- Home

- »

- Drilling & Extraction Equipments

- »

-

Sodium Bromide Market Size, Share, Industry Report 2030GVR Report cover

![Sodium Bromide Market Size, Share & Trends Report]()

Sodium Bromide Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Industrial, Medical), By Industrial Application (Oil & Gas, Water Treatment, Chemical Industry), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-601-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sodium Bromide Market Summary

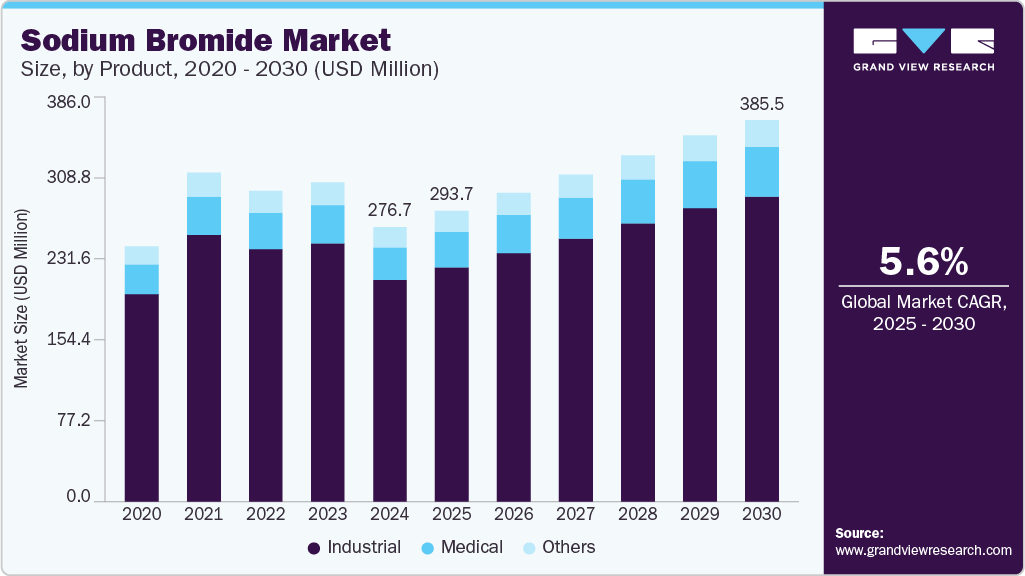

The global sodium bromide market size was estimated at USD 276.7 million in 2024 and is projected to reach USD 385.5 million by 2030, growing at a CAGR of 5.6% from 2025 to 2030. Market growth is driven by its applications in oil and gas drilling fluids, water treatment, pharmaceuticals, and flame retardants.

Key Market Trends & Insights

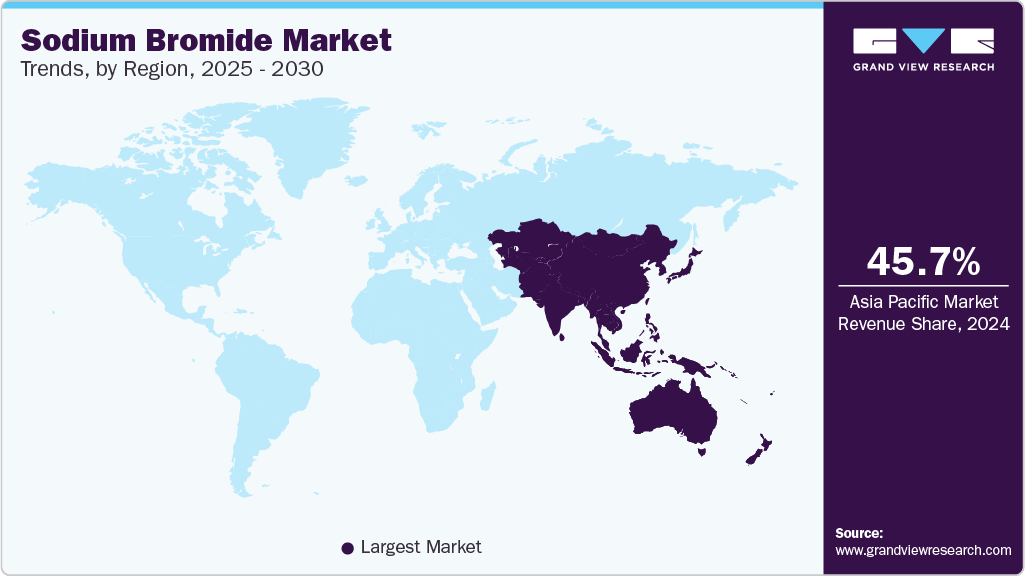

- Asia Pacific sodium bromide industry dominated the market with the largest revenue share of over 45.7% in 2024.

