- Home

- »

- Advanced Interior Materials

- »

-

Sodium Chloride Market Size, Share, Industry Report, 2030GVR Report cover

![Sodium Chloride Market Size, Share & Trend Report]()

Sodium Chloride Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (Industrial, Food, Medical Grade Salt), By End Use (Chemical Manufacturing, Water Treatment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-538-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sodium Chloride Market Summary

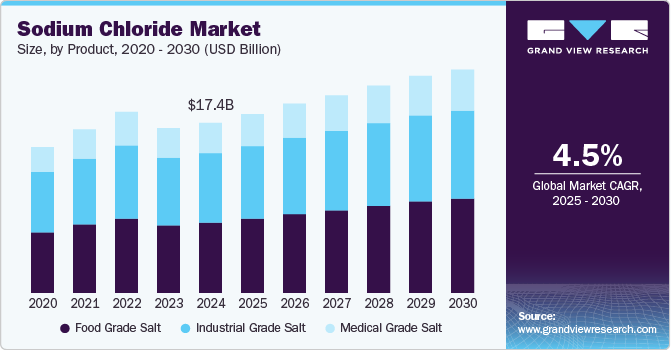

The global sodium chloride market size was estimated at USD 17.36 billion in 2024 and is projected to reach USD 22.79 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. This growth is largely attributed to its essential role in chemical manufacturing, food processing, water treatment, and other industrial applications.

Key Market Trends & Insights

- Asia Pacific sodium chloride market dominates the global sodium chloride market.

- North America Sodium chloride market is poised to be the fastest-growing region.

- Based on product, the industrial grade salt segment dominated the market with a revenue share of 40.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.36 Billion

- 2030 Projected Market Size: USD 22.79 Billion

- CAGR (2025-2030): 4.5%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Sodium chloride, commonly known as salt, remains a critical raw material in several production processes, reinforcing its significance in global trade and supply chains.

Growing healthcare investments in emerging economies are expected to propel demand further. Moreover, technological advancements in mining and refining processes are enabling cost-effective production while ensuring high purity levels, enhancing sodium chloride’s value in specialized applications.

Price volatility in energy and transportation costs can impact production expenses, affecting overall profitability for manufacturers. Supply chain disruptions, particularly in regions heavily reliant on imports, may further hinder market expansion. Companies in the industry are increasingly focusing on sustainable production methods and efficient supply chain management to mitigate these challenges and maintain steady growth.

Drivers, Opportunities & Restraints

The global sodium chloride market is primarily driven by its extensive use across multiple industries, including food processing, pharmaceuticals, chemicals, and water treatment. One of the key factors fueling demand is the increasing consumption of processed and packaged foods, where sodium chloride is a key preservative and flavor enhancer. Additionally, the chemical industry remains a major consumer, as sodium chloride is a crucial raw material in the production of chlorine, caustic soda, and other essential chemicals.

The growing demand for water treatment solutions, particularly in regions facing freshwater scarcity, also contributes to market growth. Sodium chloride is widely used in desalination plants and wastewater treatment facilities, where it plays a vital role in softening and purification processes. Furthermore, its application as a de-icing agent in cold regions, particularly in North America and Europe, continues to drive seasonal demand, supporting overall market stability.

The rising focus on sustainability and environmentally friendly practices presents significant growth opportunities for the sodium chloride market. Advancements in salt production methods, such as solar evaporation and vacuum crystallization, are improving efficiency while reducing environmental impact. Additionally, research into innovative applications, including sodium chloride’s potential use in energy storage systems and renewable energy infrastructure, is expanding its market potential.

Despite its widespread applications, the sodium chloride market faces several challenges. One of the primary constraints is environmental concerns associated with excessive salt mining and brine disposal, which can lead to soil degradation, water contamination, and ecosystem imbalance.

Product Insights

Industrial grade salt segment holds the largest market share due to its extensive use in chemical manufacturing. It serves as a fundamental raw material for producing key chemicals such as chlorine and caustic soda, which are integral to numerous industries, including pharmaceuticals, textiles, and paper production.

