- Home

- »

- Next Generation Technologies

- »

-

Software Licensing Management Market Size Report, 2030GVR Report cover

![Software Licensing Management Market Size, Share & Trends Report]()

Software Licensing Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Licensing Type (Subscription-Based, User-Based, Usage-Based, Others), Deployment, Enterprise Size, End-Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-575-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Software Licensing Management Market Summary

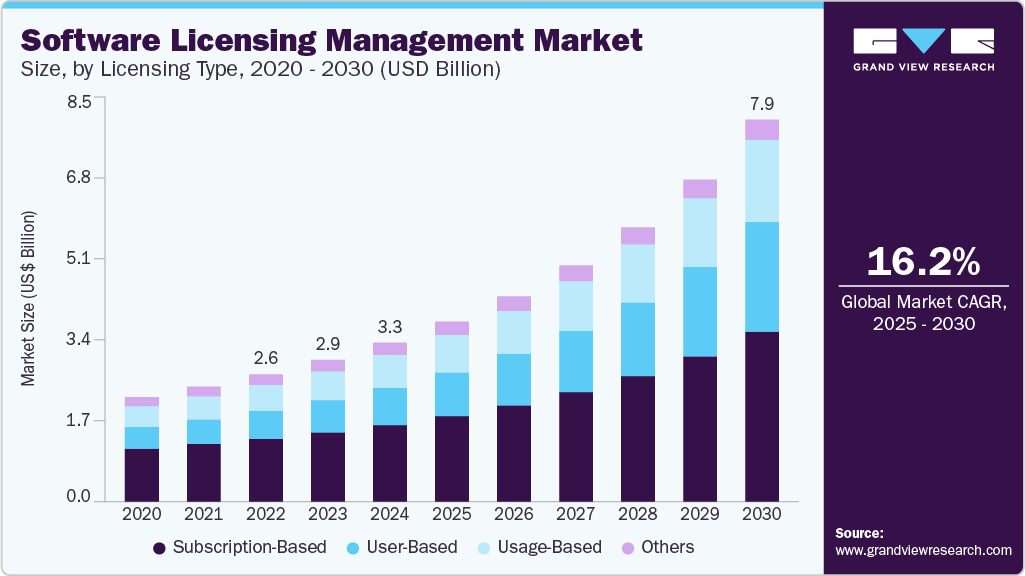

The global software licensing management market size was estimated at USD 3,296.4 million in 2024 and is projected to reach USD 7,913.5 million by 2030, growing at a CAGR of 16.2% from 2025 to 2030. The future of software license management (SLM) offers significant growth opportunities driven by digital transformation, cloud adoption, and increasing regulatory demands.

Key Market Trends & Insights

- North America dominated with a revenue share of over 38.2% in 2024.

- The U.S. software licensing management market is anticipated to exhibit a significant CAGR over the forecast period.

- By licensing type, the subscription-based segment led the market in 2024, accounting for over 48.2% of the global revenue.

- By deployment, the cloud segment accounted for the largest market revenue share in 2024.

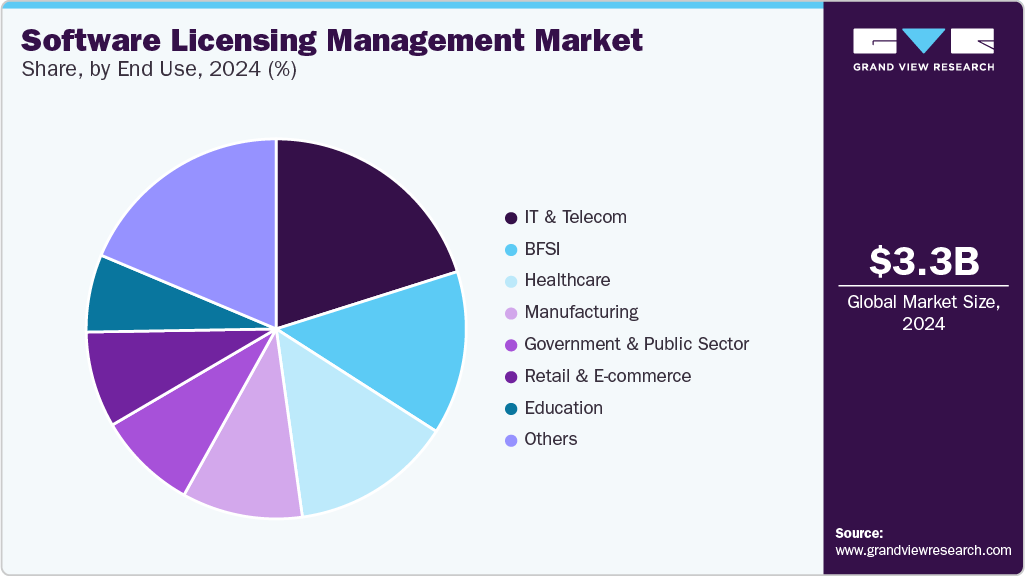

- By end use, the BFSI segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,296.4 Million

