- Home

- »

- Agrochemicals & Fertilizers

- »

-

Soil Conditioners Market Size & Share, Industry Report, 2033GVR Report cover

![Soil Conditioners Market Size, Share & Trends Report]()

Soil Conditioners Market (2026 - 2033) Size, Share & Trends Analysis Report Product (Natural, Synthetic), By Solubility (Water Soluble, Hydrogels), By Soil Type (Sand, Peat, Clay, Loam), By Crop Type (Cereals & Grains, Oilseeds & Pulses), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-698-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soil Conditioners Market Summary

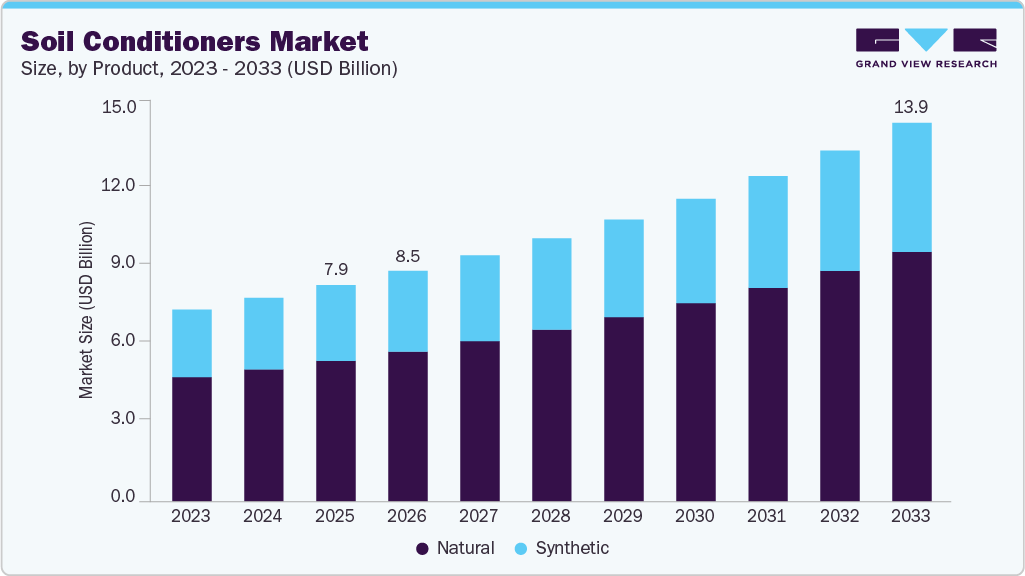

The global soil conditioners market size was estimated at USD 7,946.6 million in 2025 and is projected to reach USD 13,907.2 million by 2033, growing at a CAGR of 7.2% from 2026 to 2033. Market demand is supported by the shift toward sustainable and regenerative farming systems, where soil conditioners play a crucial role in enhancing soil structure, improving moisture retention, and optimizing nutrient efficiency, while also aligning with regulatory and environmental sustainability objectives.

Key Market Trends & Insights

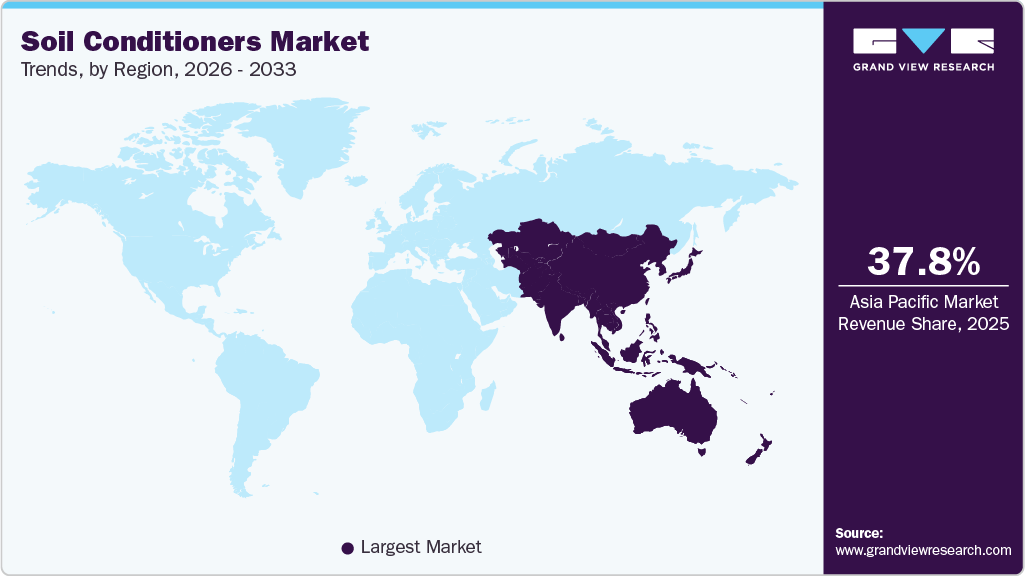

- Asia Pacific dominated the global soil conditioners market with the largest revenue share of 37.8% in 2025.

