- Home

- »

- Advanced Interior Materials

- »

-

Sorting Machines Market Size, Share, Industry Report, 2030GVR Report cover

![Sorting Machines Market Size, Share & Trends Report]()

Sorting Machines Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Weight Sorter, Optical Sorter), By End Use (Mining, Food & Beverage, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-673-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sorting Machines Market Summary

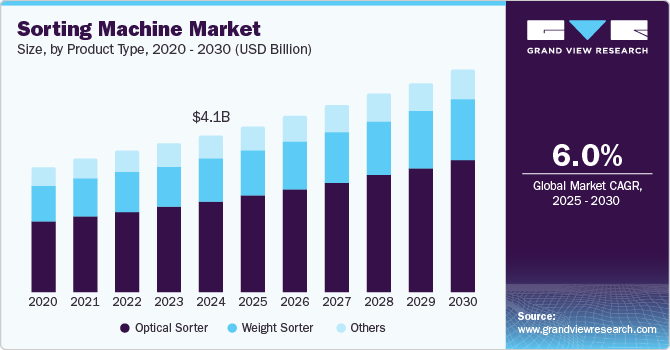

The global sorting machines market size was estimated at USD 4,135.1 million in 2024 and is projected to reach USD 5,861.9 million by 2030, growing at a CAGR of 6% from 2025 to 2030. This growth is attributed to a surge in demand from the food and beverage sector as industries seek to enhance efficiency and ensure quality control through automation.

Key Market Trends & Insights

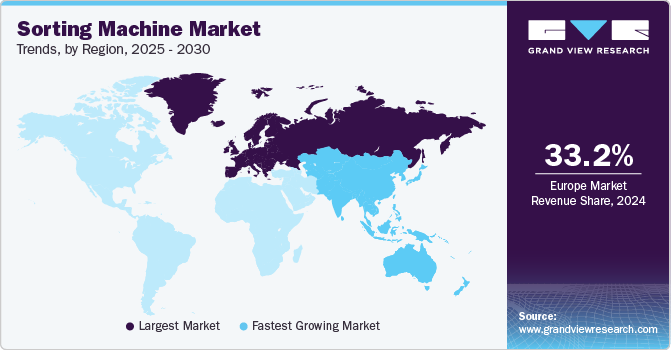

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, optical sorter accounted for a revenue of USD 2,523.1 million in 2024.

- Optical Sorter is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4,135.1 Million

- 2030 Projected Market Size: USD 5,861.9 Million

- CAGR (2025-2030): 6%

- Europe: Largest market in 2024

In addition, the rapid expansion of e-commerce necessitates advanced sorting solutions to swiftly manage high volumes of products. Furthermore, environmental concerns and the need for recycling are also pushing industries towards automated sorting systems. Moreover, technological advancements, including AI and IoT integration, are enhancing the capabilities and appeal of sorting machines across various sectors.

A sorting machine is a sophisticated device engineered to efficiently categorize large volumes of items arranged in complex configurations. These machines play a vital role in organizing products systematically according to specific criteria, grouping similar items, and identifying those that do not meet standards for removal. In sectors such as food processing, sorting machines are essential for sorting fruits, vegetables, empty bottles, and pharmaceutical goods based on weight, thereby ensuring quality control.

The main categories of sorting machines include optical sorters and weight/gravity sorters. Optical sorting is commonly utilized for grains, food items, and plastics, while gravity sorters are effective for processing seeds such as corn and various vegetables. Sorting machines have extensive applications across industries such as waste recycling, pharmaceuticals, mining, and food & beverage. They incorporate advanced technologies, including laser sorting, camera systems, and X-ray capabilities.

In addition, the demand for sorting machines is rising significantly due to the expanding food and beverage sector. This industry is experiencing increased exports and production activities, which drives the need for efficient sorting solutions. Furthermore, the rapid growth of e-commerce significantly contributes to this trend. As e-commerce continues to thrive, sorting machines become crucial for optimizing order fulfillment processes, lowering operational costs, and improving customer satisfaction.