Meanwhile, food-grade salt plays a crucial role in the food and beverage sector, where it functions as a preservative, seasoning, and flavor enhancer. The increasing consumption of processed and convenience foods worldwide has propelled demand for this segment. Additionally, medical-grade salt is emerging as the fastest-growing segment, driven by its application in pharmaceutical formulations, intravenous solutions, and dialysis treatments. The growing healthcare sector and advancements in medical treatments are expected to accelerate demand for high-purity sodium chloride in the coming years.

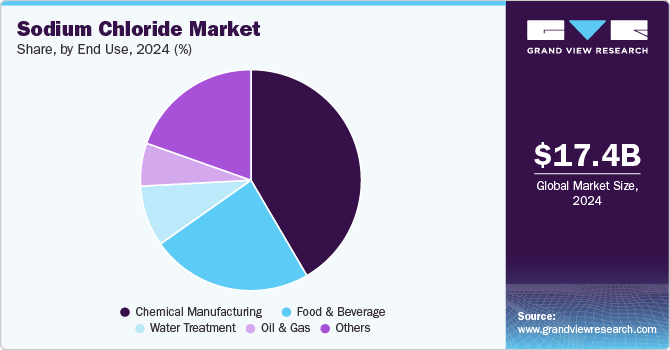

End Use Insights

The chemical manufacturing segment showcase substation growth in the sodium chloride market, as it relies heavily on salt for the production of essential chemicals. The food and beverage industry also represents a significant share, given salt’s critical role in food preservation and processing.

Furthermore, the water treatment industry is the second-fastest-growing segment, as sodium chloride is widely used in water purification and softening processes. With increasing concerns over water quality and scarcity, governments and industries worldwide are investing in advanced water treatment solutions, fueling demand for sodium chloride. The oil and gas sector also utilizes sodium chloride in drilling fluids to maintain well pressure and enhance drilling efficiency, highlighting its importance in energy production.

Regional Insights

Asia Pacific sodium chloride market dominates the global sodium chloride market, accounting for the largest share due to rapid industrialization, urbanization, and population growth. Countries such as China and India are major contributors, with high demand from the chemical, food processing, and water treatment industries. The region's growing pharmaceutical sector is also boosting demand for medical-grade salt.

Additionally, increasing investment in infrastructure development and rising energy demands are driving the use of sodium chloride in the oil and gas sector. The availability of abundant raw materials and cost-effective production further enhances Asia Pacific’s leadership in the global sodium chloride market.

North America Sodium Chloride Market Trends

North America Sodium chloride market is poised to be the fastest-growing region in the global sodium chloride market, driven by its robust industrial infrastructure and high demand across multiple sectors. The region's well-established chemical manufacturing industry relies heavily on sodium chloride to produce essential chemicals such as chlorine and caustic soda.

Water treatment applications are also expanding as stringent environmental regulations drive the adoption of advanced purification technologies. The presence of major industry players, including Compass Minerals International, further strengthens North America’s position in the global market.

U.S. Sodium Chloride Market Trends

The U.S. experiences a high demand for de-icing salt, particularly in northern states, where harsh winter conditions necessitate extensive road maintenance. The food and beverage industry is another major consumer, with a growing demand for processed and packaged foods. Moreover, advancements in water treatment technologies, driven by stringent environmental regulations, are further propelling market growth.

Europe Sodium Chloride Market Trends

Europe holds a substantial share of the sodium chloride market, supported by strong industrial and pharmaceutical sectors. The region’s developed chemical industry extensively utilizes sodium chloride in various production processes, including plastics, detergents, and pharmaceuticals. Additionally, the rising demand for high-quality food-grade salt, driven by consumer preferences for healthier and organic food products, has bolstered market growth.

Central & South America Sodium Chloride Market Trends

Central and South America are experiencing moderate growth in the sodium chloride market, largely driven by the region’s expanding food and beverage industry. Brazil and Argentina are key markets, where the demand for processed foods and packaged goods is on the rise. Additionally, the chemical and pharmaceutical sectors are gradually increasing their reliance on sodium chloride for various manufacturing processes. The region’s growing mining activities also contribute to demand, as sodium chloride is used in ore processing and metal extraction. However, economic fluctuations and trade uncertainties in some countries may impact market stability.

