- Home

- »

- Advanced Interior Materials

- »

-

Soil Testing Equipment Market Size And Share Report, 2030GVR Report cover

![Soil Testing Equipment Market Size, Share & Trends Report]()

Soil Testing Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Test Type (Road-rail, Road-water, Road-air, Others), By Degree of Automation, By Site, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-402-1

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soil Testing Equipment Market Size & Trends

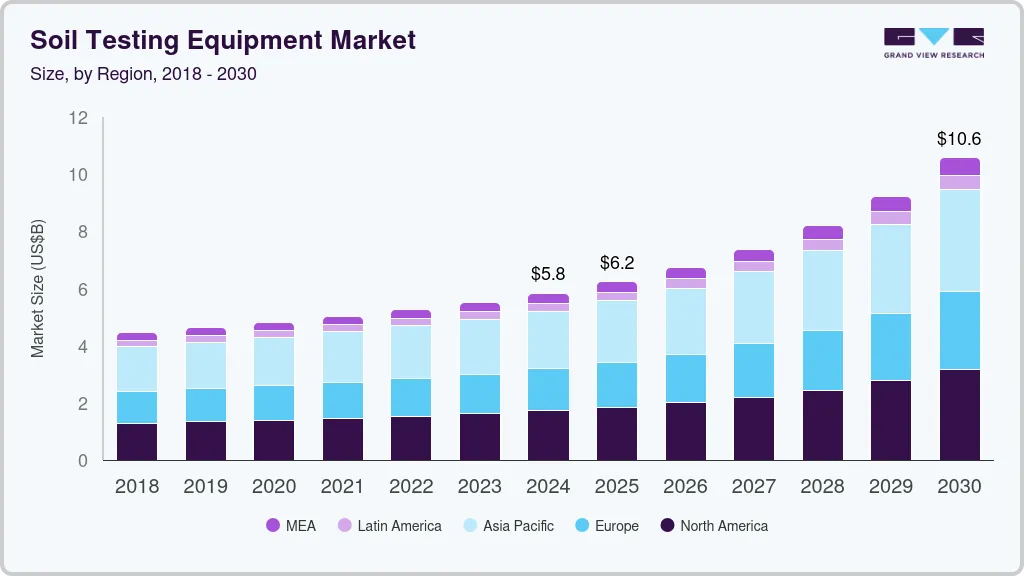

The global soil testing equipment market size was valued at USD 5,837.6 million in 2024 and is expected to register a CAGR of 10.4% from 2025 to 2030. The soil testing equipment encompasses a range of tools and devices used to analyze soil samples for their chemical, physical, and biological properties. These instruments are essential for determining soil fertility, nutrient levels, pH balance, and contamination, thereby guiding agricultural practices, environmental monitoring, and land management decisions. The market is growing significantly due to factors such as the growing agricultural sector, beneficial government regulations and policies, technological advancements in soil testing, rising awareness of soil health, and the expansion of research and development.

The agricultural sector is experiencing significant growth globally, driven by the increasing demand for food and agricultural products. As a result, farmers and agricultural businesses are increasingly turning to soil testing equipment to optimize crop yields and ensure sustainable farming practices. Precise soil analysis helps in identifying nutrient deficiencies and determining the appropriate fertilizer application, thereby enhancing productivity. This growing demand for agricultural products directly impacts the market, by increasing the need for accurate and reliable soil testing solutions. Moreover, as modern agriculture evolves, precision farming techniques become more prevalent, further boosting the demand for advanced soil testing technologies. The expansion of large-scale farming operations also necessitates comprehensive soil testing to maintain soil health and maximize efficiency.

Technological advancements in soil testing equipment have revolutionized the way soil analysis is conducted, making it more accurate, efficient, and user-friendly. Innovations such as digital soil mapping, remote sensing, and portable soil testing kits have enhanced the precision and convenience of soil testing. These technologies allow for real-time data collection and analysis, providing farmers with actionable insights to improve soil management practices. The integration of advanced sensors and automated systems in soil testing equipment also reduces human error and increases reliability. Furthermore, the development of cloud-based platforms and mobile applications for soil data management enables seamless data sharing and analysis, facilitating informed decision-making. The continuous evolution of soil testing technologies drives market growth by offering more sophisticated and cost-effective solutions to meet the diverse needs of the agricultural sector. As a result, the adoption of technologically advanced soil testing equipment is on the rise, contributing to market growth and innovation.

