- Home

- »

- Next Generation Technologies

- »

-

Space Robotics Market Size & Share, Industry Report, 2030GVR Report cover

![Space Robotics Market Size, Share & Trends Report]()

Space Robotics Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution, By Application (Deep Space, Near Space, Ground), By Organization Type (Commercial, Government), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-256-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Space Robotics Market Summary

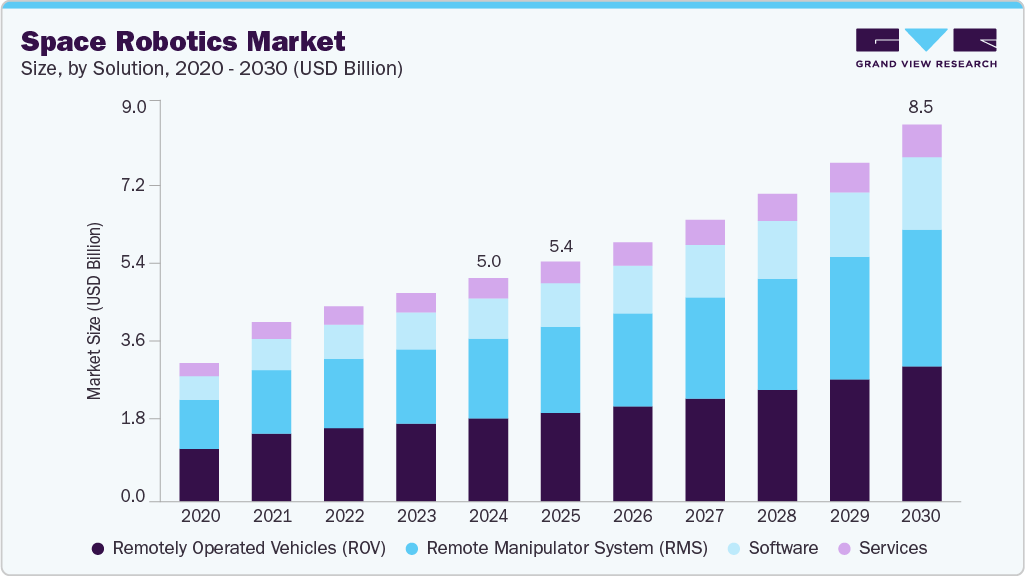

The global space robotics market size was estimated at USD 5,039.8 million in 2024 and is projected to reach USD 8,503.2 million by 2030, growing at a CAGR of 9.5% from 2025 to 2030. The market growth is primarily driven by the increasing focus on autonomous satellite servicing, on-orbit manufacturing, and planetary exploration missions that demand high-precision robotic systems.

