- Home

- »

- Next Generation Technologies

- »

-

Space Technology Market Size, Share, Industry Report, 2030GVR Report cover

![Space Technology Market Size, Share & Trends Report]()

Space Technology Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Satellite Systems, Launch Systems, Ground Systems, In Space Infrastructure Systems), By End-use (Commercial, Military), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-086-9

- Number of Report Pages: 139

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Space Technology Market Summary

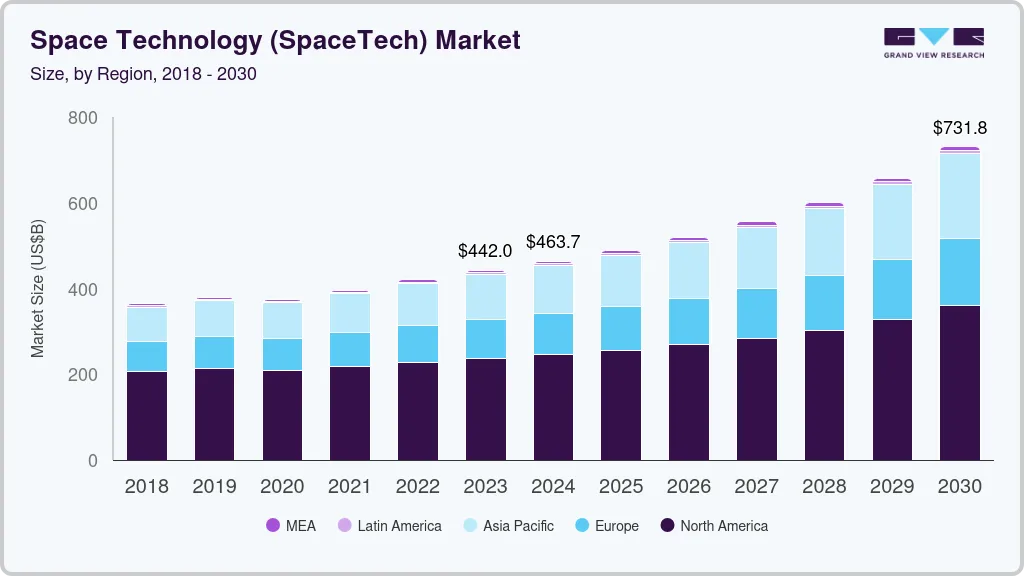

The global space technology market size was estimated at USD 466.1 billion in 2024 and is projected to reach USD 769.7 billion by 2030, growing at a CAGR of 9.3% from 2025 to 2030. This growth trend is fueled by a surge in government and private sector investments across key areas such as satellite communications, earth observation, space tourism, and interplanetary exploration.

Key Market Trends & Insights

- The space technology market in North America generated the highest revenue share, accounting for over 46% in 2024.

- The U.S. space technology market held a dominant position in 2024.

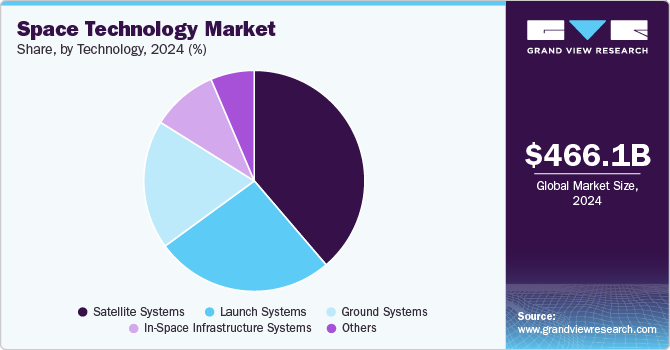

- By technology, the satellite systems segment captured the highest revenue share of over 38% in 2024.

- By application, the navigation & mapping segment captured highest market share in 2024.

