Spain Flavors Market Summary

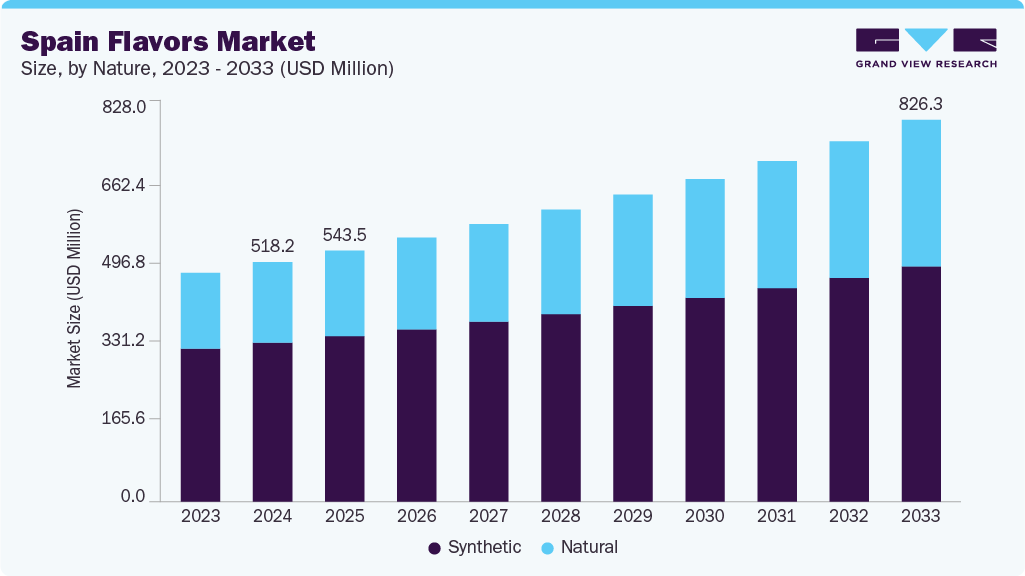

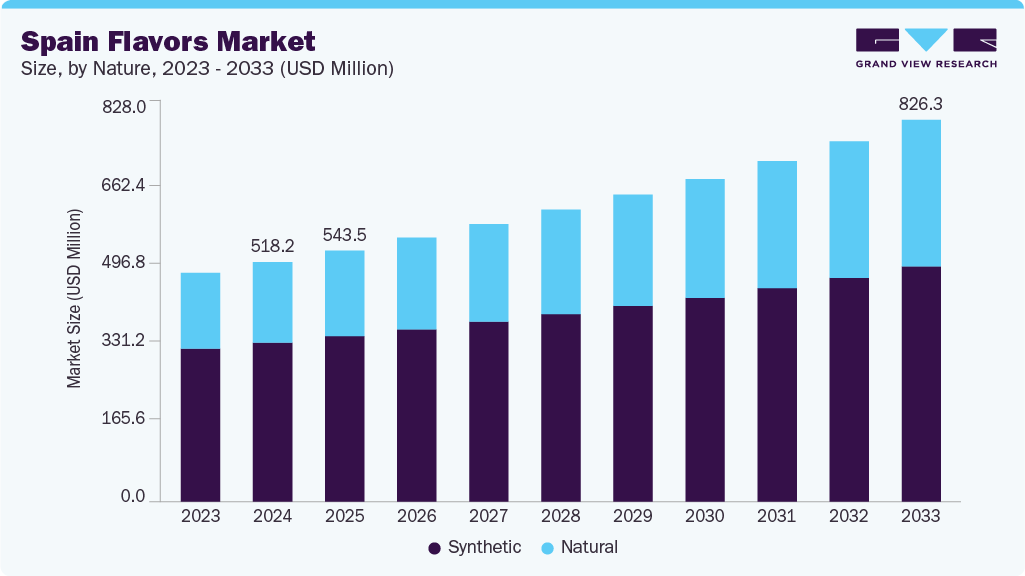

The Spain flavors market size was estimated at USD 518.2 million in 2024 and is expected to reach USD 826.3 million by 2033, expanding at a CAGR of 5.4% from 2025 to 2033. This growth is driven by rising consumer demand for natural and clean-label ingredients, the expansion of the functional food & beverage industry, and the increasing popularity of global cuisines in Spain.

