- Home

- »

- Next Generation Technologies

- »

-

SoftPOS Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![SoftPOS Market Size, Share & Trends Report]()

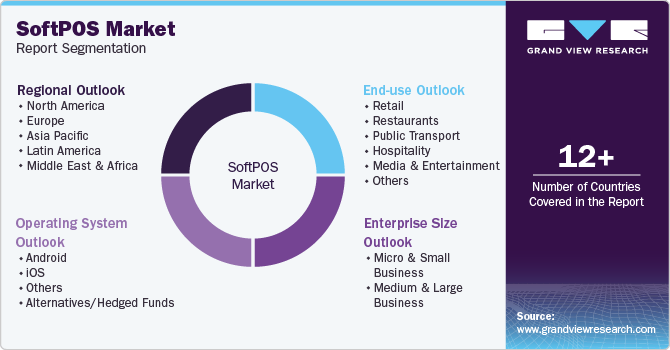

SoftPOS Market (2025 - 2030) Size, Share & Trends Analysis Report By Enterprise Size (Micro & Small Business, Medium & Large Business), By Operating System, By End Use (Retail, Restaurants, Public Transport, Hospitality, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-153-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

SoftPOS Market Summary

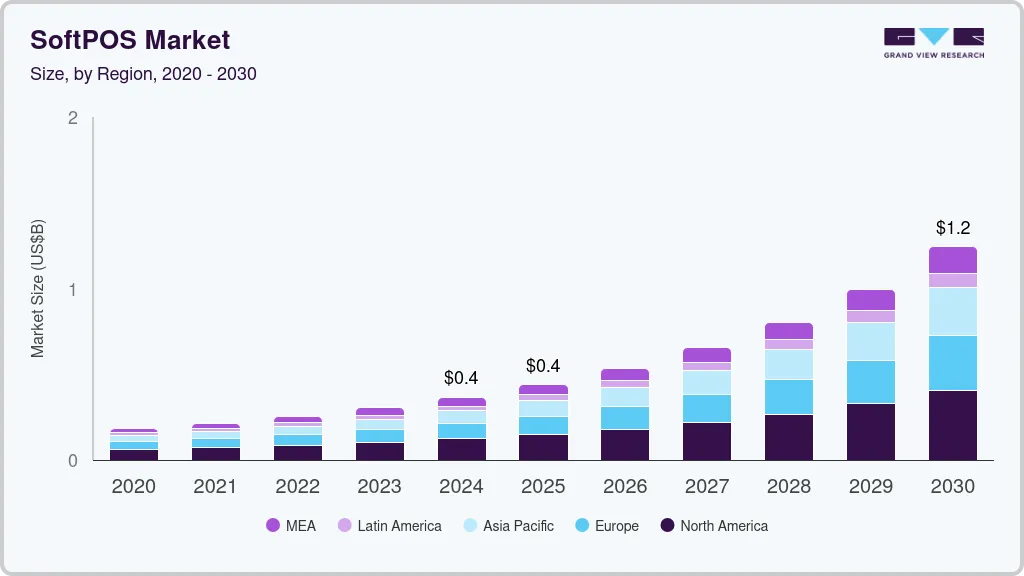

The global softpos market size was estimated at USD 365.0 million in 2024 and is projected to reach USD 1,243.9 million by 2030, growing at a CAGR of 23.1% from 2025 to 2030. A software point of sales (SoftPOS) is a type of software-based payment system that enables merchants to accept debit and credit card payments using a tablet or smartphone.

Key Market Trends & Insights

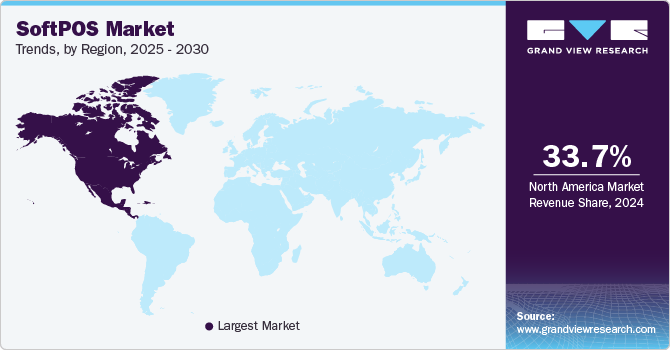

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, micro & small businesses accounted for a revenue of USD 280.0 million in 2024.

