sectors in the region actively invest in social data platforms to improve customer engagement and brand monitoring. Strong presence of major technology providers and availability of skilled professionals also drive regional growth.

U.S. Social Business Intelligence Market Trends

The social business intelligence market in the U.S. accounted for the largest revenue share in North America in 2024, supported by robust adoption of AI-driven analytics and a mature digital ecosystem. U.S. enterprises use social intelligence extensively for brand management, sentiment tracking, and competitive analysis. The presence of key market players and heavy investments in marketing automation drive continuous growth.

Europe Social Business Intelligence Market Trends

The social business intelligence market in Europe is anticipated to grow at a significant CAGR during the forecast period. In Europe, AI adoption in accounting is growing steadily, supported by regulatory pressures and digital finance initiatives. Businesses are implementing AI to enhance transparency, accuracy, and audit readiness. Automated Bookkeeping is widely adopted among SMEs due to cost efficiency. Financial Forecasting and Auditing is gaining momentum as firms focus on financial planning and risk management. Government support and data protection regulations are shaping AI implementation strategies.

Asia Pacific Social Business Intelligence Market Trends

The social business intelligence market in Asia Pacific is anticipated to register at the fastest CAGR over the forecast period. The expansion is driven by increasing social media usage and digital engagement across emerging economies. Businesses are adopting SBI tools to understand regional trends, consumer sentiment, and local market behavior. Growth in e-commerce and mobile-first platforms is boosting demand for real-time social insights. Companies in the region are investing in these tools to improve personalization, marketing effectiveness, and customer experience.

Key Social Business Intelligence Company Insights

Some of the key companies in the social business intelligence industry include Adobe Inc., Google LLC, HubSpot, Inc., IBM Corporation, Meltwater, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Google LLC supports social business intelligence through its Cloud AI, BigQuery, and Looker platforms, enabling organizations to analyze social media and digital engagement data at scale. Marketers and analysts use Google’s Natural Language API and machine learning tools to extract sentiment, intent, and trends from unstructured social content. Google Cloud integrations with third-party tools (e.g., Sprinklr, Hootsuite) further enhance its relevance in the SBI landscape.

-

IBM Corporation offers social business intelligence capabilities through its Watson AI and IBM Cognos Analytics platforms. Watson Natural Language Understanding enables analysis of social sentiment, emotion, and personality insights across platforms. IBM's solutions are used by enterprises to extract customer intelligence, monitor brand reputation, and optimize social engagement strategies. IBM also partners with social data providers to integrate external conversation streams into its analytics workflows.

Key Social Business Intelligence Companies:

The following are the leading companies in the social business intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Inc.

- Google LLC

- HubSpot, Inc.

- IBM Corporation

- Meltwater

- Microsoft

- Oracle

- SAP SE

- Salesforce, Inc.

- Sprinklr Inc.

Recent Developments

-

In June 2025, Adobe Inc. and IBM Corporation expanded their partnership to integrate IBM’s Watson AI into Adobe Experience Platform, enhancing personalized marketing, governance, and workflow automation. This collaboration empowers brands to scale generative AI capabilities, improve content precision, and accelerate marketing execution across hybrid environments.

-

In May 2025, Meltwater launched Mira, an AI-powered assistant designed to streamline social and media intelligence by delivering insights through a conversational interface. It simplifies complex workflows such as brand monitoring and trend analysis, helping organizations make faster, data-informed decisions.

-

In March 2025, Microsoft introduced two AI-powered tools—Researcher and Analyst—within Microsoft 365 Copilot to enhance deep research and data analysis. These tools use reasoning AI models and integrate internal and third-party data sources, supporting advanced business intelligence tasks such as strategy development and performance reporting.

Social Business Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32,512.9 million

Revenue forecast in 2033

USD 81,051.5 million

Growth rate

CAGR of 12.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Component, business function, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Adobe Inc.; Google LLC; HubSpot, Inc.; IBM Corporation; Meltwater; Microsoft; Oracle; SAP SE; Salesforce, Inc.; Sprinklr Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

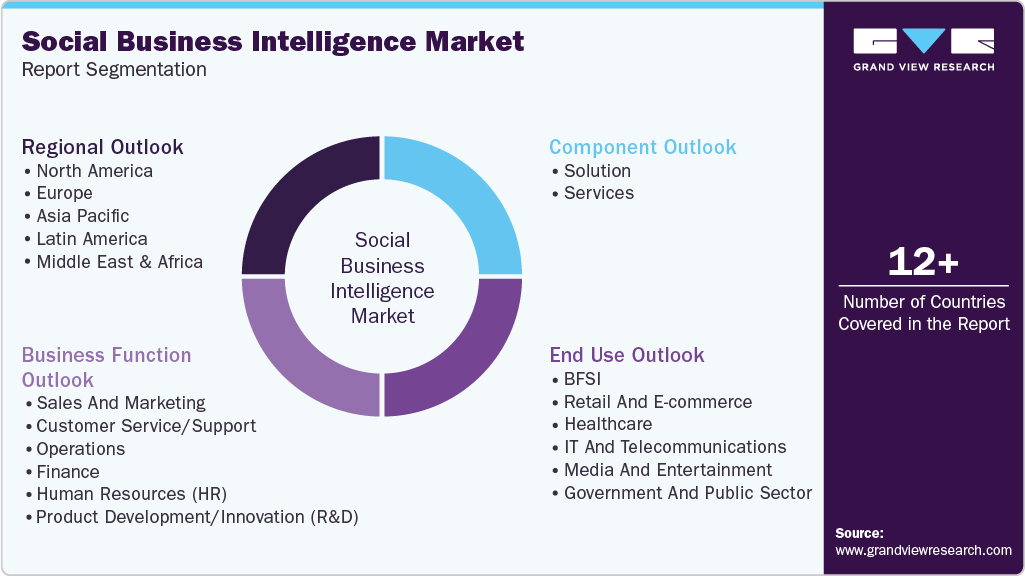

Global Social Business Intelligence Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels. It provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global social business intelligence market report based on the component, business function, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Services

-

-

Business Function Outlook (Revenue, USD Million, 2021 - 2033)

-

Sales and Marketing

-

Customer Service/Support

-

Operations

-

Finance

-

Human Resources (HR)

-

Product Development/Innovation (R&D)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Retail and E-commerce

-

Healthcare

-

IT and Telecommunications

-

Media and Entertainment

-

Government and Public Sector

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global social business intelligence market size was estimated at USD 29.33 billion in 2024 and is expected to reach USD 32.51 billion in 2025.

b. The global social business intelligence market is expected to grow at a compound annual growth rate of 12.1% from 2025 to 2033 to reach USD 81.05 billion by 2033.

b. North America dominated the social business intelligence market with a share of 38.4% in 2024. This is attributable to early adoption of advanced analytics and widespread use of digital marketing tools. Organizations across sectors in the region actively invest in social data platforms to improve customer engagement and brand monitoring.

b. Some key players operating in the social business intelligence market include Adobe Inc., Google LLC, HubSpot, Inc., IBM Corporation, Meltwater, Microsoft, Oracle, SAP SE, Salesforce, Inc., Sprinklr Inc.

b. Key factors that are driving the market growth include explosion of social media & big data, adoption of AI/ML & real-time analytics, and cloud-based, self-service & SME access

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.