- Home

- »

- Agrochemicals & Fertilizers

- »

-

Specialty Fertilizers Market Size, Industry Report, 2030GVR Report cover

![Specialty Fertilizers Market Size, Share & Trends Report]()

Specialty Fertilizers Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology, By Crop Type (Cereals & Grains, Frutis & Vegetables,Oilseeds & Pulses) By Type, By Application (Fertigation, Foliar, Soil), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-230-4

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Fertilizers Market Summary

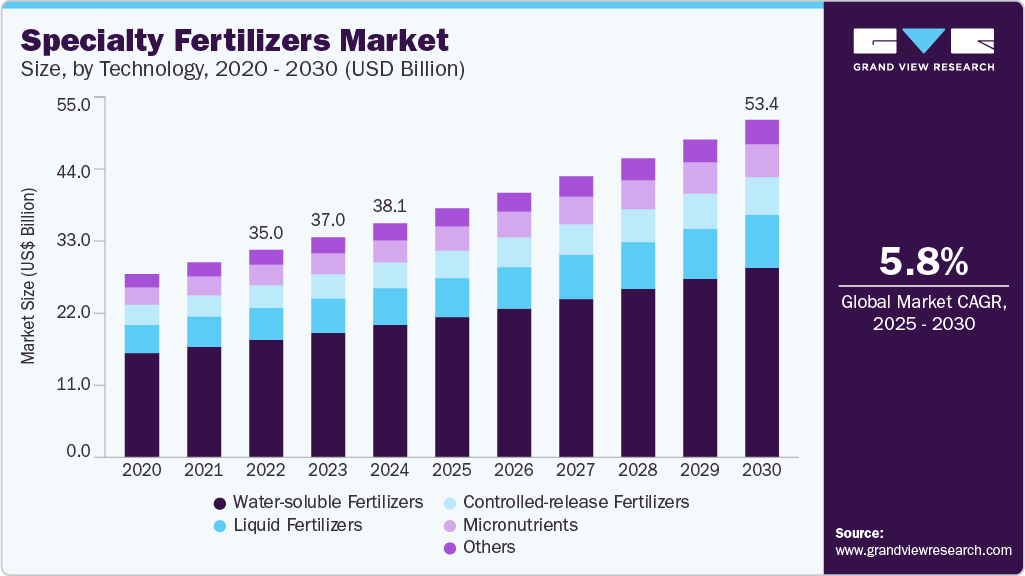

The global specialty fertilizers market size was estimated at USD 38,062 million in 2024 and is projected to reach USD 53,383.72 million by 2030, growing at a CAGR of 5.8% from 2025 to 2030. The dry segment is projected to hold the largest market share in the market.

Key Market Trends & Insights

- Asia Pacific dominated the specialty fertilizers market with the largest revenue share of 32.71% in 2024.

- The specialty fertilizers market in China accounted for the largest revenue share of 32.46% in 2024.

