- Home

- »

- Medical Devices

- »

-

South East Asia Advanced Wound Care Market Report, 2030GVR Report cover

![South East Asia Advanced Wound Care Market Size, Share & Trends Report]()

South East Asia Advanced Wound Care Market Size, Share & Trends Analysis Report By Product, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-021-2

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The South East Asia advanced wound care market size was valued at USD 221.28 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.11% from 2023 to 2030. The rising prevalence of chronic diseases, mainly, diabetes and obesity, is one of the key factors leading to an increase in the incidence of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers. For instance, as per data published by the government of Singapore (Ministry of Health), as of December 2021, a study showed that diabetes contributed to 87% of arterial insufficiency ulcers in the population of Singapore.

Similarly, according to IDF Diabetes Atlas, Indonesia ranked 5th in 2019 with around 7.9 million adults aged between 20 and 79 having undiagnosed diabetes. Healing of these chronic wounds requires advanced wound care products, thus, impelling the growth of the market over the forecast period.

The rising prevalence of obesity is another key factor likely to drive market growth, as it is associated with chronic wounds and lower extremity amputations. Obese people are at a higher risk of pressure ulcers, with reduced vascular activity in adipose tissue. The incapability of these patients to reposition themselves in bed acts as a precursor for pressure-related injuries.

Furthermore, the skin folds on their bodies provide ideal conditions for microorganisms to thrive. Ulcers are caused by the breakdown of skin caused by these microorganisms. Thus, this factor is likely to boost the demand for advanced wound care products, leading to market growth.

In recent times, the incidence of road accidents, trauma, and burn events has been rapidly increasing across Southeast Asian countries. For instance, according to WHO, in 2021, Thailand has the world's second-highest rate of traffic-incident-related fatalities. As per the same source, each year, an estimated 22,941 individuals die in Thailand as a result of traffic-related incidents, accounting for roughly 33% of all deaths in the country.

Moreover, according to WHO data, in 2018, there were around 41,862 deaths due to road traffic accidents in Indonesia. Such accidents frequently result in significant blood loss and other injuries, necessitating prompt medical treatment and surgical procedures to offer patients instant relief. Thus, the rising number of accidents is likely to boost the demand for advanced wound care, which is anticipated to lead to substantial market growth over the forecast period.

The COVID-19 pandemic considerably decreased the demand for advanced wound care products in South East Asian countries. Even though advanced wound care is a crucial part of healthcare, it experienced low demand in the market owing surge in COVID-19 cases. The rate of hospitalization escalated, which increased the pressure on hospitals and clinics to reprofile their patients and treat patients with COVID-19 on priority.

However, players in this market altered their strategies by opting for R&D during the pandemic and developing innovative products to help combat the pandemic. Companies in South-East Asia were engaged in developing new techniques and products to combat the scarcity of advanced wound care products. For instance, PatchMed Cosmetics developed a perforated cellulose patch for patients with diabetic foot ulcers and a spray gel for advanced wound care.

Product Insights

The moist wound care segment dominated with a revenue share of 59.15% in 2022. This can be attributed to rising burn cases in the South East Asia region. The majority of these occur in low- and middle-income countries and nearly two-thirds occur in the WHO African and South East Asia regions. For instance, according to a study published by NCBI in 2020, the mortality rate of burn injuries in South East Asia was 11.6%. Furthermore, in Indonesia, the number of burn-related deaths was estimated to be approximately 195,000 people per year. Moist wound care products are majorly used to prevent exudation from burn injuries; hence, increasing burn cases are expected to boost the segment growth over the forecast period.

The antimicrobial wound care segment is projected to witness the fastest CAGR of 6.65% over the forecast period. The segment is majorly indicated for partial and full-thickness wounds, such as surgical incisions and percutaneous line sites. These products are available as nylon fabric, film care, sponges, impregnated woven gauzes, or a combination of different materials. Major factors contributing to market growth include increasing incidence of ulcers such as arterial ulcers & diabetic foot ulcers.

For instance, according to ScienceDirect, diabetic foot ulcers may affect more than 25% of the diabetic population and may lead to the amputation of a foot in 20% of patients. Therefore, with an increase in the number of people suffering from diabetes coupled with a rise in the number of expected diabetic foot ulcer patients, the use of antimicrobial wound products is anticipated to impel over the forecast period.

Application Insights

The chronic wounds segment held the largest revenue share of 59.31% in 2022. The increasing incidence of chronic diseases, especially diabetes, and the rising geriatric population are among the major factors driving the segment growth. For instance, according to Ageing Asia, in Indonesia, the number of people aged 60 and above was 27,524,000 in 2019, which is anticipated to increase by 153.56% and reach 69,792,000 in 2050, accounting for 21.1% of the total population. Older people are more susceptible and prone to injury, which may lead to an increase in the incidence of chronic wounds.