Middle East & Africa Sodium Chloride Market Trends

The Middle East & Africa region is witnessing steady growth in the sodium chloride market, primarily driven by increasing water treatment and oil and gas applications. Many countries in the region, particularly those in the GCC, rely on desalination plants for freshwater supply, where sodium chloride plays a crucial role. Additionally, the region’s significant oil and gas reserves necessitate the use of sodium chloride in drilling and extraction processes. The food processing sector is also expanding, with rising urbanization and changing dietary habits fueling the demand for salt. However, limited local production and dependency on imports may pose challenges for market expansion in certain areas.

Key Sodium Chloride Company Insights

Some of the key players operating in the market include Cargill, Incorporated, Compass Minerals, and K+S Aktiengesellschaft.

-

Cargill, Incorporated is a global company in food and agriculture, with a strong presence in the sodium chloride market. The company produces a wide range of salt products, including food-grade, industrial, and de-icing salt. Cargill emphasizes sustainability by implementing eco-friendly mining and processing techniques. Its extensive distribution network and R&D investments strengthen its market position.

-

Compass Minerals is a key player in the sodium chloride market, primarily operating in North America and the UK. The company produces a variety of mineral-based products, including road de-icing salt, water conditioning salt, and specialty food-grade salt.

-

K+S Aktiengesellschaft is a major producer of potash and salt products, serving industrial, agricultural, and consumer markets worldwide. The company operates large scale salt mines and refineries, ensuring a steady supply to various industries. It focuses on innovation, particularly in sustainable extraction methods and environmentally responsible disposal of mining residues.

Key Sodium Chloride Companies:

The following are the leading companies in the sodium chloride market These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Incorporated

- Compass Minerals

- INEOS

- K+S Aktiengesellschaft

- Kishida Chemical Co., Ltd.

- Maldon Crystal Salt Company Ltd

- Nouryon

- Rio Tinto

- Südwestdeutsche Salzwerke AG

- Swiss Salt Works AG

- Tata Chemicals Limited

- Wacker Chemie AG

Recent Developments

-

In December 2024, Goyal Salt Limited announced an investment of INR 80 crore (~USD 9.2 million) to establish a new manufacturing plant in India, aimed at enhancing its production capacity and market reach. This strategic expansion aligns with the company's growth plans to meet the rising demand for high-quality salt across various industries, including food processing, pharmaceuticals, and industrial applications.

-

In September 2024, QatarEnergy announced a joint venture to develop a USD 275 million industrial salt production plant with a planned capacity of 1 million tons per annum in Qatar. The facility will produce table and industrial salts, catering to various sectors. This initiative aims to strengthen Qatar’s domestic production capabilities and reduce reliance on imports.

Sodium Chloride Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.26 billion

Revenue forecast in 2030

USD 22.79 billion

Growth rate

CAGR of 4.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; Poland; China; India; Japan; South Korea; Brazil; Saudi Arabia; Egypt

Key companies profiled

Cargill, Incorporated; Wacker Chemie AG; INEOS; Tata Chemicals Limited; Nouryon; Kishida Chemical Co., Ltd.; Südwestdeutsche Salzwerke AG; Swiss Salt Works AG; K+S Aktiengesellschaft; Rio Tinto; Maldon Crystal Salt Company Ltd; Compass Minerals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sodium Chloride Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sodium chloride market report on the basis of product, end use, and region.

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Industrial Grade Salt

-

Food Grade Salt

-

Medical Grade Salt

-

-

End Use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Chemical Manufacturing

-

Water Treatment

-

Oil & Gas

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

Egypt

-

-

Frequently Asked Questions About This Report

b. .The global sodium chloride market size was estimated at USD 17.36 billion in 2024 and is expected to reach USD 18.26 billion in 2025.

b. The global sodium chloride market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach USD 22.79 billion by 2030.

b. The industrial grade salt segment dominated the market with a revenue share of 40.0% in 2024.

b. Some of the key vendors of the global sodium chloride market are Cargill, ncorporated; Wacker Chemie AG; INEOS; Tata Chemicals Limited; Nouryon; Kishida Chemical Co., Ltd.; Südwestdeutsche Salzwerke AG; Swiss Salt Works AG; K+S Aktiengesellschaft; Rio Tinto; among others.

b. The key factor that is driving the growth of the global sodium chloride market is the growing demand for its essential role in chemical manufacturing, food processing, water treatment, and other industrial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.