There is a growing awareness among farmers, agronomists, and agricultural stakeholders about the importance of soil health and its impact on crop productivity and environmental sustainability. This increased awareness has led to a greater emphasis on soil testing as a critical component of effective soil management practices. Farmers are now more informed about the benefits of regular soil testing, including optimizing fertilizer use, improving crop yields, and preventing soil degradation. Educational initiatives and extension services provided by agricultural institutions and organizations further promote the significance of soil health and the role of soil testing. As a result, there is a rising demand for reliable and accessible soil testing equipment to support these practices. The heightened focus on soil health not only drives the adoption of soil testing technologies but also encourages continuous improvement and innovation in the market. Ultimately, the growing awareness of soil health positively influences the market by fostering a culture of proactive soil management.

Test Type Insights

The chemical test type segment held the largest market share of 43.6% and also registered the fastest CAGR of 10.9% in the market due to its critical role in determining essential soil nutrients and pH levels, which are vital for optimizing crop yields. Chemical soil tests provide precise and reliable data on nutrient availability, helping farmers make informed decisions about fertilizer application. These tests are widely used in both developed and developing regions, contributing to their dominant market presence. In addition, the ongoing advancements in chemical testing technologies have enhanced their accuracy and efficiency, further driving their adoption and market share.

The residual test type segment is anticipated to register the second fastest CAGR of 10.7% over the forecast period due to the increasing need to detect and manage soil contaminants, such as pesticides and heavy metals, which can have significant environmental and health impacts. Growing regulatory pressure and stringent environmental standards have driven the demand for comprehensive residual testing to ensure soil safety and compliance. Advancements in testing technologies have improved the sensitivity and accuracy of residual tests, making them more effective and widely adopted. Furthermore, rising awareness about sustainable agriculture and the importance of soil health has led to greater emphasis on monitoring residual chemicals, thus boosting the growth of this segment.

Degree of Automation Insights

The semi-automatic degree of automation segment held the largest market share of 38.9% in the market due to its optimal balance between cost-effectiveness and operational efficiency. Semi-automatic equipment provides more accurate and reliable results than manual methods while being less expensive and easier to operate than fully automatic systems. This makes it particularly attractive to small and medium-sized agricultural enterprises that require precise soil analysis without incurring high costs. In addition, the flexibility and user control offered by semi-automatic equipment make it suitable for a wide range of soil testing applications, further driving its widespread adoption.

The automatic degree of automation segment is anticipated to register the fastest CAGR of 11.2% over the forecast period due to its ability to deliver high throughput and consistent accuracy, which are critical for large-scale agricultural operations and research applications. Automatic soil testing equipment minimizes human error and labor costs, significantly enhancing efficiency and productivity. Technological advancements have made automatic systems more sophisticated and user-friendly, encouraging their adoption among agribusinesses and research institutions. In addition, the growing trend towards precision agriculture and data-driven farming practices has fueled demand for advanced, automated soil testing solutions, contributing to the segment's rapid growth.

Site Insights

The laboratory segment held the largest market share in the market in 2023 due to the high demand for accurate and detailed soil analysis that laboratories can provide. Laboratory testing ensures precise measurements of soil properties, such as nutrient content, pH levels, and contaminant presence, which are critical for informed agricultural and environmental decision-making. Advanced equipment and controlled testing environments in laboratories allow for more sophisticated and reliable results compared to field testing. The increased regulatory requirements for soil quality and environmental protection have driven the need for thorough laboratory analyses. Furthermore, the growth of research activities in soil science and the development of new agricultural technologies have fueled the demand for laboratory-based soil testing.

