- Home

- »

- Electronic & Electrical

- »

-

Soda Water Dispenser Market Size & Share Report, 2030GVR Report cover

![Soda Water Dispenser Market Size, Share & Trends Report]()

Soda Water Dispenser Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Countertop, Drop-In), By Dispenser Style (Push Button Dispenser, Lever Dispenser), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-266-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soda Water Dispenser Market Summary

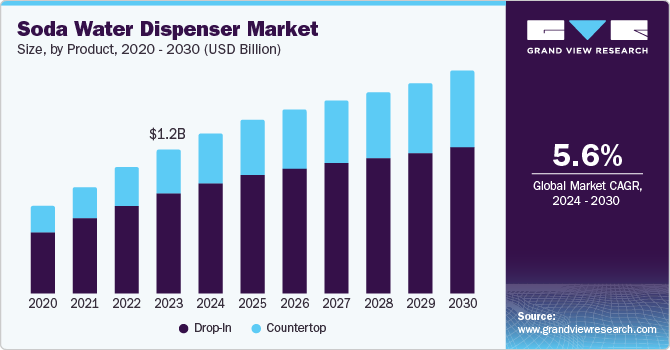

The global soda water dispenser market size was valued at USD 1.23 billion in 2023 and is projected to reach USD 1.89 billion by 2030, growing at a CAGR of 5.6% from 2024 to 2030. This is due to growing demand for convenient options for beverages in various settings such as restaurants, convenience stores and cafes.

Key Market Trends & Insights

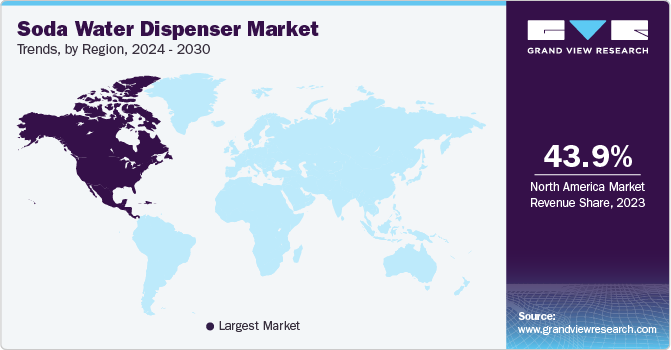

- North America soda water dispenser market held 43.9% market share in 2023.

- Asia Pacific market is anticipated to witness significant growth in the coming years.

- Based on product, the countertop segment accounted for the largest share of 67.6% in 2023.

- In terms of product, the drop-in segment is projected to witness fastest CAGR of 6.5% over the forecast period.

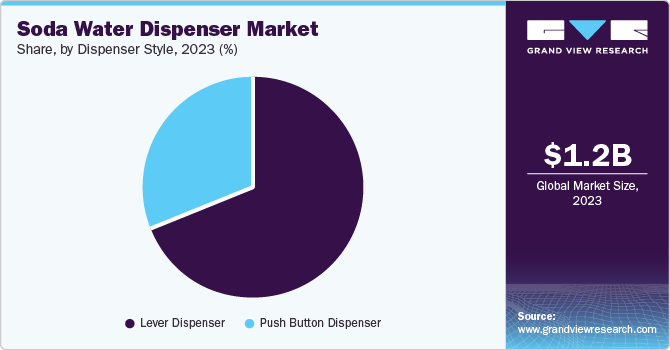

- Based on dispenser style, the lever dispenser segment dominated the market with a share of 69.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.23 Billion

- 2030 Projected Market Size: USD 1.89 Billion

- CAGR (2024-2030): 5.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

As consumers are shifting towards healthier beverage choices, soda water dispensers offering fruit-infused and sugar free alternatives are gaining popularity, which is driving the market growth. Beverages made with sparkling water are in demand leading to higher demand and thus increasing sales of such machines.High penetration of soda dispensers in high-end restaurants, bars, and small-town diners is a key driving factor. The soda dispenser reduces the cost of packaging and bottling and gives higher profit margins to its owners, thereby resulting in boosting the sales in the market over the forecast period. Moreover, consumers consider it to be a fresh drink option as compared to those soda cans and bottles in the market, thereby increasing its market share in the industry.

The soda fountains also help to minimize the use of soda bottles and cans, thereby reducing the hectic work to keep a bulk of beverage containers in-store. However, awareness regarding the disposal of plastic bottles and aluminum cans has increased the sales of beverage dispensers in the industry. The use of regular tap waters for the making of soda beverages in dispensers has lowered the use of water containers.

This reduces the manufacturing of plastic containers, thereby creating a less plastic environment in the industry. Also, the transportation cost for the delivery of bottle containers gets reduced by the incorporation of soda machines in the industry. Moreover, customizations such as mixing various flavors in a single drink increase its penetration in the market.

The product helps to keep the favorite drinks of consumers loaded in a dispenser, thereby saving time by providing instant flavors of drinks ready to be served at parties and restaurants. Also, the use of such machines at events and parties reduces the cost of hiring a bartender for serving and handling the drinks to the members. Moreover, keeping the soda machines at commercial spaces and institutes helps to keep the employees refreshed and active throughout the working hours of the day.

Product Insights

The countertop segment accounted for the largest share of 67.6% in 2023. Countertop soda water dispensers offer convenience as they can be easily placed on kitchen counters or tabletops, allowing users to quickly access and enjoy carbonated water without requiring large appliances. Many countertop soda water dispensers come with features that allow users to adjust their carbonation levels, flavors, and even add fruits to create personalized beverages.

