- Home

- »

- Specialty Polymers

- »

-

Specialty Nitrile Butadiene Rubber Market Size Report, 2030GVR Report cover

![Specialty Nitrile Butadiene Rubber Market Size, Share & Trends Report]()

Specialty Nitrile Butadiene Rubber Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Carboxylated, Bimodal), By Application (Printing Rubber Rollers, Extrusion & Calendaring), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-028-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

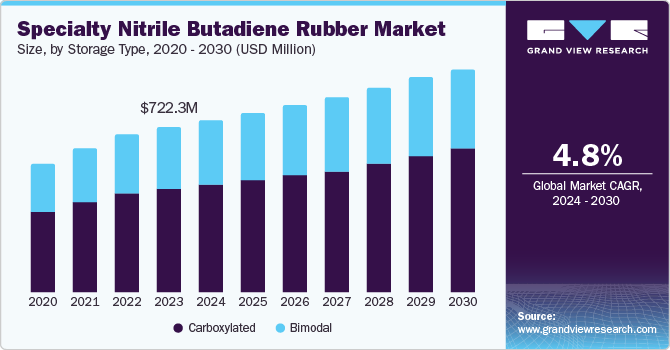

The global specialty nitrile butadiene rubber market size was valued at USD 722.3 million in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. The market growth is driven by the increasing demand for Nitrile Butadiene Rubber (NBR) in the automotive industry, particularly for manufacturing seals, gaskets, and hoses due to its excellent resistance to oils and chemicals. In addition, the rising adoption of NBR in the healthcare sector for producing medical gloves and other protective equipment has significantly contributed to market expansion, especially in the wake of heightened hygiene awareness post-pandemic.

The growing industrialization in emerging economies, coupled with advancements in NBR production technologies, is also propelling market growth. The push towards sustainable and high-performance materials in various applications is encouraging the development and use of specialty NBR, enhancing its market prospects.

Rapid industrialization in developing countries has significantly contributed to the growth of the global specialty NBR market. Increased investments in sectors such as construction, healthcare, and automotive have led to a rise in demand for specialty NBR. Modernization and population growth have driven the need for new buildings and the renovation of old residential and commercial infrastructures. Specialty NBR is used in making seals and gaskets for windows, roofs, and doors to prevent water leakage. Its use in plumbing operations ensures leak-proof water connections.

In the automotive sector, specialty NBR is utilized in processes such as lamination, bonding, and assembly of vehicle components. The rising use of adhesives and sealants to join materials such as metals, glass, and plastics has also increased the demand for specialty NBR. Additionally, it is used in manufacturing fuel lines, coolant hoses, and brake lines. The growing demand for electric cars has further boosted the market for specialty NBR. The surge in automobile companies is a key factor driving the growth of electric vehicle production, leading to potential growth opportunities for the specialty NBR market. Therefore, these factors have collectively resulted in the expansion of the specialty nitrile butadiene rubber market.

Type Insights

The carboxylated segment dominated the market in 2023 with a share of 62.7% attributed to the superior properties of carboxylated NBR (XNBR), such as enhanced abrasion resistance, improved tensile strength, and better oil resistance compared to non-carboxylated variants. These properties make it highly suitable for applications in industries such as automotive, oil and gas, and manufacturing, where durability and resistance to harsh conditions are crucial. Additionally, the increasing demand for high-performance rubber in the production of seals, gaskets, and hoses further bolsters the market position of the carboxylated segment. The segment’s dominance is also supported by ongoing advancements in production technologies, which enhance the quality and performance of XNBR, making it a preferred choice for various end-use applications.

The bimodal segment is expected to grow at a CAGR of 4.4% over the forecast period. Bimodal NBR is characterized by its unique molecular structure, which provides a balance of properties such as flexibility, toughness, and resistance to wear and tear. This makes it particularly advantageous for applications requiring a combination of strength and elasticity, such as in the production of automotive components, industrial belts, and footwear. The anticipated growth of the bimodal segment can be attributed to the rising demand for versatile and high-performance materials in various industries. Furthermore, the ongoing research and development efforts aimed at enhancing the properties of bimodal NBR are expected to open new avenues for its application, thereby driving its market growth.