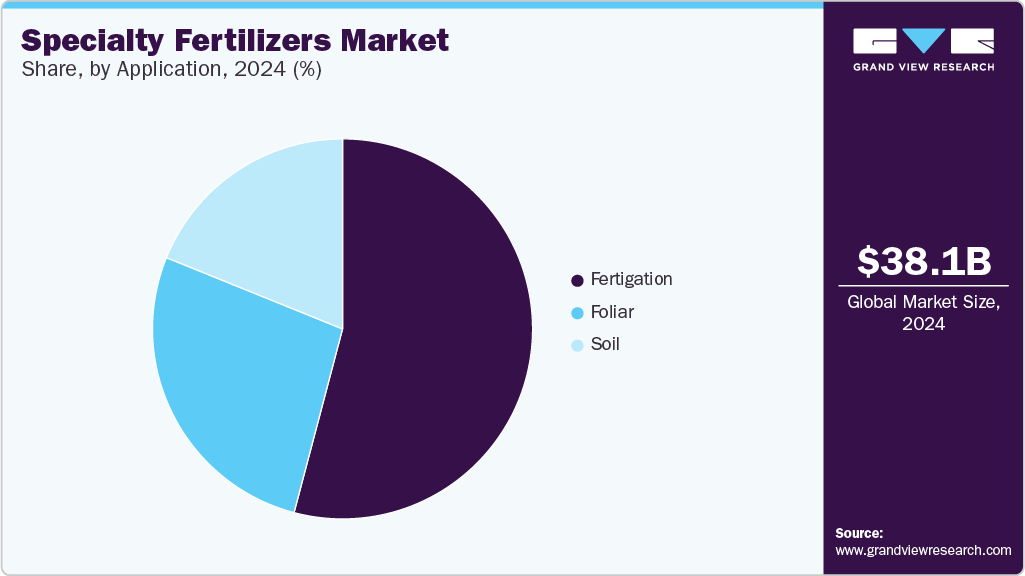

- Based on application, the fertigation segment led the market with the largest revenue share of 54.11% in 2024.

- Based on technology, the CRF technology segment accounted for the largest market revenue share in 2024.

- Based on type, the urea ammonium nitrate (UAN) fertilizer segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38,062 Million

- 2030 Projected Market Size: USD 53,383.72 Million

- CAGR (2025-2030): 5.8%

- Asia Pacific: Largest market in 2024

This is primarily due to the increasing use of controlled-release and slow-release fertilizers and the ease of application and high effectiveness of dry specialty fertilizers. In addition, dry specialty fertilizers are cost-effective, have a longer shelf life, provide long-term nutrient release, and perform well in all weather conditions, making them more efficient than their alternatives.The market is being primarily driven by factors such as the increasing demand for high-quality crops, the growing need for sustainable agricultural practices, and the adoption of precision agriculture techniques, which require specialized fertilizers. The high nutrient use efficiency and precise & localized application associated with specialty fertilizers are expected to drive the market in terms of value sales significantly.

Controlled-release fertilizers (CRF) are set to dominate the market. The CRFs work by gradually releasing nutrients to meet the changing demands of crops throughout their growth cycle. These consist of water-soluble nutrients encased within a polymer coating, forming granules. When applied to the soil, the polymer coating allows moisture to penetrate, initiating the release of nutrients. The rate of release is influenced by soil temperature, and the nutrients are released back into the rooting zone for plant uptake over an extended period. This controlled release helps maximize nutrient use efficiency, minimize environmental concerns, and provide plants with a more uniform and sustained supply of nutrients.

Market Concentration & Characteristics

The specialty fertilizers industry is fragmented with the presence of a large number of manufacturers. Specialty fertilizers come in various forms, such as controlled-release, water-soluble, micronutrient, and customized fertilizers, each catering to specific crop and soil needs. The market is driven by technological advancements, such as precision agriculture and fertigation, which require specialized fertilizers. The adoption of sustainable agriculture practices and precision farming techniques is driving the demand for the market.

The end-use concentration of the specialty fertilizers industry is influenced by various factors such as the type of crop, the application method, and the technology used. The products are tailored to specific crop types, including cereals & grains, fruits & vegetables, oilseeds & pulses, and turf & ornamentals. They are available in different forms such as controlled-release, water-soluble, and liquid fertilizers. The application methods include fertigation, foliar application, and soil application.

Technology Insights

The CRF technology segment accounted for the largest market revenue share in 2024, due to the rising need for highly efficient fertilizers, the growing global population, increasing application rates in developing countries, and increasing demand for high-value crops. Nutrient loss to the environment is a major concern for farmers worldwide, and CRF helps reduce nutrient loss and improve nutrient use efficiency. The market is also driven by the need for sustainable farming practices, technological advancements, and government support. The market is segmented by type, end-use, and application method, with North America and Asia-Pacific being the major markets.