- The soil conditioners market in China accounted for the largest market revenue share in the Asia Pacific in 2025.

- By product, the natural segment led the market with the largest revenue share of 64.9% in 2025.

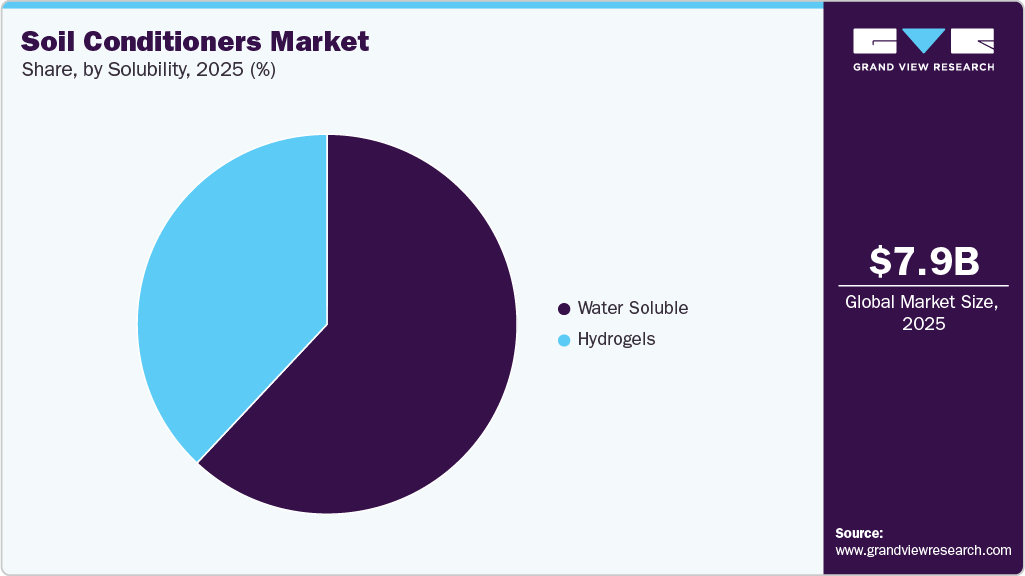

- By solubility, the water soluble segment led the market with the largest revenue share of 62.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7,946.6 Million

- 2033 Projected Market Size: USD 13,907.2 Million

- CAGR (2026-2033): 7.2%

- Asia Pacific: Largest market in 2025

With limited availability of arable land and rising global food demand, growers are prioritizing solutions that improve yield performance and resource utilization. Soil conditioners support this need by optimizing root development, improving nutrient uptake, and enhancing water-use efficiency, making them an increasingly essential component in high-intensity and precision-driven agricultural production systems.

The growing adoption of organic farming and biologically based agricultural inputs presents a significant growth opportunity for the soil conditioners industry. Rising demand for eco-friendly solutions, coupled with increasing regulatory support for reduced chemical usage, is encouraging manufacturers to invest in microbial, humic, and bio-based soil conditioners. This shift enables companies to differentiate their portfolios, capture premium pricing, and expand penetration in high-growth regions focused on sustainable agriculture.