- By product, the industrial grade sodium bromide accounted for 80.8% of the total revenue in 2024.

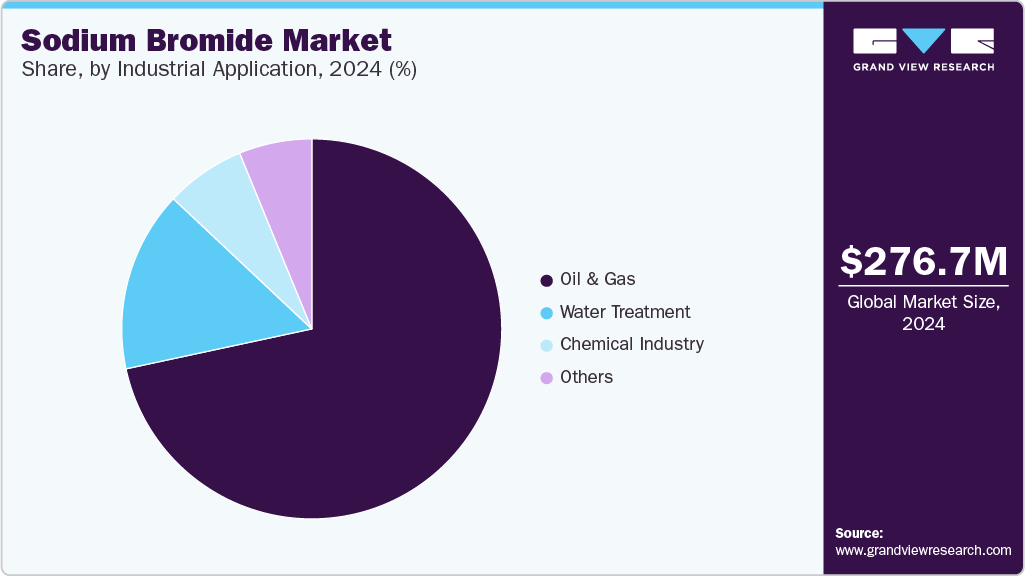

- By industrial application, the oil & gas segment recorded the largest market share of over 71.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 276.7 Million

- 2030 Projected Market Size: USD 385.5 Million

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

The increasing global demand for energy, combined with the exploration of new offshore and unconventional reserves, continues to boost sodium bromide consumption in this sector. The water treatment industry is also a major contributor to market demand. Sodium bromide is used in conjunction with oxidizing agents like chlorine or ozone to form hypobromous acid, which serves as an effective disinfectant. With growing concerns about water pollution and the need for efficient water sanitization, especially in municipal, industrial, and recreational facilities, the application of sodium bromide in water treatment continues to rise.The increasing demand from the chemical industry for bromide compounds drives market growth. It acts as a precursor in the synthesis of various organic bromides used in dyes, flame retardants, and photographic chemicals. As industries seek more efficient and versatile halogen-based compounds, its utility as a reagent and intermediate maintains its relevance in multiple downstream applications. Although primarily used in oilfield and water treatment applications, sodium bromide is also gaining attention for use in innovative energy storage systems, particularly in molten salt thermal storage for solar power.

The global sodium bromide production landscape is driven by regional industrial growth and changing market dynamics. Israel has emerged as the leading producer, increasing output from 22.7 Kilotons in 2018 to 36.5 Kilotons in 2023. This growth is primarily fueled by Israel's well-established bromine extraction facilities and its strategic position as a global supplier of bromine derivatives. The presence of large-scale chemical manufacturing units and the country's focus on expanding production capacity have solidified its top position.

The U.S. also significantly increased its production during the same period. This growth is attributed to the expansion of bromine production facilities in states like Arkansas, driven by the rising demand for sodium bromide in oilfield chemicals and industrial water treatment. The U.S. has leveraged its strong industrial base and advanced chemical processing capabilities to boost output, catering to both domestic and international markets. Meanwhile, Russia maintained a steady production growth, primarily supported by its established chemical and oilfield sectors.