- By end-use, the government segment captured a significant revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 466.1 Billion

- 2030 Projected Market Size: USD 769.7 Billion

- CAGR (2025-2030): 9.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advancements in miniaturization, artificial intelligence, and robotics are accelerating innovation in space missions, while the emergence of reusable rockets and commercial spaceports is dramatically reducing launch costs. At the same time, rising geopolitical tensions and national security priorities are prompting increased investment in satellite defense capabilities.The space technology (SpaceTech) industry is being revolutionized by the development and adoption of reusable rocket systems. Companies such as SpaceX and Blue Origin have shown that launching, landing, and relaunching the same rocket significantly reduces operational costs. This innovation enables more frequent and affordable access to orbit, expanding mission feasibility for both government and commercial stakeholders. Reusability enhances launch cadence, improves supply chain predictability, and supports rapid deployment of satellite networks. The trend aligns with environmental sustainability goals and long-term space infrastructure development. Economic efficiency and mission scalability are the major forces driving this shift within the space technology industry.

The space technology industry plays a vital role in monitoring climate change, environmental patterns, and natural disasters. Earth observation satellites provide real-time imagery and analytics for agriculture, forestry, urban planning, and emergency response. High-resolution data enables early warnings, better decision-making, and sustainable resource management. Governments and corporations rely on these tools to meet sustainability goals and policy frameworks. Advancements in optical and radar imaging are enhancing precision and usability. The growing need for environmental intelligence fuels this trend in the space technology industry.

Additive manufacturing is gaining momentum in the space technology (SpaceTech) industry for producing parts and tools directly in space. 3D printers aboard the ISS have already fabricated mission-critical components. This capability reduces dependence on Earth-based supply chains and supports deep space missions. Future applications include printing habitats on the Moon or Mars using local materials. The ability to manufacture on-demand enhances mission flexibility and cost efficiency. Innovation in this space is poised to redefine logistics within the space technology industry.

The space technology industry is advancing in-orbit satellite service, including refueling, repairs, and upgrades. These services extend satellite lifespans and reduce the need for costly replacements. Robotic servicing missions have already demonstrated success in repositioning and maintaining space assets. In-orbit service also supports debris mitigation by safely deorbiting defunct satellites. Insurance companies and satellite operators are increasingly interested in these capabilities. The emphasis on asset longevity and sustainability is driving this trend in the space technology industry.

Technology Insights

The satellite systems segment captured the highest revenue share of over 38% in 2024. The rising demand for real-time data, global internet coverage, and secure communications is fueling growth in the satellite systems segment. The shift from traditional geostationary satellites to LEO and MEO constellations enables lower latency and higher bandwidth, which is crucial for modern applications, including autonomous vehicles, IoT connectivity, and smart agriculture. Governments and private players are also increasing investments in dual-use satellites for both civilian and defense purposes, reflecting the strategic importance of space assets. The emergence of satellite-as-a-service (SataaS) models is lowering entry barriers, allowing smaller organizations to access satellite capabilities without owning infrastructure.

The in-space infrastructure systems segment is expected to witness the highest CAGR of over 13% from 2025 to 2030. The in-space infrastructure systems segment is rapidly evolving as space exploration shifts from short-term missions to sustained, long-duration operations. Key drivers include the development of robotic servicing, in-orbit refueling, and modular habitats that enable flexible and cost-effective infrastructure. The rise of commercial space stations and lunar gateways reflects a growing private-sector role in supporting research, tourism, and deep space logistics. As nations and companies invest in cislunar and Mars infrastructure, this segment is becoming central to the future of the space economy.

Application Insights

The navigation & mapping segment captured highest market share in 2024. The use of satellite-based Earth observation for mapping and monitoring is transforming sectors such as urban planning, disaster management, and environmental monitoring. Companies such as Planet Labs and Maxar Technologies are developing high-resolution imaging satellites that provide real-time geospatial data for mapping applications. These advancements enable detailed land use tracking, infrastructure development, and environmental hazard assessment.

