- Home

- »

- Biotechnology

- »

-

Spatial Genomics & Transcriptomics Market Report, 2030GVR Report cover

![Spatial Genomics & Transcriptomics Market Size, Share & Trends Report]()

Spatial Genomics & Transcriptomics Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Spatial Transcriptomics, Spatial Genomics), By Product (Consumables, Software), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-220-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spatial Genomics & Transcriptomics Market Summary

The global spatial genomics & transcriptomics market was estimated at USD 232.5 million in 2022 and is projected to reach USD 574.3 million by 2030, growing at a CAGR of 12.2% from 2023 to 2030. The implementation of spatial genomics & transcriptomics in drug discovery and development is experiencing an increasing demand.

Key Market Trends & Insights

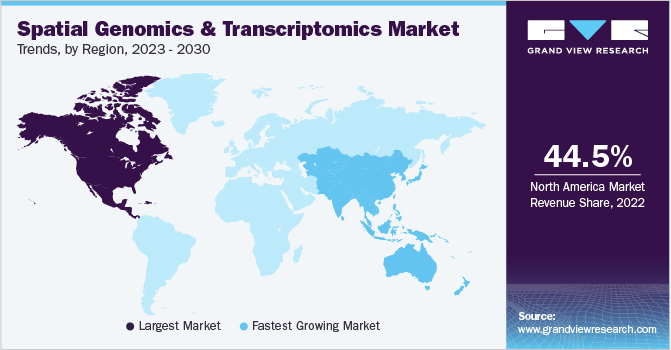

- North America dominated the market, accounting for 44.47% of the revenue share in 2022.

- The Asia Pacific region is anticipated to be the fastest-growing regional market over the forecast period.

- By technology, the spatial transcriptomics segment held the largest revenue share of 79.0% in 2022.

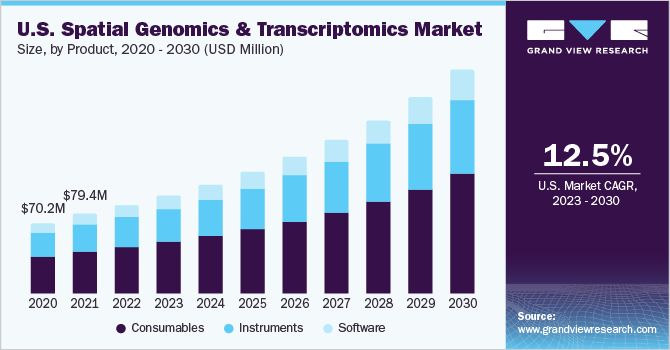

- By product, the consumables segment accounted for the highest revenue share of 52.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD USD 232.5 Million

- 2030 Projected Market Size: USD 574.3 Million

- CAGR (2023-2030): 12.2%

- North America: Largest market in 2022

Over the past few years, this demand has expanded beyond research and has become focused on drug discovery & development, particularly for disorders such as neurodegenerative disorders and cancer. The rising potential of spatial genomic analysis as a cancer detection tool and the introduction of the fourth generation of sequencing are anticipated to further fuel the growth.

For example, as per the Frontiers Journal paper released in October 2022, spatial transcriptomics was discussed as a benefit for detecting and thoroughly understanding unique spatial locations such as tumor interfaces and tertiary lymphoid structures. The study also inferred that spatial transcriptomics had considerable potential for enhancing pathology diagnosis and discovering new cancer prognostic variables. These advantages of spatial genomics and transcriptomics for cancer detection are anticipated to fuel market expansion.

The other key drivers influencing the market expansion include the rising demand for personalized medicine, the identification of novel biomarkers for diagnosis, and an increase in investments in research & development. The increasing incidence of chronic diseases, especially cancer, increases the diagnosis rate along with the scope for advanced diagnostics. As per the National Center for Health Statistics, in the U.S., there were 1,918,030 new cancer cases in 2022, and 609,360 deaths due to cancer.

