- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Container Market Size, Share, Industry Report, 2033GVR Report cover

![Plastic Container Market Size, Share & Trends Report]()

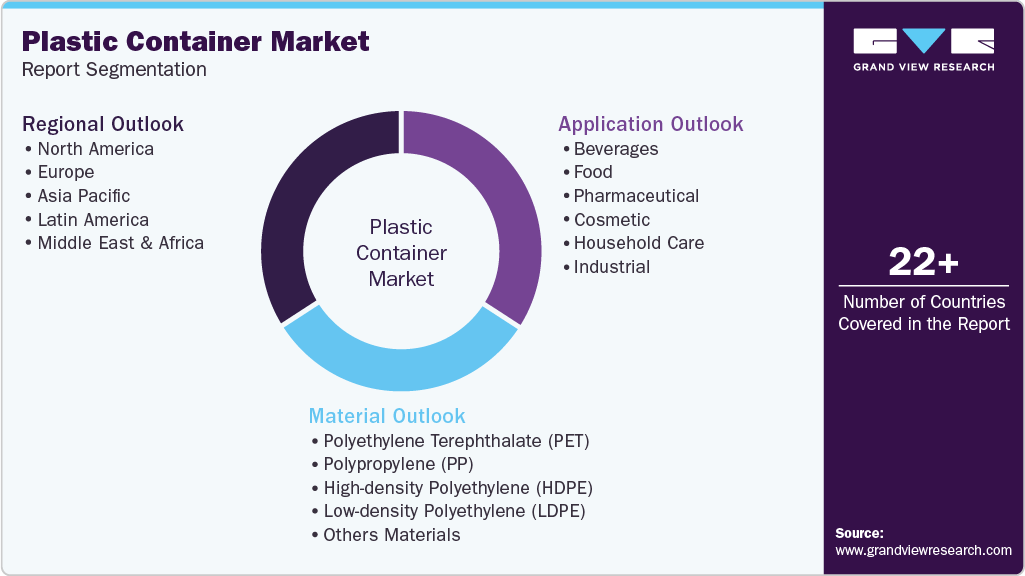

Plastic Container Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (PET, HDPE, LDPE, PP), By Application (Beverages, Industrial, Food, Cosmetic, Household Care, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-327-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Container Market Summary