Product Type Insights

The optical sorter dominated the market and accounted for the largest revenue share of 57.4% in 2024. This growth is attributed to increasing automation demands across various industries, especially food processing and recycling. In addition, as companies strive to enhance efficiency and maintain high quality standards, the need for precise sorting solutions becomes critical. Furthermore, advancements in imaging technology and artificial intelligence improve sorting accuracy and speed, making optical sorters more appealing. Moreover, the rising focus on food safety and compliance with stringent regulations further propels the adoption of optical sorting systems.

The weight sorter is expected to grow at a CAGR of 5.8% over the forecast period. This growth is driven by agriculture and food processing industries, which require efficient systems to ensure uniformity and quality in product distribution. In addition, accurate weight measurement helps optimize packaging and reduce waste, which is crucial for cost management. Furthermore, the growing emphasis on quality control and compliance with industry standards drives manufacturers to invest in weight sorting technology. Moreover, innovations that enhance speed and precision also contribute to the increasing demand for weight sorters.

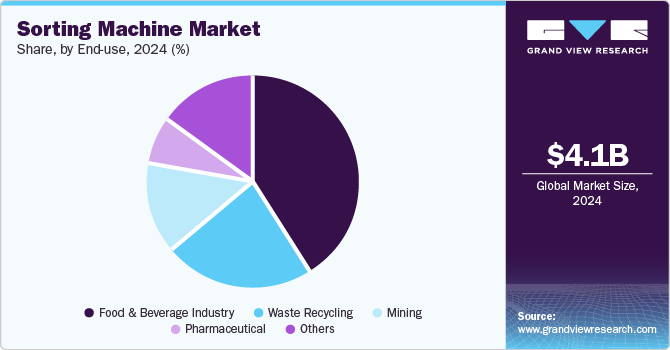

End Use Insights

The food and beverage industry dominated the market and accounted for the largest revenue share of 40.7% in 2024, primarily driven by rising demand for automation to improve operational efficiency and ensure food safety. In addition, stringent regulations regarding food quality and safety standards compel manufacturers to implement advanced sorting technologies. Furthermore, the increasing focus on minimizing waste and optimizing production processes drives the adoption of sorting machines, enabling companies to maintain high quality while meeting consumer expectations.

The waste recycling segment is expected to grow at a CAGR of 7.0% from 2025 to 2030, owing to increased environmental awareness and the pressing need for effective waste management solutions. As governments and organizations emphasize sustainability, an increasing demand for automated sorting systems can enhance recycling rates and reduce contamination. Furthermore, innovations in sorting technology, such as improved sensor capabilities and AI integration, further support this growth by enabling more efficient separation of recyclable materials, ultimately contributing to a circular economy.

Regional Insights

The sorting machines market in North America is expected to grow significantly over the forecast period, owing to a growing demand for processed and nutritional foods. The increasing emphasis on food safety standards compels manufacturers to invest in advanced sorting technologies that enhance quality control. In addition, rising labor costs are prompting industries to automate operations, leading to higher adoption rates of sorting machines. Furthermore, the presence of established manufacturers and a strong focus on innovation further contribute to market growth as companies seek efficient solutions to meet consumer demands.

U.S. Sorting Machines Market Trends

The growth of the U.S. sorting machines market is fueled by a strong demand for high-quality food products and rapid advancements in automation technology. In addition, the food and beverage industry's focus on efficiency and quality assurance drives investments in sophisticated sorting machines that can handle diverse products. Furthermore, the increasing trend toward sustainability and waste reduction encourages companies to adopt automated sorting solutions for recycling purposes. Moreover, as consumer preferences evolve towards healthier options, manufacturers must enhance their sorting capabilities to effectively meet these expectations.

Europe Sorting Machines Market Trends

The sorting machines market in Europe dominated the global market and accounted for the largest revenue share of 33.2% in 2024. This growth is attributed to the rising demand for high-quality food products, driven by consumer awareness regarding food safety and stringent regulations imposed by European authorities. In addition, the food and beverage sector, the largest manufacturing industry in the EU, is investing heavily in advanced sorting technologies to meet quality standards. Furthermore, the growth of the organic food sector necessitates sophisticated sorting systems, further propelling market expansion as companies strive to enhance efficiency and compliance with safety regulations.