Key Market Trends & Insights

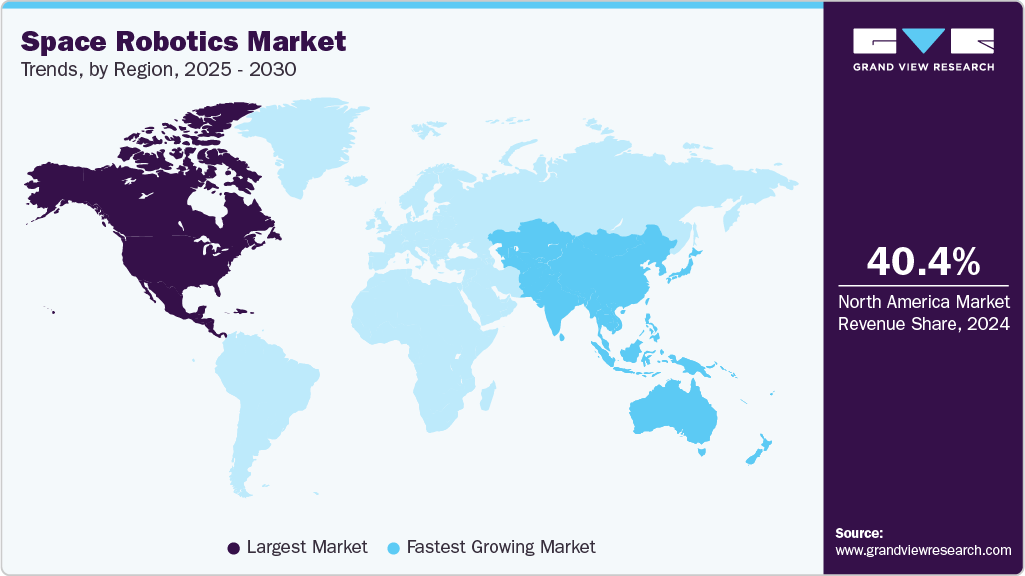

- North America dominated the global space robotics market with the largest revenue share of 40.39% in 2024.

- The space robotics market in the U.S accounted for the largest market revenue share in North America in 2024.

- By solution, the remotely operated vehicles (ROV) segment led the market with the largest revenue share of 37.77% in 2024.

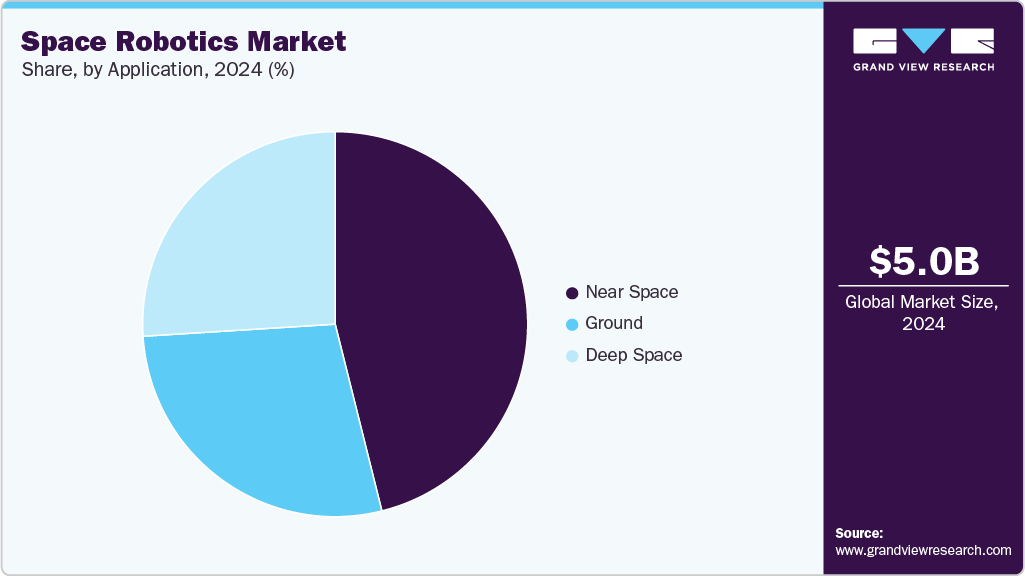

- By application, the near space segment led the market with the largest revenue share of 46.13% in 2024.

- By organization type, the government segment led the market and held the largest revenue share of 70.13% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,039.8 Million

- 2030 Projected Market Size: USD 8,503.2 Million

- CAGR (2025-2030): 9.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Investment growth in space missions is accelerating market expansion, with governments and commercial aerospace players prioritizing modular robotic systems capable of autonomous docking, payload handling, and infrastructure maintenance.The growth is primarily driven by the increasing demand for advanced robotic systems that enhance mission efficiency, safety, and autonomous operations in space environments. Rising investments in space exploration missions, including satellite servicing, lunar and Mars exploration, and on-orbit manufacturing, are prompting space agencies and commercial players to adopt sophisticated robotics solutions. The focus on optimizing robotic manipulation, autonomous docking, payload handling, and infrastructure maintenance is accelerating the integration of AI, vision processing, and haptic feedback technologies. These drivers contribute to the expanding role of space robotics in enabling sustainable and efficient space operations globally.

The increasing demand for cost-efficient and autonomous space missions is significantly driving the growth of the space robotics industry. Robotic systems such as autonomous spacecraft docking platforms, robotic arms, and surface exploration rovers enable efficient mission execution by reducing dependence on direct human intervention. These technologies enhance mission safety, precision, and sustainability, thereby accelerating adoption across agencies and commercial space operators. The rising utilization of robotics for satellite servicing, debris removal, and payload deployment continues to support the expansion of the space robotics industry.

