- Home

- »

- Pharmaceuticals

- »

-

South East Asia Nutraceutical Excipients Market Report, 2025GVR Report cover

![South East Asia Nutraceutical Excipients Market Size, Share & Trends Report]()

South East Asia Nutraceutical Excipients Market Size, Share & Trends Analysis Report By Product (Film Coating, Binders, Sugars and Polyols (Solid), Modified Release), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-184-9

- Number of Report Pages: 86

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Healthcare

Report Overview

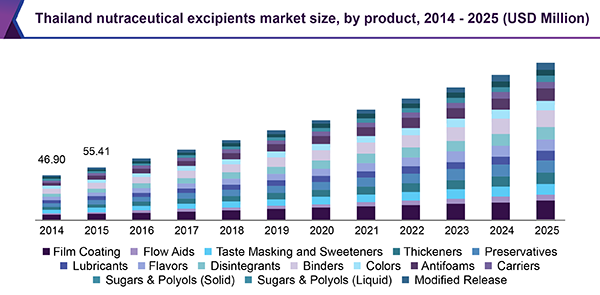

The South East Asia nutraceutical excipients market size was estimated at USD 547.28 million in 2017. Recent advances in bioactive food components and functional foods used as nutrition supplements are anticipated to drive demand. The South East Asian (SEA) market is diversified in nature and the population here exhibits greater reliance on functional foods in order to manage lifestyle associated diseases.

Growing demand for nutraceuticals in several SEA countries has earned this region the status of a hub for innovation in functional foods and new ingredients. Competitive economies in this region have been attracting global players with immense growth potential and lower risk viewpoints.

The process of creating a regulatory framework for harmonized health supplements was started in 2004 by the ten ASEAN governments and was completed in 2015. The ASEAN Alliance of Health Supplement Association is engaged in the study of this regulatory framework for safety, quality, and labeling of nutraceuticals/health supplements. The harmonization of regulatory standards is a significant step toward simplifying international trade activities in the region.

Rising awareness amongst the population pertaining to disease management and prevention using nutraceuticals has resulted in increased demand. The expansion of the wellness industry is also expected to fuel growth prospects over the forecast period. Protecting and safeguarding the nutrient value of a nutraceutical is a major challenge for manufacturers. However, research initiatives are on in the chemical industry to overcome such challenges and this is anticipated to drive the market.

Emerging trends in nutraceuticals have created a demand for molecules with multiple functionalities to improve manufacturing processes. Technological innovations are being implemented to develop molecules that improve nutraceutical efficacy. For instance, the development of multifunctional excipients in order to gain combined advantages of bulk excipients.

Nutricosmetics-a blend of cosmeceutical and nutraceutical-is expected to witness substantial growth with an expanding aging population base. Investments in novel formulations for aesthetic appeal have further strengthened demand in Indonesia, Philippines, and Vietnam. However, fewer investments have been observed in some markets by several multinational excipient manufacturers over the past few years, except in the area of specialty excipients. This could threaten market growth in the long run.

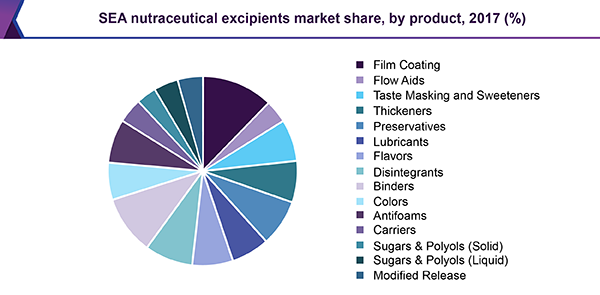

Products Insights

Nutraceutical excipients are categorized on the basis of product into film coating, flow aids, thickeners, preservatives, lubricants, disintegrants, colors, antifoaming, and sugars and polyols (solid and liquid). The formulation of nutraceuticals is complicated compared to traditional pharmaceutical products owing to various factors. For instance, the most common multivitamin nutraceutical formulation is composed of two to eight excipients and up to 25 active ingredients, whereas a traditional pharmaceutical formulation contains five to six excipients and one to four active pharmaceutical ingredients.

The number of active ingredients is directly proportional to challenges presented in terms of quality control, content uniformity, compressibility, flow, particle size, moisture sensitivity, and ingredient interaction. Many participants are involved in the development of co-processed, multifunctional excipients to allow nutraceutical manufacturers to reduce the number of ingredients in the final formulation. This helps overcome the above-mentioned challenges. For example, multifunctional calcium phosphate serves the purpose of fillers and binders, along with being a source of phosphorous and calcium in dietary supplements.