Germany sorting machines market led the European market and accounted for the largest revenue share in 2024, driven by its strong manufacturing base and the presence of key industry players such as Allgaier Werke and Sesotec. In addition, the increasing demand for high-quality food products with shorter delivery cycles is a significant driver as manufacturers seek to optimize production processes. Furthermore, Germany's commitment to sustainability and recycling initiatives is fostering investments in advanced sorting technologies, enabling efficient waste management and resource recovery, thereby enhancing overall market dynamics in the region.

Asia Pacific Sorting Machines Market Trends

The sorting machines market in Asia Pacific is expected to grow at a CAGR of 6.9% over the forecast period, owing to industrialization and urbanization. Furthermore, the increasing focus on quality control and efficiency in production processes is prompting manufacturers to adopt advanced sorting technologies. Rising consumer expectations for high-quality products are pushing industries to invest in sorting machines to enhance operational efficiency and meet regulatory standards.

China sorting machines market dominated the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its booming manufacturing sector and increasing automation adoption. In addition, the rapid growth of e-commerce is driving demand for efficient sorting solutions to swiftly manage high volumes of products. Furthermore, government initiatives promoting environmental sustainability are encouraging investments in waste recycling technologies. As industries strive for improved quality control and compliance with safety regulations, the need for advanced sorting machines becomes critical, further propelling market growth in China.

Key Sorting Machines Company Insights

Key global sorting machines industry companies include TOMRA, BarcoVision, Daewon GSE, and others. These companies employ several strategies to enhance their market presence and gain a competitive edge. These include focusing on product innovation and technological advancements to improve efficiency and accuracy. In addition, companies are engaging in strategic partnerships, mergers, and acquisitions to expand their market presence and capabilities. Furthermore, investments in research and development are critical for creating advanced sorting technologies that cater to diverse industry needs.

-

Daewon GSE manufactures advanced sorting machines primarily for the agricultural sector, focusing on grain and food processing. Their product lineup includes color and grain sorters designed to enhance the quality and efficiency of sorting crops such as rice, beans, and wheat. Operating in the agricultural machinery segment, the company employs cutting-edge technology to improve sorting accuracy and productivity.

-

Bühler Sortex manufactures high-precision optical sorting equipment primarily for food processing and recycling industries. Their innovative solutions are designed to sort a wide range of products, including grains, nuts, and plastics, ensuring quality control and safety. Operating in the food technology and waste management segments, the company leverages advanced technologies such as multispectral imaging and artificial intelligence to enhance sorting efficiency and accuracy.

Key Sorting Machines Companies:

The following are the leading companies in the sorting machines market. These companies collectively hold the largest market share and dictate industry trends.

- TOMRA

- BarcoVision

- Daewon GSE

- BT-Wolfgang Binder

- Dematic

- Bühler Sortex

- Sesotec

- Raytec Vision

- Concept Engineers

- Satake Corporation

- CP Global

- National Recovery Technologies

- GREEFA

- Allgaier Werke

- Cimbria

Recent Developments

-

In April 2024, Dematic officially opened a new office in Riyadh, Saudi Arabia, enhancing its presence in the Middle East. This expansion aims to meet the growing demand for automation solutions, including sorting machines, across various sectors such as e-commerce and pharmaceuticals. Mithun Perinchery, Head of Sales for the region, emphasized that this move aligns with Saudi Arabia's Vision 2030 and positions Dematic as a key partner in logistics automation. The office will facilitate improved service and project management capabilities for local customers.

Sorting Machines Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.38 billion

Revenue forecast in 2030

USD 5.86 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, and region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, China, India, Japan, South Korea, Australia, Germany, UK, France, Italy, Spain, Brazil, Argentina, Saudi Arabia, UAE

Key companies profiled

TOMRA; BarcoVision; Daewon GSE; BT-Wolfgang Binder; Dematic; Bühler Sortex; Sesotec; Raytec Vision; Concept Engineers; Satake Corporation; CP Global; National Recovery Technologies; GREEFA; Allgaier Werke; Cimbria

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sorting Machines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global sorting machines market report based on product type, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical Sorter

-

Weight Sorter

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage Industry

-

Pharmaceutical

-

Waste Recycling

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.