In addition, the growing investments in deep-space exploration initiatives are emerging as a major growth catalyst. Government agencies and private companies are increasing funding to explore the Moon, Mars, and beyond, leading to a heightened need for intelligent robotic assets capable of operating in harsh environments. Integration of advanced sensors, AI-driven navigation systems, and real-time communication networks allows robots to perform tasks such as scientific sampling and habitat construction with high accuracy. These advancements strengthen mission capability and expand the scope of space exploration programs, promoting market growth.

Furthermore, advancements in modular and reconfigurable robotic technologies are creating substantial opportunities for the space robotics industry. Space missions are increasingly leveraging robots with modular designs that support on-orbit upgrades, maintenance, and assembly of space infrastructure. This approach prolongs spacecraft operational life and minimizes mission costs while enabling the deployment of large-scale structures such as space telescopes, habitats, and solar power stations. The rising adoption of on-orbit servicing solutions underscores the growing relevance of robotics in future space architecture.

Moreover, the growing focus on strengthening safety and operational reliability in space environments is boosting demand for intelligent robotic solutions. The harsh conditions of space require systems that can withstand extreme temperatures, radiation, and isolated environments while maintaining continuous functionality. The development of AI-enabled fault detection, autonomous decision-making capabilities, and enhanced durability standards ensures mission success and reduces the risk of asset loss. These innovations support broader acceptance of advanced robotics within long-duration missions, strengthening the space robotics industry.

Solution Insights

The remotely operated vehicles (ROV) segment led the market with the largest revenue share of 37.77% in 2024, driven by its critical role in supporting complex space missions and ensuring operational safety. High-performance components, precision sensors, and autonomous navigation systems are essential for real-time maneuvering and effective task execution. The growing deployment of autonomous docking systems, satellite servicing units, and debris management robots further expands the segment’s importance. These factors collectively reinforce the segment’s prominence by enhancing mission efficiency and enabling sustainable space operations globally.

The software segment is expected to witness at the fastest CAGR of over 10% from 2025 to 2030. This growth is attributed to the increasing reliance on advanced autonomous control, mission planning, and AI-based navigation systems to enhance robotic performance. The growing need for real-time data processing, object recognition, and adaptive decision-making algorithms for satellite servicing, orbital debris removal, and lunar exploration missions is fueling software adoption. These factors underscore the software segment’s central role in enabling intelligent, autonomous, and resilient robotic operations across the evolving global space robotics ecosystem.

Organization Type Insights

The government systems segment accounted for the largest market share in 2024, primarily due to extensive government-led investments in national space programs, planetary exploration, and the development of satellite infrastructure. Continued advancements in AI-driven robotics, autonomous navigation, and radiation-resistant systems further enable governments to execute complex and long-duration missions with greater safety and operational efficiency. The strong emphasis on technological superiority and scientific advancement reinforces government dominance in the space robotics market.

The commercial segment is expected to witness at the fastest CAGR from 2025 to 2030. This growth is driven by satellite deployment, in-orbit servicing, and space tourism activities. Private companies increasingly incorporate robotic solutions to reduce mission costs, extend satellite lifespans, and support infrastructure build-outs in low Earth orbit. As commercial players seek scalable, revenue-driven mission models, robotics offers operational speed, precision, and cost optimization, propelling the commercial segment’s strong growth trajectory within the space robotics industry.

Application Insights

The near space segment accounted for the largest market share in 2024, owing to the increasing investment in satellite servicing, space infrastructure assembly, and debris removal activities in low Earth orbit. Governments and private aerospace companies are prioritizing the development of modular, autonomous robotic systems. The growing commercialization of space and the expansion of satellite are increasing the demand for robotic solutions that enhance mission efficiency and safety. As space agencies and commercial operators continue to focus on sustainable in-orbit operations, the near space segment remains pivotal, reinforcing the market's rapid expansion.