The ability to collect vast amounts of data globally with a high frequency ensures up-to-date and accurate maps, critical for decision-making in both the private and public sectors. Additionally, AI-powered analysis is increasingly being used to automate the interpretation of satellite imagery, further improving mapping efficiency. This trend is helping stakeholders, from government agencies to commercial businesses, make data-driven decisions for better resource management.

The data & analytics segment is expected to witness the highest CAGR from 2025 to 2030. The fusion of satellite data with predictive analytics and machine learning is transforming real-time decision-making across industries. From forecasting natural disaster risks in insurance to optimizing supply chains, space-based insights are enabling smarter, faster, and more accurate predictions. As analytics tools evolve, this trend is unlocking new use cases and revenue streams, fueling broader adoption of space-derived intelligence.

End-use Insights

The government segment captured a significant revenue share in 2024. Government agencies are increasingly viewing space as a critical domain for national security, driving significant investments in secure satellite communication and surveillance systems. The space technology (SpaceTech) market is seeing enhanced defense programs that include missile early-warning, reconnaissance, and cyber defense capabilities. Such programs aim to safeguard vital space assets against potential threats and emerging cyber vulnerabilities. Strategic partnerships between national defense organizations and private companies are accelerating the development of cutting-edge technologies.

The commercial segment is expected to witness the highest CAGR from 2025 to 2030. As private companies explore human presence beyond Earth, commercial space stations are gaining traction as a future segment of the space technology (SpaceTech) market. Companies such as Axiom Space and Bigelow Aerospace are working on developing private space stations and habitats that could host commercial research, manufacturing, and tourism activities. These commercial stations could serve as alternatives to or complement for the International Space Station (ISS), particularly as the ISS's operational life comes to an end. Such stations will be vital for the advancement of long-duration space exploration, including lunar and Mars missions.

Regional Insights

The space technology market in North America generated the highest revenue share, accounting for over 46% in 2024. There is growing investment in space defense and national security, led by the U.S. Space Force and defense contractors. North America is prioritizing early-warning systems, space situational awareness, and satellite resilience in response to geopolitical threats. As a result, dual-use technologies and military-grade satellite systems are becoming a key driver of market growth.

U.S. Space Technology Market Trends

The U.S. space technology market held a dominant position in 2024. The U.S. is also witnessing rapid growth in dual-use space technologies, supporting both civilian and military applications, particularly in surveillance, secure communications, and navigation. The rise of venture-backed space startups is fueling innovation in areas such as on-orbit servicing, AI-powered satellites, and space-based data analytics. Additionally, increased investment in space situational awareness and traffic management systems reflects the country's focus on safety, resilience, and long-term sustainability in space operations.

Europe Space Technology Market Trends

The space technology market in Europe was identified as a lucrative region in 2024. In Europe, countries are focusing on collaborative projects to develop advanced satellite technologies and space debris management systems. European countries France, Germany, and the UK are working together under the European Space Agency (ESA) to deploy satellite constellations for global communication and Earth observation. Moreover, the growing concern about space debris is driving European firms and governments to develop technologies to clean up orbiting waste and prevent collisions. Europe's emphasis on sustainability in space will shape its space policies and technological developments in the coming years.

The UK space technology market is focusing on the development of spaceports, particularly in Scotland and Cornwall, to establish itself as a key player in the small satellite launch market. With companies including Orbex and Skyrora leading the charge, the U.K. aims to provide flexible, low-cost access to space for small satellite operators. This trend is supported by government investment and regulatory frameworks designed to make the U.K. an attractive destination for commercial space launches.

The space technology market in Germany is advancing its position in space science, with significant contributions to deep-space exploration and planetary science through missions such as Rosetta and ExoMars. The country's collaboration with ESA and other international partners allows it to lead in astrophysics and robotics for space exploration. With institutions such as the German Aerospace Center (DLR) driving research, Germany is at the forefront of space technology development for both scientific and commercial applications.

