- Home

- »

- Agrochemicals & Fertilizers

- »

-

Water Soluble Fertilizers Market Size, Industry Report, 2033GVR Report cover

![Water Soluble Fertilizers Market Size, Share & Trends Report]()

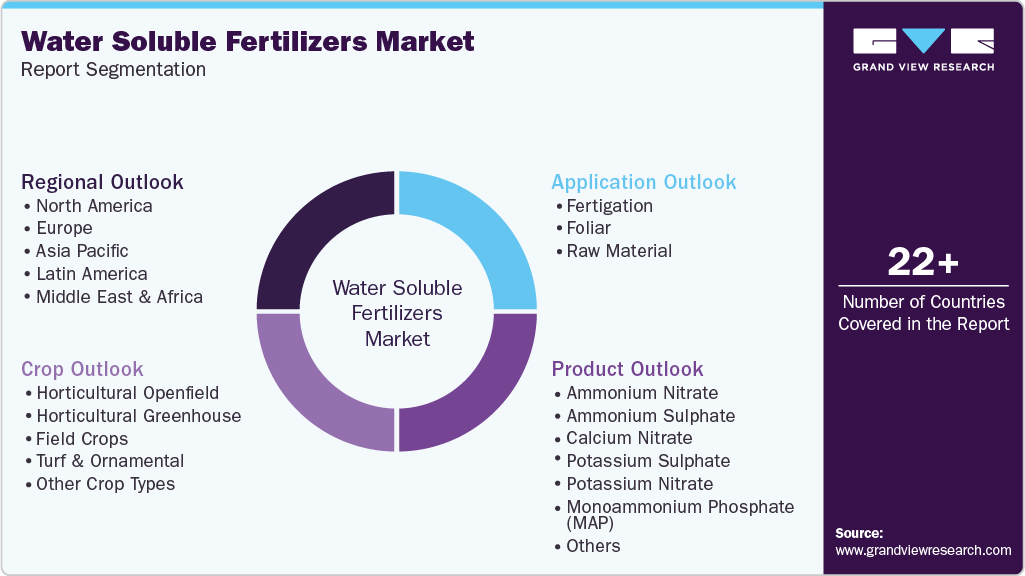

Water Soluble Fertilizers Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Nitrogenous, Phosphatic, Potassium), By Crop (Horticultural Openfield, Horticultural Greenhouse), By Application (Fertigation, Foliar, Raw Material), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-188-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Water Soluble Fertilizers Market Summary