The deep space segment is expected to witness at the fastest CAGR from 2025 to 2030. This growth is driven by the expansion of robots, or planetary robots, which play a vital role in observing, surveying, and extracting information from extraterrestrial surfaces. The robotic system is crucial for deep space exploration programs to extend human reach into space, expand planetary access capabilities, and enhance human operation efficiency by supporting the astronaut crew in space operations. Exploration robots, autonomous spacecraft, human-assistive robots, and piloted aircraft are some robotic systems gaining momentum in the market, making this segment a preferred choice in the space robotics industry.

Regional Insights

North America dominated the global space robotics market with the largest revenue share of 40.39% in 2024, primarily driven by strong investments from national space agencies and commercial space companies, accelerating robotic technology deployment for space missions. The region’s leadership in autonomous satellite servicing, space station maintenance, and planetary exploration programs promotes the adoption of advanced robotics. Heightened focus on space security, debris mitigation, and the development of next-generation lunar and deep-space missions continues to propel the demand for space robotics solutions in the region.

U.S. Space Robotics Market Trends

The space robotics market in the U.S. accounted for the largest market revenue share in North America in 2024. The increasing investments in satellite servicing, lunar exploration, and autonomous on-orbit operations are key drivers of market growth. Strong government support through NASA programs and defense initiatives continues to accelerate technological innovation in robotic arms, autonomous spacecraft, and planetary rovers. Rising participation in commercial space projects, including space tourism and private space station development, further supports market expansion in the U.S.

Europe Space Robotics Market Trends

The space robotics market in Europe is expected to grow at the significant CAGR of 8% from 2025 to 2030. In Europe, market expansion is driven by rising investments in advanced space exploration programs, satellite servicing infrastructure, and lunar mission development. The European Space Agency (ESA) and regional governments actively support autonomous robotics technologies for applications such as orbital maintenance and planetary research. Strong regulatory and funding frameworks, combined with technological innovation, continue to accelerate the adoption of AI-powered robotic vehicles and automated mission support systems across the region.

The UK space robotics market is expected to grow at a significant CAGR during the forecast period. The country is a rapidly emerging hub for commercial satellite launches, space sustainability initiatives, and the development of robotic mission technology. Increasing investments in on-orbit servicing capabilities, autonomous navigation solutions, and robotic assembly platforms are fueling demand. The growing involvement of private aerospace firms and innovation centers in robotics development is creating strong momentum for market expansion in the UK

The space robotics market in Germany is growing rapidly. Germany’s leadership in high-precision engineering, automation, and aerospace manufacturing plays a crucial role in the growth of the space robotics industry. The presence of major space research centers and robotics-focused industrial collaborations is driving advancements in robotic arms, surface exploration systems, and payload deployment technology. Germany’s strong commitment to future lunar and deep-space missions encourages the integration of intelligent robotic systems. This ongoing technological push continues to foster widespread adoption of space robotics nationwide.

Asia Pacific Space Robotics Market Trends

The space robotics market in the Asia Pacific is expected to grow at the fastest CAGR of 11% from 2025 to 2030, fueled by increasing investments in space exploration, satellite deployment, and on-orbit servicing initiatives. Government-backed programs focusing on lunar missions, low Earth orbit (LEO) infrastructure, and autonomous robotic capabilities are accelerating technological advancements. Growing private sector participation and international collaborations are driving the adoption of cost-efficient robotic systems, reinforcing the Asia Pacific’s position as a leading market for the space robotics industry.

The Japan space robotics market is gaining traction, fueled by the country’s strategic focus on robotic technology leadership and deep-space exploration. Japan’s space agency and domestic robotics companies invest heavily in advanced robotic arms, lunar rovers, and autonomous servicing systems to support mission-critical operations. Government initiatives supporting space sustainability, combined with the country's longstanding expertise in precision robotics and AI integration, are accelerating the deployment of next-generation robotic solutions for space development.

The China space robotics market is rapidly expanding. The country’s accelerated push toward independent space station operations, robotic lunar exploration, and large-scale satellite constellations drives the market. Major investments in state-owned and commercial space enterprises, coupled with rising launch frequency and upgrades to manufacturing capabilities, are strengthening China’s competitive footprint in the global space robotics ecosystem, contributing to the market's rapid growth in China.