Asia-Pacific Space Technology Market Trends

The Asia Pacific space technology market is expected to grow at the highest CAGR of 11.3% from 2025 to 2030. In the Asia-Pacific region, countries including Japan, South Korea, and Australia are investing heavily in satellite communication and navigation systems to enhance regional connectivity and technological independence. Japan is advancing its space program with a focus on high-resolution Earth observation satellites and space infrastructure development. Meanwhile, India’s space agency ISRO is making notable strides in small satellite launches and interplanetary missions, with plans to launch satellites that provide global positioning systems for the region. Asia-Pacific's growing reliance on space technology is making it a key player in the global space race.

The space technology market in China has become one of the most ambitious players in the market, with its rapidly advancing space exploration and infrastructure development. The China National Space Administration (CNSA) has made significant strides in human spaceflight, moon missions, and space station development with the launch of the Tiangong Space Station. Additionally, China’s Beidou Navigation Satellite System is positioning the country as a global competitor to the U.S.-led GPS. The expansion of China’s space ambitions is making it a formidable force in the international space market, especially in satellite services, space exploration, and communication.

India space technology market, led by ISRO, has become synonymous with cost-effective space missions, garnering attention for its successful launches, the Chandrayaan and Mangalyaan missions to the Moon and Mars, respectively. The country’s focus on small satellite launches and space exploration is positioning it as a rising star in global space activities. Moreover, India’s remote sensing satellites and growing involvement in international satellite launch services, such as those through Antrix Corporation, are helping expand its footprint in the commercial space sector. India’s ability to provide low-cost solutions in space technology is becoming a competitive advantage.

Key Space Technology Company Insights

Some key players operating in the market include Airbus SE and Lockheed Martin Corporation

-

Airbus SE is a global leader in the aerospace sector, involved in the design and manufacturing of both space and satellite systems. The company specializes in producing geostationary satellites, space exploration systems, and spacecraft for various purposes, including communications, Earth observation, and scientific exploration. Airbus also works on launch services and space transportation solutions through its Arianespace subsidiary. The company is at the forefront of innovative space technology, such as developing laser communication systems and high-performance satellite payloads.

-

Lockheed Martin Corporation is one of the leading companies in the space technology sector, with expertise in satellite systems, launch vehicles, and space exploration missions. The company specializes in advanced space systems, including Mars exploration rovers, space telescopes, and orbital defense technologies. Lockheed is also engaged in space-based missile defense systems and hypersonic technology. Their broad portfolio spans both civilian and defense applications, serving a range of governments and private sector clients.

Astra Space Inc. and ICEYE are some emerging participants in space technology industry.

-

Astra Space Inc. is an emerging player in the space industry focused on small satellite launch services. The company provides low-cost, flexible launch solutions for small payloads, catering to commercial, government, and military sectors. Astra specializes in small rockets, offering frequent launches at lower prices than traditional heavy-lift providers. They aim to revolutionize satellite deployment and space access by enabling more frequent and affordable access to orbit.

-

ICEYE is an emerging satellite technology company that focuses on providing radar imaging and Earth observation solutions via synthetic aperture radar (SAR) satellites. ICEYE's specialized technology allows for real-time, all-weather imaging, providing valuable data for applications in sectors including defense, insurance, and environmental monitoring. The company offers on-demand satellite imaging services to a variety of industries, ensuring quick and reliable information about global events. ICEYE is rapidly advancing in satellite miniaturization and SAR technology, positioning itself as a key player in the Earth observation market.

Key Space Technology Companies:

The following are the leading companies in the space technology (spacetech) market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus SE

- Astra Space Inc.

- Ball Corporation

- Blue Origin LLC

- Boeing

- General Dynamics Corporation

- Hedron

- Hindustan Aeronautics Limited

- Honeywell International Inc.

- ICEYE

- Lockheed Martin Corporation

- Maxar Technologies

- Northrop Grumman Corporation

- OHB System AB

- Rocket Lab USA

- Safran S.A.

