- Home

- »

- Renewable Energy

- »

-

Solar Water Heaters Market Size And Share Report, 2030GVR Report cover

![Solar Water Heaters Market Size, Share & Trends Report]()

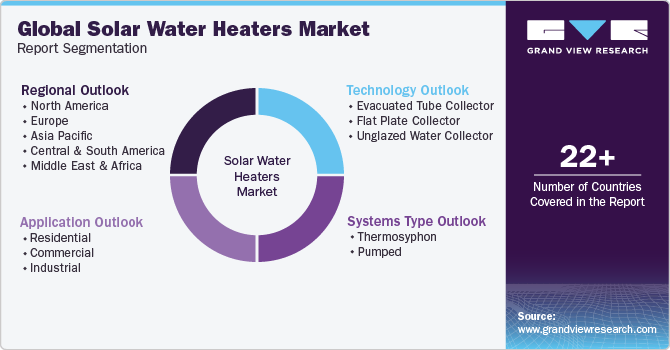

Solar Water Heaters Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology, By Application (Residential, Commercial, Industrial), By Systems (Thermosyphon, Pumped), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-198-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solar Water Heaters Market Summary

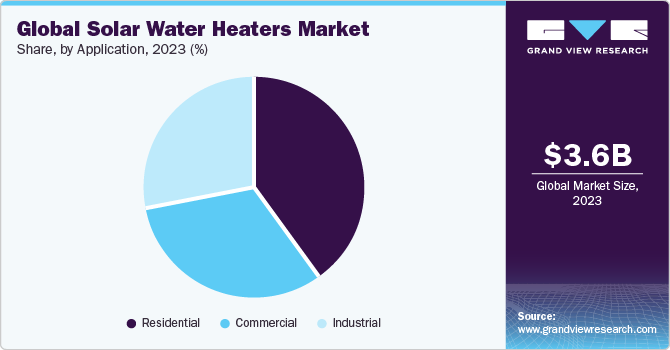

The global solar water heaters market size was estimated at USD 3.57 billion in 2023 and is projected to reach USD 6.19 billion by 2030, growing at a CAGR of 8.3% from 2024 to 2030. The increasing need for environmentally friendly, reliable, and cost-effective technology in water heating solutions for both residential and non-residential sectors is driving the market growth.

Key Market Trends & Insights

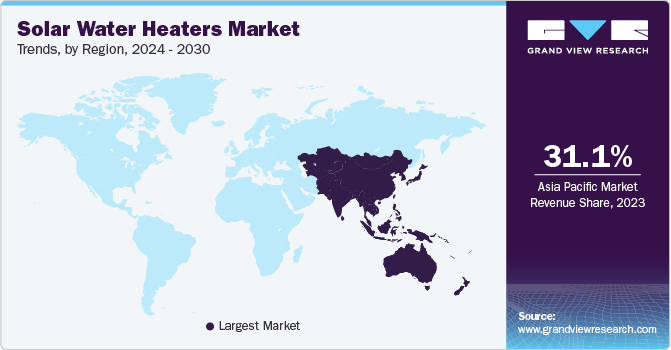

- Asia Pacific dominated the solar water heaters market with a revenue share of 31.1% in 2023.

- The solar water heaters market in U.S. accounted for over 7% share in 2023.

- Based on technology, the evacuated tube collector (ETC) segment led the market with the largest revenue share of 44.2% in 2023.

- Based on application, the residential segment led the market with the largest revenue share of 39.54% in 2023.

