- Home

- »

- Medical Devices

- »

-

South East Asia Spinal Implants Market, Industry Report, 2030GVR Report cover

![South East Asia Spinal Implants Market Size, Share & Trends Report]()

South East Asia Spinal Implants Market Size, Share & Trends Analysis Report, By Product (Spinal Fusion Implants, Non-Fusion Implants), By Raw Material, By Application, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-688-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

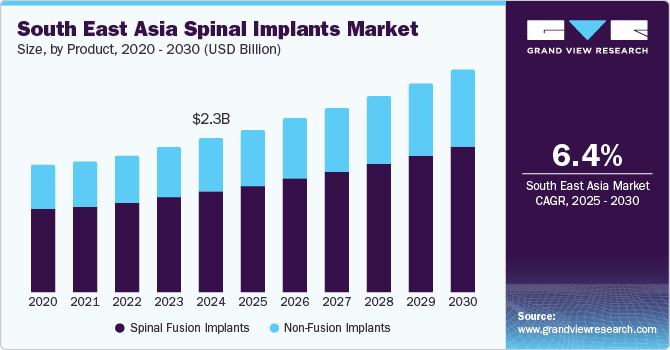

The South East Asia spinal implants market size was estimated at USD 2.30 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030, due to increasing healthcare access, rising awareness about spinal disorders, and an aging population. The growing prevalence of conditions such as degenerative disc disease, scoliosis, and spinal injuries is a significantly driving demand for surgical interventions. In addition, advancements in medical technology and improved surgical techniques have contributed to adopting spinal implants. Patients increasingly seek minimally invasive surgeries, further enhancing the South East Asia spinal implants industry growth. The rise of medical tourism in countries such as Singapore and India has added another layer of growth potential for the South East Asia spinal implants industry.

In addition, as the elderly population increases, the demand for spinal implants related to age-related disorders, including osteoporosis and degenerative spinal conditions, is anticipated to rise. Advancements in 3D printing technologies and robotic surgeries are expected to enhance the precision and effectiveness of spinal implant procedures. With these innovations, the healthcare sector is likely to witness improvements in patient outcomes, further boosting the adoption of spinal implants. The rising focus on personalized treatment options and customized implants tailored to individual patients is a witness to the growth of the South East Asia spinal implants industry. Furthermore, the expanding healthcare insurance coverage and reimbursement policies in emerging economies are expected to make spinal implant procedures more accessible to a larger population.

The increasing demand for next-generation implants from advanced materials, such as titanium and Polyetheretherketone (PEEK), is rising as they offer enhanced durability and biocompatibility. Furthermore, collaborations between international manufacturers and local healthcare providers are likely to boost market penetration and distribution. Countries such as Singapore, Malaysia, and Vietnam, with strong healthcare infrastructure and medical expertise, are expected to witness a rise in demand for advanced spinal treatments.

Product Insights

The spinal fusion implants segment dominated the market with a revenue share of 64.4% in 2024, driven by the increasing prevalence of spinal disorders that require surgical intervention. Conditions such as degenerative disc disease, spinal stenosis, and trauma often require fusion surgeries to stabilize the spine and alleviate pain. The effectiveness of these implants in providing long-term stability and improving patient outcomes has made them a preferred choice among healthcare providers. Advancements in surgical techniques and implant designs have enhanced the safety and efficacy of these procedures, further contributing to their dominance in the market.

The non-fusion implant segment is expected to grow significantly over the forecast period, which can be attributed to the rising preference for motion-preserving technologies. Non-fusion devices, such as artificial discs and dynamic stabilization systems, provide alternatives to traditional fusion surgeries, allowing for greater flexibility and mobility post-surgery. Patients increasingly seek these options due to concerns about prolonged recovery times and potential complications associated with fusion procedures. Integrating non-fusion technologies into spinal surgery has improved outcomes by enabling some movement while maintaining stability. As awareness of these benefits increases and minimally invasive surgical techniques become more popular, the demand for non-fusion implants is expected to experience significant growth.

Raw Material Insights

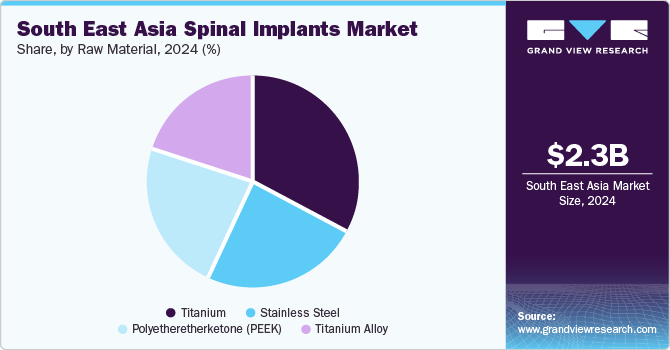

The titanium segment dominated the market with the largest revenue share in 2024, driven by its superior properties, making it an ideal material for spinal implants. Titanium is known for its strength, lightweight nature, and biocompatibility, crucial for ensuring durability and integration with bone tissue. Its corrosion resistance also enhances longevity within the body, leading to better patient outcomes. The established track record of titanium implants achieving successful surgical results contributes to their dominance in the South East Asia spinal implants industry. As manufacturers continue innovating titanium-based designs, its position as a preferred material for spinal implants is expected to remain strong.