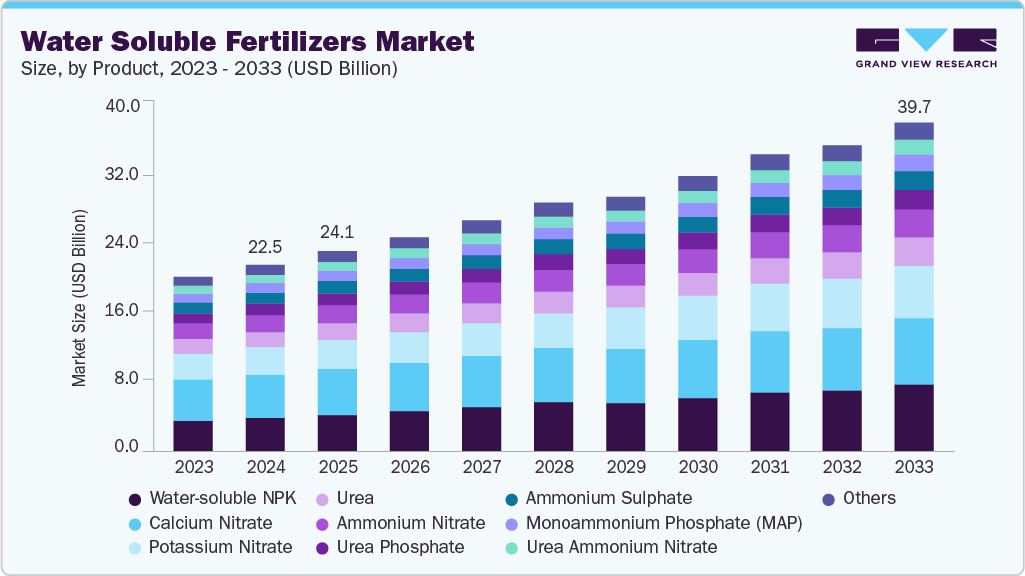

The global water soluble fertilizers market size was estimated at USD 24,075.9 million in 2025 and is projected to reach USD 39,667.7 million by 2033, growing at a CAGR of 6.3% from 2026 to 2033. Growth is primarily driven by increasing demand for high-efficiency fertilizers that support precision farming and controlled nutrient delivery.

Key Market Trends & Insights

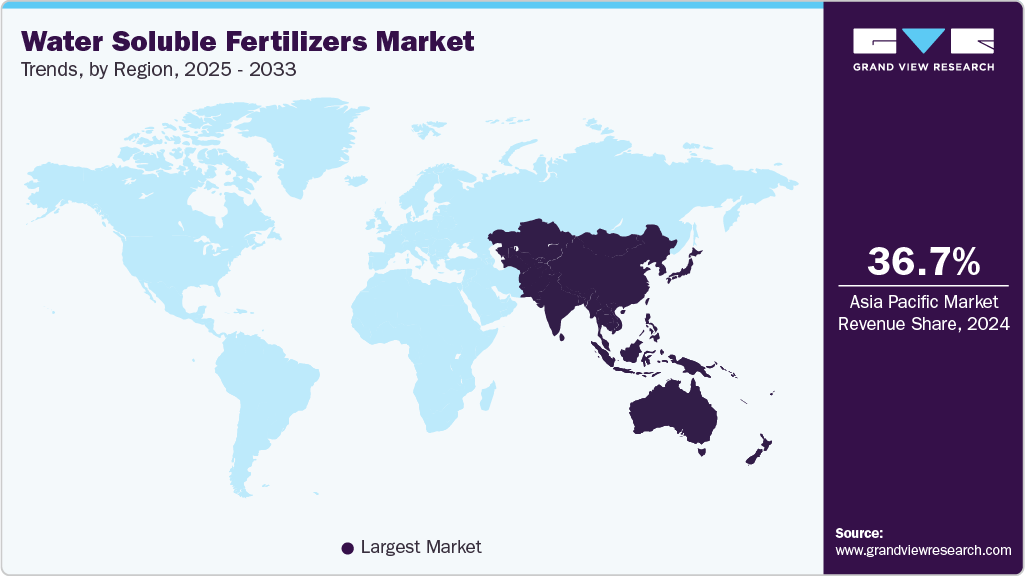

- Asia Pacific dominated the water soluble fertilizers market with the largest revenue share of 36.6% in 2025.

- The market in China is expected to grow at a significant CAGR of 6.9% from 2026 to 2033.

- By product, the potassium nitrate segment is expected to grow at a CAGR of 7.9% from 2026 to 2033 in terms of revenue.

