- Home

- »

- Next Generation Technologies

- »

-

Soft Facility Management Market Size, Industry Report, 2033GVR Report cover

![Soft Facility Management Market Size, Share & Trends Report]()

Soft Facility Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Offering Type (Outsourced, In-house), By Soft Services, By Organization Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-652-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soft Facility Management Market Summary

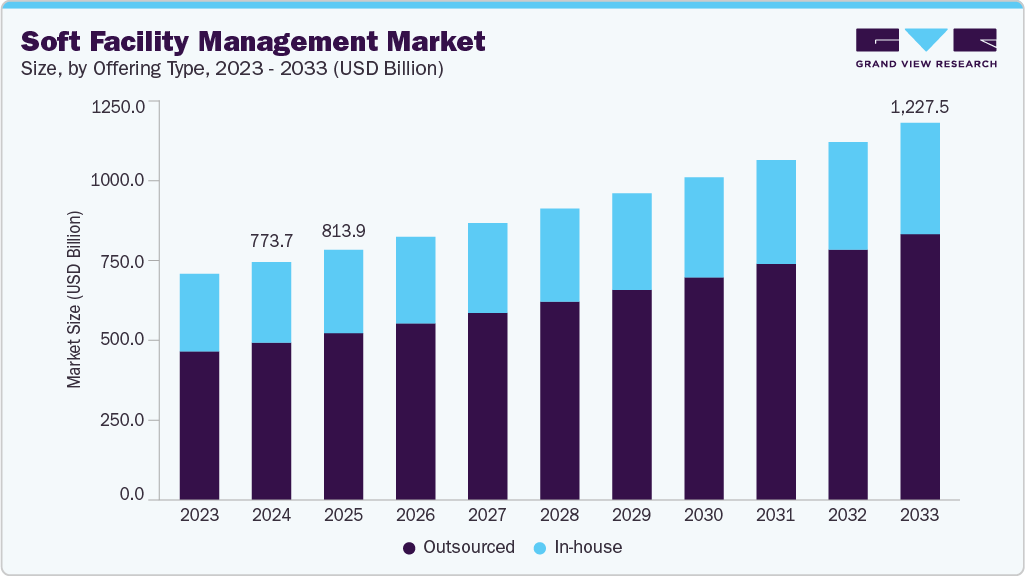

The global soft facility management market size was estimated at USD 0.77 trillion in 2024, and is projected to reach USD 1.23 trillion by 2033, growing at a CAGR of 5.3% from 2025 to 2033. The market’s growth is driven by the rising adoption of outsourced soft services, increasing focus on workplace hygiene and employee well-being, growing integration of technology in service delivery, and heightened demand from the healthcare and education sectors.

Key Market Trends & Insights

- North America dominated the global soft facility management market with the largest revenue share of 34.5% in 2024.

- The soft facility management market in the U.S. led the North America market and held the largest revenue share in 2024.

- By offering type, the outsourced segment held the dominant position in the market and accounted for the leading revenue share of 66.2% in 2024.

- By soft services, the office support and security services segment led the market, holding the largest revenue share of 37.4% in 2024.

- By end use, the construction & real estate segment is expected to grow at the fastest CAGR of 8.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 0.77 Trillion

- 2033 Projected Market Size: USD 1.23 Trillion

- CAGR (2025-2033): 5.3%

- North America: Largest market in 2024

- Asia Pacific: fastest growing market

The growing demand for environmentally sustainable operations is reshaping priorities within the soft facility management industry. Organizations are increasingly seeking eco-friendly cleaning products, energy-efficient equipment, and waste-reduction practices as part of their service expectations. This focus on sustainability is driving providers to align with ESG frameworks and incorporate green metrics into their service models. As regulatory pressure and corporate sustainability goals intensify, the soft facility management industry is moving toward greener, more responsible service delivery.The increasing demand for agile and responsive service models is reshaping the soft facility management industry as hybrid workplace models continue to expand. With dynamic occupancy levels and evolving office usage, organizations are seeking on-demand cleaning, adaptable catering, and flexible front-of-house services. This shift is compelling for service providers to invest in digital capabilities and agile operations. In response, the soft facility management industry is rapidly innovating to meet the evolving needs of the modern, hybrid workforce.

