- Home

- »

- Pharmaceuticals

- »

-

Specimen Validity Testing Market Size & Share Report, 2030GVR Report cover

![Specimen Validity Testing Market Size, Share & Trends Report]()

Specimen Validity Testing Market Size, Share & Trends Analysis Report By Type (Product (Disposables, Reagents And Calibrators, Assay Kits), Services), By Test, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-201-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Specimen Validity Testing Market Trends

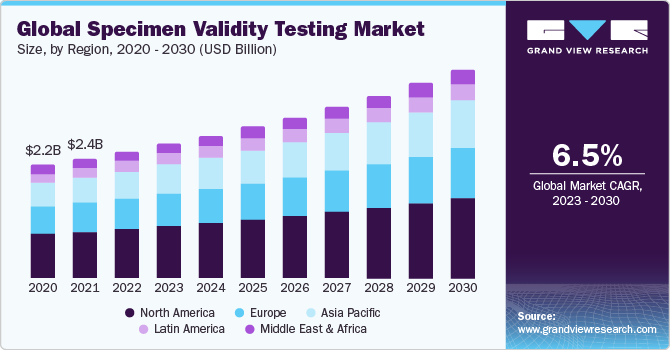

The global specimen validity testing market size was valued at USD 2.50 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.49% from 2023 to 2030. This can be attributed to the growing screening initiatives undertaken by the government that aimed at reducing drug addiction and substance misuse.

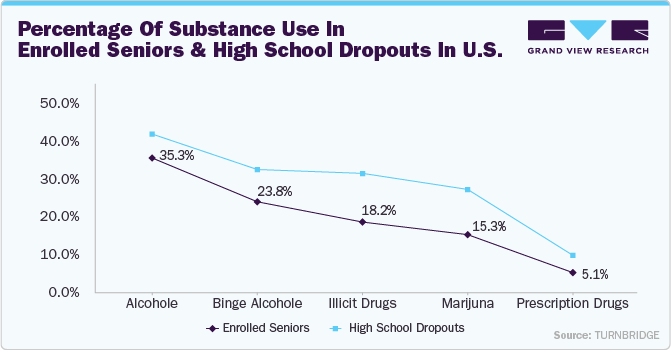

In July 2022, Punjab, India, jail authorities conducted significant anti-drug-trafficking and de-addiction efforts, with a screening of over 8,000 detainees in over 14 prisons and sub-jails. During the screening process, it was discovered that more than 42% of the inmates had drug addictions. Therefore, the specimen validity testing (SVT) market is expected to increase due to rising rates of drug misuse and drug screening over the forecast period. However, the recent development of alternative testing kits and the low knowledge of SVT is anticipated to hinder market expansion.

Furthermore, several research studies have demonstrated the benefits of POC testing for SVT in assessing the validity of urine samples, and these findings are anticipated to drive demand for SVT testing and accelerate market expansion. In January 2021, a research study that was published in the Association for Clinical Biochemistry and Laboratory Medicine journal outlined the main benefits of using point-of-care devices, such as a cheap and convenient mode for pregnant women to check for substance misuse before becoming pregnant.

Moreover, specimen validity testing is used by law enforcement to safeguard suspects and offenders by identifying the presence and residues of illegal narcotics. It helps law enforcement organizations examine the behavior and motives behind a particular crime. Furthermore, drug testing is acknowledged as a crucial part of a background check conducted before employment by the Law Enforcement Drug Testing Policy. For this reason, drug testing should be compulsory for potential hires. According to the Attorney General's Law Enforcement Drug Testing Policy 2020, law enforcement organizations that are involved in the recruiting process must provide drug tests to potential employees at any time throughout the pre-employment phase. Such recommendations are anticipated to drive the specimen validity testing market globally.

Type Insights

On the basis of the type, the market is segmented into product and services. The product segment held the largest market share in 2022. This can be attributed to the advantages offered by products in the accurate and early detection of samples and specimens. Additionally, robust economic growth, rising disposable income, expanding healthcare infrastructure, and increasing investments by industry players to curb drug abuse are the main drivers propelling the segment's growth.

Test Insights

Based on the test, the specimen validity testing market is segmented into rapid/POC testing and laboratory testing. The laboratory testing segment held the largest market share in 2022. Laboratories are the best platform for all urine drug tests through specimen validity testing. It gives doctors vital information regarding the dependability and accuracy of drug test findings as well as confirmation that the sample is a legitimate urine sample from a human. Although, in-office point-of-care drug testing does not standardize specimen validity testing, urine drug testing facilities often have defined specimen validity testing methodologies and toxicologists for better result interpretation. Thus, the increasing number of laboratories engaged in SVT is anticipated to drive segment growth.

End-use Insights

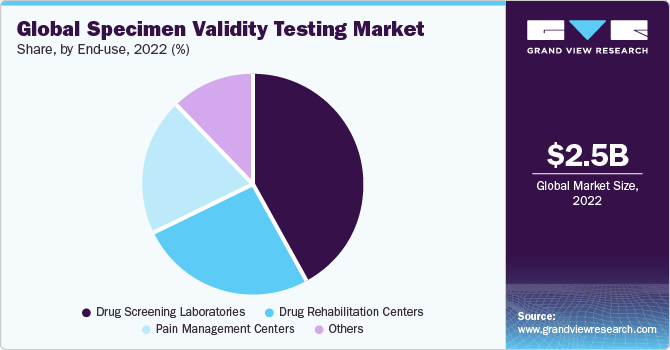

Based on the source, the specimen validity testing market is segmented into drug rehabilitation centers, pain management centers, drug screening laboratories, and others. The drug screening laboratories segment held the largest market share in 2022. This can be attributed to the availability of technologically advanced screening & detection equipment and services to support a wide customer base. The improved accessibility and operability to a complete range of SVT tests incorporating the identification of illegal drug use is anticipated to drive segment growth.

Regional Insights

North America dominated the market in 2022. This can be due to a variety of factors, including the high rate of drug misuse, the number of SVT drug tests conducted in the area, and the significant advancements made by the industry participants. For instance, according to statistics published in 2021 by the Substance Abuse and Mental Health Services Administration (SAMHSA), approximately 9.2 million individuals aged 12 years of age and older misused opioids in the last year. Asia-Pacific is expected to witness the fastest CAGR over the forecast period. This can be attributed to the increased awareness of benefits associated with specimen validity testing among physicians and patients in countries like China and India, where consumption of illegal substances use is high.

Key Specimen Validity Testing Company Insights

Several prominent industry players operating in the market are employing a variety of strategies, including the launch of novel SVT products for use in healthcare settings. On the other hand, some are focusing on mergers and acquisitions to strengthen their presence in international markets throughout the anticipated period. Several firms leading the market are Abbott, Thermo Fisher Scientific Inc., Puritan Medical Products, BD, Laboratory Corporation of America Holdings, Medline Industries, Inc., and others.

The following are some instances of strategic initiatives:

-

In March 2023, Healgen Scientific LLC acquired a New York-based office complex and the 25,000-square-foot factory of American Bio Medica for USD 3 million. This acquisition is expected to drive market growth.

-

In December 2022, Omega Laboratories launched “Urine Drugs of Abuse” testing services in its Ontario-based state-of-the-art laboratory in Canada. This launch is expected to have a positive impact on market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."