- Home

- »

- Green Building Materials

- »

-

Soft Covering Flooring Market Size & Share Report, 2030GVR Report cover

![Soft Covering Flooring Market Size, Share & Trends Report]()

Soft Covering Flooring Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Carpet Tiles, Broadloom), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-499-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soft Covering Flooring Market Size & Trends

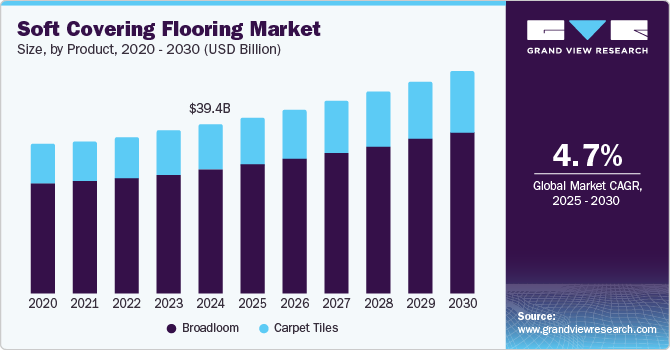

The global soft covering flooring market size was estimated at USD 39.4 billion in 2024 and is expected to grow at a CAGR of 4.7% from 2025 to 2030. This growth is attributed to the increasing demand for aesthetically pleasing and durable flooring solutions in residential and commercial sectors, significantly contributing to market expansion. In addition, the rise in construction activities, particularly in emerging economies, along with a growing preference for eco-friendly materials, further fuels this demand. Furthermore, innovations in design and materials, coupled with the expansion of the tourism and hospitality industries, are also pivotal in enhancing market prospects.

Soft covering flooring, including area rugs, carpets, and vinyl options, is increasingly favored in residential settings because it creates a warm and inviting atmosphere. This type of flooring not only enhances comfort but also effectively reduces noise and provides insulation. Moreover, technological advancements have created soft coverings that are long-lasting and easy to maintain. These features make them suitable for high-traffic areas such as hallways and family rooms. As a result, the demand for soft covering flooring in residential applications is expected to rise as consumers seek stylish yet comfortable home options.

The growth of the real estate market, especially in developing countries, significantly boosts the demand for luxurious flooring solutions. As new residential and commercial properties emerge, the need for aesthetically pleasing interiors becomes paramount. Furthermore, there is a growing consumer preference for comfortable indoor environments that enhance visual appeal, further driving market expansion. Due to their booming construction industries, developing markets are crucial in the soft-covering flooring sector. The increasing infrastructure development across various sectors, such as healthcare, education, and industrial automotive, combined with ongoing residential construction projects, is anticipated to propel the soft-covering flooring market growth.

Product Insights

Broadloom dominated the market and accounted for the largest revenue share of 73.5% in 2024, attributed to its seamless installation and aesthetic appeal. Its ability to cover large areas without visible seams makes it a preferred choice for residential and commercial spaces, creating a cohesive look. In addition, advancements in manufacturing have led to the production of durable and eco-friendly materials, aligning with consumer preferences for sustainability. Furthermore, the increasing demand for luxurious and comfortable interiors, particularly in the expanding real estate market, further drives the popularity of broadloom flooring.

Carpet tiles are expected to grow at a CAGR of 4.7% over the forecast period, owing to their practicality and design versatility. Their modular nature allows for easy installation and maintenance, enabling users to replace individual tiles without disrupting the entire floor, which is particularly advantageous in high-traffic commercial environments. In addition, the variety of colors, patterns, and textures caters to evolving design trends, making them appealing to consumers. Furthermore, as businesses and homeowners prioritize stylish yet functional flooring solutions, the demand for carpet tiles continues to rise.

Application Insights

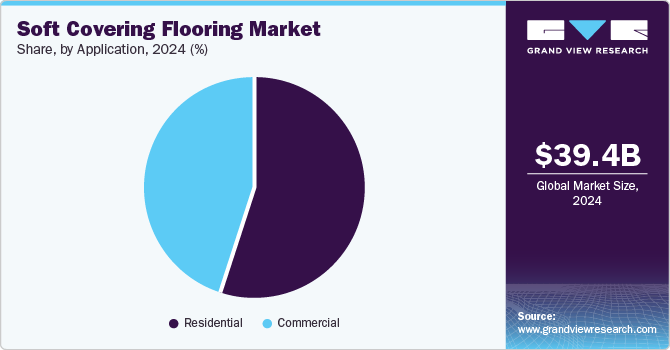

The residential application segment led the market and accounted for the largest revenue share of 54.8% in 2024 attributed to a growing consumer preference for comfort and aesthetics in home environments. As urbanization increases, more homeowners are investing in interior design, seeking flooring solutions that enhance the warmth and appeal of their living spaces. In addition, soft-covering flooring options, such as carpets and area rugs, provide visual charm and functional benefits, including noise reduction and insulation. Furthermore, advancements in eco-friendly materials align with the rising demand for sustainable living, further propelling this segment's growth.