- Micro & Small Businesses is the most lucrative enterprise size segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 365.0 Million

- 2030 Projected Market Size: USD 1,243.9 Million

- CAGR (2025-2030): 23.1%

- North America: Largest market in 2024

Increasing adoption of SoftPOS solutions by small and medium businesses and merchants owing to it, such as cost savings, increased flexibility, improved security, and easy integration is a major driving factor behind the growth of the market. The growing number of smartphone users across the globe and increasing government initiatives regarding digital payments are further driving the market growth.

The SoftPOS systems offer cost savings to merchants by eliminating the need to invest in physical hardware such as card readers and traditional POS terminals. This feature makes this system an optimal solution for small businesses and emerging merchants. These systems are highly flexible and are used on a variety of devices, including tablets and smartphones. This enables merchants to accept payments anytime, anywhere, making it a perfect solution for merchants on-the-go or pop-up or temporary stores. Furthermore, this system offers improved security by using tokenization and encryption to protect sensitive information and reduce the risk of fraud. This helps to ensure that both consumers and merchants are protected during transactions.

A rapid technological advancement in payment technology is further contributing to the growth of the SoftPOS industry. The SoftPOS solution depends on Near-Field Communication (NFC) technology. By using the built-in capabilities of mobile devices, such as QR code scanning and NFC, SoftPOS securely processes transactions. This reduces the need for additional hardware, minimizing costs and streamlining the payment process for businesses. Lower costs, minimal hardware requirements, and an easy payment process are contributing to the market’s growth over the forecast period.

Increasing development of SoftPOS systems by various major market players is further contributing to the market’s growth. In February 2023, Qatar’s leading digital bank, Qatar Islamic Bank (QIB), partnered with Mastercard, a global payment-processing corporation, to launch its new smart payment solution for merchants. The QIB SoftPOS application transforms an Android smartphone into a Point-of-Sale terminal, facilitating the secure acceptance of contactless payments through the device's embedded Near-Field Communication (NFC) functionality. With the QIB SoftPOS solution, supported by Mastercard, merchants could utilize their Android smartphones to process contactless transactions from all EMV contactless cards, as well as NFC-enabled phones equipped with digital wallets such as Google Pay and Apple Pay, and other NFC-enabled wearable devices such as Garmin Pay, Apple Watch, or Android smartwatches.

Despite the myriad advantages and promising prospects associated with the SoftPOS systems, there are specific challenges and limitations that could hamper the growth of the market. Existing SoftPOS solutions exhibit certain limitations, including exclusive compatibility with international card schemes, restricted support for cardholder verification methods, and limited use in markets with offline PIN validations. However, the increased number of contactless transactions post-COVID-19 pandemic is driving the demand for advanced payment solutions in the market. This, in turn, is propelling the SoftPos industry growth.

Enterprise Size Insights

The micro & small businesses segment accounted for the largest share of 63.2% in 2024. Increasing adoption of SoftPOS solutions by micro and small businesses across the world owing to its several benefits is a major factor behind the segment’s growth. These benefits include low cost, ease of use, and fast payment process. For instance, the SoftPOS solution allows small businesses to process payments more quickly compared to traditional payment methods, potentially leading to higher turnover and enhanced convenience, thus driving the market’s demand amongst small businesses. In addition, the growing number of micro and small businesses across the globe is fueling the growth of the market.

The medium and large business segment is expected to grow at a moderate CAGR during the forecast period. For medium and large businesses, the SoftPOS solution is gaining traction as a feasible alternative to using dedicated hardware, which offers versatility and accessibility. As a result, the growing popularity of SoftPOS solutions in medium and large-sized businesses, owing to its above-mentioned benefits, is fueling the segment’s growth.

Operating System Insights

The android segment held the largest market in 2024. Android-based tablets and smartphones are the main platforms supported by SoftPOS systems. Android is the most widely used operating system in the world. According to StatCounter, a web traffic analysis website’s latest data, the Android operating system (OS) has a 73.49% mobile operating system market share as of December 2024. Thus, the increasing number of android smartphone or mobile users across the world is a major factor driving the segment’s growth.

The iOS segment is expected to register a notable CAGR during the forecast period. Initially, a significant barrier to the adoption of SoftPOS was its lack of support on iOS. However, Apple’s February 2022 announcement of Tap to Pay on iPhone is expected to be a key driver of growth in this segment. This feature is expected to enable millions of merchants worldwide, ranging from small businesses to large enterprises, to securely and effortlessly accept Apple Pay, contactless debit and credit cards, and other mobile wallets by simply tapping them on an iPhone, eliminating the need for additional hardware.