Key Market Trends & Insights

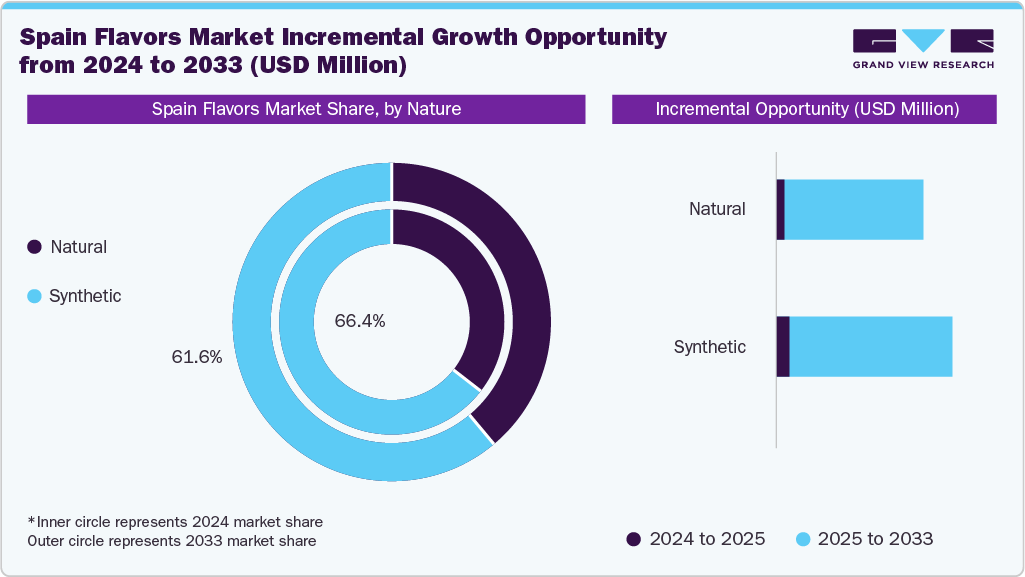

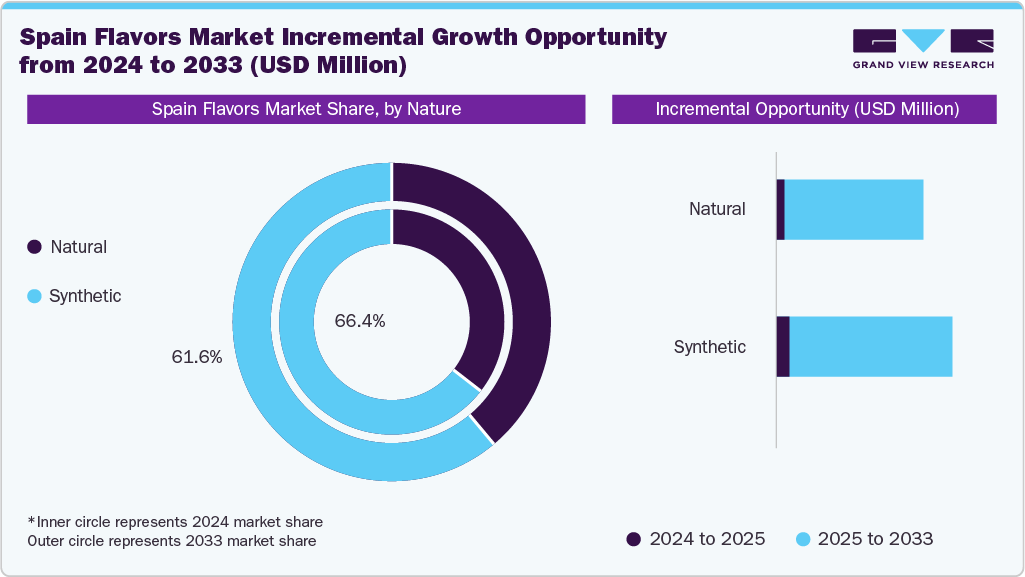

- By nature, the synthetic segment held the largest market share of 66.4% in 2024.

- Based on form, the powder segment is projected to grow at the fastest CAGR of 5.8% from 2025 to 2033.