- Sierra Nevada Corporation

- SpaceX

- Thales Group

- Virgin Galactic.

Recent Developments

-

In April 2025, Russian company Avant Space unveiled plans to transform the night sky into a vast advertising platform by deploying laser-equipped satellites. These satellites would project advertisements-including logos and QR codes-visible during dawn and dusk to minimize interference with astronomical research and reduce light pollution. The initiative has sparked opposition from the scientific community, concerned about potential disruptions to astronomical observations and the increasing clutter in low-Earth orbit.

-

In April 2025, Honda announced plans to develop a regenerative fuel cell system to support sustained human presence on the Moon. This system aims to produce electricity, oxygen, and hydrogen by harnessing solar energy to electrolyze water, providing breathable oxygen for astronauts and generating power for lunar colonies. Honda is collaborating with Sierra Space and Tec-Masters to test components of this system aboard the International Space Station, marking a significant step toward establishing a self-sustaining energy infrastructure for future lunar missions.

-

In February 2025, India's space regulator, IN-SPACe, launched a Technology Adoption Fund worth 5 billion rupees (USD 57.58 million) to promote early-stage space technology commercialization and reduce reliance on imports. The fund will provide financial support covering up to 60% of project costs for startups and SMEs, with a maximum of 250 million rupees per project. This initiative is part of the government's broader strategy to liberalize the space sector and attract global investments, similar to the commercial space growth in the U.S. and Europe.

Space Technology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 494.3 billion

Revenue forecast in 2030

USD 769.7 billion

Growth rate

CAGR of 9.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, application, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; Mexico

Key companies profiled

Northrop Grumman Corporation; Lockheed Martin Corporation; SpaceX; Maxar Technologies; Boeing; Thales Group; Safran S.A.; Rocket Lab USA; ICEYE; Airbus SE; among others

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Space Technology Market Report Segmentation

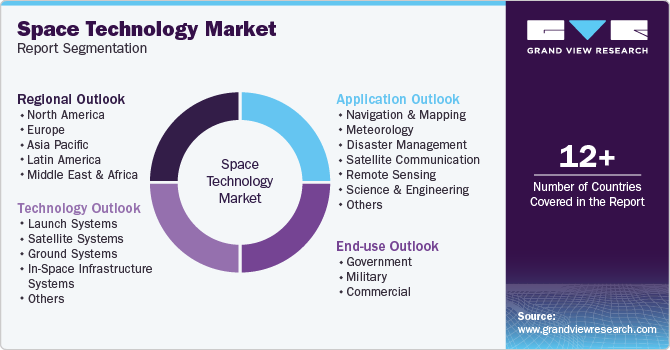

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global space technology (SpaceTech) market report based on technology, end-use, application, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Launch Systems

-

Satellite Systems

-

Ground Systems

-

In-Space Infrastructure Systems

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Government

-

Military

-

Commercial

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Navigation & Mapping

-

Meteorology

-

Disaster Management

-

Satellite Communication

-

Remote Sensing

-

Science & Engineering

-

Earth Observation

-

Military and national security

-

Data & Analytics

-

Information Technology

-

Internet Services

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global space technology market size was estimated at USD 466.13 billion in 2024 and is expected to reach USD 494.33 billion in 2025.

b. The global space technology market is expected to grow at a compound annual growth rate of 9.3% from 2025 to 2030 to reach USD 769.70 billion by 2030.

b. Based on technology, the satellite systems segment dominated the market in 2024 with a share of more than 38.0%. The rising demand for real-time data, global internet coverage, and secure communications is fueling growth in the satellite systems segment.

b. The key players in this industry are Northrop Grumman Corporation, Lockheed Martin Corporation, SpaceX, Maxar Technologies, Boeing, Thales Group, Safran S.A., Rocket Lab USA, ICEYE, Airbus SE, and among others.

b. Key factors that are driving the space technology market growth include technological advancements, increasing private sector participation, and growing government initiatives among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.