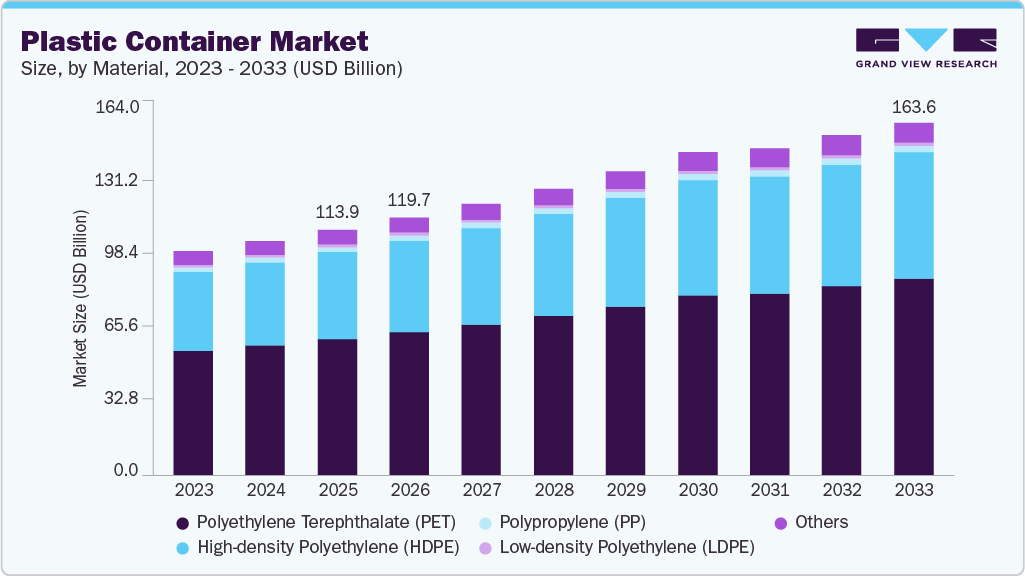

The global plastic container market size was estimated at USD 113.92 billion in 2025 and is projected to reach USD 163.62 billion by 2033, growing at a CAGR of 4.6% from 2026 to 2033. The increasing demand for plastic containers in the cosmetics & personal care, growing demand for rigid packaging from food and beverage packaging, and increased need for lightweight, durable, and cost-effective packaging in industries such as pharmaceuticals, and personal care are the factors driving market growth worldwide.

Key Market Trends & Insights

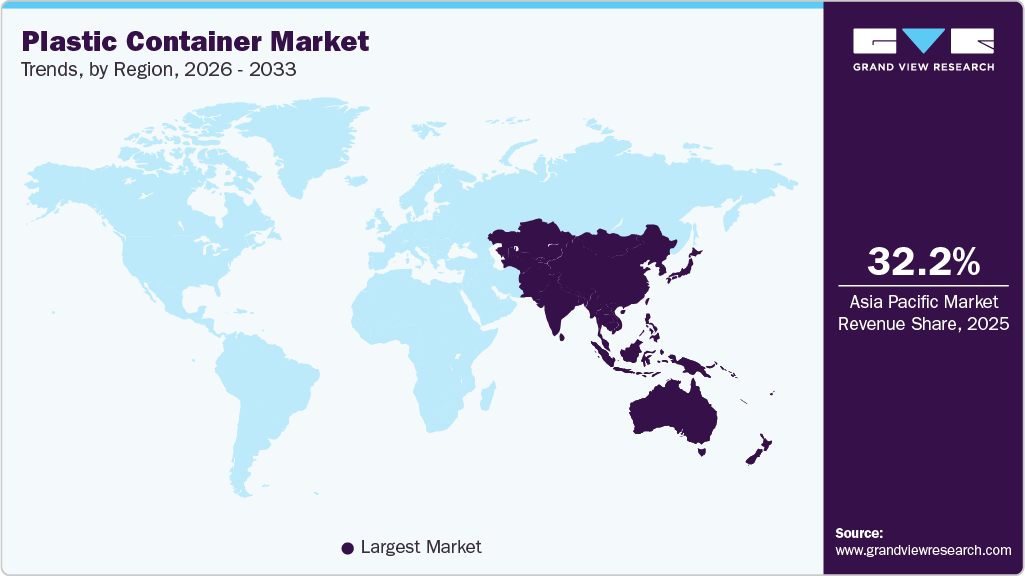

- Asia Pacific dominated the plastic container market with the largest revenue share of 32.20% in 2025.

- The plastic container market in U.S. is expected to grow at a substantial CAGR of 4.2% from 2026 to 2033.

- By material, the high-density polyethylene (HDPE) segment is expected to grow at the fastest CAGR of 4.7% from 2026 to 2033 in terms of revenue.

- By application, the beverage segment is expected to grow at a significant CAGR of 4.9% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 113.92 Billion

- 2033 Projected Market Size: USD 163.62 Billion

- CAGR (2026-2033): 4.6%

- Asia Pacific: Largest market in 2024

The demand for plastic packaging has been escalating due to its convenience, creative visual appeal, and innovative eco-friendly options. The plastic container market is witnessing significant growth, driven by the availability of advanced, affordable, and sustainable packaging solutions. The excellent barrier properties of plastic packaging play a crucial role in market development, effectively protecting products from air and moisture, which is particularly important in industries such as cosmetics and personal care.