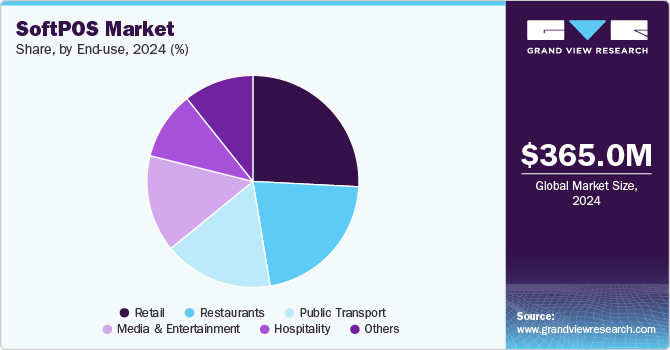

End Use Insights

The retail segment dominated the market in 2024. Rapid growth in the global economic retail industry and several benefits of SoftPOS for retailers are driving the segment growth. It allows retailers to accept payments using smartphones and tablets. It's a modern alternative to traditional POS systems, which require expensive hardware. In addition, the increasing adoption of digital payment processing solutions by various retailers is further improving the market’s growth.

The restaurants segment is expected to grow at a notable CAGR during the forecast period. Contactless payment has gained significant popularity in the restaurants and hospitality industry. The SoftPOS technology can be seamlessly integrated with the restaurant's core business application, such as order collection. This technology provides benefits to both restaurant managers and customers, enhancing the efficiency of the check-in and checkout process, thereby boosting staff’s productivity, and improving the overall customer experience simultaneously. The expected growth of this technology is owing to the substantial increase in contactless payments in recent years, which offer a seamless, convenient, reliable, and secure payment method.

Regional Insights

North America SoftPOS market dominated the global market in 2024. Increasing adoption of contactless payment and rising adoption of advanced digital technologies are major factors behind the growth of the market in the North American region.In addition, the push for cashless transactions in retail, hospitality, and small businesses, coupled with rising cybersecurity measures, is fueling adoption across the region.

U.S. SoftPOS Market Trends

The U.S. SoftPOS market held a dominant position in 2024. The market is benefiting from Apple’s Tap to Pay on iPhone launch and growing partnerships between payment processors and financial institutions. Businesses across sectors, from small merchants to enterprise retailers, are increasingly adopting SoftPOS solutions to eliminate hardware costs and streamline payments, thereby driving the market’s growth.

Europe SoftPOS Market Trends

The Europe SoftPOS industry was identified as a lucrative region in 2024. The market is expanding due to strong regulatory support for digital payments, increasing fintech innovations, and widespread NFC-enabled smartphone penetration. In addition, the growing demand for cost-effective payment solutions among small and medium-sized enterprises (SMEs) and the rise of mobile-first banking solutions are accelerating the adoption of SoftPOS across European markets.

The Germany SoftPOS market is expected to register a moderate CAGR during the forecast period. The market is growing steadily as businesses shift from traditional cash-based transactions to digital payments. SMEs and independent retailers are a key growth segment, as they look for cost-effective, hardware-free payment solutions to enhance customer convenience.

SoftPOS market in the UK held a substantial market share in 2024, driven by a highly digital banking ecosystem, high smartphone penetration, and increasing merchant demand for low-cost payment acceptance solutions.

Asia Pacific SoftPOS Market Trends

The Asia Pacific SoftPOS market is anticipated to grow at a CAGR of 25.1% during the forecast period. This is owing to the rising digitalization, government initiatives for cashless economies, and the booming e-commerce sector. Countries such as China, India, and Japan are witnessing a surge in QR code-based and NFC payments, making SoftPOS an attractive solution for small merchants, street vendors, and large retail chains. In addition, rising smartphone penetration, affordable internet access, and fintech innovations are accelerating adoption across urban and rural markets.

India’s SoftPOS market is expected to grow at the highest growth rate during the forecast period. The growth is driven by the government’s push for a cashless economy, UPI integration, and rapid fintech growth. With the rise of digital wallets and increased acceptance of NFC-based payments, SoftPOS solutions are becoming vital for small businesses, grocery stores, and delivery services.