The soft facility management industry is witnessing accelerated expansion across emerging markets due to growing urban infrastructure and rising service expectations. Rapid development in Asia, Latin America, and the Middle East is prompting organizations to outsource soft FM services for improved efficiency and scalability. Regional providers are expanding their footprints, while global players are entering through partnerships, acquisitions, and strategic alliances. As economic reforms and investments in real estate continue, the soft facility management industry is set to benefit from increased market penetration and growth opportunities.

The growing demand for hospitality-style workplace services is driving transformation in the soft facility management industry, particularly in corporate settings. Organizations are prioritizing employee experience through high-quality concierge, reception, and workplace engagement services to improve satisfaction and retention. This has led to a shift toward premium, tech-enabled front-of-house offering that align with modern workplace expectations. As a result, the soft facility management industry is redefining its service standards to support more human-centric and employee-focused environments.

The soft facility management industry is evolving as organizations increasingly demand customized service-level agreements (SLAs) that reflect their operational goals and business environments. Clients are seeking flexible arrangements tailored to specific facility types, workforce patterns, and regulatory needs. This trend is pushing service providers to deliver more personalized, outcome-based services supported by data and performance metrics. Within the soft facility management industry, this shift toward tailored SLAs is fostering a new era of client-centric service delivery.

Offering Type Insights

The outsourced segment led the market with the largest revenue share of 66.2% in 2024, owing to the increasing focus on workforce experience and workplace branding, the demand for front-of-house and concierge services is rising. Organizations now view reception and guest management not just as functional roles, but as part of their brand identity and employee experience strategy. Enhanced front-desk operations, hospitality-style greetings, and digitally enabled check-ins are becoming standard expectations. This shift is prompting the soft facility management industry to elevate its service approach in delivering people-first workplace experiences.

The in-house segment is expected to register at the fastest CAGR of 3.7% from 2025 - 2033. The increasing demand for greater control, customization, and internal accountability is driving growth in the in-house segment. Many organizations are opting to manage soft services such as cleaning, catering, and front-desk operations internally to align service delivery more closely with their corporate culture and operational standards. In-house models allow for direct supervision, faster decision-making, and tailored service execution based on site-specific needs. As service personalization and brand consistency become more critical, the in-house segment is gaining renewed importance within the soft facility management industry.

Soft Services Insights

The office support and security services segment accounted for the largest market revenue share in 2024, owing to the growing demand for streamlined workplace operations and heightened emphasis on on-site safety. Organizations increasingly adopted professional services such as reception management, mailroom handling, and visitor coordination to improve day-to-day efficiency and employee experience. Simultaneously, the need for robust security protocols led to higher investment in trained personnel and access control solutions. This blend of administrative support and security assurance has solidified the segment's critical position in the soft facility management industry.

The cleaning services segment is expected to grow at the fastest CAGR during the forecast period, owing to rising hygiene standards and heightened health awareness across industries. Businesses are increasingly prioritizing cleanliness in workplaces, especially in sectors like healthcare, education, and corporate offices, to ensure employee safety and regulatory compliance. The demand for specialized services such as deep cleaning, disinfection, and green cleaning solutions has significantly increased post-pandemic. As organizations adopt long-term workplace hygiene strategies, the cleaning services segment is expected to remain a cornerstone of the soft facility management industry.

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024, owing to the growing need for consistent, scalable, and cost-effective soft facility management solutions. These organizations operate across multiple sites and require uniform service quality in areas such as cleaning, catering, security, and office support to maintain operational efficiency. By adopting a mix of in-house and outsourced models, large enterprises are optimizing resource allocation, improving employee satisfaction, and ensuring regulatory compliance. As the complexity of managing large-scale facilities increases, this segment continues to drive significant growth within the soft facility management industry.