In the cosmetics and personal care sector, polypropylene is widely used to manufacture bottles and jars for packaging creams, powders, and other cosmetic products. The compact size and durability of these containers provide protection from air, light, moisture, dust, and dirt, ensuring the integrity of the packaged products. The increasing demand for skin care products has contributed to the growth of the cosmetics and personal care market, which is expected to drive the plastic containers market share over the forecast period

Drivers, Opportunities & Restraints

One of the key drivers for the rising adoption of sustainable and recyclable plastic containers, particularly PET and HDPE, is supported by investments in advanced recycling technologies. Brands in FMCG, cosmetics, and pharmaceuticals increasingly prefer recyclable containers to meet corporate sustainability targets and regulatory expectations. The development of rPET and rHDPE containers with near-virgin quality, along with lightweighting initiatives, is accelerating the use of plastics over alternatives such as glass and metal, especially where cost, breakage resistance, and shelf-life performance are critical.

The emerging opportunity lies in smart and functional plastic packaging. Integration of QR codes, tamper-evident features, antimicrobial coatings, and intelligent freshness indicators is expanding the role of plastic containers beyond simple storage. In pharmaceuticals and healthcare, demand for sterile, contamination-resistant, and single-use plastic containers is rising with the growth of biologics, injectable drugs, and home-care treatments. Similarly, the expansion of e-commerce and cold-chain logistics is increasing the need for durable containers that maintain product integrity during long-distance shipments.

One of the key restraints for the plastic container market is the strict environmental regulations aimed at reducing single-use plastics. Policies such as the EU Single-Use Plastics Directive, EPR regulations, and rising landfill/packaging waste fees increase compliance costs for producers. Many regions are enforcing restrictions on plastic use, mandating minimum recycled content, or imposing taxes on virgin plastics. These measures create uncertainty for manufacturers reliant on conventional fossil-based resins, particularly in food-contact applications where recycled-content use remains technically challenging.

Market Concentration & Characteristics

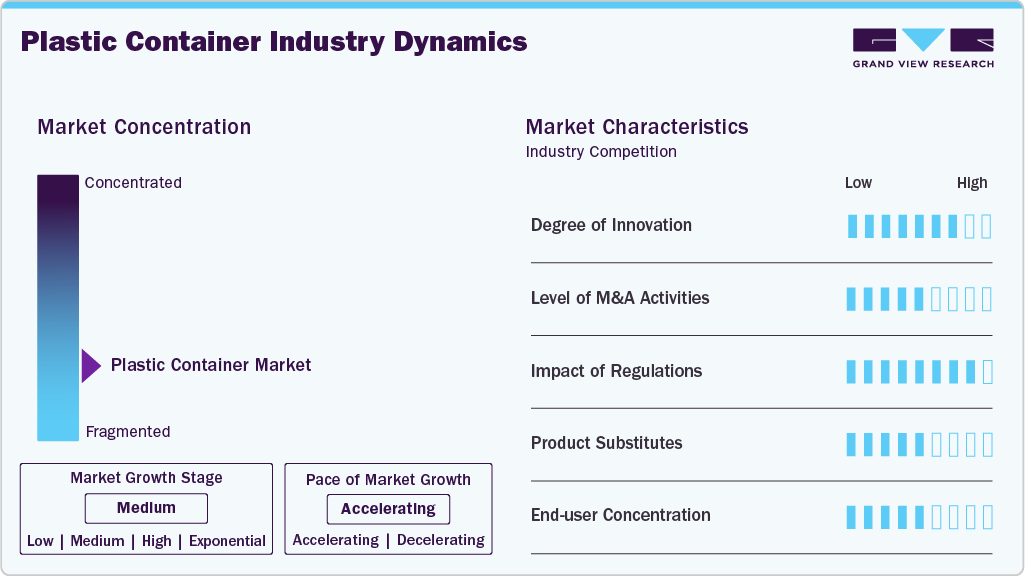

The plastic container market is currently in a medium growth stage, with an accelerating pace. Innovation in the plastic container market is moderate to high, driven by advancements in recycled-content resin technology, lightweighting, and functional packaging. Manufacturers are integrating bio-based polymers, improved barrier technologies, and intelligent features such as traceability tags and tamper-evident systems.