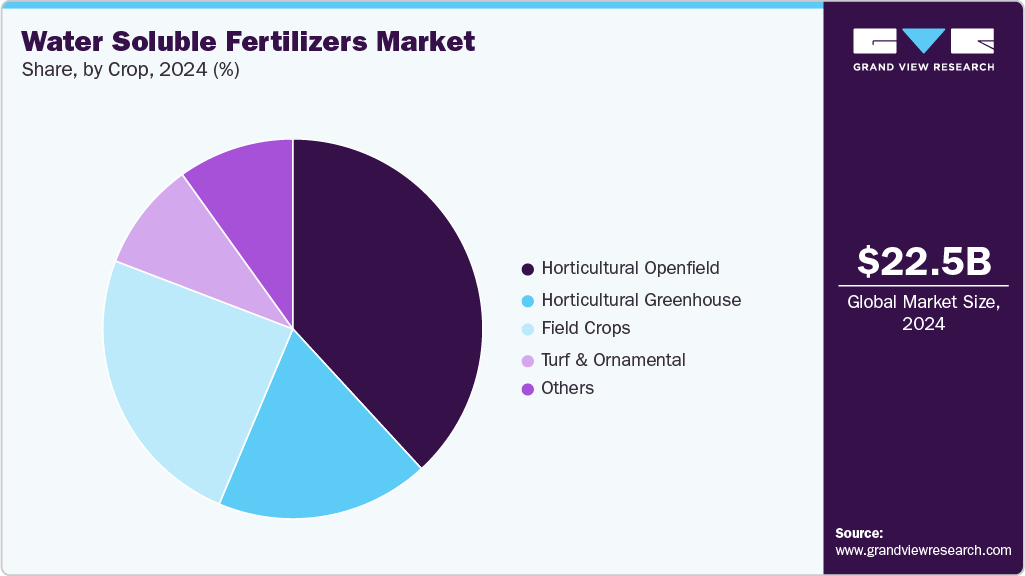

- By crop type, the horticultural openfield segment held the largest revenue share of 38.1% in 2025 in terms of value.

- By application, the fertigation segment held the largest revenue share of 67.6% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 24,075.9 Million

- 2033 Projected Market Size: USD 39,667.7 Million

- CAGR (2025-2033): 6.3%

- Asia Pacific: Largest market in 2025

- North America: Fastest growing market

Rising adoption of fertigation and foliar application techniques, along with the declining availability of arable land, is encouraging farmers to shift toward nutrient-efficient solutions. In addition, growing emphasis on sustainable agricultural practices and supportive government initiatives promoting water-efficient, high-yield crop production continues to accelerate market expansion.The market offers significant growth opportunities, supported by the rapid expansion of greenhouse cultivation, vertical farming, and precision agriculture across emerging economies. Advancements in fertigation technologies, along with rising investments in sustainable agricultural inputs, are facilitating wider market penetration. In addition, increasing demand for specialty and high-value crops such as fruits, vegetables, and ornamentals, particularly in export-oriented regions, is creating attractive opportunities for product innovation and portfolio diversification among market participants.

However, despite strong growth prospects, the market continues to face challenges, including high upfront costs associated with fertigation infrastructure and limited awareness among small-scale farmers in developing regions. Environmental and regulatory concerns related to nutrient leaching and soil degradation resulting from improper or excessive fertilizer application further restrain adoption. Moreover, fragmented distribution networks and reliance on weather-dependent crop cycles can affect demand stability and profitability for manufacturers and distributors.