The Polyetheretherketone (PEEK) segment is projected to grow at the highest CAGR over the forecast period, fueled by its unique characteristics tailored to specific patient needs. PEEK is a high-performance polymer known for its excellent mechanical properties and radiolucency, allowing for clear imaging during follow-up assessments without interference from metal artifacts. Its flexibility and compatibility with surrounding tissues make it an attractive option for spinal implants that require a balance between stability and movement. As advancements in manufacturing techniques improve the quality of PEEK implants, their adoption in clinical settings is expected to increase significantly.

Application Insights

The degenerative disc disease segment dominated the market with the largest revenue share in 2024, driven by the high prevalence among aging populations. Degenerative disc disease often leads to chronic pain and functional impairment, prompting many patients to seek surgical solutions such as spinal implants. The effectiveness of spinal fusion and non-fusion devices in alleviating symptoms associated with degenerative disc disease has made them essential components of treatment plans. As awareness grows regarding available treatment options and their benefits, this segment is expected to maintain its leading position in the market.

The spine fractures segment is projected to witness a significant CAGR over the forecast period, which can be attributed to an increase in trauma cases and accidents leading to spinal injuries. The rising incidence of osteoporosis-related fractures among older adults also contributes to this growth, as weakened bones are more susceptible to fractures. Advances in surgical techniques and implant technologies have improved outcomes for patients suffering from spine fractures, further driving demand for spinal implants. Increasing awareness about treatment options for spine fractures enhances South East Asia spinal implants industry growth as more patients seek timely interventions.

End-use Insights

The hospitals segment dominated the market with the largest revenue share in 2024, driven by their capacity to perform complex spinal surgeries requiring advanced technology and specialized care. Hospitals typically have access to comprehensive resources, including skilled surgeons and state-of-the-art equipment necessary for successful spinal procedures. As healthcare systems continue to invest in improving surgical facilities and capabilities, hospitals serve as key players in delivering spinal implant surgeries. The increasing volume of surgeries performed in hospital settings further solidifies hospitals dominance.

The ambulatory surgical centers segment is projected to grow at the highest CAGR over the forecast period, fueled by a shift toward outpatient procedures that reduced patient recovery times. These centers provide a cost-effective alternative for various surgical interventions while maintaining high standards of care. The rising preference for minimally invasive techniques aligns well with the operational model of ambulatory surgical centers, making them increasingly popular among patients seeking quicker recovery options. As healthcare providers expand the services offered at these centers, their role in the spinal implants market is expected to grow significantly.

Key South East Asia Spinal Implants Company Insights

Some key companies operating in the market include Medtronic, Medical Device Business Services, Inc., NuVasive, Inc., Stryker, and Globus Medical. Companies are undertaking strategic initiatives such as mergers, acquisitions, and product launches to expand their market presence and address the evolving healthcare demands in the South East Asia spinal implants market.

-

Medtronic offers a diverse range of products in the spinal implants market, emphasizing improved surgical outcomes and patient care. Its leading products include the Catalyft Expandable Interbody System, designed for minimally invasive surgeries, featuring precise anterior rim engagement and integration with StealthStation Navigation. Moreover, the lineup includes spinal fusion devices such as the CD Horizon series and biologics, including Infuse Bone Graft.

-

NuVasive, Inc. provides a comprehensive range of products and services in the spinal implants market, emphasizing minimally invasive surgical techniques and advanced materials science. Its products include Modulus Titanium Technology, a 3D-printed titanium implant designed for optimal strength and bone integration, ideal for spinal fusion procedures. The company also offers various spinal implants, including the C360 portfolio and Attrax Putty, along with advanced surgical instruments and technologies that enhance surgical planning and execution.

Key South East Asia Spinal Implants Companies:

- Medtronic

- Medical Device Business Services, Inc.

- NuVasive, Inc.

- Stryker

- Globus Medical

- Zimmer Biomet

- RTI Surgical

- Orthofix Medical Inc.

- SeaSpine.

- B. Braun SE

Recent Developments

-

In September 2024, Medtronic plc announced a partnership with Siemens Healthineers to co-market the Multitom Rax imaging system, which will be integrated into the AiBLE ecosystem. This system offers advanced imaging capabilities, including standing and weight-bearing imaging, that support precise surgical planning and execution for spinal patients.

-

In October 2021, NuVasive, Inc. launched the Cohere TLIF-O implant, a new porous PEEK solution for posterior spine surgery. This implant enhances bony ingrowth for the transforaminal lumbar interbody fusion (TLIF) procedure.

South East Asia Spinal Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.44 billion

Revenue forecast in 2030

USD 3.33 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product,raw material, application, end use, country

Regional scope

South East Asia

Country scope

China; Japan; India; Singapore; Indonesia; Malaysia; Thailand; Philippines; Vietnam

Key companies profiled

Medtronic.; Medical Device Business Services, Inc.; NuVasive, Inc.; Stryker; Globus Medical; Zimmer Biomet.; RTI Surgical.; Orthofix Medical Inc.; SeaSpine; B. Braun SE.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

South East Asia Spinal Implants Market Report Segmentation

This report forecasts country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the South East Asia spinal implants market report based on product, raw material, application, end use, and countries:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spinal Fusion Implants

-

Plates

-

Rods

-

Pedicle Screw Systems

-

Interbody Fusion Devices (Spinal Cages)

-

-

Non-Fusion Implants

-

Expandable Cages

-

Others

-

-

-

Raw Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Titanium

-

Titanium Alloy

-

Stainless Steel

-

Polyetheretherketone (PEEK)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spine Fractures

-

Spinal Stenosis

-

Degenerative Disc Disease

-

Complex Deformity

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Clinics

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."