The drop-in segment is projected to witness fastest CAGR of 6.5% over the forecast period. The drop-in type has a wide space at the bottom for filling the soda and ice in the machine. This large space is utilized for operation and other small works, thereby boosting its growth in the market. Bars and restaurants make extensive usage of the machine due to its feature of extra space. The machine is very easy to operate as it is a simple mechanical device as compared to countertop types, thereby fueling the growth of the product over the forecast period. This also makes the dispenser less costly to the buyers. Moreover, its reliability due to a safe flush provided in the machine increases its demand in the market.

Dispenser Style Insights

The lever dispenser segment dominated the market with a share of 69.2% in 2023. Lever dispensers offer a convenient way for users to easily control the amount of soda water they dispense, resulting in higher user satisfaction and ease of use. Level dispensers help maintain hygiene as they reduce the need for direct contact with the dispenser, especially in public spaces and areas with heavy foot traffic.

The push button dispenser segment is projected to grow at the fastest CAGR of 8.6% over the forecast period. Push button dispensers are easy to use, requiring minimal effort to operate, which makes them popular among consumers looking for a hassle-free experience. Push button dispensers provide fast and efficient dispensing of soda water, perfect for busy environments where quick service is essential.

Regional Insights

North America soda water dispenser market held 43.9% market share in 2023. The market is driven by the growing penetration of leading quick-service restaurants such as Subway, McDonald's, KFC, Burger King, Pizza Hut, and Dominoes. These restaurants are incorporating soda machines for the fast delivery of drinks for the consumers. Moreover, the penetration of leading manufacturers in the region such as The Coca-Cola Company, PepsiCo Inc., and Dr. Pepper has driven the sales of soda dispensers. The soda water dispenser market growth is attributed to rising demand among the people for a fresh delivery of soda drinks in the industry.

U.S. Soda Water Dispenser Market Trends

The U.S. soda water dispenser market is dominated the North American soda water dispenser market with a share of 89.4% in 2023. The U.S. market is experiencing a change towards healthier lifestyle, as consumers are choosing low calorie and sugar free drinks such as soda water.

Europe Soda Water Dispenser Market Trends

Europe soda water dispenser market was identified as a lucrative region in 2023 due tothe increasing awareness about the harmful effects of sugary drinks that has led to a shift towards alternatives like soda water. With the rising concerns about plastic pollution and environmental sustainability, there is a growing trend towards decreasing the use of single-use plastic bottles and soda water dispensers offer eco-friendlier option by eliminating need for such bottles.

The Germany soda water dispenser market held a substantial market share in 2023. Germany is known for its strong emphasis on sustainability and environmental responsibility. The availability of advanced soda water dispenser models with features such as accurate carbonation control, smart connectivity, and sleek designs attracts to tech-savvy consumers, fueling the market growth.

Asia Pacific Soda Water Dispenser Market Trends

Asia Pacific market is anticipated to witness significant growth in the coming years on account of rising demand for the soda machines in the fast-food restaurant industry in countries such as China and India. The demand is anticipated to grow due to the rise in the purchasing power of the consumers, inclination towards the use of cost-effective products, and rising government initiatives. The soda water dispenser is an environmentally friendly machine due to its delivery through paper cups. This, in turn, has reduced the sales of plastic bottles, thereby boosting the market growth in Asia Pacific.

Key Soda Water Dispenser Company Insights

Some of the key companies in the soda water dispenser market include PepsiCo, The Coca-Cola Company, Zikool Refrigeration Pvt. Ltd., and others. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.In May 2018, The Coca-Cola Company launched a next-generation soda dispenser with a touch screen design for an easy and fast experience for the users. The growth in the market is attributed to the rise in the number of manufacturers due to growing demand among consumers for fresh and quick dispensing options for soda drinks in the industry.

- Zikool Refrigeration Pvt. Ltd operates as both a manufacturer and exporter, specializing in products such as soda machines, soda fountain machines, and soda mobile van machines.

Key Soda Water Dispenser Companies:

The following are the leading companies in the soda water dispenser market. These companies collectively hold the largest market share and dictate industry trends.

- PepsiCo

- The Coca-Cola Company

- Hoshizaki America, Inc.

- Marmon Foodservice Technologies, Inc.

- Keurig Dr Pepper Inc.

- WELBILT INC

- Cool Star Equipment

- Zikool Refrigeration Pvt. Ltd.

- Planet Soda

- Himalay Soda Fountain

Recent Developments

-

In February 2023, Smart Soda Holdings launched IoT JuLi Connect, a new countertop beverage solution. It is developed for commercial use and enables users to customize tea, soda, still-flavoured alkaline and sparkling water by setting carbonation levels, functional nutrition boosts and flavor combinations.

-

In July 2020, Pepsico launched Soda Stream Professional. It is a connected sparkling water system for the offices.

Soda Water Dispenser Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.36 billion

Revenue forecast in 2030

USD 1.89 billion

Growth Rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, dispenser style, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

PepsiCo, The Coca-Cola Company, Hoshizaki America, Inc., Marmon Foodservice Technologies, Inc., Keurig Dr Pepper Inc., WELBILT INC, Cool Star Equipment, Zikool Refrigeration Pvt. Ltd., Planet Soda, Himalay Soda Fountain

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soda Water Dispenser Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global soda water dispenser market report based on product, dispenser style, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Countertop

-

Drop-In

-

-

Dispenser Style Outlook (Revenue, USD Million, 2018 - 2030)

-

Push Button Dispenser

-

Lever Dispenser

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.