The on-site site segment is anticipated to register the fastest CAGR of 11.2% over the forecast period. This is due to the growing demand for immediate and actionable soil analysis in agricultural and environmental applications. Portable and user-friendly on-site testing equipment allows farmers and researchers to obtain real-time data, enabling swift decision-making and timely interventions. Advances in technology have made on-site testing tools more accurate and reliable, bridging the gap between field and laboratory results. In addition, the increasing emphasis on precision agriculture and sustainable land management practices has driven the adoption of on-site soil testing to optimize resource use and crop yields. The convenience and cost-effectiveness of on-site testing, eliminating the need for sample transportation and laboratory fees, further contribute to its rapid market growth.

End Use Insights

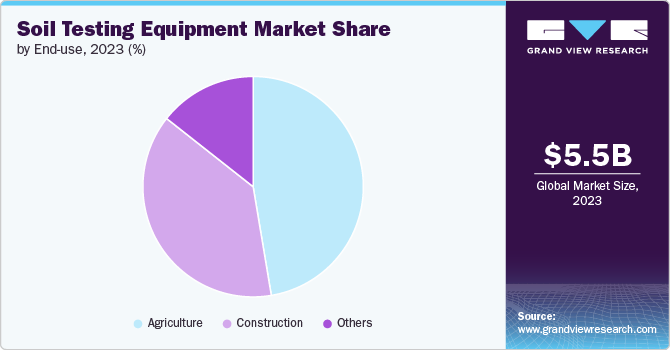

The agriculture segment held the largest market share of 47.4% in 2023 due to the critical need for soil health and fertility management in crop production. Farmers and agronomists rely on soil testing to optimize nutrient levels and enhance crop yield, driving substantial demand for these tools. Precision agriculture practices further emphasize the importance of accurate soil analysis for better resource management. Government initiatives and subsidies often support soil testing to boost agricultural productivity and sustainability. In addition, the growing focus on sustainable farming practices and soil conservation has led to increased adoption of soil testing equipment in agriculture.

The construction segment is anticipated to register the fastest CAGR over the forecast period due to the rising infrastructure development and construction projects globally, necessitating thorough soil analysis for foundational stability. Increasing urbanization and the demand for residential, commercial, and industrial spaces have driven the need for comprehensive soil testing to ensure safety and compliance with building standards. Advances in soil testing technology have enabled more efficient and accurate on-site assessments, which are crucial for timely project progress in construction. In addition, stringent regulatory requirements for construction safety and environmental impact assessments have bolstered the demand for reliable soil testing equipment. The focus on sustainable construction practices and the prevention of structural failures further emphasizes the importance of precise soil analysis in the construction industry, contributing to the rapid growth of this segment.

Regional Insights

North America soil testing equipment market is anticipated to grow at the fastest CAGR of 10.9% over the forecast period, primarily due to advanced agricultural technologies and a high adoption rate of precision farming. The region's focus on increasing crop yields and sustainable farming practices drove significant investment in soil analysis tools. IN addition, strong support from government policies and research funding further accelerated market growth.

U.S. Soil Testing Equipment Market Trends

The U.S. held the largest market share in North America in the Soil Testing Equipment Market in 2023 due to its advanced agricultural sector and high level of technology integration. The country's extensive farmland and emphasis on precision agriculture contributed to significant demand for soil testing solutions. Additionally, robust investment in agricultural research and development further strengthened the U.S. market position.

Asia Pacific Soil Testing Equipment Market Trends

In 2023, Asia Pacific dominated the soil testing equipment market with a 34.7% share, largely due to rapid agricultural development and increasing investments in modern farming technologies. The region's large agricultural base, combined with government initiatives aimed at improving soil quality and crop productivity, fueled demand for soil testing. Additionally, growing awareness of sustainable farming practices and the need for efficient resource management contributed to the market's expansion. Urbanization and infrastructure development also spurred advancements in agricultural techniques, boosting the adoption of soil testing equipment.

Europe Soil Testing Equipment Market Trends

Europe held a significant market share in the Soil Testing Equipment Market in 2023 due to its advanced agricultural practices and stringent environmental regulations, driving demand for precise soil analysis tools. The region's strong focus on sustainable farming and land management practices further bolstered the adoption of soil testing equipment. Additionally, substantial investments in research and development by European manufacturers contributed to the availability of innovative and high-quality soil testing solutions.

Key Soil Testing Equipment Company Insights

Some of the key companies operating in the market include Thermo Fisher Scientific Inc., among others.