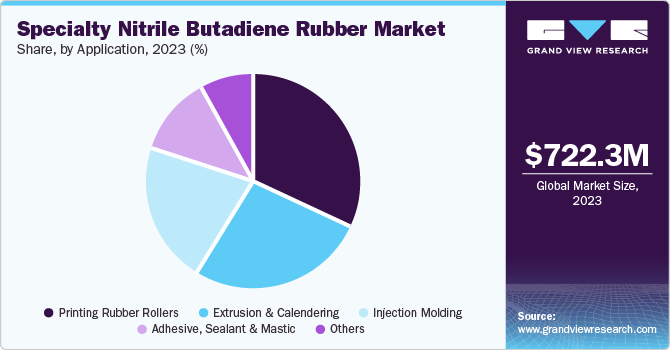

Application Insights

The printing rubber rollers segment dominated the market in 2023 pertaining to the unique properties of NBR, such as its excellent resistance to oils, chemicals, and abrasion, which are crucial for the demanding environments of printing processes. Printing rubber rollers made from NBR offer superior performance in terms of durability and longevity, reducing the frequency of replacements and maintenance. Additionally, the increasing demand for high-quality printing in various industries, including packaging, publishing, and commercial printing, has further fueled the growth of this segment. The ability of NBR to maintain its properties under varying temperatures and pressures makes it an ideal material for printing applications, ensuring consistent print quality and efficiency.

The extrusion and calendaring segment is projected to grow at a CAGR of 4.9% over the forecast period. This growth can be attributed to the expanding applications of NBR in the manufacturing of hoses, seals, gaskets, and other molded products. The automotive and industrial sectors, in particular, are driving the demand for NBR in extrusion and calendaring applications due to the material’s excellent mechanical properties and resistance to wear and tear. As industries continue to seek materials that offer both reliability and cost-effectiveness, the extrusion and calendaring segment is expected to witness sustained growth, supported by technological advancements and increasing investments in manufacturing capabilities.

Regional Insights

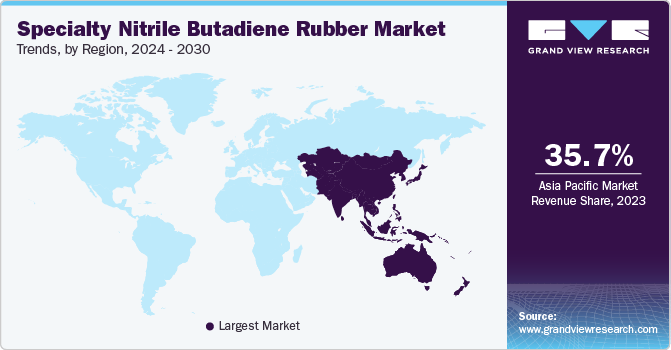

Asia Pacific dominated the specialty nitrile butadiene rubber market in 2023 with a revenue share of 35.7% primarily driven by the rapid industrialization and economic expansion in countries such as China, India, and Japan. The burgeoning automotive and construction sectors in these countries have significantly increased the demand for specialty NBR-based components. Additionally, the presence of a well-developed manufacturing industry in the region further supports market growth.

China Specialty Nitrile Butadiene Rubber Market Trends

China specialty NBR market held a substantial market share of 49.2% in Asia Pacific driven by the rising domestic demand for specialty NBR in various sectors, including automotive and construction. The increasing need for seals and hoses in the automotive sector, along with NBR-based insulation and waterproofing materials in the construction sector, has contributed to this market expansion. Moreover, China’s robust supply chain network facilitates the efficient delivery of NBR components both domestically and globally, further bolstering market growth.

Europe Specialty Nitrile Butadiene Rubber Market Trends

Europe specialty NBR market was identified as a lucrative region in this industry attributed to the rising utilization of specialty NBR components in industries such as automotive, oil and gas, aerospace, medical, and more. Due to this, there is an increase in the demand for high-quality NBR hoses, seals, and more. Furthermore, increased focus on sustainability has led to companies adopting the usage of eco-friendly NBR products.

Germany specialty nitrile butadiene rubber market is expected to grow rapidly due to the presence of major automotive and chemical industries in the country. The country’s strong emphasis on high-precision engineering and innovation has led to a heightened demand for high-grade NBR components. German industries, known for their rigorous quality standards, rely heavily on specialty NBR for applications that require durability and reliability. Furthermore, major investments in research and development by major companies aim to enhance specialty NBR technology and expand its applications.