Key Space Robotics Company Insight

Some of the key players operating in the market include SPACEX and MDA Space among others.

-

SPACEX is a prominent player in the space robotics industry, leveraging advanced automation, autonomous docking capabilities, and robotic satellite deployment systems to support commercial and deep-space missions. Its robotics-enabled spacecraft technologies improve mission efficiency, reduce dependency on human intervention, and ensure precision during orbital construction and servicing tasks. SPACEX continues to strengthen its role in space robotics by scaling satellite infrastructure through Starlink, developing robotic systems and collaborating with global space agencies to enable next-generation autonomous space operations.

-

MDA Space is a leading player in the space robotics industry, known for its highly advanced robotic arms and on-orbit servicing capabilities deployed in major international space missions. The company’s technologies, including Canadarm robotic systems, enable assembly, maintenance, and robotic manipulation tasks on space stations and satellites. MDA Space is leading innovation through developments in autonomous navigation, space infrastructure robotics, and lunar surface mobility, helping accelerate the growth of sustainable and modular space operations.

ASTROSCALE and Lunar Outpost Inc. are some of the emerging market participants in the space robotics industry.

-

ASTROSCALE is an emerging player gaining recognition for its pioneering solutions in space debris removal and on-orbit servicing robotics. The company develops robotic capture systems, docking mechanisms, and autonomous maneuvering tools designed to extend satellite lifespan and enhance orbital sustainability. With growing partnerships and mission demonstrations, ASTROSCALE is rapidly expanding its presence and shaping the future of safe and responsible space robotics operations.

-

Lunar Outpost Inc is an emerging player in the space robotics industry focused on developing lunar rover platforms and robotic infrastructure systems for planetary surface exploration. Its autonomous mobility systems support key applications such as resource extraction, scientific sampling, and surface construction. By collaborating with space agencies and commercial mission developers, Lunar Outpost is accelerating lunar industrialization and positioning itself as a significant innovator in robotic activities.

Key Space Robotics Companies:

The following are the leading companies in the space robotics market. These companies collectively hold the largest market share and dictate industry trends.

- ASTROBOTIC TECHNOLOGY

- Motiv Space Systems, Inc.

- MDA Space

- ASTROSCALE

- SPACEX

- Intuitive Machines, LLC.

- Ceres Robotics, Inc.

- D-Orbit S.p.A.

- Metecs, LLC.

- Lunar Outpost Inc

- Orbit Fab, Inc.

- Oceaneering International, Inc.

Recent Developments

-

In July 2025, MDA Space led a consortium selected by the Canadian Space Agency to conduct an early-phase study for Canada’s proposed Lunar Utility Vehicle (LUV). The company will utilize MDA’s modular robotic suite SKYMAKER. This development reinforces MDA Space’s leadership in advanced robotic capabilities and highlights its growing role in enabling sustainable and autonomous lunar operations within the global space robotics industry.

-

In June 2025, Astrobotic Technology announced that its CubeRover-1 lunar rover completed its acceptance test campaign, advancing the company’s surface mobility and robotic payload delivery capabilities for South Pole exploration. This strengthens Astrobotic’s role as a commercial provider of robotic lunar surface systems, increasing its ability to support science, prospecting, and infrastructure deployment on future missions.

-

In April 2025, Orbit Fab, Inc. announced the development of the first commercial spacecraft refueling service. The service aims to eliminate single-use satellites by enabling in-orbit servicing and significantly extending the lifetimes of assets. The company’s refueling technology supports autonomous docking, fluid transfer robotics, and sustainable satellite operations. This advancement strengthens Orbit Fab’s position as a key innovator in robotic servicing infrastructure, contributing to greater sustainability and long-term viability within the space robotics industry.