- 2030 Projected Market Size: USD 7,913.5 Million

- CAGR (2025-2030): 16.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As businesses increasingly shift to cloud-based infrastructures and Software as a Service (SaaS) models, there is a growing need for flexible, scalable SLM solutions that manage dynamic license environments. This shift allows vendors to develop intelligent, cloud-native software licensing management platforms that support real-time tracking and license optimization. Moreover, integrating artificial intelligence and automation into SLM systems enhances efficiency by enabling predictive analytics, automating compliance checks, and identifying underutilized software. This allows organizations to reduce costs and make data-driven decisions regarding software investments.Effective SLM involves comprehensive visibility into software assets, usage monitoring, vendor management, timely license renewals, and automated lifecycle management. These practices help organizations identify underutilized licenses, eliminate redundancies, and streamline software provisioning and deprovisioning processes. As highlighted by TechRadar, the shift towards subscription-based models further emphasizes the importance of robust SLM in managing recurring costs and adapting to evolving software usage patterns. With tools like Zluri's SaaS management platform, businesses can gain real-time insights, enforce licensing policies, and integrate seamlessly with enterprise systems, ensuring efficient utilization of software licenses and supporting strategic decision-making.

Major players are significantly contributing to the market with key initiatives and developments for instance, in April 2025, Flexera unveiled its new Cloud License Management solution, designed to help organizations optimize cloud software costs by up to 25%. Built on Flexera’s Technology Intelligence Platform, this tool offers unified visibility and actionable insights into cloud software spend, enabling ITAM and FinOps teams to manage licenses more effectively.

Licensing Type Insights

The subscription-based segment led the market in 2024, accounting for over 48.2% of the global revenue. The market is driven largely by the ongoing shift to SaaS and cloud-based solutions. This model is now one of the most popular, favored by providers and customers for its flexibility, predictable revenue streams, and enhanced customer satisfaction. Major companies like Adobe, Microsoft, and Netflix have successfully transitioned to this model, further validating its market appeal. Customers value the transparency of regular billing cycles and the self-service features that subscription models enable. The growing demand for entitlement management and scalable licensing options is fueling further adoption. As businesses seek agility and cost efficiency, subscription-based licensing will continue to outpace traditional perpetual models. This trend is expected to accelerate as more software vendors prioritize recurring revenue and customer-centric offerings.

User-based segment is expected to hold a significant CAGR in the forecast period. User-based licensing, traditionally a foundation of software monetization, is undergoing significant transformation in response to evolving technological and economic landscapes. While it has offered predictability and simplicity, the surge in AI-driven applications and cloud computing is prompting a shift towards more flexible, usage-based models. This transition is evident as companies like Monday.com and ServiceNow adopt hybrid pricing strategies, combining user-based fees with consumption-based charges to align costs with actual usage better.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024. The software license management (SLM) market is undergoing significant transformation, driven by the shift to cloud-based deployments and the adoption of subscription models. Integrating AI and automation into these solutions enhances predictive analytics and streamlines license optimization processes. This evolution benefits small and medium-sized enterprises (SMEs) seeking efficient and cost-effective license management tools. Additionally, the increasing complexity of software ecosystems and stringent regulatory requirements are compelling organizations to adopt robust SLM systems to ensure compliance and optimize software investments.

The on-premises segment is expected to exhibit the highest CAGR over the forecast period. This segment in software licensing management continues to show steady demand, especially in industries where data security, compliance, and infrastructure control are critical such as government, finance, and healthcare. Although the rise of cloud-based solutions, organizations bound by strict regulations or with legacy IT environments often prefer on-premises systems for their full administrative control and offline capabilities. This creates opportunities for vendors to offer hybrid solutions, advanced audit automation, and tailored deployments that integrate with local infrastructure. Emerging markets, particularly in Asia and Latin America, also present growth potential due to slower cloud adoption. Additionally, on-prem solutions can be positioned as premium offerings with high customization and security, making them suitable for security-first enterprises.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. Enterprises are increasingly adopting Software-as-a-Service (SaaS) models, necessitating sophisticated license management tools to ensure compliance and optimize costs. The rise in unused software highlights the need for effective license tracking to reduce waste. Moreover, integrating artificial intelligence and automation into license management tools enhances predictive analytics and compliance checks, further driving market expansion. Furthermore, this growth is also fueled by increasing regulatory compliance requirements and the need for organizations to manage complex software ecosystems effectively.