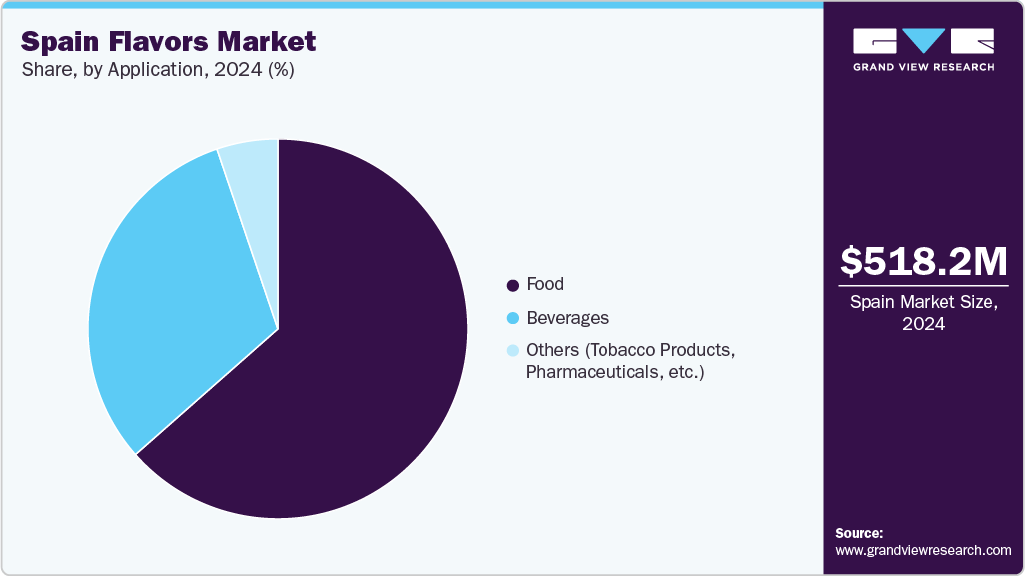

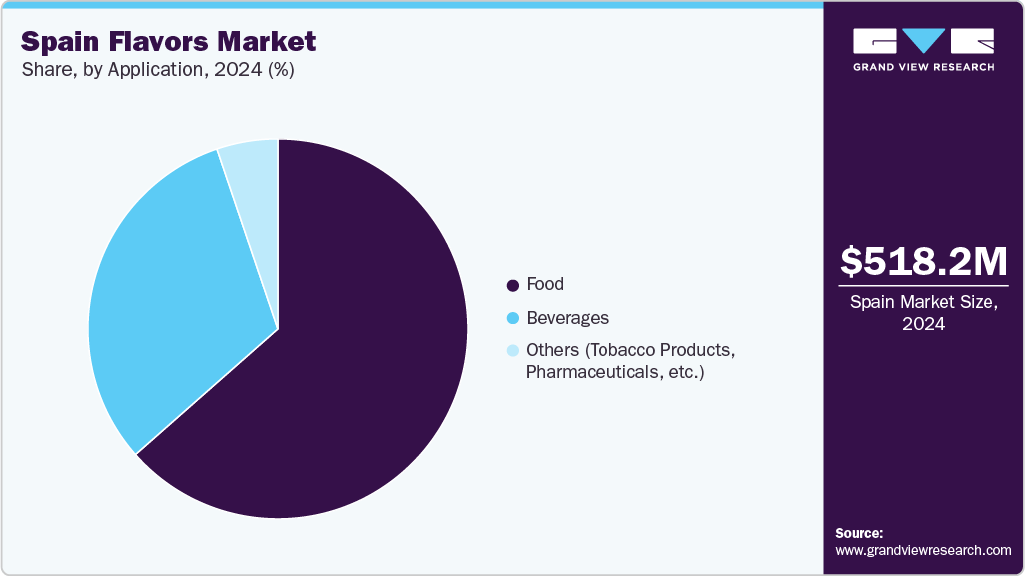

- By application, the food segment held the largest market share of 63.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 518.2 Million

- 2033 Projected Market Size: USD 826.3 Million

- CAGR (2025-2033): 5.4%

The growing awareness regarding health and wellness is pushing manufacturers to develop flavors that cater to sugar reduction, develop plant-based products, and fortified food & beverage formulations. Spain’s strong processed food industry, along with the growing demand for flavored dairy products and ready-to-drink beverages, is fueling the growth of the flavors market. Advances in encapsulation and delivery systems are helping manufacturers offer flavors with better stability, longer shelf-life, and richer taste, supporting their wider use across products. In addition, strong export position of Spain within the EU motivates producers to create tailored flavor solutions that match the changing tastes of consumers across food, beverage, and pharmaceutical applications.

Government initiatives promoting healthier diets and transparency in food labeling are expected to influence the flavors market in the coming years significantly. These efforts are pushing manufacturers to use more natural and clean-label flavor options. In addition, EU regulations on food safety and additives guide the use of flavoring substances, ensuring consumer safety and standardization across food & beverage products in Spain. For instance, under the WHO Framework Convention on Tobacco Control (WHO FCTC) and the EU Tobacco Products Directive, Spain has banned the characterization of flavors, including menthol, in heated tobacco products. The regulatory push is expected to impact the flavors market, requiring manufacturers to adjust formulations to comply with these restrictions while maintaining product acceptability.