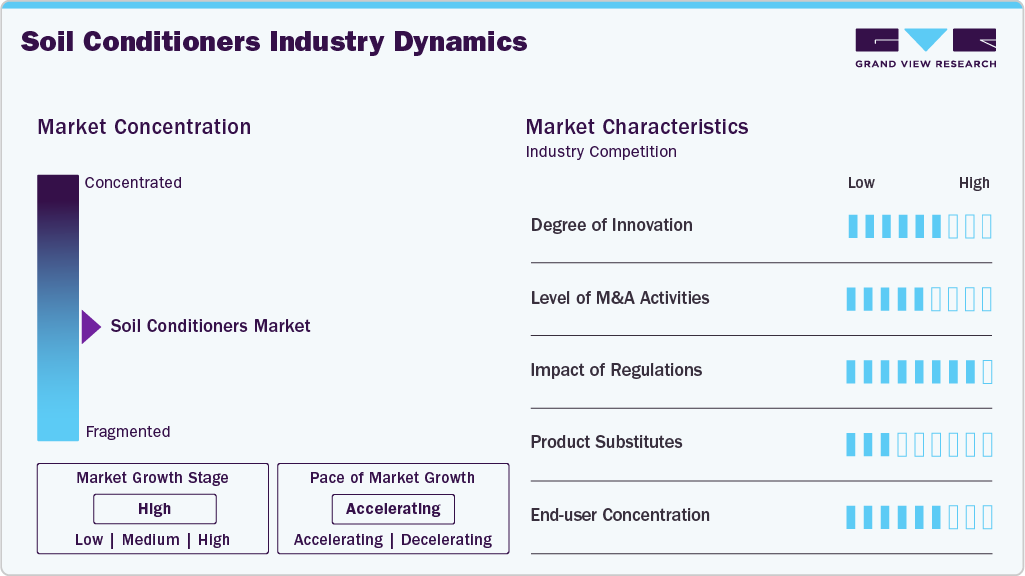

Market Concentration & Characteristics

The soil conditioners industry is moderately fragmented, with global agribusiness leaders competing alongside regional and specialty manufacturers. Large players benefit from strong R&D, established brands, and wide distribution networks, while smaller companies focus on niche and organic solutions.

The soil conditioners industry features a broad mix of organic, inorganic, and polymer-based products driven by soil health improvement and sustainable farming needs. Demand is influenced by crop cycles, regulatory support, and the growing adoption of precision and resource-efficient agriculture.

Product Insights

The natural segment led the market with the largest revenue share of 64.9% in 2025, due to growing adoption of sustainable and organic farming practices. Increasing awareness of soil health, regulatory support for eco-friendly inputs, and rising demand for organic food are driving the use of compost, humic substances, and bio-based conditioners that improve soil structure and fertility while minimizing environmental impact.

The synthetic segment is expected to grow at the fastest CAGR of 6.9% from 2026 to 2033, driven by the need for immediate and consistent soil performance in high-intensity farming systems. These products offer precise control over soil properties such as water retention and nutrient availability, making them highly suitable for large-scale commercial agriculture and regions facing water stress and declining soil productivity.

Solubility Insights

The water soluble segment led the market with the largest revenue share of 62.0% in 2025, due to its ease of application and rapid effectiveness in improving nutrient availability and soil structure. These products are widely adopted in conventional and precision agriculture as they integrate seamlessly with irrigation and fertigation systems, enabling uniform distribution and immediate soil performance benefits.

The hydrogels segment led the market with the largest revenue share of CAGR of 7.4% during the forecast period, driven by increasing water scarcity and the need for improved moisture management in agriculture. Their high water-retention capacity helps reduce irrigation frequency and enhances crop resilience under drought conditions, making them increasingly attractive in arid and semi-arid regions that focus on efficient water use and sustainable farming practices.

Soil Type Insights

The loam segment led the market with the largest revenue share of 29.2% in 2025, due to its widespread use in agriculture and high suitability for diverse crops. Farmers commonly apply soil conditioners in loam soils to maintain optimal structure, enhance nutrient retention, and sustain long-term productivity, driving consistent demand across major agricultural regions.

The clay segment is anticipated to grow at the fastest CAGR of 7.6% during the forecast period, driven by the need to address poor drainage, compaction, and limited root penetration associated with heavy soils. Increasing adoption of soil conditioners to improve aeration, water movement, and workability in clay-rich soils is supporting rapid growth, particularly in intensive farming and infrastructure-driven agricultural areas.

Crop Type Insights

The cereals & grain segment led the market with the largest revenue share of 43.2% in 2025, due to their large cultivation area and their role as staple food crops globally. High demand for yield stability and soil fertility management in crops such as wheat, rice, and maize drives consistent use of soil conditioners to enhance nutrient efficiency and maintain soil productivity.

The oilseeds & pulses segment is anticipated to grow at the fastest CAGR of 9.2% during the forecast period, supported by rising global demand for edible oils and plant-based protein. Increased focus on improving soil health, nitrogen efficiency, and root development in crops such as soybean, sunflower, and pulses is accelerating the adoption of soil conditioners in this segment.

Regional Insights

Asia Pacific dominated the global soil conditioners market with the largest revenue share of 37.8% in 2025 and is projected to grow at the fastest CAGR during the forecast period, supported by rapid agricultural intensification and declining soil quality, prompting increased use of soil conditioners to improve yield performance and soil resilience in high-cropping-frequency farming systems.

China Soil Conditioners Market Trends

The soil conditioners market in China accounted for the largest market revenue share in Asia Pacific in 2025. China’s market growth is driven by government-led initiatives focused on soil remediation and sustainable farming practices to restore degraded farmland and improve agricultural efficiency.

North America Soil Conditioners Market Trends

The soil conditioners market in North America held second-largest revenue share of 34.7% in 2025, driven by the widespread adoption of precision agriculture and advanced farm input technologies, where soil conditioners are used to enhance input efficiency, manage soil variability, and support high-value crop production across large-scale commercial farms.

The soil conditioners market in the U.S. is driven by large-scale mechanized farming and high adoption of soil health management practices, where soil conditioners are increasingly used to optimize yields, improve soil structure, and support long-term farm productivity.