The SMEs segment is anticipated to exhibit the highest CAGR over the forecast period. SMEs increasingly recognize software licensing as a strategic asset rather than a compliance issue. The complexity of hybrid IT environments pushes SMEs to adopt smarter tools for license tracking and optimization. Vendor audits are becoming more common, prompting proactive management. Subscription-based models have lowered entry barriers, making license management tools more accessible. Additionally, integration with broader IT management platforms makes adoption easier and more appealing to smaller firms. There's also a shift from manual tracking to automation as SMEs scale operations.

End Use Insights

The BFSI segment accounted for the largest market revenue share in 2024. The growth is driven by increasing regulatory compliance demands and the need to mitigate risks associated with software audits and penalties. As BFSI organizations rapidly adopt cloud computing, SaaS solutions, and digital transformation initiatives, managing complex and dynamic software environments has become critical. This sector faces intense data security and privacy scrutiny, making robust license management essential for safeguarding sensitive information. Additionally, optimizing software costs and ensuring efficient allocation of licenses are key priorities, given the scale and complexity of BFSI operations. Together, these factors fuel significant investment in advanced license management solutions tailored to the unique needs of the financial sector.

The manufacturing segment will exhibit a significant CAGR over the forecast period. Effective software license management (SLM) is essential for optimizing operations and ensuring compliance in the manufacturing sector. As manufacturers increasingly adopt diverse software tools for design, production, and supply chain management, SLM provides centralized oversight to manage these assets efficiently. By tracking software usage, SLM helps identify underutilized licenses, allowing cost savings through reallocating or terminating unnecessary licenses. Moreover, SLM ensures adherence to licensing agreements, mitigating the risk of legal penalties and maintaining good vendor relationships.

Regional Insights

North America dominated with a revenue share of over 38.2% in 2024. In North America, key driving factors for software licensing management include stringent regulatory compliance requirements such as SOX and HIPAA, which mandate transparent software usage and auditing. The growing adoption of cloud-based services and hybrid work environments has increased the complexity of software environments, necessitating robust license management solutions. Moreover, major players in the market are taking key initiatives to fuel the market growth. For instance, in May 2025, Wibu-Systems unveiled new innovations in its CodeMeter deployment for software licensing and security at Automate 2025. The latest advancements aim to enhance protection, flexibility, and monetization for software vendors and industrial automation companies. These solutions address the growing need for robust cybersecurity and efficient license management in the evolving automation sector.

U.S. Software Licensing Management Market Trends

The U.S. software licensing management market is anticipated to exhibit a significant CAGR over the forecast period. Driving factors for software licensing management in the U.S. include increasing regulatory compliance requirements, especially around data protection and intellectual property. The rise in cloud-based solutions and SaaS models demands more dynamic and scalable license tracking. Additionally, growing cybersecurity threats and audit risks push organizations to adopt robust license management to avoid penalties and ensure operational continuity. Cost optimization also plays a key role, as businesses aim to eliminate overspending on unused or duplicate software.

Europe Software Licensing Management Market Trends

The software licensing management market in Europe is expected to witness significant growth over the forecast period. This market is influenced by stringent data protection laws like GDPR, which enforce strict compliance on software usage and data handling. Emphasizing transparency and sustainability also encourages businesses to adopt more accountable software management practices. Additionally, with the complex multi-jurisdictional legal landscape in the region, companies must ensure they adhere to varying national regulations and avoid the risk of cross-border penalties.

Asia Pacific Software Licensing Management Market Trends

The software licensing management market in the Asia Pacific region is expected to register the highest CAGR over the forecast period. Driving factors for software licensing management in the Asia Pacific region include increasing regulatory compliance requirements, the rapid digital transformation across industries, and heightened concerns about software piracy and intellectual property protection. Additionally, businesses focus on cost optimization and scalability, prompting greater demand for effective software asset management solutions. The rise of cloud computing and subscription-based models also contributes to the need for streamlined licensing management.

Key Software Licensing Management Comapny Insights

Key software licensing management companies include Agilis International / Agilis Management, Inc., Microsoft Corporation, Oracle Corporation, ServiceNow, Flexera Software, HP, Inc., and IBM Corporation are active in the software licensing management market and are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ deployment development. For instance, in November 2024, Thales announced the expansion of its CipherTrust Data Security Platform as-a-Service offerings with the launch of CipherTrust Transparent Encryption (CTE). This new service delivers high-performance, transparent encryption for complex environments without requiring changes to applications or infrastructure. CTE helps organizations meet compliance requirements and protect sensitive data across clouds, on-premises, and containers, while also offering advanced ransomware protection. With this expansion, Thales enables enterprises to deploy robust data security quickly, cost-effectively, and with minimal disruption.