The small & medium enterprises segment is expected to grow at the fastest CAGR during the forecast period, driven by the need for flexible, affordable, and efficient soft facility management solutions. SMEs are increasingly turning into outsourced service models to access professional cleaning, reception, and catering services without the burden of managing dedicated in-house teams. As these businesses scale, they demand modular and scalable FM solutions that align with budget constraints and changing operational requirements. This rising adoption is positioning the SME segment as a high-potential growth area within the soft facility management industry.

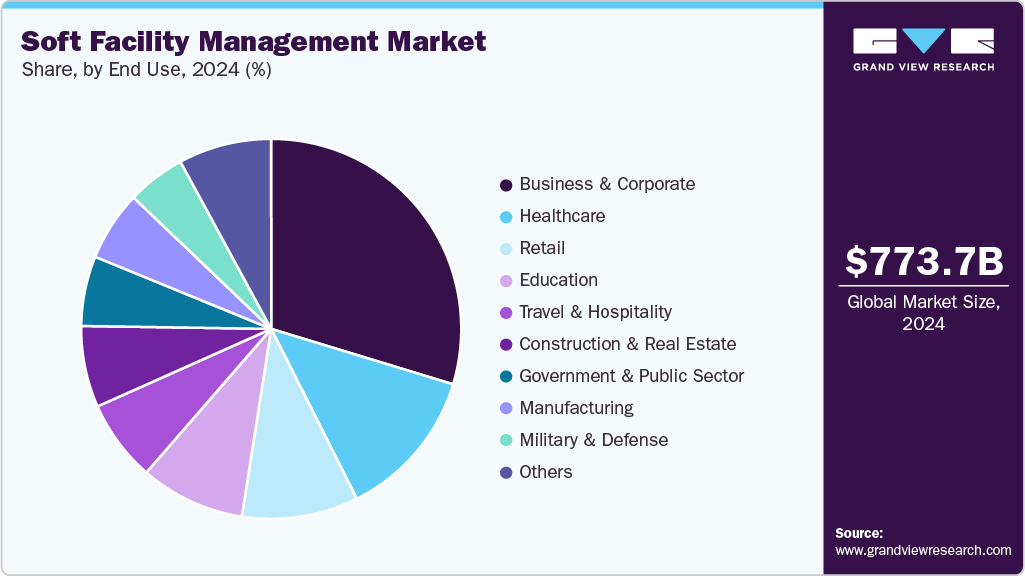

End Use Insights

The business & corporate segment accounted for the largest market revenue share in 2024, owing to evolving workplace expectations and a shift toward experience-driven environments. The increasing adoption of hybrid work models has pushed companies to rethink how soft services-such as catering, concierge, office support, and cleaning-are structured and delivered. There is a rising preference for flexible, tech-enabled service solutions that can adapt to fluctuating occupancy levels and ensure a consistent, branded experience across locations. As a result, the soft facility management industry is seeing growing investment from corporate clients aiming to enhance employee engagement, productivity, and operational agility.

The construction & real estate segment is expected to grow at the fastest CAGR during the forecast period, fueled by the rising need for integrated facility services during project handovers and ongoing property management. As developers and property managers finalize new builds or manage commercial and residential portfolios, they require comprehensive soft facility management, covering cleaning, security, reception, landscaping, and catering, to ensure tenant satisfaction and operational readiness. These integrated service demands are prompting providers to offer turnkey solutions that combine pre-handover deep cleaning and post-handover ongoing maintenance. The soft facility management industry is thus evolving to deliver end-to-end, lifecycle-driven service packages tailored to property transition and long-term usability.

Regional Insights

North America dominated the soft facility management market with the largest revenue share of 34.5% in 2024, driven by increasing emphasis on enhancing tenant experience and premium workplace design. Organizations are investing in concierge-style front-of-house and digitally enabled support services. This shift is transforming traditional service contracts into hospitality-driven models tailored to modern corporate environments. The soft facility management industry is evolving toward experience-oriented service delivery across commercial portfolios.