The commercial application segment is expected to grow at a CAGR of 4.7%, owing to the increasing demand for durable and visually appealing flooring solutions in various industries. Businesses prioritize aesthetics and comfort in their spaces to create inviting environments for customers and employees. Soft covering flooring offers versatility, easy maintenance, and sound absorption, making it ideal for high-traffic areas such as offices, retail stores, and hospitality venues. Furthermore, expanding urban development and infrastructure projects worldwide is driving the need for innovative flooring solutions that meet both functional and aesthetic requirements in commercial settings.

Regional Insights

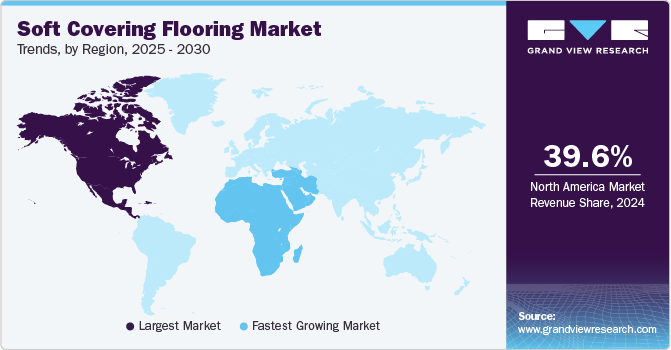

The North America soft covering flooring market dominated the global market and accounted for the largest revenue share of 39.6% in 2024 attributed to robust demand in residential and commercial sectors. The ongoing trend of home renovations and improvements drives consumers to invest in high-quality flooring solutions. In addition, the region's focus on eco-friendly materials also aligns with increasing consumer sustainability awareness. Furthermore, urbanization and rising disposable incomes further fuel the market as homeowners seek comfortable and aesthetically pleasing flooring options that enhance their living spaces.

U.S. Soft Covering Flooring Market Trends

The U.S. soft covering flooring market dominated the North American market and accounted for the largest revenue share in 2024, driven by significant investments in residential construction and renovation projects. With a strong real estate sector, consumers increasingly opt for luxurious and durable flooring solutions such as carpets and rugs. In addition, the trend toward sustainable building practices also influences purchasing decisions, as more homeowners prioritize eco-friendly materials. Furthermore, low mortgage rates encourage homeownership, leading to increased spending on home improvements and contributing to the market's expansion.

Middle East And Africa Soft Covering Flooring Market Trends

The Middle East and Africa soft covering flooring market is expected to grow at a CAGR of 6.4% over the forecast period, owing to rapid urbanization and substantial investments in infrastructure development. The hospitality sector's growth, fueled by tourism, increases demand for luxurious flooring solutions in hotels and resorts. In addition, rising disposable incomes among consumers are prompting investments in home decor, including carpets and rugs. Furthermore, the region's climate influences flooring preferences that provide insulation and comfort, further driving market growth in residential and commercial applications.

Asia Pacific Soft Covering Flooring Market Trends

The soft covering flooring market in the Asia Pacific region is witnessing significant growth, primarily driven by rapid urbanization and increasing construction activities. Countries such as India and China are experiencing a surge in residential and commercial projects that drive demand for aesthetically pleasing and durable flooring solutions. Furthermore, a growing middle class with rising disposable incomes leads to increased home improvement spending. Moreover, the trend toward eco-friendly materials also plays a crucial role as consumers seek sustainable options in their flooring choices.

The China soft-covering flooring market is expected to grow significantly, driven by substantial government investments in infrastructure and housing projects. Initiatives aimed at providing affordable housing are increasing the demand for cost-effective yet stylish flooring solutions. In addition, urbanization continues to drive consumer preferences for modern interior designs that incorporate soft coverings for comfort and aesthetics. Moreover, growing environmental awareness pushes manufacturers to innovate with eco-friendly materials, expanding the market.