Space Robotics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,412.8 million

Revenue forecast in 2030

USD 8,503.2 million

Growth rate

CAGR of 9.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

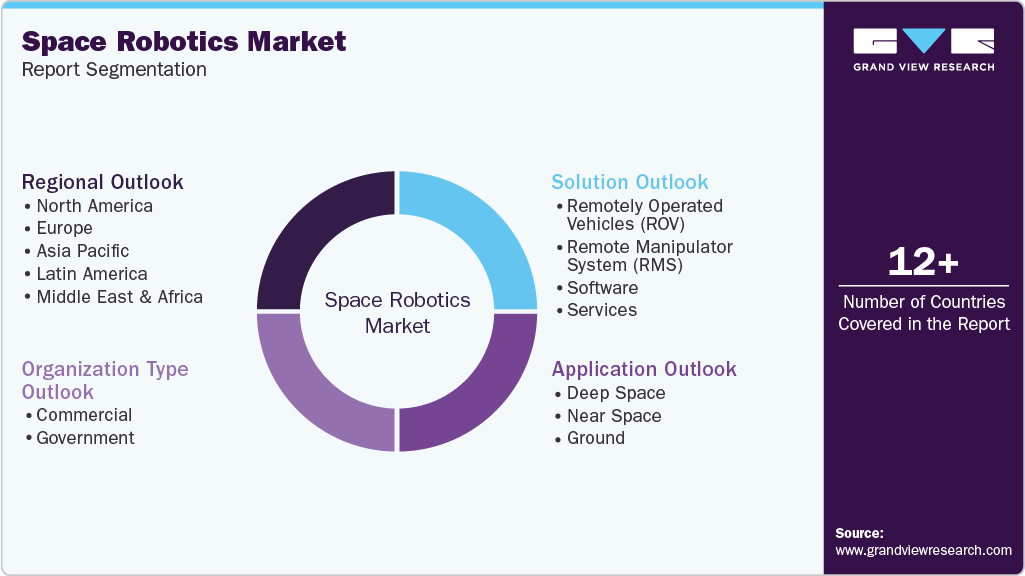

Solution, application, organization type, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

ASTROBOTIC TECHNOLOGY; Motiv Space Systems, Inc.; MDA Space; ASTROSCALE; SPACEX; Intuitive Machines, LLC.; Ceres Robotics, Inc.; D-Orbit S.p.A.; Metecs, LLC.; Lunar Outpost Inc.; Orbit Fab, Inc.; Oceaneering International, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Space Robotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the global space roboticsmarket report based on solution, application, organization type, and region:

-

Solution Outlook (Revenue, USD Million, 2021 - 2030)

-

Remotely Operated Vehicles (ROV)

-

Rovers/Spacecraft Landers

-

Space Probes

-

Others

-

-

Remote Manipulator System (RMS)

-

Robotic Arms/Manipulator Systems

-

Gripping & Docking Systems

-

Others

-

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2030)

-

Deep Space

-

Space Transportation

-

Space Exploration

-

Others

-

-

Near Space

-

Space Transportation

-

Space Exploration

-

In-space Maintenance

-

Others

-

-

Ground

-

-

Organization Type Outlook (Revenue, USD Million, 2021 - 2030)

-

Commercial

-

Government

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global space robotics market was estimated at USD 5,039.8 million in 2024 and is expected to reach USD 5,412.8 million in 2025.

b. The global space robotics market is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2030 and to reach USD 8,503.2 million by 2030.

b. The North America space robotics market accounted for the largest market share of over 40% in 2024, primarily driven by strong investments from national space agencies and commercial space companies, accelerating robotic technology deployment for space missions. The region’s leadership in autonomous satellite servicing, space station maintenance, and planetary exploration programs promotes the adoption of advanced robotics. Heightened focus on space security, debris mitigation, and the development of next-generation deep-space missions continues to propel the demand for space robotics solutions in the region.

b. The key players in the space robotics market are ASTROBOTIC TECHNOLOGY, Motiv Space Systems, Inc., MDA Space, ASTROSCALE, SPACEX, Intuitive Machines, LLC., Ceres Robotics, Inc., D-Orbit S.p.A., Metecs, LLC., Lunar Outpost Inc, Orbit Fab, Inc., Oceaneering International, Inc.

b. Key drivers of the space robotics market include the increasing focus on autonomous satellite servicing, on-orbit manufacturing, and planetary exploration missions that demand high-precision robotic systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.