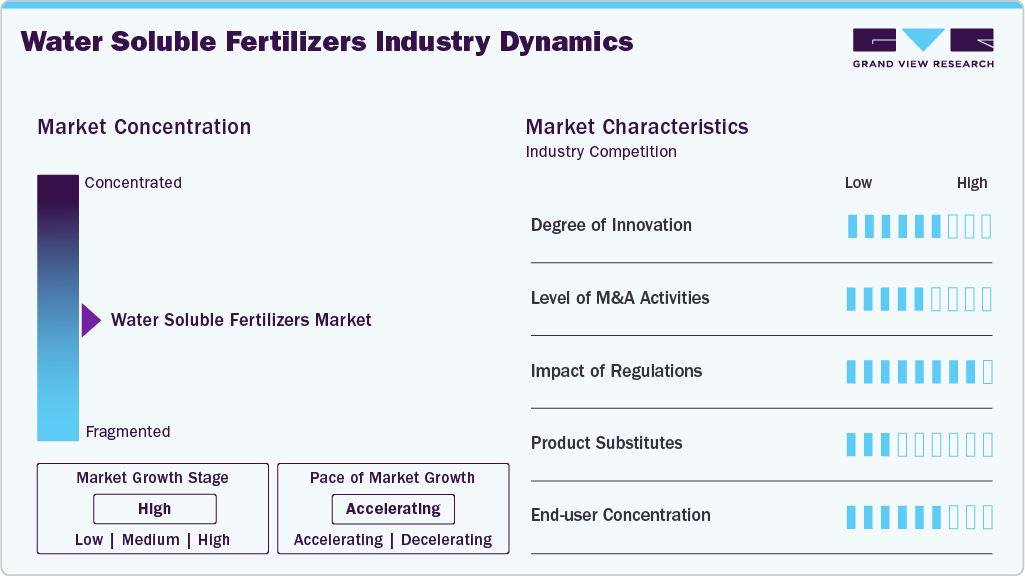

Market Concentration & Characteristics

The global water soluble fertilizers industry is moderately fragmented, characterized by the presence of a limited number of large multinational players alongside several regional participants. Leading companies benefit from extensive operational scale, competitive pricing strategies, and diversified product portfolios. To strengthen their market positions, these players are actively investing in research and development, expanding production capacities, and increasingly focusing on sustainable manufacturing practices and environmentally responsible product offerings.

Leading market participants are adopting a mix of strategies such as product innovation, strategic collaborations, and geographic expansion to reinforce their market presence. Ongoing investments in research and development are focused on creating crop-specific and micronutrient-enriched formulations that improve yields and enhance nutrient uptake efficiency. In parallel, partnerships with agritech companies and drip irrigation solution providers are supporting the development of integrated solutions tailored to precision agriculture applications.

Product Insights

Calcium nitrate accounted for approximately 22.3% of the global market revenue in 2025, emerging as the leading product segment. Its strong adoption is driven by increasing use in fruit and vegetable cultivation, where calcium is essential for improving fruit firmness, shelf life, and resistance to physiological disorders such as blossom end rot. High water solubility and rapid nutrient availability support efficient uptake through fertigation and foliar application.

The segment further benefits from rising demand in greenhouse farming, protected cultivation, and export-oriented horticulture, where crop quality and consistency are critical. In addition, compatibility with modern irrigation systems and the dual supply of calcium and readily available nitrogen strengthen its market position. With growing emphasis on yield optimization, quality enhancement, and sustainable nutrient management, calcium nitrate is expected to retain a strong share over the forecast period.

Application Insights

By application, the fertigation segment dominated the market with a 67.6% share in 2025, owing to its efficiency in delivering nutrients directly through irrigation systems, ensuring uniform distribution and optimal absorption by plant roots. This method is widely adopted in large-scale field and horticultural crop cultivation, particularly in regions with well-developed irrigation infrastructure, including Europe, North America, and parts of the Asia Pacific. Fertigation allows precise nutrient management, minimizes wastage, and supports sustainable agriculture by reducing runoff and environmental impact. With the growing adoption of precision farming, the integration of water-soluble fertilizers into fertigation systems is expected to expand significantly.

Meanwhile, the foliar application segment is gaining traction due to its ability to provide rapid nutrient uptake, especially during critical growth stages or when soil conditions limit root absorption. It is particularly effective for micronutrient delivery and is widely applied in high-value crops such as fruits, vegetables, and ornamental plants. Foliar application also helps correct visible nutrient deficiencies and enhances crop resilience under stress conditions. Its cost-effectiveness and compatibility with integrated pest and disease management practices make it an increasingly preferred choice among small to medium-scale farmers worldwide.

Crop Insights

The horticultural open-field segment accounted for the largest revenue share of 38.1% in 2025, driven by the widespread global cultivation of fruits, vegetables, and other high-value crops under open-field conditions. These crops are highly sensitive to nutrient imbalances and require consistent and efficient nutrient management to achieve optimal yield and quality. Water-soluble fertilizers are widely adopted in this segment as they enable precise nutrient delivery through fertigation and foliar application, reducing nutrient losses and improving plant uptake efficiency. Rising consumer demand for fresh produce, particularly in export-oriented regions such as the Asia Pacific and Latin America, has further encouraged large-scale adoption of water-soluble fertilizers among commercial growers.

Other application segments continue to support overall market growth. The horticultural greenhouse segment is expanding steadily, supported by the increasing adoption of controlled-environment agriculture for year-round production of premium fruits, vegetables, and floriculture crops. Greenhouse operations rely heavily on fertigation systems and precision nutrient management, driving demand for high-performance water-soluble formulations. The field crops segment, traditionally dominated by conventional fertilizers, is witnessing a gradual uptake of water-soluble variants to improve nutrient-use efficiency and support sustainable large-scale farming practices. The turf and ornamental segment serves landscaping, nurseries, and golf courses, where uniform growth and visual appeal are essential. The other category includes specialty and industrial crops, such as medicinal plants and herbs, which are increasingly benefiting from customized nutrient solutions.