The rising number of product launches and investments made by different market participants in the discovery of cutting-edge spatial genomics and transcriptomics technologies is also one of the factors boosting the market. For instance, in June 2022, AGBT general conference in Orlando, 10x Genomics unveiled several product enhancements, such as Chromium, Visium, Xenium, and various others.

Additionally, in February 2022, Fulgent Genetics invested in Spatial Genomics Inc. to help the latter develop its seqFISH technology and multi-omics platform for use in the company's full range of genetic testing services. In addition to the market drivers, the lack of skilled professionals associated with spatial genomics and transcriptomics, coupled with high equipment cost is leading to the low adoption rate of transcriptomic techniques and technology.

Technology Insights

The spatial transcriptomics segment generated the largest revenue share of 79.0% in 2022. High adoption compared to spatial genomic methods, for the transcriptomic study of single cells is a key segment driver. The segment dominance is due to the accessibility of automated sequencing methodologies to cater to the growing demand for nucleic acid sequencing of biological samples or single cells.

Sequencing of a nucleic acid of single cells or specific biological specimens has increased, which has driven the need for automated, robust, and scalable library preparation solutions. Furthermore, an increased understanding of tissue heterogeneity has resulted in the launch of several unique sequencing workflows that are aimed at inferring or preserving spatial information. This has also accelerated the revenue flow in this segment.

The determination of the spatial arrangement of molecules in cells and tissue samples is the basis for biological research and clinical practice and has gained the attention of several entities involved in the field of genetics. Furthermore, advancements in genome perturbation tools like the CRISPR/Cas9 system aid the adoption of spatial genomic tools, thereby driving the segment. Moreover, there is an increasing adoption rate of in situ sequencing techniques, which would further boost the segment’s growth.

Product Insights

The consumables segment accounted for the highest revenue share of 52.6% in 2022. repetitive consumption across various workflow steps along with a large number of product offerings from key players are the major reason for revenue leadership. Spatial genomics and transcriptomics offer unique advantages in studying the spatial organization and interactions of cells within complex biological systems. This allows researchers to gain insights into the spatial distribution of genes and their expression patterns, which is not possible with traditional genomics methods.

The development of any new instrument or upgrade of any existing instrument has a direct impact on the growth of the segment, as the development of any new instrument will result in the need for developing the required consumables. On the other hand, the software segment is anticipated to grow lucratively through 2028. The increasing volume of ongoing genomic research studies has led to the need for robust software solutions for data management and their interpretation.

According to the World Health Organization, the U.S. had an estimated 1.9 million new cases of cancer in 2021. The survey also stated that in 23 nations, cervical cancer is the most prevalent and that 400,000 young population is diagnosed with cancer each year. Breast, lung, colon, rectum, and prostate cancers are the most prevalent types of cancer. The rising prevalence of cancer cases is anticipated to increase demand for consumables and support segment expansion.

Additionally, it is anticipated that product launches, acquisitions, and collaborations are likely to support the expansion of the research segment. For instance, in October 2022, Oxford Nanopore Technologies and 10x Genomics collaborated to manufacture consumables for single-cell and spatial full-length isoform transcript sequencing. Such collaborations to create cutting-edge consumables are anticipated to favor the segment’s growth.