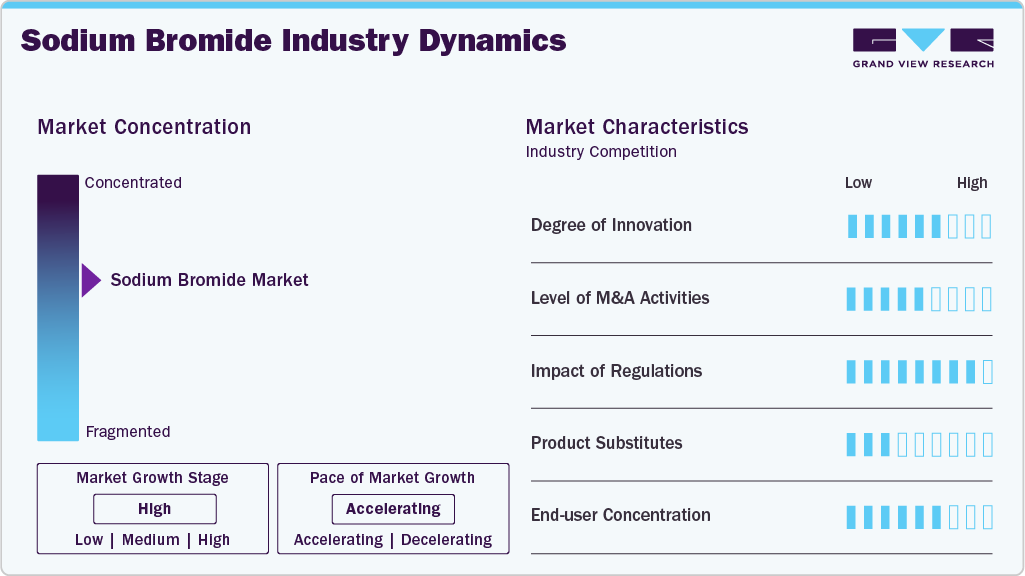

Market Concentration & Characteristics

The sodium bromide industry is moderately concentrated, featuring a mix of large global chemical manufacturers with extensive production and distribution capabilities alongside specialized regional producers catering to niche applications and local demand.Major participants are leveraging advancements in production technologies, process optimization, and supply chain integration to maintain competitiveness. Strategic initiatives such as mergers, acquisitions, and joint ventures are commonly pursued to expand geographical reach and product offerings. In addition, ongoing investments in R&D are driving innovation in application areas, particularly within oil and gas drilling fluids, pharmaceuticals, and water treatment sectors, thereby strengthening market positioning.

Despite steady demand, the sodium bromide industry faces substitution threats from alternative bromine compounds and evolving water treatment technologies. Environmental regulations concerning the handling and disposal of bromide-based products also pose operational challenges. Furthermore, fluctuating raw material prices and dependence on bromine supply chains, particularly from limited-source regions, can impact cost structures and production stability. Nonetheless, strong end use industry demand and the compound’s effectiveness as a dense, clear brine continue to support market resilience and long-term growth potential.

Product Insights

The industrial grade sodium bromide accounted for 80.8% of the total revenue in 2024. This grade is primarily utilized in large-scale applications such as oil and gas drilling fluids, water treatment, and chemical synthesis. The widespread use of sodium bromide as a clear brine fluid in offshore drilling operations significantly boosts its demand within the industrial sector. In addition, the compound’s role as a biocide in industrial water treatment processes further solidifies its dominance. Industrial-grade sodium bromide is also a key ingredient in flame retardants, particularly in regions with stringent fire safety regulations.

The medical grade sodium bromide is primarily used in the pharmaceutical industry. Its application as a sedative and anticonvulsant remains crucial, particularly in niche therapeutic areas. Despite being significantly smaller than the industrial segment, the medical grade’s stable demand is attributed to its established use in formulations requiring high-purity bromides. In addition, emerging research on bromide compounds in medical diagnostics is expected to support moderate growth in this segment.