- Based on system, the thermosyphon segment led the market with the largest revenue share of 58.87% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.57 Billion

- 2030 Projected Market Size: USD 6.19 Billion

- CAGR (2024-2030): 8.3%

- Asia Pacific: Largest market in 2023

In addition, these systems require minimal maintenance and contribute to environmental conservation by reducing carbon footprints associated with conventional heating methods. Solar water heaters harness the sun's energy to heat water, significantly reducing the need for electricity or gas-powered heating systems. These systems substantially decrease energy consumption by utilizing solar power, translating into lower electricity bills and offering long-term cost savings. This environmentally friendly technology is widely used in residential and industrial settings, providing an efficient and sustainable way to meet hot water needs while reducing carbon emissions. The initial investment in a solar water heater can be recouped relatively quickly through energy savings, making it a cost-effective and eco-friendly choice for those looking to reduce their carbon footprint and save on utility costs over the long term. In January 2024, Malta's Green Transition initiatives significantly benefited over 3,800 families through various government schemes promoting sustainability and renewable energy. With an investment of USD 11.5 million in renewable energy projects, the country has implemented vital measures to accelerate its transition towards a greener economy.

Government incentives, subsidies, rebates, and tax credits play a crucial role in promoting the adoption of solar water heaters, making these systems more affordable and encouraging consumers to embrace renewable energy technologies. The US federal government provides a tax credit for individuals who invest in solar water heater systems to promote the use of renewable energy sources like solar power. This tax credit is accessible to those who adhere to the Solar Rating and Certification Corporation (SRCC) criteria.

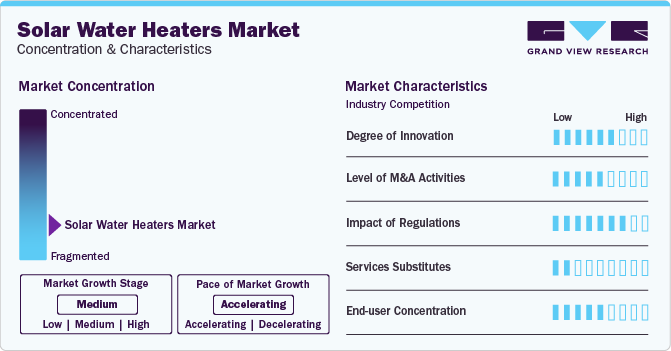

Market Concentration & Characteristics

The industry growth stage is medium, and the pace is accelerating. However, the industry is fragmented in nature owing to the existence of a large number of players worldwide. Recent advancements in solar water heating technology have significantly enhanced the efficiency and reliability of solar water heaters. Innovations in solar collector design, system integration, and heat exchanger technology have played a crucial role in improving the performance of these systems. One notable advancement is the incorporation of smart sensors, actuators, and control algorithms, enabling real-time monitoring and dynamic optimization of solar water heating systems. As a result, these innovations drive increased market adoption of solar water heating systems, offering a sustainable and energy-efficient solution for residential and commercial applications. In December 2023, VaySunic launched the V series hybrid solar water heater, where users can monitor and adjust their water heater remotely using a Wi-Fi connection.

The impact regulations are high as regulatory authorities frequently establish energy efficiency criteria that products such as solar water heaters must adhere to. Adherence to these standards guarantees the product's quality and enhances consumer trust in the technology, fostering greater acceptance and utilization.

Solar water heaters have limited substitutes, with electric and gas geysers among the primary alternatives. These substitutes rely on electricity and gas for water heating, offering convenience to households, but are generally less energy-efficient than solar water heaters. Electric water heaters and gas geysers also contribute to greenhouse gas emissions, unlike solar water heaters, which harness the sun's energy for a more sustainable heating solution.

Technology Insights

Based on technology, the market is segmented into evacuated tube collectors, flat plate collectors, and unglazed water collectors. The evacuated tube collector (ETC) segment led the market with the largest revenue share of 44.2% in 2023 and is anticipated to register at the fastest CAGR over the forecast period, due to the growing necessity for energy-efficient hot water distribution systems in industrial and commercial structures. Key attributes like space efficiency, high conversion rates, and minimal maintenance expenses drive the market growth.

The unglazed water collector segment is expected to grow at a significant CAGR during the forecast period. Due to their design and effectiveness in utilizing solar energy, they are suitable for regions with warmer climates. Unlike glazed collectors, unglazed collectors lack a glass covering, allowing for direct sunlight absorption. In regions with consistent sunlight and higher average temperatures, unglazed collectors effectively heat water.