SoftPOS market in China held a substantial market share in 2024. China is one of the most advanced digital payment markets. While QR code-based payments are the most prevalent, SoftPOS adoption is increasing as businesses look for alternative, low-cost contactless solutions. In addition, China’s focus on cashless infrastructure and AI-driven financial services is expected to further accelerate SoftPOS adoption.

Key SoftPOS Company Insights

Some of the key companies in the SoftPOS industry include Worldline, Tidypay, Alcinéo and others. The key companies often engage in mergers and acquisitions, product launch, strategic partnerships, and collaborations to expand their market share and enhance their offerings.

-

Tidypay is a payment solutions provider that offers a SoftPOS solution, enabling businesses to accept contactless payments directly through smartphones and tablets without additional hardware. The company’s SoftPOS technology is designed to serve small businesses, merchants, and mobile service providers looking for a cost-effective, flexible, and secure way to process transactions.

-

Worldline, a prominent company in payment and transaction services, has expanded into the SoftPOS market, offering businesses a secure, hardware-free contactless payment solution. With the rise of Tap-to-Pay technology, the company’s SoftPOS solution enables merchants to accept contactless card payments, digital wallets and NFC-enabled transactions directly on Android and iOS smartphones and tablets.

Key SoftPOS Companies:

The following are the leading companies in the SoftPOS market. These companies collectively hold the largest market share and dictate industry trends.

- Tidypay

- Worldline

- Alcinéo

- Wizzit (Pty) Ltd

- Bindo Labs Group Limited

- Fairbit

- Yazara

- Asseco South Eastern Europe

- CM.com

- Fime SAS

Recent Developments

-

In May 2024, Fleksa, a pioneer in restaurant technology, introduced its cutting-edge SoftPOS solution for both Android and iOS platforms, developed in partnership with fintech giant Stripe. This innovative solution empowers Fleksa’s partner restaurants to accept payments directly on their smartphones, whether using iPhones or Android devices, representing a major advancement in the digital transformation of the restaurant industry.

-

In March 2023, PAYM8, a South African financial gateway service provider, in collaboration with a global innovative payment solution provider, Wizzit (Pty) Ltd, launched its Tap-on-Phone SoftPOS solution. The solution provides an advanced alternative to conventional point-of-sale devices. It is expected to offer customers of PAYM8 an easy, safe method to pay that is usable in any location. The solution meets EMV (Europay, MasterCard, and Visa) and PCI (Payment Card Industry) requirements.

-

In March 2023, Verve, the prominent digital token and payment card brand in Africa, announced a partnership with Alcineo, a prominent provider of payment software and services. This collaboration aims to deploy a Software Point-of-Sale (SoftPOS) SDK solution, which offers a cost-effective way for merchants to accept contactless payments from customers using their mobile phones or mobile devices.

SoftPOS Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 439.9 million

Revenue forecast in 2030

USD 1,243.9 million

Growth rate

CAGR of 23.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Enterprise size, operating system, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa

Key companies profiled

Tidypay; Worldline; Alcinéo; Wizzit (Pty) Ltd; Bindo Labs Group Limited; Fairbit; Yazara; Asseco South Eastern Europe; CM.com; Fime SAS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global SoftPOS Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global SoftPOS market report based on enterprise size, operating system, end use, and region:

-

Enterprise Size Outlook (Revenue, USD Million, 2020 - 2030)

-

Micro & Small Business

-

Medium & Large Business

-

-

Operating System Outlook (Revenue, USD Million, 2020 - 2030)

-

Android

-

iOS

-

Others

-

Alternatives/Hedged Funds

-

-

End Use Outlook (Revenue, USD Million, 2020 - 2030)

-

Retail

-

Restaurants

-

Public Transport

-

Hospitality

-

Media and Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global SoftPOS market size was estimated at USD 365.0 million in 2024 and is expected to reach USD 439.9 million in 2025.

b. The global SoftPOS market is expected to grow at a compound annual growth rate of 23.1% from 2025 to 2030 to reach USD 1,243.9 million by 2030

b. North America dominated the SoftPOS market with a share of 33.66% in 2024. Increasing adoption of contactless payment and rising adoption of advanced digital technologies are major factors behind the growth of the market in North American region

b. Some key players operating in the SoftPOS market include Tidypay, Worldline, Alcinéo, Wizzit (Pty) Ltd, Bindo Labs Group Limited, Fairbit, Yazara, Asseco South Eastern Europe, CM.com, Fime SAS.

b. Key factors that are driving the SoftPOS market growth include increasing number of smartphone users and growing adoption of contactless payment solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.