The water soluble fertilizers segment is expected to grow at the fastest CAGR over the forecast period. The need for sustainable agriculture practices and the rising global population. Water-soluble fertilizers are multi-compound that can dissolve in liquid, making them easily applied by fertigation or foliar application. They are primarily used to control the number of times nutrients are provided to plants, leading to improved crop yields and overall plant health. The market is segmented by type, application, crop type, and region, with the Asia-Pacific region dominating the market. The market is highly competitive, with several key players dominating the market.

Type Insights

The urea ammonium nitrate (UAN) fertilizer segment accounted for the largest market revenue share in 2024, due to attributable to several factors, including its balanced nutrient content, high application efficiency, and versatility, making it a popular choice among farmers. UAN is a liquid type composed of a combination of urea and ammonium nitrate, providing prolonged nutrition to plants with high nitrogen availability. Its widespread use in various climatic zones, including dry climates, further contributes to its market dominance. In addition, the reduction of residual soil nitrogen due to UAN application is driving its market growth.

The micronutrient fertilizers segment is expected to grow at the fastest CAGR during the forecast period, due to the increasing demand for high-efficiency fertilizers that address specific nutrient deficiencies in soils. These are used to supply essential nutrients such as zinc, boron, and molybdenum, which are often deficient in agricultural soils. The growing adoption of precision agriculture and the need for sustainable agriculture practices are driving the demand for micronutrient fertilizers.

Crop Type

The fruits & vegetables segment accounted for the largest market revenue share in 2024. Specialty fertilizers are commonly used in fruit and vegetable production. Two types are slow-release fertilizers (SRFs), such as methylene urea (MU), and CRFs. Potassium nitrate is also widely used to improve the quality and yield of fruits, nuts, horticulture crops, and flowering plants. For fruit trees, potassium chloride is the most commonly used source of potassium. Fast-release fertilizers containing nitrogen in nitrate, ammoniacal, and urea are commonly used for vegetables. However, SRFs are preferred for long-term vegetable production as they minimize nutrient losses and help maintain soil fertility.

The cereals and grains segment is expected to grow at the fastest CAGR during the forecast period. Specialized fertilizers that cater to the specific nutrient requirements of cereals and grains are becoming increasingly popular. This trend is directly related to the need for sustainable food production to feed a growing population and ensure food security. Cereals and grains are crucial for food consumption and have numerous industrial applications, which further contributes to their high demand. The production of cereals and grains is influenced by various cultural, environmental, and economic factors, adding to their demand. Cereals and grains are staple foods in many parts of the world, which leads to sustained demand and market growth.

Application Insights

The fertigation segment led the market with the largest revenue share of 54.11% in 2024. Fertigation allows for the precise application of nutrients, reducing nutrient losses and improving crop yields. Fertigation can reduce water usage by applying nutrients directly to the root zone, which helps to minimize water runoff and leaching. The growing popularity of fertigation, particularly in the market, where precision and efficiency are critical for maximizing crop yields and minimizing environmental impact.

The foliar segment is anticipated to grow at the fastest CAGR during the forecast period. The foliar is widely used during critical growth stages to correct micronutrient deficiencies quickly. This method is especially beneficial under stress conditions and is popular among horticulture and greenhouse growers, with chelated micronutrient formulations gaining traction. Soil application remains the most conventional and widely practiced method, particularly in field crop cultivation. Controlled-release and stabilized specialty fertilizers used in soil application enhance long-term nutrient availability, promote strong root development, and minimize leaching losses, making it essential for sustainable soil health management.

Regional Insights

The specialty fertilizers market in North America is driven by technological adoption in precision farming and sustainable nutrient management practices. The demand for specialty fertilizers is increasing due to environmental regulations encouraging low-runoff solutions and enhanced nutrient efficiency. The U.S. and Canada are leading markets, particularly for fertigation and controlled-release products.

U.S. Specialty Fertilizers Market Trends

The specialty fertilizers market in the U.S. is shaped by large-scale commercial farming and stringent environmental compliance. Specialty fertilizers are being increasingly adopted to meet yield targets while aligning with soil health initiatives. The rising use of fertigation in California and the Midwest’s preference for slow-release variants reflect strong application-specific demand.