U.S. Soft Facility Management Market Trends

The soft facility management market in the U.S. accounted for the largest market revenue share of 77.6% in in 2024. The growing demand for robust business continuity and emergency preparedness is prompting institutions to integrate crisis response capabilities into facility service contracts. From hospitals to federal agencies, clients are requiring enhanced hygiene protocols, contingency staffing, and continuity plans. As a result, the soft facility management industry is becoming more resilience-focused, with providers offering adaptive solutions under high-compliance scenarios.

Europe Soft Facility Management Market Trends

The soft facility management market in Europe is expected to grow at a rapid CAGR of 4.1% from 2025 to 2033, fueled by labor shortages and high operating costs, facility managers are accelerating the use of automation, AI, and robotics in soft service operations. Whether it’s autonomous floor cleaners or smart scheduling software, digital innovation is driving efficiency and service consistency. The soft facility management industry is embracing intelligent automation as a response to workforce constraints and rising service expectations.

The Germany soft facility management market is expected to grow at a significant CAGR during the forecast period. The increasing demand for certified, regulation-compliant service models is shaping procurement standards across both public and private sectors. Clients are prioritizing FM providers with DIN-compliant hygiene protocols, qualified staffing, and auditable processes. As expectations for formal compliance rise, the soft facility management industry is seeing strong growth among providers offering structured, standards-driven solutions.

The soft facility management market in the UK is expected to grow at a significant CAGR during the forecast period. Due to rising focus on social value in public procurement, organizations are embedding community engagement, local hiring, and supplier diversity into their FM contracts. FM providers are expected to demonstrate measurable contributions to social and environmental sustainability. These evolving tendering requirements are pushing the soft facility management industry to align closely with ESG and local policy objectives.

Asia Pacific Soft Facility Management Market Trends

The soft facility management market in Asia Pacific is expected to grow at the fastest CAGR of 7.6% from 2025 to 2033, primarily driven by large-scale real estate expansion and smart city initiatives. Developers are demanding multi-property service coverage and integrated FM delivery across commercial and residential spaces. Bundled contracts for cleaning, catering, and reception services are becoming common across mixed-use developments. This growing complexity is positioning the soft facility management industry for rapid scalability across urban centers.

The China soft facility management market is experiencing an increasing growth of public-private infrastructure partnerships is fueling demand for standardized, cost-effective soft services in transportation, education, and municipal assets. Government entities are outsourcing non-core operations like security and maintenance under structured long-term contracts. The soft facility management industry is rapidly expanding as service providers are adapting to serve high-volume, compliance-heavy institutional projects.

The soft facility management market in Japan is driven by a cultural preference for service precision and declining labor availability. Businesses are implementing hybrid models that combine automation with human oversight. High-end concierge services and routine-intensive cleaning remain critical in corporate and healthcare environments. The soft facility management industry is uniquely positioned to grow through a mix of advanced technologies and elevated service expectations.

Key Soft Facility Management Company Insights

Some of the key players operating in the market include Sodexo Inc. and CBRE Group Inc. among others.

-

Sodexo Inc. is a global leader in the soft facility management industry, offering a wide range of services including catering, cleaning, reception, and workplace support. The company serves various industries such as corporate offices, healthcare, education, and defense, with a strong emphasis on employee well-being and operational excellence. Its integrated service model allows clients to streamline multiple soft FM functions under one provider. Sodexo’s scale and innovation in food and hospitality services make it one of the most recognized players in the industry.

-

CBRE Group Inc. is a major real estate and facilities management firm that offers a comprehensive suite of soft FM services like reception, janitorial, and concierge management. It focuses on enterprise clients with multi-site portfolios, using data-driven tools to optimize service efficiency and workplace experience. CBRE specializes in combining real estate expertise with integrated soft FM delivery. This capability enables it to support complex client needs across sectors globally.

Tenon Group and Guardian Service Industries Inc. are some of the emerging market participants in the soft facility management industry.