Europe Soil Conditioners Market Trends

The soil conditioners market in Europe is driven by strict environmental regulations and strong policy support for sustainable agriculture, encouraging the adoption of soil conditioners that improve soil health while reducing chemical fertilizer dependence.

The Germany soil conditioners market is anticipated to grow at a significant CAGR during the forecast period. The demand is driven by advanced agronomic practices and strong emphasis on environmentally responsible farming, supporting the use of soil conditioners that align with sustainable and organic agriculture standards.

Latin America Soil Conditioners Market Trends

The soil conditioners market in Latin America is driven by expansion of commercial agriculture and export-oriented crop production, particularly in oilseeds and cereals, increasing the need for soil conditioners to maintain long-term soil productivity.

Middle East & Africa Soil Conditioners Market Trends

The soil conditioners market in Middle East & Africa is growing rapidly. Rising water scarcity and poor soil conditions are key drivers in the Middle East & Africa, boosting demand for soil conditioners that enhance water retention and improve crop performance in arid and semi-arid environments.

Key Soil Conditioners Company Insights

Key players, such as BASF SE, Syngenta AG, Novozymes A/S, Eastman Chemical Company, Aquatrols Corporation of America, Solvay S.A., Rallis India Limited, GreenBest Ltd., and Grow More Inc., are dominating the market.

-

BASF leverages its global chemical expertise to provide advanced soil conditioner solutions that enhance soil structure, water retention, and nutrient efficiency. The company focuses on innovative formulations, including humic and polymer-based conditioners, catering to both conventional and sustainable agriculture, strengthening its position as a market leader in improving soil health and crop productivity worldwide.

-

Syngenta integrates crop protection with soil health strategies, offering a range of biological and chemical soil conditioners that optimize soil fertility and plant growth. Its solutions emphasize sustainable agriculture and precision farming, supporting farmers in enhancing yield, soil resilience, and long‑term land productivity, reinforcing Syngenta’s role as a key player in the soil conditioners industry.

Key Soil Conditioners Companies:

The following are the leading companies in the soil conditioners market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Syngenta AG

- Novozymes A/S

- Eastman Chemical Company

- Aquatrols Corporation of America

- Solvay S.A.

- Rallis India Limited

- GreenBest Ltd.

- Grow More Inc.

Recent Developments

-

In 2024, UPL Corp has unveiled NIMAXXA, a new triple‑strain bionematicide seed treatment registered by the U.S. EPA that offers season‑long protection for soybeans (and corn) against major nematodes including soybean cyst, root‑knot, and reniform nematodes by combining three biological strains that attack nematode eggs and juveniles, form a protective zone around roots, and stimulate root growth to enhance crop resilience for the 2025 season.

Soil Conditioners Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8,463.9 million

Revenue forecast in 2033

USD 13,907.2 million

Growth rate

CAGR of 7.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, solubility, soil type, crop type, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Saudi Arabia; Brazil; Argentina

Key companies profiled

BASF SE; Syngenta AG; Novozymes A/S; Eastman Chemical Company; Aquatrols Corporation of America; Solvay S.A.; Rallis India Limited; GreenBest Ltd.; Grow More Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soil Conditioners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global soil conditioners market report based on product, solubility, soil type, crop type and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Natural

-

Polysaccharides Derivatives

-

Others

-

Compost

-

Sewage Sludge

-

Animal Manure

-

-

-

Synthetic

-

Polymers

-

Minerals

-

Gypsum

-

-

-

Solubility Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Water Soluble

-

Hydrogels

-

-

Soil Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Loam

-

Sand

-

Peat

-

Silt

-

Clay

-

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Middle East & Africa

-

Saudi Arabia

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global soil conditioners market size was estimated at USD 7,946.6 million in 2025 and is expected to reach USD 8,463.9 million in 2026.

b. The soil conditioners market is expected to grow at a compound annual growth rate of 7.2% from 2026 to 2033 to reach USD 13,907.2 million by 2033.

b. The natural segment held the largest revenue share of 64.9% in 2025, due to growing adoption of sustainable and organic farming practices. Increasing awareness of soil health, regulatory support for eco-friendly inputs, and rising demand for organic food are driving the use of compost, humic substances, and bio-based conditioners that improve soil structure and fertility while minimizing environmental impact.

b. Key players, such as BASF SE, Syngenta AG, Novozymes A/S, Eastman Chemical Company, Aquatrols Corporation of America, Solvay S.A., Rallis India Limited, GreenBest Ltd., Grow More Inc., are dominating the market.

b. Market demand is supported by the shift toward sustainable and regenerative farming systems, where soil conditioners play a critical role in improving soil structure, moisture retention, and nutrient efficiency, while also aligning with regulatory and environmental sustainability objectives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.