Industrial Application Insights

The oil & gas segment recorded the largest market share of over 71.7% in 2024. In the oil and gas industry, it is primarily used as a clear brine fluid in drilling and well completion operations. The increasing global demand for energy, combined with the expansion of offshore and unconventional drilling projects, continues to drive the consumption of sodium bromide in this sector. Moreover, as exploration moves into deeper and more geologically challenging reserves, the demand for reliable, high-performance drilling fluids is expected to rise, supporting sustained market growth.

The chemical industry utilizes sodium bromide as a precursor in the synthesis of various bromine-based compounds, including photographic chemicals, dyes, and pharmaceuticals. Its role as a catalyst and reactant in multiple chemical reactions underpins steady demand in specialized manufacturing. As innovation in specialty chemicals continues, particularly in developing economies, the compound's versatile reactivity supports its importance across a broad range of chemical processes. The resurgence of bromine chemistry in pharmaceutical R&D and agrochemical production also contributes to market expansion.

Regional Insights

North America sodium bromide industry, particularly the U.S. and Canada, represents a mature yet steadily evolving sodium bromide industry. This position is largely supported by the region’s well-established oil and gas industry, where sodium bromide is widely used as a dense brine fluid in drilling and completion operations. North America’s strong research infrastructure, combined with increasing investment in pharmaceutical innovation, supports its ongoing usage.

U.S. Sodium Bromide MarketTrends

U.S. sodium bromide market growth is driven by its critical role in the oil and gas sector, where it is used as a high-density brine fluid for drilling, completion, and workover operations, particularly in shale and offshore projects. In addition, stringent environmental regulations are boosting its demand in industrial wastewater treatment. The market is further supported by its application in pharmaceutical synthesis and flame retardants, with strong domestic R&D and manufacturing capabilities reinforcing sustained demand.

Asia Pacific Sodium Bromide Market Trends

Asia Pacific sodium bromide industry dominated the market with the largest revenue share of over 45.7% in 2024. This substantial contribution can be attributed to the region's robust industrial base, particularly in China and India, where sodium bromide is extensively used in water treatment and the growing pharmaceutical sector. In addition, increasing demand for flame retardants in electronics and textiles, driven by rapid urbanization and manufacturing growth, further supports the region’s leading position.

China's sodium bromide industry is experiencing robust growth, driven by its expansive chemical manufacturing sector and increasing demand in pharmaceuticals and water treatment applications, as well as strategic initiatives under the "Belt and Road" policy that facilitate access to overseas markets and raw materials. These factors collectively position China as a pivotal player in the global market, balancing domestic priorities with international trade considerations.

Middle East & Africa Sodium Bromide Market Trends

The Middle East sodium bromide industry emerged as the second-largest revenue contributor to the global market. This region’s strong presence in the market is primarily driven by extensive oil & gas exploration activities. Countries such as Saudi Arabia, UAE, and Qatar heavily invest in offshore drilling and production enhancement, where sodium bromide serves as a key component in clear brine fluids. Furthermore, the Middle East’s strategic focus on enhancing water treatment facilities amid rising water scarcity issues has also fueled the regional demand.

UAE sodium bromide industry growth is primarily driven by the country's robust oil and gas sector. It is extensively utilized as a clear brine fluid in drilling operations, which are integral to the UAE's energy industry. The nation's ongoing investments in oil exploration and production activities necessitate high-performance drilling fluids, thereby increasing the demand for sodium bromide.In addition, the UAE's strategic initiatives to diversify its economy and enhance its industrial base have led to increased applications of sodium bromide in water treatment and chemical manufacturing processes.

Europe Sodium Bromide Market Trends

The European sodium bromide industry is experiencing a nuanced growth trajectory, influenced by a combination of industrial demand, regulatory frameworks, and supply chain dynamics. Key drivers include the compound's application in oil and gas drilling fluids, where it serves as a dense brine to control wellbore pressures.

Key Sodium Bromide Company Insights

Some of the key players operating in the market include ICL, Albemarle Corporation, Shandong Tianxin Pharma-Tech Co., Ltd. Jordan Bromine Company.

- ICL is a global specialty minerals and chemicals company. It is a leading producer of bromine, potash, phosphate fertilizers, and specialty phosphates, serving agriculture, food, and industrial markets worldwide. The company leverages unique mineral assets, including resources from the Dead Sea, and emphasizes R&D and sustainability to drive innovation and growth. ICL holds a dominant position in the global sodium bromide industry, primarily attributed to its extensive production capabilities, efficient distribution networks, and strong customer relationships worldwide.