M&A activity in the plastic container market is steady, driven by consolidation among packaging converters and resin suppliers seeking scale, expanded geographic reach, and access to recycling technologies. Large players frequently acquire regional manufacturers, specialized bottle-to-bottle recyclers, or companies offering sustainable polymer solutions to strengthen their product portfolios amid growing sustainability pressures.

Regulations have a significant impact on the market, especially policies targeting single-use plastics, mandatory recycled-content requirements, and stricter guidelines for food-contact safety. Producers must comply with FDA, EFSA, and regional EPR standards, often requiring investments in traceability, certification, and production upgrades. Regulatory pressures are pushing companies toward more sustainable materials and closed-loop recycling systems.

Plastic containers face competition from glass, metal, and paper-based packaging, particularly in premium beverages, cosmetics, and eco-conscious consumer goods. While plastics offer superior lightweighting and durability, substitutes are gaining traction in regions where sustainability perceptions favor non-plastic materials. However, plastics remain dominant due to their affordability and versatility.

Material Insights

Polyethylene Terephthalate (PET) segment dominated the plastic container market in terms of revenue, accounting for a market share of 55.61% in 2025. PET is the preferred packaging material for carbonated drinks, bottled water, and juice due to its light weight, durability, and recyclability. With PET bottles used for 70% of mineral water, soft drinks, and juice transportation, its market share is expected to grow alongside the rising demand for bottled water and juice.

High-density Polyethylene (HDPE) segment is expected to register the fastest CAGR of 4.7% during the forecast period. HDPE is a robust and stiff material renowned for its exceptional stress, crack resistance, and melt strength. Its properties provide a superior barrier against moisture and make it an ideal choice for packaging in personal care, beverages, food, and chemical industries, offering a durable and rigid solution for container manufacturing.

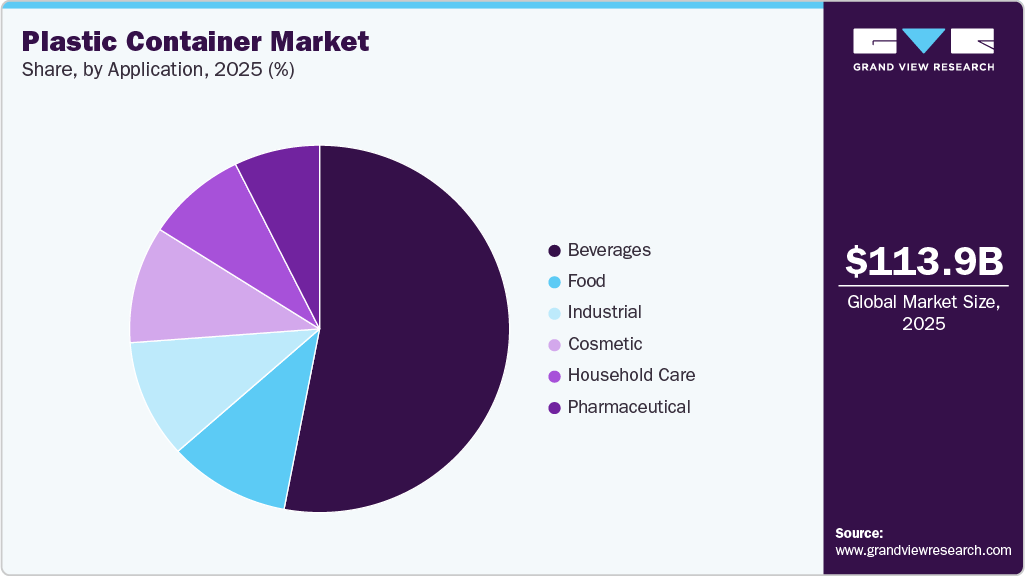

Application Insights

The beverages led the plastic container market across the application segmentation in terms of revenue, accounting for a market share of 53.01% in 2025. Beverage containers, primarily bottles and jars, play a critical role in the supply chain, ensuring product safety and extended shelf life while protecting against leakage, moisture, and chemical exposure. As demand for convenience and ready-to-drink products increases, particularly plastic bottles for carbonated soft drinks, juices, and milk & dairy drinks, industry’s growth will drive demand for packaging materials.