- Thermo Fisher Scientific Inc. is a leading provider of soil testing equipment, offering advanced analytical instruments and solutions that cater to various soil analysis needs. The company’s product portfolio includes cutting-edge spectrometers, chromatographs, and elemental analyzers designed to ensure accurate and reliable soil composition data. Their equipment is widely used in agricultural research, environmental monitoring, and geotechnical engineering, reflecting the company's strong presence in the soil testing market.

Martin Lishman Ltd. and Sun Labtek Equipments Pvt. Ltd. are some of the emerging market companies in the target market.

- Martin Lishman Ltd. is a prominent manufacturer of soil testing equipment specializing in innovative solutions for agricultural and environmental applications. The company offers a range of portable soil testing kits and digital moisture meters designed to provide quick and accurate soil analysis in the field. Their equipment is widely recognized for its reliability and ease of use, making it a preferred choice for farmers, agronomists, and researchers.

Key Soil Testing Equipment Companies:

The following are the leading companies in the soil testing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Humboldt Mfg. Co.

- Sun Labtek Equipments Pvt. Ltd.

- S.W. Cole

- Agilent Technologies

- Martin Lishman Ltd.

- LaMotte Company

- Ele International Controls S.p.A

- Merck Group

- Geotechnical Testing Equipment UK Ltd.

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

- Gilson Company Inc.

Recent Developments

-

In December 2023, Martin Lishman Ltd. announced the launch of a new range of soil testing kits designed for rapid, accurate field analysis, addressing industry needs following the discontinuation of Palintest's soil test range. The kits include digital meters and professional agriculture test kits for N, P, and K tests, integrating seamlessly with Martin Lishman's existing soil analysis tools.

-

In August 2023, Thermo Fisher Scientific Inc. introduced the iCAP RQplus ICP-MS Analyzer and the iSC-65 Autosampler to simplify trace elemental analysis in various testing laboratories, enhancing accuracy and productivity for high matrix samples. These new tools provide operational simplicity, stability, and smart automation, supporting laboratories in achieving reliable and efficient analysis across environmental, food, pharmaceutical, and industrial applications.

Soil Testing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,236.9 million

Revenue forecast in 2030

USD 10,570.3 million

Growth Rate

CAGR of 10.4% from 2025 to 2030

Actual Data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, degree of automation, site, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

Humboldt Mfg. Co., Sun Labtek Equipments Pvt. Ltd., S.W. Cole, Agilent Technologies, Martin Lishman Ltd., LaMotte Company, Ele International Controls S.p.A, Merck Group, Geotechnical Testing Equipment UK Ltd., PerkinElmer Inc., Thermo Fisher Scientific Inc., Gilson Company Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soil Testing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global soil testing equipment market report based on Test Type, Degree of Automation, Site, End Use, and Region.

-

Test Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Physical

-

Residual

-

Chemical

-

-

Degree of Automation Outlook (Revenue, USD Million, 2017 - 2030)

-

Manual

-

Semi-Automatic

-

Automatic

-

-

Site Outlook (Revenue, USD Million, 2017 - 2030)

-

Laboratory

-

On-Site

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Agriculture

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global soil testing equipment market size was valued at USD 5.52 billion in 2023 and is expected to reach USD 5.84 billion in 2024.

b. The global soil testing equipment market is expected to witness a compound annual growth rate of 10.4% from 2024 to 2030 to reach USD 10.57 billion by 2030.

b. The laboratory segment held the largest market share in the soil testing equipment market due to the high demand for accurate and detailed soil analysis that laboratories can provide.

b. Key players in the soil testing equipment market include Humboldt Mfg. Co., Sun Labtek Equipments Pvt. Ltd., S.W. Cole, Agilent Technologies, Martin Lishman Ltd., LaMotte Company, Ele International Controls S.p.A, Merck Group, Geotechnical Testing Equipment UK Ltd., PerkinElmer Inc., Thermo Fisher Scientific Inc., and Gilson Company Inc.

b. The soil testing equipment market is growing significantly due to factors such as the growing agricultural sector, beneficial government regulations and policies, technological advancements in soil testing, rising awareness of soil health, and the expansion of research and development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.