North America Specialty Nitrile Butadiene Rubber Market Trends

North America specialty nitrile butadiene rubber market held a significant market share in 2023 due to the presence of major automotive and oil and gas companies in the region. The rising demand for electric vehicles has also resulted in increased usage of specialty NBR hoses and seals. Increased usage of specialty NBR in sectors such as aerospace and defense has also aided in market growth. Hence, these factors are responsible for the market growth in this region.

The U.S. specialty nitrile butadiene rubber market is expected to grow rapidly due to increased demand for specialty NBR in growing sectors such as automotive, oil and gas, aerospace, and chemical manufacturing. There is an increase in the demand for NBR components such as seals, gaskets, hoses, sheets, and more. Furthermore, growth in the electric vehicle and additive manufacturing sector has also aided in the market growth of the specialty nitrile butadiene rubber market in the U.S.

Key Specialty Nitrile Butadiene Rubber Company Insights

Some of the major companies in the specialty nitrile butadiene rubber market are ZEON CORPORATION, American Rubber Products, JSR Corporation, China Petrochemical, Corporation, and more. Companies are focusing on improving production efficiency and management of raw material. Companies are also focusing on improvement of market penetration with the help of launching new products and increasing the number of manufacturing facilities.

-

ZEON CORPORATION is a chemical company that specializes in the manufacture and development of synthetic rubber. The company’s portfolio includes synthetic rubbers, synthetic lattices, aroma chemicals, specialty chemicals, and more.

-

JSR Corporation is a company specializing in the production and distribution of various chemicals and synthetic rubbers. The company deals with products such as rubbers, emulsions, resins, latex, and more.

Key Specialty Nitrile Butadiene Rubber Companies:

The following are the leading companies in the specialty nitrile butadiene rubber market. These companies collectively hold the largest market share and dictate industry trends.

- ZEON CORPORATION

- American Rubber Products

- JSR Corporation

- China Petrochemical Corporation

- LG Chem

- OMNOVA North America Inc.

- KUMHO POLYCHEM

- Lion Elastomers

- Griffith Rubber Mills

- ARLANXEO

Recent Developments

-

In June 2024, Trillium Renewable Chemicals opted for Ineos Nitriles' Green Lake facility in Texas to host a demonstration plant for the conversion of plant-based glycerol into acrylonitrile. This initiative, known as “Project Falcon,” aims to validate Trillium's proprietary technology for producing sustainable acrylonitrile, a critical raw material in various industries, including automotive, aerospace, medical, and consumer goods.

-

In November 2023, SKF introduced a new line of spherical roller bearings in November 2023, tailored specifically for the food and beverage industry. Equipped with food-grade grease and seals, these bearings offer extended service life and enhanced food safety compliance. These bearings feature a high-performance nitrile butadiene rubber contact seal, approved by both the FDA and EC, which provides robust protection against water, detergents, and contaminants.

Specialty Nitrile Butadiene Rubber Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 756.9 million

Revenue forecast in 2030

USD 1.0 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, China, India, Japan, South Korea, Australia, Indonesia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

ZEON CORPORATION; American Rubber Products; JSR Corporation; China Petrochemical Corporation; LG Chem; OMNOVA North America Inc.; KUMHO POLYCHEM; Lion Elastomers; Griffith Rubber Mills; ARLANXEO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

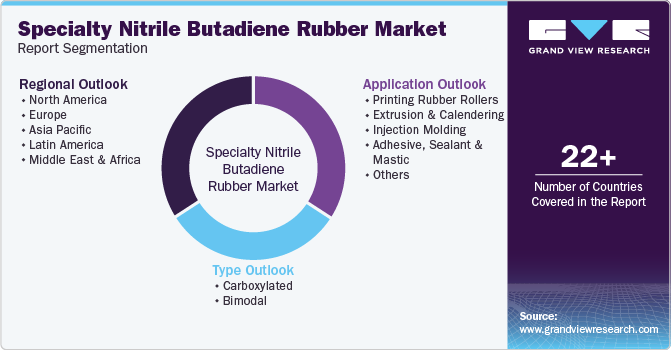

Global Specialty Nitrile Butadiene Rubber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialty nitrile butadiene rubber market report based on type, application, and region:

-

Type Material Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Based Carboxylated

-

Bimodal

-

-

Application Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Printing Rubber Rollers

-

Extrusion & Calendering

-

Injection Molding

-

Adhesive, Sealant & Mastic

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.