The acute wounds segment is projected to witness the fastest CAGR of 6.23% over the forecast period. The acute wounds segment comprises surgical & traumatic wounds and burns. This can be accredited to the rising number of surgical wounds and surgical site infections in this region. For instance, as per Driven Communications Sdn Bhd. total of 402,626 road accidents was recorded in Malaysia from January to September 2022, resulting in 4,379 fatalities.

This is a jump from the 255,532 road accidents from the same period in 2021 in which 3,324 deaths were recorded. As per a similar source, the number of accident cases during the first nine months of 2022 in Malaysia is up 58% (or 147,094) from the same period in 2021, while the death toll rose by around 32% (or 1,055 fatalities). Thus, propelling the segment growth.

End-use Insights

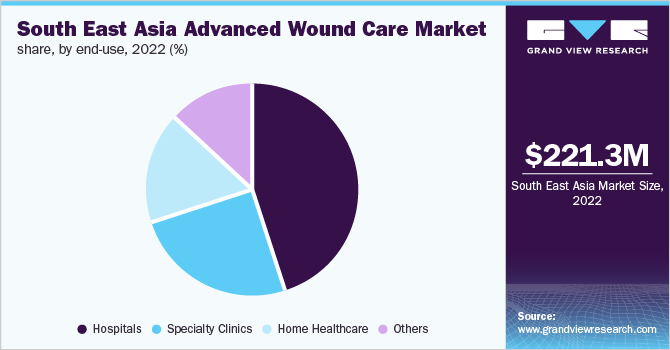

The hospital segment dominated South East Asia advanced wound care market with a revenue share of 45.36% in 2022. This can be accredited to rising surgical procedures, the increasing number of hospitals, and the surge in the number of accidental cases in this region. For instance, according to Philkotse, the number of road accidents has nearly doubled from 63,072 in 2007 to 116,906 in 2018.

An increase in the number of accidents is leading to a greater number of surgeries and the use of advanced wound care products. Moreover, development in healthcare services is leading to the growth of the advanced wound care market. According to Medical Tourism Center, Indonesia is more focused on the niche segment of health check-ups such as cosmetic surgery, breast augmentation, rhinoplasty, and dentistry. With an increasing number of breast augmentation and cosmetic surgeries, the need for advanced wound care products is growing, which is expected to fuel the market growth during the forecast period. Thus, due to the aforementioned factors, the hospital segment is expected to dominate the end-use segment.

However, the home healthcare segment is projected to witness the fastest CAGR of 6.66% during the forecast period. Home healthcare settings have been increasing in many countries. Moreover, many surgeries require a prolonged recovery period, leading to frequent changes in wound dressing. Further, the rising geriatric population in the South East Asia region may increase the demand for home healthcare settings. For instance, according to IDF Diabetes Atlas, Indonesia ranked 5th in 2019 with around 7.9 million adults aged between 20 and 79 having undiagnosed diabetes. As the elder population is more inclined toward home healthcare, the segment is expected to witness growth over the forecast duration.

Country Insights

Thailand captured a revenue share of over 18% in 2020. This can be accredited to the rising diabetic population in Thailand. For instance, according to WHO, the prevalence of diabetes among the Thai population aged 30 and above was estimated to be 9.6%. With the rise in diabetes, the wound healing capability decreases which is expected to increase the demand for advanced wound care in the South Asian region.

Moreover, traumatic accidents and surgical cases are further expected to impel the advanced wound care market. For instance, as per the Thai Public Broadcasting Services, in the year 2020, around 17,831 road accidents were recorded in Thailand. Such road accidents may require surgical procedures, which increases the consumption of advanced wound care products. Thereby impelling the market.

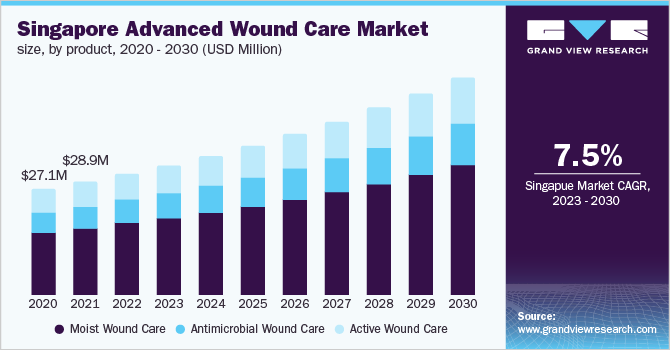

However, Singapore is projected to witness the fastest growth rate in this region with a CAGR of 7.55% during the forecast period. An increase in the number of surgeries, the presence of well-developed healthcare infrastructure, and the rise in medical tourism are among the major factors driving the market. Moreover, according to International Trade Administration, the Singapore healthcare market is expected to grow to USD 49.4 billion by 2029.