Asia Pacific Specialty Fertilizers Market Trends

Asia Pacific dominated the specialty fertilizers market with the largest revenue share of 32.71% in 2024, led by India and China, due to intensive agriculture and rising awareness about nutrient efficiency. Government subsidies on specialty products and the proliferation of micro-irrigation systems are boosting fertigation usage. Soil and foliar applications remain vital in paddy and plantation crops.

The specialty fertilizers market in China accounted for the largest revenue share of 32.46% in 2024. The market innovative nutrient sources are used in specific soil and plant conditions to trigger special responses that improve plant growth and productivity. Due to repeated cropping without sufficient time for the soil to regain its fertility, Asia-Pacific soils are becoming unsuitable for cultivation.

Europe Specialty Fertilizers Market Trends

The specialty fertilizers market in Europe is influenced by stringent EU regulations on nitrate leaching and climate-smart agriculture. The region shows strong demand for slow- and controlled-release fertilizers, especially in countries like Germany, France, and the Netherlands. Foliar feeding is prevalent in vineyards and specialty crops to maintain nutritional balance.

The UK specialty fertilizers market is expected to grow at a significant CAGR during the forecast period. The repeated cropping without allowing the soil to regain fertility makes soils unsuitable for cultivation in the UK market. However, the product can help provide timely nutrition to the soil while impacting the environment less. These factors are expected to drive the market's growth, increasing the demand for the product.

Middle East & Africa Specialty Fertilizers Market Trends

The specialty fertilizers market in the Middle East & Africa is anticipated to grow at a substantial CAGR during the forecast period. Water scarcity and poor soil quality are accelerating the shift toward fertigation and efficient fertilizer use. Gulf countries are heavily investing in drip irrigation and greenhouse systems, supporting the fertigation demand. In Sub-Saharan Africa, foliar and soil applications are preferred due to cost and infrastructure limitations.

The Saudi Arabia specialty fertilizers market has one of the highest consumptions of red meat in the Middle East and North Africa region. According to the World Bank database, Saudi Arabia is the largest economy in the Middle East, and its GDP stood at USD 793 billion in 2019, which increased by 2.2% from 2018 and accounted for 2.2% in 2020.

Central and South America Specialty Fertilizers Market Trends

The specialty fertilizers market in Central and South America is anticipated to grow at a significant CAGR during the forecast period. The South American market comprises Brazil, Argentina, Chile, and the Rest of South America. According to the USDA, Brazil is one of the few nations capable of increasing agricultural yields and area. The rising adoption of agrochemicals, advancements in farming techniques in Brazil and Argentina, and extensive distribution channels of global agrochemical players are expected to drive market growth.

The Brazil and Argentina specialty fertilizers market will occupy the major market share for specialty fertilizers in South America in 2024. The climatic conditions in these countries are conducive to cultivating diverse crops, including soybean, sugarcane, corn, rice, vegetables, and fruits. Other growth drivers include using new techniques and technologies to bring unusable and barren lands into productivity. Crop production in South America has risen dramatically in recent decades, and growers are expected to expand the planted area and push for higher yields, thus supporting the consumption.

Key Specialty Fertilizers Company Insights

Some of the key players operating in the market include K+S Aktiengesellschaft, Yara, Nutrien, Nufram, and Eurochem Group, among others.

-

K+S Aktiengesellschaft is a German mineral company that researches, produces, and sells standard and specialty fertilizers, plant care, and salt products. They extract crude salts containing potassium, magnesium, and sulfur from mines in Germany.

-

Nutrien is the largest provider of crop inputs and services globally, distributing 27 million tons of potash, nitrogen, and phosphate products. Nutrien's agronomists and crop advisors recommend maintaining the ideal balance of macro- and micronutrients to support soil and crop health. They employ precision agricultural technologies to assist growers in boosting crop yields and soil health while minimizing the risk of nutrient loss to the environment.