Regional Insights

Asia Pacific held the largest revenue share of 36.6% in 2025, driven by rising food demand due to population growth, decreasing availability of arable land, and increasing adoption of modern agricultural practices. Countries in the region are investing in precision irrigation technologies, greenhouse cultivation, and high-efficiency fertilizers to enhance productivity, optimize nutrient use, and improve crop quality.

China Water Soluble Fertilizers Market Trends

The water soluble fertilizers market in China is the leading agricultural economy in the Asia Pacific region, and holds a significant market share. The country is transitioning toward more sustainable agricultural practices, supported by national policies focused on reducing chemical fertilizer usage and enhancing nutrient-use efficiency. These initiatives are encouraging the adoption of high-efficiency water-soluble fertilizers and precision nutrient management across major crop sectors.

Europe Water Soluble Fertilizers Market Trends

The water soluble fertilizers market in Europe held the second-largest revenue share of 28.5% in 2025, driven by its strong regulatory emphasis on sustainable agriculture, efficient water use, and nutrient management. The region benefits from advanced farming infrastructure, widespread adoption of fertigation in greenhouse cultivation, and a high level of awareness regarding the environmental impacts of conventional fertilizers.

Germany water soluble fertilizers market is a key agricultural and turf & ornamental market in Europe, playing a pivotal role in the water-soluble fertilizers sector. The country’s focus on innovation, precision farming, and environmental stewardship drives the adoption of advanced nutrient solutions. German farmers are increasingly favoring crop-specific, water-efficient fertilizers, particularly for protected cultivation and high-value crop segments, supporting both productivity and sustainability objectives.

North America Water Soluble Fertilizers Market Trends

The water soluble fertilizers market in North America accounted for a significant revenue share in 2025, representing a mature and technologically advanced market for water-soluble fertilizers. Growth is driven by widespread adoption of precision farming, fertigation systems, and controlled-environment agriculture. The region benefits from strong institutional support, advanced irrigation infrastructure, and high farmer awareness regarding nutrient management and sustainable agricultural practices.

The U.S. water soluble fertilizers market is the largest market within North America, plays a critical role in shaping regional trends through its large-scale agricultural operations, robust R&D ecosystem, and active regulatory frameworks promoting environmentally responsible farming practices.

Latin America Water Soluble Fertilizers Market Trends

The water soluble fertilizers market in Latin America is emerging as a high-potential market, supported by the expansion of export-driven agriculture and increasing adoption of modern irrigation systems. Countries such as Brazil and Chile are witnessing strong demand for high-value crops, including fruits, vegetables, and coffee, which require precise nutrient management for quality and yield optimization.

Middle East & Africa Water Soluble Fertilizers Market Trends

The water soluble fertilizers market in the Middle East & Africa (MEA) is also experiencing steady growth, largely driven by the need to optimize agricultural output in arid and semi-arid regions. With limited water resources and challenging soil conditions, farmers in countries such as Saudi Arabia, the UAE, Egypt, and South Africa are increasingly adopting water-efficient fertilization techniques.

Key Water Soluble Fertilizers Company Insights

Key players, such as Agrium Inc., Potash Corp, Israel Chemicals Limited, and The Mosaic Company, are dominating the market.

Israel Chemicals Limited

-

Israel Chemicals Limited (ICL) is a globally diversified specialty minerals and chemicals company with a strong presence in the fertilizers sector. The company produces a wide range of water‑soluble macro- and micro-nutrient fertilizers, including potash, phosphates, and specialty plant nutrition products, serving agricultural markets, food manufacturers, and Turf & ornamental customers. Leveraging its integrated operations, ICL controls the value chain from mining and raw-material processing to advanced formulation and distribution, enabling it to deliver tailored nutrient solutions and controlled-release technologies. With significant production capacity in Israel, Europe, and North America, and robust investment in R&D and sustainable innovation, ICL targets both large-scale agriculture and high-value horticultural segments across global markets.