Europe Soft Covering Flooring Market Trends

The soft covering flooring market in Europe accounted for a significant revenue share in 2024 attributed to rising consumer disposable incomes. In addition, the demand for luxurious flooring options is increasing as homeowners invest more in enhancing the aesthetics of their living spaces. Furthermore, sustainability is a significant factor, with consumers leaning toward eco-friendly products. Moreover, ongoing construction projects across residential and commercial sectors drive demand for soft coverings, particularly carpets and rugs, which are favored for their comfort and design versatility.

Key Soft Covering Flooring Company Insights

Some key companies in the market include Mohawk Industries Inc., Engineered Floors LLC, Beaulieu Group LLC, and others. These companies are adopting several strategies, such as new product launches, introducing eco-friendly carpets, and smart flooring solutions with advanced features such as antimicrobial properties to enhance their competitiveness in the market. In addition, strategic partnerships with technology firms enable the integration of innovative functionalities, and mergers and acquisitions allow larger companies to diversify product lines and consolidate market share, fostering growth in an increasingly dynamic industry landscape.

-

Shaw Industries Group, Inc. specializes in diverse products, including carpets, area rugs, and carpet tiles. Based in Dalton, Georgia, the company focuses on residential and commercial applications, providing innovative flooring solutions emphasizing sustainability and design. The company is known for its commitment to quality and environmental responsibility and offers products that meet the needs of various consumer segments.

-

Mohawk Industries Inc. produces extensive flooring products, including broadloom carpets, carpet tiles, rugs, and luxury vinyl tile. The company serves both residential and commercial markets across North America and Europe. Mohawk's diverse product offerings cater to evolving consumer preferences for durability and eco-friendliness, positioning it as a leader in the competitive flooring industry.

Key Soft Covering Flooring Companies:

The following are the leading companies in the soft covering flooring market. These companies collectively hold the largest market share and dictate industry trends.

- Shaw Industries Group, Inc.

- Mohawk Industries Inc.

- Engineered Floors LLC

- Beaulieu Group LLC

- Dixie Group Inc.

- Tuftex

- Forbo Flooring Systems

- Milliken & Company

- Dow

- Arkem S.A.

- Ashland Inc.

- Mapei S.p.A

- MUHU

Recent Developments

-

In October 2023, Forbo Flooring Systems announced the launch of its new Surestep Balance range, specifically designed for dementia-friendly environments. This safety flooring complies with Health and Safety Executive (HSE) standards and features eight subtle color options with a minimalist matte finish.

-

In October 2023, Shaw Industries announced a partnership with Encina to develop a groundbreaking carpet waste recycling program. This collaboration aimed to convert post-consumer carpet waste into valuable products, significantly reducing landfill contributions. Using Encina's advanced technology, the initiative focused on transforming discarded carpets into sustainable materials for various applications.

Soft Covering Flooring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41.0 billion

Revenue forecast in 2030

USD 51.7 billion

Growth Rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in million square meters, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; China; India; Japan; Australia; Germany; UK; Italy; Spain; France; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Shaw Industries Group, Inc.; Mohawk Industries Inc.; Engineered Floors LLC; Beaulieu Group LLC; Dixie Group Inc.; Tuftex; Forbo Flooring Systems; Milliken & Company; Dow; Arkem S.A.; Ashland Inc.; Mapei S.p.A; MUHU

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soft Covering Flooring Market Report Segmentation

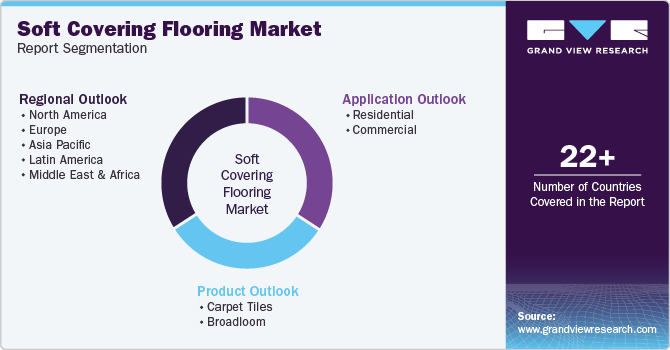

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global soft covering flooring market report based on product, application, and region.

-

Product Outlook (Volume, Million Square Meters, Revenue, USD Million, 2018 - 2030)

-

Carpet Tiles

-

Broadloom

-

-

Application Outlook (Volume, Million Square Meters, Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Volume, Million Square Meters, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.