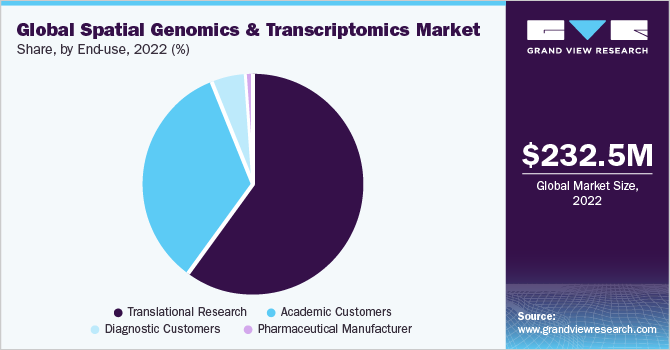

End-use Insights

The translational research segment held the largest revenue share of 60.2% in 2022. The use of spatial omics technologies in translational research may potentially benefit research by providing a thorough analysis of the physiology & state of a disease which further propels the introduction of new diagnostic tools and therapeutics. In addition, spatial genomics & transcriptomics are being used to provide high-throughput information on the organizational structure of cell content from tissues and cell species. Considering these potential benefits, key players are involved in the research and development of predictive and pharmacogenetic tests that help in the early diagnosis of critical disorders.

Academic end-users have captured one of the largest revenue shares in the year 2022. This is because spatial genomic analyses are increasingly being employed in academic research institutions as they provide a comprehensive analysis of various disorders. For instance, the research institute at the Children’s Hospital of Philadelphia has installed a Center of Spatial and Functional Genomics to study the genetic basis of several common disorders with the help of 3D Genomics-based techniques.

Spatial genomics and transcriptomics have enabled researchers at universities to explore new areas in gene expression dynamics. The technology finds applications in large research projects such as the Human Cell Atlas and is useful for academic researchers involved in the study of the morphological state of cells for genetically derived diseases such as cancer, diabetes, Alzheimer’s disease, and others.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 44.47% in 2022. This is due to the strategic investments in disease pathology research and increased focus on transcriptomics R&D. For instance, the ongoing Single Cell Analysis Program by the National Institutes of Health Common Fund initiated in 2012, focuses on sequencing approaches and improvement of spatial resolution through fluorescence-based techniques.

Along with novel developments and product launches, the introduction of preventive disease through genomics by a number of general hospitals and other concerned organizations would contribute to the market's growth. For instance, in March 2022 the National Institute of Health declared that it has a dataset of almost 100,000 whole-genome sequences from various organisms. Such research programs being conducted in various research institutes are predicted to maintain the demand for spatial genomics and transcriptomics.

Furthermore, regional companies are actively involved in collaborations for applications of spatial genomics and transcriptomics. In November 2021, Illumina in collaboration with Genetic Alliance launched a USD 120 million global program to strengthen equity and improve outcomes for families affected by genetic illnesses. This demonstrates that government organizations in North America place a significant emphasis on genomics, which will drive the market's growth during the projection period.

Another data from the Public Health Agency of Canada released in October 2021 showed that an estimated 2 in 5 Canadians had a cancer diagnosis at some point in their lifetime, and that number rose to an expected 229,000 in 2021. According to the survey, the most commonly diagnosed malignancies in 2021 were projected to be lung, breast, colorectal, and prostate cancers, accounting for approximately 46% of all diagnoses. The high prevalence of cancer cases in North American countries is anticipated to increase demand for cutting-edge diagnostics such as spatial genomics and transcriptomics, which will fuel the market's expansion.

The Asia Pacific region is anticipated to grow at a lucrative growth rate during the forecast period. The collaboration between regional research institutes and global companies is anticipated to boost regional revenue generation. For instance, in June 2022, the end-to-end RNA translational research capabilities of MGI's DNBSeq-T10 system, MiRxes, and BGI's Stereo-Seq technology were combined in the three-way agreement. The outcome will be based at the Biopolis research and development facility in Singapore, which is home to MiRxes' multiomics laboratory.

Competitive Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of the market share. New product launches, strategic collaborations, and partnerships are the key initiatives taken by various companies. For instance, in April 2023, Bio-Techne and Lunaphore announced a partnership to design and develop the world’s first automated spatial omics multiworkflow. The system will be designed to provide complete flexibility in panel design. Such R&D programs are likely to bring new products to the market. Furthermore, in February 2023, Curio Bioscience announced the launch of Curio Seeker, which is a whole-transcriptome spatial mapping kit with a high-resolution imaging technique. Some prominent players in the global spatial genomics & transcriptomics market include:

-

Natera Inc.