Key Water Soluble Fertilizers Companies:

The following are the leading companies in the water soluble fertilizers market. These companies collectively hold the largest market share and dictate industry trends.

- Agrium Inc.

- Potash Corp

- Israel Chemicals Limited

- The Mosaic Company

- K+S AG

- EuroChem

- Yara International ASA

- Coromandel International Limited

- Compo GmbH & Co. KG

- Hebei Monband Water Soluble Fertilizer Co. Limited

Recent Developments

-

In December 2023, Coromandel International Limited launched Fertinex, a next-generation water-soluble fertilizer developed specifically for fertigation applications. Backed by in-house R&D and extensive agronomic trials, the product reflects the company’s focus on innovation-led, farmer-centric solutions. Such advancements enhance nutrient use efficiency, support precision farming, and accelerate the adoption of fertigation practices, thereby driving market growth.

-

In April 2023, agritech company Zuari FarmHub partnered with Novozymes South Asia to launch Poorna Advanced, a 100% water-soluble fertilizer incorporating innovative LCO Promoter Technology. The technology enhances plant-microbe signaling in the root zone, improving nutrient uptake, root health, and crop resilience. Such biologically enhanced water-soluble fertilizers support sustainable and high-efficiency nutrient management, driving wider adoption and market growth.

Water Soluble Fertilizers Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 25,819.0 million

Revenue forecast in 2033

USD 39,667.7 million

Growth rate

CAGR of 6.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, crop, application, region

Regional scope

North America; Europe; Asia Pacific; MEA; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Africa; Saudi Arabia

Key companies profiled

Agrium Inc.; Potash Corp; Israel Chemicals Limited; The Mosaic Company; K+S AG; EuroChem; Yara International ASA; Coromandel International Limited; Compo GmbH & Co. KG; Hebei Monband Water Soluble Fertilizer Co. Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water Soluble Fertilizers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global water soluble fertilizers market report based on product, crop, application, and region:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Ammonium Nitrate

-

Ammonium Sulphate

-

Calcium Nitrate

-

Potassium Sulphate

-

Potassium Nitrate

-

Monoammonium Phosphate (MAP)

-

Mono Potassium Phosphate (MKP)

-

Urea Phosphate

-

Magnesium Nitrate

-

Magnesium Sulfate

-

Water-soluble NPK

-

19:19:19

-

20:20:20

-

13;40:13

-

Other Water Soluble NPK

-

-

Urea

-

Urea Ammonium Nitrate

-

Other Products

-

-

Crop Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Horticultural Openfield

-

Horticultural Greenhouse

-

Field Crops

-

Turf & Ornamental

-

Other Crop Types

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Fertigation

-

Foliar

-

Raw Material

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global water soluble fertilizers market size was estimated at USD 24,075.9 million in 2025 and is expected to reach USD 25,819.0 million in 2026.

b. The global water soluble fertilizers market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach USD 39,667.7 million by 2033.

b. The horticultural open-field segment accounted for the largest revenue share in 2025, driven by the extensive cultivation of high-value crops such as fruits and vegetables that require precise and efficient nutrient management. Growth in this segment is further supported by increasing adoption of fertigation techniques and rising global demand for high-quality produce.

b. Some of the key players operating in the water soluble fertilizers market include Merck, Shandong Kunda Biological Technology Co.,Ltd., Titan Biotech, TCI, Hunan Huari Pharmaceutical Co.,Ltd., Jiangsu Mupro Ift Corp., Celanese Corporation, BIMAL PHARMA PVT. LTD., FBC Industries, Conflate Chemtech, ASTRRA CHEMICALS.

b. Key factors driving the water-soluble fertilizers market include rising demand for efficient nutrient delivery solutions to support increasing global food production and the growing adoption of precision agriculture practices. Expanding use in horticulture, greenhouse cultivation, and high-value crops is boosting demand for fertilizers that offer rapid nutrient availability and improved uptake efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.