-

IBM is a global player in deployment and innovation, operating in over 170 countries with a strong commitment to responsible business, ethics, and sustainability. The company offers a comprehensive suite of AI and hybrid cloud solutions, helping organizations modernize, automate, and secure their IT environments. IBM’s expertise extends to designing, deploying, and managing end-to-end software solutions, including robust software licensing management to optimize productivity and reduce costs. With a focus on integrating cutting-edge technologies, IBM empowers businesses to unlock value from their data and future-proof their operations. Their Partner Plus program and global research facilities ensure tailored solutions that address complex business challenges and drive better outcomes.

-

Microsoft is a global deployment player committed to expanding opportunity, earning trust, and advancing sustainability. The company offers a wide range of products and services, focusing on software solutions and cloud technologies. A key aspect of Microsoft’s offerings is its strong software licensing management, which enables organizations to efficiently acquire, deploy, and manage software across various platforms and environments. Microsoft helps businesses optimize software usage, ensure compliance, and streamline operations through flexible licensing models and advanced management tools. This approach supports organizations in achieving more with the Microsoft Cloud and other innovative technologies while maintaining security and operational efficiency.

Key Software Licensing Management Companies:

The following are the leading companies in the software licensing management market. These companies collectively hold the largest market share and dictate industry trends.

- Agilis International / Agilis Management, Inc.

- DXC Technology

- Flexera Software

- HP, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Reprise Software

- SafeNet, Inc. (now part of Thales)

- ServiceNow

- Snow Software

- Thales Group (including Gemalto)

- USU Software AG

Recent Developments

-

In April 2025, Flexera unveiled its new cloud license management solution, designed to help organizations optimize cloud software costs by up to 25%. Integrated within Flexera’s Technology Intelligence Platform, this tool offers comprehensive visibility into software usage across AWS and Azure, enabling smarter licensing decisions and reducing compliance risks. By bridging IT Asset Management (ITAM) and FinOps, it empowers businesses to forecast, manage, and control cloud software expenditures more effectively.

-

In February 2024, Flexera completed its acquisition of Snow Software, significantly expanding its portfolio for deployment value optimization. This strategic move empowers IT Asset Management (ITAM) and FinOps teams with enhanced data and intelligence to better manage spending and reduce risk across hybrid IT environments. Flexera will continue to support and innovate both Flexera and Snow solutions, offering customers and partners broader capabilities and improved support. The combined expertise of both companies aims to deliver greater business outcomes, helping organizations optimize costs and manage risks across cloud, SaaS, on-premises, and AI technologies.

Software Licensing Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,729.0 million

Revenue forecast in 2030

USD 7,913.5 million

Growth rate

CAGR of 16.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Licensing type, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Agilis International / Agilis Management, Inc.; DXC Technology; Flexera Software; HP Inc.; IBM Corporation

Microsoft Corporation; Oracle Corporation; Reprise Software; ServiceNow; Snow Software; Thales Group

USU Software AG; Wibu-Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Software Licensing Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global software licensing management market report based on the licensing type, deployment, enterprise size, end use, and region.

-

Licensing Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Subscription-Based

-

User-Based

-

Usage-Based

-

Others

-

-

Deployment Outlook (Revenue, USD Million; 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Enterprise Size Outlook (Revenue, USD Million; 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Million; 2017 - 2030)

-

IT & Telecom

-

BFSI

-

Healthcare

-

Manufacturing

-

Government & Public Sector

-

Retail & E-commerce

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global software licensing management market size was estimated at USD 3,296.4 million in 2024 and is expected to reach USD 3,729.0 million in 2025.

b. The global software licensing management market is expected to grow at a compound annual growth rate of 16.2% from 2025 to 2030 to reach USD 7,913.5 million by 2030.

b. North America dominated the software licensing management market with a share of 38.2% in 2024. The growing adoption of cloud-based services and hybrid work environments has increased the complexity of software environments, necessitating robust license management solutions and expand the market growth.

b. Some key players operating in the software licensing management market include Agilis International / Agilis Management, Inc.; DXC Technology; Flexera Software; HP Inc.; IBM Corporation; Microsoft Corporation; Oracle Corporation; Reprise Software; ServiceNow; Snow Software; Thales Group; USU Software AG; Wibu-Systems

b. The future of software license management (SLM) offers significant growth opportunities driven by digital transformation, cloud adoption, and increasing regulatory demands. As businesses increasingly shift to cloud-based infrastructures and Software as a Service (SaaS) models, there is a growing need for SLM solutions that are flexible, scalable, and capable of managing dynamic license environments

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.