The new generation mineral excipients are highly efficient carriers for multiple substances and are useful due to their controlled release properties. The introduction of such products is expected to increase the efficiency of nutraceutical manufacturing processes, thereby driving the South East Asia nutraceutical excipients market.

Owing to the significant role of film coating excipients in tablet formulations, this segment accounted for the largest revenue share in 2017. These are used to smoothen the uneven surface of tablets, overcome the bitter taste, provide delayed-release, or serve as a barrier to moisture.

Innovation in film coating materials such as functional film coatings for enteric or controlled release has further contributed to higher usage of these products in several formulations. The requirement of excipients to support bioactive delivery to achieve desired pharmacokinetic and pharmacodynamic properties is expected to boost innovation in nutraceuticals. Thus, excipients offering controlled release are also expected to witness lucrative growth over the coming years.

Higher sweetness achieved by the use of low-calorie carbohydrates is rapidly gaining popularity as a substitute for sugar, which is anticipated to result in the rapid growth of the sugar and polyols segment. Usage of these polyols in solid or liquid depends on the country of interest and the formulation being designed.

Country Insights

Australia dominated the market in 2017 owing to the established presence of international players. The implementation of its Free Trade Agreement (AUSFTA) with the U.S. in 2005 created an opportunity for the U.S. manufacturers to enter the Australian and New Zealand markets, thus resulting in substantial developments over time.

Malaysia is projected to exhibit the fastest CAGR owing to the high penetration of nutraceuticals in the market, along with improving regulations by Drug Control Authority. Nutraceuticals are rapidly adopted by Malaysian women for slimming purposes while men are using them to enhance body functioning.

Indonesia is another lucrative market and presents immense potential for the coming years. Indonesia ranks among the top ten markets in the global health and wellness industry. This can be attributed to the willingness of people to invest in health foods. This thereby creates ample opportunities for market players to increase their profits.

South East Asia Nutraceutical Excipients Market Share Insights

The market is highly fragmented owing to the presence of numerous small players and their distributors at various locations. A few international players have established their presence in the market by expanding operations of their pharmaceutical excipients to nutraceutical manufacturers. Majority of global players have distribution partnerships and strategic collaborations with local chemical distributors.

Key companies in this market include but are not limited to SPI Pharma; DuPont Nutrition and Health; The Dow Chemical Company; Barentz; Cargill Inc.; BASF SE; JRS Pharma; BEHN MEYER; and Sensient Colors LLC. Participation of companies in international expos, conferences, and events to enhance business promotion is one of the key sustainability strategies adopted by industry participants.

South East Asia Nutraceutical Excipients Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 725.48 million

Revenue forecast in 2025

USD 1,029.67 million

Growth Rate

CAGR of 8.22% from 2018 to 2025

Base year for estimation

2017

Historical data

2014 - 2016

Forecast period

2018 - 2025

Quantitative units

Revenue in USD million and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Products, country

Regional scope

South East Asia

Country scope

Malaysia; Vietnam; Philippines; Indonesia; Thailand; Singapore; Australia; and New Zealand

Key companies profiled

SPI Pharma; DuPont Nutrition and Health; The Dow Chemical Company; Barentz; Cargill Inc.; BASF SE; JRS Pharma; BEHN MEYER; Sensient Colors LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the South East Asia nutraceutical excipients market report on the basis of product and country:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Film Coating

-

Flow Aids

-

Taste Masking and Sweeteners

-

Thickeners

-

Preservatives

-

Lubricants

-

Flavors

-

Disintegrants

-

Binders

-

Colors

-

Antifoams

-

Carriers

-

Sugars & Polyols (Solid)

-

Sugars & Polyols (Liquid)

-

Modified Release

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

Malaysia

-

Vietnam

-

Philippines

-

Indonesia

-

Thailand

-

Singapore

-

Australia

-

New Zealand

-

Frequently Asked Questions About This Report

b. The South East Asia nutraceutical excipients market size was estimated at USD 665.65 million in 2019 and is expected to reach USD 725.48 million in 2020.

b. The South East Asia nutraceutical excipients market is expected to grow at a compound annual growth rate of 8.22% from 2018 to 2025 to reach USD 1,029.67 million by 2025.

b. Film coating segment dominated the South East Asia nutraceutical excipients market with a share of 12.2% in 2019. This is attributed to the to the significant role of film coating excipients in tablet formulations.

b. Some key players operating in the South East Asia nutraceutical excipients market include SPI Pharma; DuPont Nutrition and Health; The Dow Chemical Company; Barentz; Cargill Inc.; BASF SE; JRS Pharma; BEHN MEYER; and Sensient Colors LLC.

b. Key factors that are driving the market growth include recent advances in bioactive food components, growing demand for innovative functional foods, and rising awareness among the population pertaining to disease management.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."