Application Insights

Based on application, the residential segment led the market with the largest revenue share of 39.54% in 2023. Harnessing solar energy enables households to reduce reliance on unstable external energy sources, which is crucial in areas with high energy expenses or unreliable infrastructure. Solar power offers a stable, cost-effective alternative, shielding against price fluctuations and supply interruptions. They are used in applications such as water heating for household purposes, swimming pool heating, and others. Homeowners seek cost-effective energy solutions as electricity and natural gas costs increase, contributing to the market's growth.

The commercial segment is anticipated to register at the fastest CAGR over the forecast period. Solar water heaters are utilized in commercial settings such as hotels, restaurants, and hospitals. These sectors require heating significant amounts of water efficiently and regularly. The growing market will boost sales of commercial water heaters, as they can effectively manage large water volumes. Commercial water heaters are engineered for uninterrupted operation, guaranteeing a steady hot water supply.

System Insights

Based on system, the thermosyphon segment led the market with the largest revenue share of 58.87% in 2023. Thermosyphon systems are a popular and efficient method for solar water heating, leveraging the natural circulation of water to transfer heat from solar collectors to a storage tank without mechanical pumps. This process is driven by the principle that hot water rises while cooler water sinks. Due to their simplicity, reliability, and lower operational costs, thermosyphon systems are widely used, especially in residential applications.

The pumped system is expected to witness at the fastest CAGR during the forecast period. Pumped systems in solar water heaters are designed to be reliable and durable, providing a consistent hot water supply even in extreme weather conditions. The robust construction of these systems ensures long-term performance and minimal maintenance requirements, enhancing their appeal to consumers seeking hassle-free solutions.

Regional Insights

The solar water heaters market in North America accounted for a significant share in 2023. A growing trend towards green building certifications, such as LEED (Leadership in Energy and Environmental Design), which often incentivize or require the use of renewable energy sources fuels the market growth in the region.

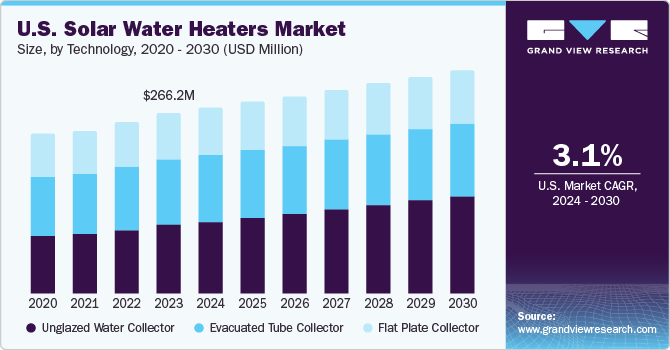

U.S. Solar Water Heaters Market Trends

The solar water heaters market in U.S. accounted for over 7% share in 2023 and is expected to grow at a significant CAGR over the forecast period. The federal investment tax credit (ITC) has been a significant driver for solar water heating installations in the country by reducing the upfront cost of solar thermal systems. The ITC allows homeowners, businesses, and other entities to deduct a portion of their solar water heating system costs from their taxes. In addition, many states offer incentives, such as rebates, property tax exemptions, and sales tax exemptions, further reducing the investment required.

Europe Solar Water Heaters Market Trends

The solar water heaters market in Europe accounted for a significant share in 2023. The European Union directives and national policies strongly support renewable energy and energy efficiency. The Renewable Energy Directive (RED), Energy Performance of Buildings Directive (EPBD), and ambitious climate targets for 2030 and 2050 have been critical in driving the adoption of solar thermal technologies.

The Russia solar water heaters market accounted for the largest share in Europe. Russia, known for its vast reserves of fossil fuels, may diversify its energy sources to include more renewable energy as part of broader energy strategy shifts, both for domestic consumption and for strengthening its position in the global energy market.