Cosmetic application of plastic containers is projected to grow at the fastest CAGR of 5.2% over the forecast period. The cosmetic industry relies heavily on plastic containers for flexible packaging solutions, catering to the rapid release of new products. Plastic containers offer portability, light weight, and durability, making them an ideal choice. Notably, China is a significant consumer of plastic containers globally, driven by the growing demand for beauty products within the country.

Regional Insights

Asia Pacific plastic container marketled the respective global market with a revenue share of 32.20% in 2025. The region is witnessing a significant growth in the plastic container industry, driven by the rising demand for plastic bottles for bottled water and carbonated beverages. PET is the dominant material used for beverage packaging. China and India are key drivers of this demand, underscoring the region’s importance in the global plastic container market.

The plastic container market in China dominated Asia Pacific in 2025. The cosmetic industry’s escalating demand for plastic protective packaging is expected to propel market growth in the future. In addition, the growing presence of automotive manufacturers in China is boosting the need for automotive lubricants and greases, thereby increasing the usage of plastic containers, driving demand and expansion in the region.

North America Plastic Container Market Trends

North America plastic container market is anticipated to witness significant growth in the respective global market. The food industry relies heavily on rigid plastic bottles and jars to prevent leakage and contamination, while pharmaceuticals utilize plastic containers for storing medicines and healthcare products due to their lightweight and strength characteristics, enabling efficient storage and transportation. This demand drives the growth of the plastic container market.

U.S. Plastic Container Market Trends

The plastic container market in the U.S. held the largest market share of 81.11% in the North American market in 2025. Industry growth in the country remains highly lucrative due to the growing food and pharmaceutical industries. Plastic bottles and jars are widely used in the food industry to securely store fluids and foods, while pharmaceuticals demand them for their strength and portability. The rise in demand for home cleaners, driven by consumer emphasis on health and hygiene, further boosts market growth.

Europe Plastic Container Market Trends

Europe plastic container market was identified as a lucrative region in the global plastic container market in 2025. The FMCG and automotive sectors are driving market growth. The region’s high demand for liquid FMCGs, such as detergents and cleaners, and the presence of luxury car brands, necessitates a significant supply of automotive fluids. As a result, the demand for plastic packaging of lubricants, oil, coolants, and other fluids is increasing, fueling market expansion.

The plastic container market in Germany is expected to grow rapidly in the coming years owing to robust demand-supply dynamics, increasing demand for convenient food consumption among busy professionals, and the thriving food and beverage sector. In Germany, the market is particularly buoyed by a significant surge in demand for single-use plastic containers for water and carbonated beverages, fueling expansion.

Latin America Plastic Container Market Trends

Latin America’s plastic container market is expanding steadily, driven by population growth, increasing urbanization, and rising consumption of packaged food, beverages, personal-care products, and pharmaceuticals. While the region has fewer stringent regulations on plastics compared to Europe or North America, sustainability awareness is increasing, leading to growing adoption of recyclable PET and HDPE containers.

Plastic container market in Brazil represents one of the most dynamic plastic container markets in Latin America, fueled by strong demand from the food & beverage, personal-care, and household-chemical sectors. The country has a large base of local converters and resin producers, giving it competitive manufacturing costs. PET and HDPE containers dominate, supported by expanding e-commerce and rising consumption of packaged beverages and dairy products.

Middle East & Africa Plastic Container Market Trends

The growth of plastic container market in Middle East & Africais supported by rising disposable incomes, expanding food processing industries, and increasing demand for pharmaceuticals and personal-care products. Countries in the GCC are rapidly modernizing packaging infrastructure, adopting advanced injection and blow-molding technologies. However, recycling infrastructure remains underdeveloped in many African countries, which limits the growth of high-PCR containers.