Nature Insights

The synthetic segment dominated the Spain flavors market and accounted for a revenue share of 66.4% in 2024. The strong demand for processed and packaged foods in Spain continues to support synthetic flavors in bakery, confectionery, snacks, and soft drinks. In addition, the ability to replicate complex flavor profiles at a lower cost makes synthetic flavors a practical choice for manufacturers operating in competitive pricing environments. Unlike natural flavors, which depend on seasonal and agricultural variables, synthetic flavors are stable and scalable. This makes synthetic products ideal for large-batch production and ensures uniformity across the product line.

The natural segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2033. The rising interest in plant-based and vegan diets encourages the development of natural flavors that align with clean-label trends while enhancing taste. As more consumers focus on health, there is a growing need for flavors that help reduce sugar in drinks and snacks without compromising taste. The expanding hotel, restaurant, and cafe sector is also expected to drive the demand for creative flavors in sauces, desserts, and beverages. Moreover, the popularity of premium and artisanal foods and drinks in Spain creates opportunities for unique and authentic flavors, presenting new avenues for the growth of the natural flavors segment.

Form Insights

The powder form segment accounted for the largest revenue share of the Spain flavors industry in 2024 and is expected to record the fastest CAGR over the forecast period. This dominance is driven by powdered flavors' practicality and stability across a wide range of food & beverage applications. Powders are easier to transport and store, have a longer shelf life, and allow manufacturers to maintain consistent flavor profiles while controlling costs. In Spain, powdered flavors are especially notable in bakery products, snacks, and instant beverage mixes, where precise dosing and quick solubility are critical for production efficiency.

The liquid/gel form segment is projected to grow rapidly from 2025 to 2033. This growth is driven by the versatility of liquid and gel flavors in beverages, dairy, and confectionery products, where immediate solubility, uniform distribution, and enhanced sensory profiles are critical. In Spain, the rising demand for flavored beverages, including functional drinks and ready-to-drink coffees, is fueling the uptake of liquid flavors that allow manufacturers to achieve consistent taste while reducing processing complexity. Liquid and gel flavors are favored for blending seamlessly into syrups, fillings, and creams, ensuring homogeneity in taste and color without altering the texture of end products.

Application Insights

The food segment dominated the Spain flavors market with a revenue share of 63.5% in 2024. This growth is driven by the country’s strong processed food industry and rising demand for convenient and flavorful ready-to-eat meals across categories such as bakery, dairy, snacks, and sauces. Consumers in Spain are increasingly seeking products with authentic Mediterranean taste profiles while demanding clean-label and natural ingredients in their everyday foods. To meet these evolving preferences, manufacturers are incorporating floral and superfruit flavor blends in bakery and confectionery items, such as lavender-lemon cakes and fruit-infused desserts, to deliver new taste experiences.

The beverages segment is expected to grow at the fastest CAGR from 2025 to 2033. Growing consumer demand for healthier and flavorful beverages is shaping Spain’s market for liquid flavors. As more people prioritize wellness, they are reaching for functional drinks, ready-to-drink teas, fruit-based beverages, and low- or no-alcohol options that offer innovative taste experiences while supporting healthier lifestyles. To meet these preferences, manufacturers use natural and clean-label flavors, incorporating botanical, floral, and exotic fruit profiles to create distinct products while reducing sugar content.

Key Spain Flavors Company Insights

Some key companies operating in the market include Givaudan, International Flavors & Fragrances Inc., Symrise, and dsm-firmenich.

-

Givaudan is the global leader in flavors and fragrances, with its Taste & Wellbeing division supplying custom flavor solutions to the food and beverage industry worldwide. In Spain, Givaudan operates a major production site in Sant Celoni, which is dedicated to manufacturing high-quality ingredients for flavor and fragrance applications.

Key Spain Flavors Companies:

- Givaudan

- International Flavors & Fragrances Inc.

- Symrise

- dsm-firmenich

Spain Flavors Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 543.5 million

|

|

Revenue forecast in 2033

|

USD 826.3 million

|

|

Growth rate

|

CAGR of 5.4% from 2025 to 2033

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD Million and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Nature, form, application, country

|

|

Key companies profiled

|

Givaudan; International Flavors & Fragrances Inc.; Symrise; dsm-firmenich

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Spain Flavors Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Spain flavors market report based on nature, form, and application:

-

Nature Outlook (Revenue, USD Million, 2018 - 2033)

-

Form Outlook (Revenue, USD Million, 2018 - 2033)

-

Application Outlook (Revenue, USD Million, 2018 - 2033)