Shandong Haiwang Chemical Co., Ltd. and Shandong Tianyi Chemical Co., Ltd. are some of the emerging market participants in the sodium bromide industry.

- Shandong Haiwang Chemical Co., Ltd, established in 2003, is a leading Chinese manufacturer specializing in bromine, brominated flame retardants, and oilfield chemicals. Itholds a prominent and growing share in the global sodium bromide industry, driven by its dedicated focus on bromine and bromine-based chemical production. The company leverages its strategically located facilities in Shandong Province-one of China’s key bromine-producing regions-to maintain stable access to high-quality raw materials. Its large-scale, integrated production capabilities enable high output and competitive pricing for sodium bromide, particularly for use in oilfield drilling fluids, where demand remains strong.

Key Sodium Bromide Companies:

The following are the leading companies in the sodium bromide market. These companies collectively hold the largest market share and dictate industry trends.

- ICL

- Albemarle Corporation

- Shandong Tianxin Pharma-Tech Co.,

- LANXESS

- Merck KGaA

- Jordan Bromine Company

- Tosoh Corporation

- TETRA Technologies, Inc.

- Shandong Haiwang Chemical Co., Ltd.

- Shandong Tianyi Chemical Co., Ltd.

Recent Development

-

In November 2023, Utico and Shandong Tianyi Chemical Co., Ltd. announced a groundbreaking joint venture to establish a circular economy project in Ras Al Khaimah, investing USD 45.2 million. This project, the first of its kind in the GCC, will extract industrial chemicals, including sodium bromide, from brine waste produced by desalination plants. The initiative supports the UAE-China bilateral cooperation under the Belt and Road Initiative. It aligns with the UAE's sustainability goals, aiming to minimize environmental impact and enhance the renewables portfolio.

-

In January 2022, Shandong Haiwang Chemical Co., Ltd completed and implemented the sodium bromide expansion project at its Laos base in Gammon Province by early 2022. After an intensive 78-day construction period, the commissioning of the new production facilities was completed on January 3rd, marking a significant increase in the production capacity of sodium bromide at this site.

Sodium Bromide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 293.7 million

Revenue forecast in 2030

USD 385.5 million

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, industrial application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Azerbaijan; Czech Republic; China; India; Japan; South Korea; Thailand; Indonesia; Malaysia; Philippines; Brazil; Argentina; Colombia; Costa Rica; Saudi Arabia; South Africa; UAE; Israel; Nigeria; Egypt; Kenya.

Key companies profiled

ICL; Albemarle Corporation; Shandong Tianxin Pharma-Tech Co., Ltd.; LANXESS; Merck KGaA; Jordan Bromine Company; Tosoh Corporation; TETRA Technologies, Inc.; Shandong Haiwang Chemical Co., Ltd.; Shandong Tianyi Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sodium Bromide Market Report Segmentation

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sodium bromide market report based on product, industrial application, and region:

Product Outlook (Volume, Kilotons; Rue,even USD Million, 2018 - 2030)

-

Industrial

-

Medical

-

Others

Industrial Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Water Treatment

-

Chemical Industry

-

Others

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Russia

-

Azerbaijan

-

Czech Republic

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Philippines

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Costa Rico

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Israel

-

South Africa

-

Nigeria

-

Egypt

-

Kenya

-

Frequently Asked Questions About This Report

b. The global sodium bromide market size was estimated at USD 276.7 million in 2024 and is expected to reach USD 293.7 million in 2025.

b. The global sodium bromide market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 385.5 million in 2030.

b. Asia Pacific dominated the sodium bromide market with a share of 45.69% in 2024. This substantial contribution can be attributed to the region's robust industrial base, particularly in China and India, where sodium bromide is extensively used in water treatment and the growing pharmaceutical sector.

b. Some key players operating in the sodium bromide market include ICL, Albemarle Corporation, Shandong Tianxin Pharma-Tech Co., Ltd., LANXESS, Merck KGaA, Jordan Bromine Company, Tosoh Corporation, TETRA Technologies, Inc., Shandong Haiwang Chemical Co., Ltd., and Shandong Tianyi Chemical Co., Ltd.

b. Market growth of sodium bromide is driven by its applications in oil and gas drilling fluids, water treatment, pharmaceuticals, and flame retardants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.