In Saudi Arabia, the plastic container market is driven by strong demand from food & beverage, petrochemical, pharmaceutical, and household-product manufacturers. Vision 2030’s industrial diversification initiatives have spurred investments in packaging manufacturing, logistics, and downstream plastics processing.

Key Plastic Container Market Company Insights

Some key companies in the plastic container market include Alpha Packaging, Inc.; Amcor plc; Bemis Manufacturing Company; and others. While market players adopt strategies such as mergers and acquisitions to increase product offerings, their focus remains on expanding their production capacity by adopting innovative technologies in order to meet consumer demand.

-

CKS Packaging is a manufacturer and supplier of plastic packaging solutions, catering to diverse industries, including food, beverage, health, beauty, personal care, automotive, medical, chemicals, and solutions.

-

Plastipak Holdings, Inc. is a manufacturer and designer of rigid plastic packaging solutions for the food, beverage, and consumer goods industries. The company provides a comprehensive range of services, including design, labeling, filling, delivery, and specialty services such as thermoshaping and direct printing.

Key Plastic Container Companies:

The following are the leading companies in the plastic container market. These companies collectively hold the largest market share and dictate industry trends.

- Alpha Packaging, Inc.

- Amcor plc

- Bemis Manufacturing Company

- CKS Packaging

- Constar Inernational Inc.

- Huhtamaki

- Klöckner Pentaplast

- Sonoco Products Company

- Plastipak Holdings, Inc.

Recent Developments

-

In September 2025, Ring Container Technologies announced to establish new operations in Whitestown, Indiana with a USD 77.0 million investment. The project is expected to repurpose a 400,576‑square‑foot warehouse facility. Supported by a local tax abatement, the expansion underscores Ring’s commitment to reliability, innovation, and sustainability, while strengthening its ability to serve customers in the food, agriculture, chemical, and pet care sectors with 100% recyclable containers. The initiative highlights Boone County’s attractiveness for advanced manufacturing and reinforces Central Indiana’s role in the region’s economic growth.

-

In May 2024, Plastipak Holdings, Inc., collaborated with Kraft Heinz to convert containers of KRAFT Real Mayo and MIRACLE WHIP to rPET material, successfully implementing a sustainable packaging initiative.

Plastic Container Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 119.65 billion

Revenue forecast in 2033

USD 163.62 billion

Growth rate

CAGR of 4.6% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, applications, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia, Brazil; Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

Alpha Packaging, Inc.; Amcor plc; Bemis Manufacturing Company; CKS Packaging; Constar Inernational Inc.; Huhtamaki; Klöckner Pentaplast; Sonoco Products Company; Plastipak Holdings, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Container Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global plastic container market report based on material, applications, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Polyethylene Terephthalate (PET)

-

Polypropylene (PP)

-

High-density Polyethylene (HDPE)

-

Low-density Polyethylene (LDPE)

-

Others Materials

-

-

Applications Outlook (Revenue, USD Million, 2021 - 2033)

-

Beverages

-

Food

-

Pharmaceutical

-

Cosmetic

-

Household Care

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plastic container market size was estimated at USD 113.92 billion in 2025 and is expected to reach USD 119.65 billion in 2026.

b. The global plastic container market is expected to grow at a compound annual growth rate of 4.6% from 2026 to 2033 to reach USD 163.62 billion by 2033.

b. The Asia Pacific dominated the plastic container market with a share of 32.20% in 2025. This is attributable to the increasing consumption of water, soft drinks, and juice owing to the changing consumer lifestyle.

b. Some key players operating in the plastic container market include Alpha Packaging, Inc., Amcor plc, Bemis Manufacturing Company, CKS Packaging, Constar Inernational Inc., Huhtamaki, Klöckner Pentaplast, Sonoco Products Company, and Plastipak Holdings, Inc.

b. Key factors that are driving the plastic container market growth include changing lifestyle and food preference in emerging economies including China and India, which are expected to expand the scope of convenience foods, which, in turn, will promote the utility of packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.