-

Tenon Group is a rapidly growing soft FM provider in Asia-Pacific, with a stronghold in India and a growing footprint in the Middle East. It offers services such as security, cleaning, front-desk support, and staffing for IT parks, commercial real estate, and industrial sites. Tenon specializes in affordable and scalable manpower-based service delivery with tech integration. Its regional strength and agility make it a notable emerging player in the soft facility management industry.

-

Guardian Service Industries Inc. is gaining traction in the U.S. soft facility management industry by delivering janitorial, security, and concierge services across educational and government institutions. It is known for personalized service, regulatory compliance, and reliable staff performance. Guardian specializes in facility support for high-traffic, public-facing properties with strict cleanliness and safety standards. The company’s customer-first model is driving steady regional expansion.

Key Soft Facility Management Companies:

The following are the leading companies in the soft facility management market. These companies collectively hold the largest market share and dictate industry trends.

- AHI Facility Services Inc.

- Aramark

- CBRE Group Inc.

- Compass Group

- Cushman & Wakefield plc

- Guardian Service Industries Inc.

- ISS A/S

- SMI Facility Services

- Sodexo Inc.

- Tenon Group

Recent Developments

-

In February 2025, ABM unveiled its new brand platform, “Driving possibility, together,” highlighting its transformation into a tech-enabled facility solutions provider. The initiative emphasizes ABM’s integration of AI, smart-building platforms, and data-driven strategies across its soft and hard services. This repositioning aims to enhance operational efficiency and deliver more sustainable, client-centric solutions.

-

In February 2025, Equans partnered with the Portsmouth Hospitals University Trust to extend its soft facilities management contract through 2029. The renewed agreement introduces innovations like cleaning robots, electronic meal ordering, and enhanced ward-level services. This partnership underscores Equans’ commitment to innovation, efficiency, and excellence in healthcare facility operations.

-

In January 2025, ENGIE Solutions partnered with KIEHL to expand its soft facility management services. The collaboration focuses on delivering high-quality, eco-friendly cleaning solutions. This move strengthens ENGIE’s commitment to sustainable and innovative service delivery.

Soft Facility Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.81 trillion

Revenue forecast in 2033

USD 1.23 trillion

Growth rate

CAGR of 5.3% from 2025 to 2033

Base Year of Estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering type, soft services, organization size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

AHI Facility Services Inc.; Aramark; CBRE Group Inc.; Compass Group; Cushman & Wakefield plc; Guardian Service Industries Inc.; ISS A/S; SMI Facility Services; Sodexo Inc.; Tenon Group.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soft Facility Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global soft facility management market report based on offering type, soft services, organization size, end use, and region:

-

Offering Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Outsourced

-

In-house

-

-

Soft Services Outlook (Revenue, USD Billion, 2021 - 2033)

-

Office Support and Security Services

-

Cleaning Services

-

Catering Services

-

Other

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Business & Corporate

-

Healthcare

-

Retail

-

Education

-

Travel & Hospitality

-

Construction & Real Estate

-

Government & Public Sector

-

Manufacturing

-

Military & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global soft facility management market size was estimated at USD 0.77 trillion in 2024 and is expected to reach USD 0.81 trillion in 2025.

b. The global soft facility management market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2033 to reach USD 1.23 trillion by 2033.

b. North America dominated the soft facility management market with a share of over 34.5% in 2024, driven by increasing emphasis on enhancing tenant experience and premium workplace design. Organizations are investing in concierge-style front-of-house and digitally enabled support services.

b. Some key players operating in the soft facility management market include AHI Facility Services Inc., Aramark, CBRE Group Inc., Compass Group, Cushman & Wakefield plc, Guardian Service Industries Inc., ISS A/S, SMI Facility Services, Sodexo Inc., and Tenon Group.

b. Key factors that are driving the market growth include the growing adoption of smart technologies for enhanced efficiency, a stronger focus on sustainability and eco-friendly practices, and an increasing shift towards outsourcing soft services to specialized providers for cost optimization.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.