The Mosaic Company, CF Industries and Holdings, Inc., Nufarm, SQM SA, OCP Group and Sociedad Quimica y Minera De Chile SA., among others, are some of the emerging market participants in the specialty fertilizers industry.

-

Mosaic is a renowned company that specializes in producing concentrated phosphate and potash. These nutrients are essential for crop growth and help farmers yield more per acre. Mosaic mines produce and distribute millions of tons of top-quality potash and phosphate products annually.

-

Sociedad Química y Minera de Chile SA (SQM) is a company that specializes in producing and distributing specialty fertilizers. Their product range includes potassium nitrate, sodium nitrate, potassium sulfate, potassium chloride, and sulfate. These fertilizers are designed for wheat, corn, rice, and sugar crops. More than half of SQM's sales come from its specialty fertilizers.

Key Specialty Fertilizers Companies:

The following are the leading companies in the specialty fertilizers market. These companies collectively hold the largest market share and dictate industry trends.

- Nutrien Ltd

- Yara

- ICL

- The Mosaic Company

- CF Industries and Holdings, Inc.

- Nufarm

- SQM SA

- OCP Group

- K+S Aktiengesellschaft

- Eurochem Group

- Sociedad Quimica y Minera de Chile SA

Recent Developments

-

In 2024, the specialty fertilizers industry witnessed renewed expansion, driven by rising demand for precision agriculture and sustainable nutrient management solutions. Global adoption of specialty formulations-such as controlled-release fertilizers, water-soluble fertilizers, and micronutrient blends-has accelerated, particularly in regions facing water stress and soil nutrient depletion.

-

In December 2024, ICL Group acquired GreenBest, a UK-based manufacturer of specialty fertilizers, marking a strategic move to bolster its footprint in the turf and landscape nutrition sector. The acquisition not only expands ICL's product portfolio but also enhances its market presence in the United Kingdom, providing direct access to GreenBest’s established customer base and localized production capabilities.

Specialty Fertilizers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39,909.3 million

Revenue forecast in 2030

USD 53,383.72 million

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, type, crop-type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Nutrien Ltd; Yara; ICL; CF Industries and Holdings, Inc.; Nufarm; SQM SA; OCP Group; K+S Aktiengesellschaft; Eurochem Group; The Mosaic Co.; Sociedad Quimica y Minera de Chile SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty Fertilizers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialty fertilizers market report based on technology, type, crop-type, application, and region.

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Controlled-release Fertilizers

-

Water-soluble Fertilizers

-

Liquid Fertilizers

-

Micronutrients

-

Others

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Urea Ammonium Nitrate

-

Calcium Ammonium Nitrate

-

Monoammonium Phosphate

-

Sulfate of Potash

-

Potassium Nitrate

-

Urea Derivatives

-

Blends of NPK

-

Others

-

-

Crop-Type Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Cereals & Grains

-

Frutis & Vegetables

-

Oilseeds & Pulses

-

Other

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Fertigation

-

Foliar

-

Soil

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global specialty fertilizers market size was valued at USD 36.2 billion in 2023 and is expected to reach USD 38.0 billion in 2024.

b. The global specialty fertilizers market size is projected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2030 to reach USD 53.0 billion by 2030.

b. The dry segment is projected to hold the largest market share in the market. This is primarily due to the increasing use of controlled-release and slow-release fertilizers and the ease of application and high effectiveness of dry specialty fertilizers.

b. Some prominent players in the global specialty fertilizers market include: ● Nutrien Ltd ● Yara ● ICL ● The Mosaic Company ● CF Industries and Holdings, Inc. ● Nufarm ● SQM SA

b. The market is being primarily driven by factors such as the increasing demand for high-quality crops, the growing need for sustainable agricultural practices, and the adoption of precision agriculture techniques, which require specialized fertilizers. The high nutrient use efficiency and precise & localized application associated with specialty fertilizers are expected to significantly drive the market in terms of value sales.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.