The solar water heaters market in Italy is anticipated to register at the fastest CAGR over the forecast period. The government of Italy implemented "Conto Termico," a scheme that provides financial incentives for adopting energy efficiency measures and installing small-scale renewable energy systems, including solar thermal systems. It has significantly increased the attractiveness of solar water heaters.

Asia Pacific Solar Water Heaters Market Trends

Asia Pacific dominated the solar water heaters market with a revenue share of 31.1% in 2023. Rapid economic growth, urbanization, and the region's increasing population have led to a surge in energy demand. Solar water heaters offer a sustainable solution to this demand, particularly for domestic hot water needs.

Key Solar Water Heaters Company Insights

Some of the key companies operating in global market are V-Guard Industries LTD, Rheem Manufacturing Company, and A.O. Smith.

-

V-Guard Industries LTD offers a variety of solar water heater models to suit different household needs and preferences. It includes different capacities and types (such as evacuated tube collectors and flat plate collectors) to cater to various hot water requirements and installation spaces

-

Rheem Manufacturing Company offers a range of solar water heating systems designed to cater to different climatic conditions, customer needs, and energy efficiency goals. Their solar water heater offerings typically include active (pumped) and passive (thermosiphon) systems, accommodating residential and commercial applications

Key Solar Water Heaters Companies:

The following are the leading companies in the solar water heaters market. These companies collectively hold the largest market share and dictate industry trends.

- A.O. Smith

- Bosch Thermotechnology

- Bradford White Corporation

- Eurostar Solar

- G E Appliances

- Kodsan

- Racold

- Rheem Manufacturing Company

- SunEarth

- SUNPAD, GREENoneTEC Solarindustrie GmbH

- SUNRAIN

- VaySunic

- V-Guard Industries LTD

Recent Developments

-

In January 2022, SunEarth partnered with Nyle Water Heating Systems to launch a scalable Solar Series Heat Pump Water Heater for the commercial sector. This innovative system offers the potential to reduce system operation costs by up to 90% compared to traditional water heating methods. By combining the efficiency of solar water heating and heat pumps, this solution presents a sustainable and cost-effective approach for businesses, contributing to energy savings and environmental benefits

-

In April 2023, Green Innov Industry Investment (Gi3) initiated the construction of Morocco’s inaugural solar water heater plant. The endeavor aligns closely with the nation’s energy efficiency directives, fostering the advancement of the green industrial sector

Solar Water Heaters Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.83 billion

Revenue forecast in 2030

USD 6.19 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends.

Segments covered

Technology, systems, application, region.

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; UK; Spain; Italy; France; China; Japan; South Korea; India; Australia; Brazil; Colombia; Paraguay; Saudi Arabia; UAE; South Africa; Egypt

Key companies profiled

A.O. Smith; Bosch Thermotechnology; Bradford White Corporation; Eurostar Solar; G E Appliances; Kodsan; Racold; Rheem Manufacturing Company; SunEarth; SUNPAD, GREENoneTEC Solarindustrie GmbH; SUNRAIN; VaySunic; V-Guard Industries LTD

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar Water Heaters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the solar water heaters market research report based on the technology, systems, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Evacuated Tube Collector

-

Flat Plate Collector

-

Unglazed Water Collector

-

-

Systems Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Thermosyphon

-

Pumped

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Colombia

-

Paraguay

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global solar water heaters market size was valued at USD 3.57 billion in 2023 and is expected to reach USD 3.83 billion in 2024

b. The global solar water heaters market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 6.19 billion by 2030

b. Asia Pacific accounted for the largest market share of 31.1% in 2023. Rapid economic growth, urbanization, and the region's increasing population have led to a surge in energy demand.

b. A.O. Smith; Bosch Thermotechnology; Bradford White Corporation; Eurostar Solar; G E Appliances; Kodsan; Racold; Rheem Manufacturing Company; SunEarth; SUNPAD, GREENoneTEC Solarindustrie GmbH; SUNRAIN; VaySunic; V-Guard Industries LTD

b. The factors such as the increasing need for environment-friendly, reliable, and cost-effective technology in water heating solutions for both residential and non-residential sectors are driving the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.