The country’s healthcare spending comprises private and public expenditures, accounting for 5.9% of its total GDP, which is expected to increase to 9% by 2029. According to WHO, Singapore has achieved a world-class healthcare system and ranks 6th globally. This has made the country a preferred medical destination. Therefore, the aforementioned factors are expected to help the advanced wound care market grow in Singapore.

Key Companies & Market Share Insights

The South East Asia advanced wound care industry is very fragmented, with both big and small market competitors. As present market participants intensify their plans to seize the majority share in the advanced wound care market, fierce competition is anticipated, with the level of competitiveness perhaps rising even further. Many market participants are engaging in different strategic activities, such as product launches, mergers and acquisitions, and geographic expansion, to get an advantage over rivals.

For instance, in May 2020, Integra LifeSciences announced positive clinical results for Integra Bilayer Wound Matrix (IBWM). This product is part of the company’s regenerative technology portfolio, which used collagen & amniotic products. This was expected to help the company tap into the innovative solutions market and provide surgeons with repair & close wound solutions.

Similarly, in February 2020, Integra LifeSciences launched AmnioExcel Plus Placental Allograft Membrane for soft tissue repair. With this launch, the company would increase its revenue. As a result, the South East Asia advanced wound care market is anticipated to grow over the projected period due to various strategies followed by industry participants. Some prominent players in the South East Asia advanced wound care market include:

-

Smith & Nephew

-

Molnlycke Health Care AB

-

ConvaTec Group PLC

-

Baxter International

-

URGO

-

Coloplast Corp.

-

Medtronic

-

3M

-

Derma Sciences (Integra LifeSciences)

-

Medline Industries

South East Asia Advanced Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 233.51 million

Revenue forecast in 2030

USD 353.78 million

Growth rate

CAGR of 6.11% from 2022 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Country scope

Singapore; Philippines; Thailand; Malaysia; Indonesia; Rest of South-East Asia

Key companies profiled

Smith & Nephew; Molnlycke Health Care AB; ConvaTec Group PLC; Baxter International; URGO; Coloplast Corp.; Medtronic; 3M; Derma Sciences (Integra LifeSciences); Medline Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

South East Asia Advanced Wound Care Market Segmentation

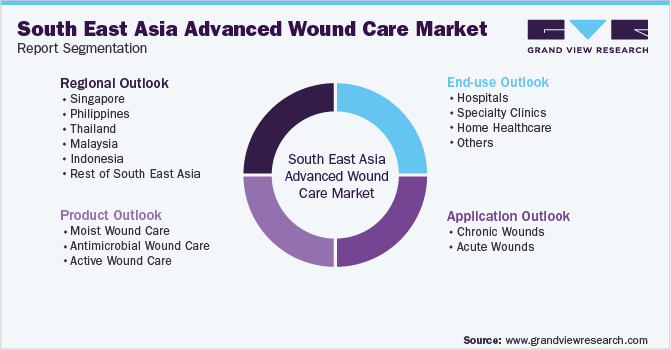

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented South East Asia advanced wound care market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Moist Wound Care

-

Foam Dressings

-

Hydrocolloid Dressings

-

Film Dressings

-

Alginate Dressings

-

Hydrogel Dressings

-

Collagen Dressings

-

Other Advanced Dressings

-

-

Antimicrobial Wound Care

-

Silver

-

Non-silver

-

-

Active Wound Care

-

Biomaterials

-

Skin-substitute

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Singapore

-

Philippines

-

Thailand

-

Malaysia

-

Indonesia

-

Rest of South East Asia

-

Frequently Asked Questions About This Report

b. The South East Asia advanced wound care market size was estimated at USD 221.28 million in 2022 and is expected to reach USD 233.51 million in 2023.

b. The South East Asia advanced wound care market is expected to grow at a compound annual growth rate of 6.11% from 2023 to 2030 to reach USD 353.78 million by 2030.

b. The Philippines dominated the South East Asia advanced wound care market with a share of 19.81% in 2022. This is attributable to the presence of key market players, favorable government regulations & reimbursement policies, and growing target population

b. Some of the key players operating in the South East Asia advanced wound care market include Smith & Nephew, Molnlycke Health Care AB, ConvaTec Group PLC, Baxter International, URGO, Coloplast Corp., Medtronic, 3M, Derma Sciences (Integra LifeSciences), and Medline Industries

b. Key factors that are driving the South East Asia advanced wound care market growth include, increasing prevalence of chronic diseases and conditions affecting wound healing capabilities, introduction of innovative and advanced wound products, rising geriatric population, and increasing number of road accidents, trauma cases, and burns.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."