-

10x Genomics

-

Dovetail Genomics

-

Illumina, Inc.

-

S2 Genomics, Inc.

-

NanoString Technologies, Inc.

-

Seven Bridges Genomics

-

Horizon Discovery Group plc

-

Bio-Techne

Spatial Genomics & Transcriptomics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 256.8 million

Revenue forecast in 2030

USD 574.3 million

Growth Rate

CAGR of 12.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Natera Inc.; 10x Genomics; Dovetail Genomics; Illumina, Inc.; S2 Genomics, Inc.; NanoString Technologies, Inc.; Seven Bridges Genomics; Horizon Discovery Group plc; Bio-Techne

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

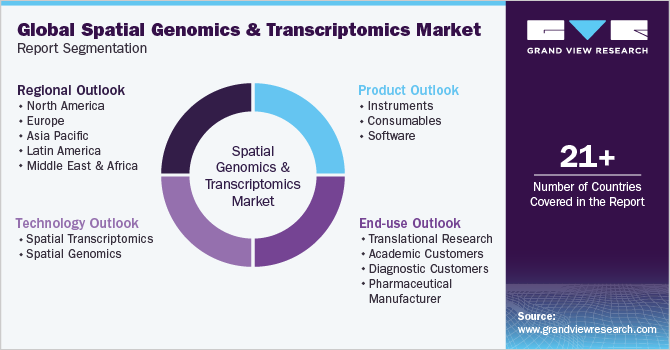

Global Spatial Genomics & Transcriptomics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spatial genomics & transcriptomics market report based on technology, product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Spatial Transcriptomics

-

Sequencing-Based Methods

-

Laser Capture Microdissection (LCM)

-

FFPE Tissue Samples

-

Others

-

-

Transcriptome In-Vivo Analysis (TIVA)

-

In Situ Sequencing

-

Microtomy Sequencing

-

-

IHC

-

Microscopy-based RNA Imaging Techniques

-

Single Molecule RNA Fluorescence In-Situ Hybridization (smFISH)

-

Padlock Probes/ Rolling Circle Amplification

-

Branched DNA Probes

-

-

-

Spatial Genomics

-

FISH

-

Microscopy-based Live DNA Imaging

-

Genome Perturbation Tools

-

Massively-Parallel Sequencing

-

Biochemical Techniques

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

By Mode

-

Automated

-

Semi-automated

-

Manual

-

-

By Type

-

Sequencing Platforms

-

IHC

-

Microscopy

-

Flow Cytometry

-

Mass Spectrometry

-

Others

-

-

-

Consumables

-

Software

-

Bioinformatics Tools

-

Imaging Tools

-

Storage and Management Databases

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Translational Research

-

Academic Customers

-

Diagnostic Customers

-

Pharmaceutical Manufacturer

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global spatial genomics & transcriptomics market size was estimated at USD 232.5 million in 2022 and is expected to reach USD 256.8 million in 2023.

b. The global spatial genomics & transcriptomics market is expected to grow at a compound annual growth rate of 12.2% from 2023 to 2030 to reach USD 574.3 million by 2030.

b. Spatial transcriptomics dominated the spatial genomics & transcriptomics market with a share of 79.0% in 2022 owing to the wide-scale implementation of spatial transcriptomic sequencing methods for the transcriptomic profiling of single cells.

b. Some key players operating in the spatial genomics & transcriptomics market include 10x Genomics; Dovetail Genomics; Illumina, Inc.; S2 Genomics, Inc.; NanoString Technologies; Seven Bridges Genomic; Horizon Discovery Group plc; CARTANA AB; and Advanced Cell Diagnostics.

b. Key factors that are driving the market growth include the emergence of the fourth generation of sequencing and the increasing demand for robust and early diagnostics in cancer management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.