- Home

- »

- Communication Services

- »

-

Speech Analytics Market Size & Share Analysis Report, 2025GVR Report cover

![Speech Analytics Market Report]()

Speech Analytics Market Analysis By Type (Solution, Service), By Deployment (On-Premise, Cloud), By Enterprise Size (Small & Medium Enterprise, Large Enterprise), By End-Use (BFSI, Telecom, IT, Retail, Healthcare, Hospitality) And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-209-9

- Number of Report Pages: 117

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2016 - 2025

- Industry: Technology

Report Overview

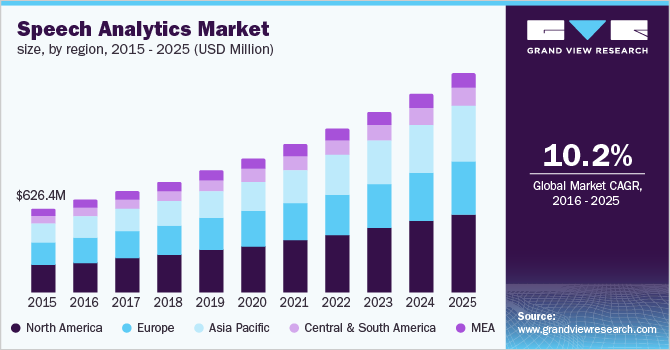

The global speech analytics market size to be valued at USD 1.64 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 10.0% from 2018 to 2025. Furthermore, the rising demand for risk and compliance management across different verticals and the increasing number of contact centers have resulted in the innovation of solutions that help companies understand the changing customer requirements. This, in turn, is expected to open new avenues for the industry over the projected period.

The growth is attributed to the increasing pressure on businesses to protect their intellectual assets for improving agility and efficiency in their operations through the extensive insights mined in the Voice of Customer (VoC). For instance, the Dodd-Frank Wall Street Reform and Consumer Protection Act (July 2010) in the U.S. have put the onus on bankers to incorporate records of their mobile phone transactions.

Speech Analytics Market Trends

The integration of speech technology with mobile banking is expected to enhance customer satisfaction with human-like conversations. Moreover, the increased dependency on operations, such as verification of passwords, and security questions accounts for latency. As a result, banks are focusing on innovation to develop their mobile banking services with speech analytics ultimately bolstering the market growth.

Speech analytics enables businesses to swiftly extract all of the hidden visions from customer conversations allowing them to better understand customer wants and successfully anticipate changing customer needs in the future. The growing pressure on enterprises to secure their intellectual assets in order to improve efficiency and agility in their operations is expected to boost the demand for speech analytics.

Moreover, speech analytics allows for high-level assessments and have all the details allowing for the identification of actionable insights through high-volume discovery. After client contacts are logged and evaluated, real-time speech analytics gives the next best actionable advisory message to agents, resulting in increased operational efficiency. Owing to these advantages, speech analytics market is expected to grow substantially in the forecast period. However, the privacy of data is a concern for users of speech analytics. The audio data and corresponding text transcripts contain the voice of individuals, personal information, and sensitive data which is vulnerable to cyber-attacks.

The COVID-19 disrupted the market globally, which had a drastic impact on manufacturing, logistics and supply chains due to lockdown. There was shortage of essential items which was required for production and lack of man force for the operation process. However, by early 2021, the market started recovering. The increasing demand for customer experience management, call monitoring, sentiment analysis and agent performance management is anticipated to fuel the speech analytics market growth.

Type Insights

Speech analytic solutions are deployed by a number of contact centers across the world in a variety of applications including compliance management, agent performance management, customer experience management, and to gain market intelligence.

In 2015, the solutions segment captured a significant share and is expected to dominate the market over the forecast period. However, the segment is expected to witness maturity ascribed to the higher adoption that will result in services segment to gain traction in the next nine years.

The market offers an extensive portfolio of solutions and, therefore, services are necessary to manage these solutions and help organizations enhance their business process for sustaining in this competitive landscape. The service segment is expected to grow at a CAGR exceeding 8% over the forecast period.

Deployment Insights

The on-premised employment was the largest segment, accounting for over 50% of the total revenue in 2015. On-premise solutions provide better control over the system and data. However, this deployment method is costly and requires a dedicated IT staff for the maintenance & support and high-end IT infrastructure, owing to which the segment is anticipated to witness sluggish growth in comparison to the cloud deployment.

The cloud-based deployment segment accounted for considerable share in 2015 and is expected to witness high demand over the forecast period. The availability of cloud deployment options for speech analytics solutions has propelled the demand further across different verticals, including telecom, IT, BFSI, and media & entertainment, among others. New firms are providing cloud-based solutions to offer SMEs cost-effective solutions.

Enterprise Size Insights

SMEs accounted for over 40% of the total share in 2015 and the segment is expected to experience a growth at a CAGR exceeding 8% over the forecast period. This is ascribed to the high penetration of speech analytics solutions for applications in security systems as well as in improving the customer experience.

Small and Medium-sized Businesses (SMBs) are relying on web-enabled services and applications progressively to run their business. Furthermore, the increasing proliferation of cloud analytics is driving product demand among SMEs.

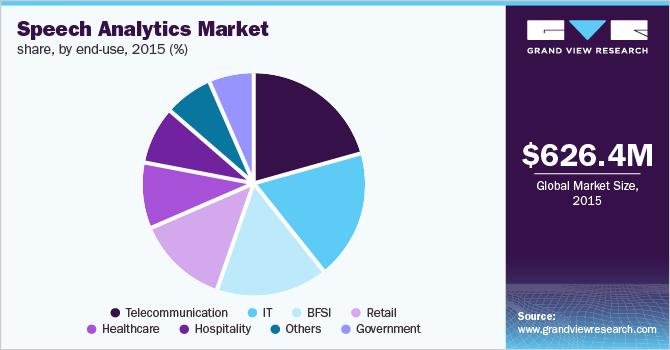

End-Use Insights

The telecom sector is expected to witness high growth over the forecast period, accounting for over 15% share in 2015. In the telecom industry, using speech analytics to gain a hold over infrastructure, telecom industry easily resolves the issues, thereby increasing productivity, decreasing stress, and saving time & money.

The speech analytics market is expected to witness significant growth in IT industry owing to rising adoption of speech analytics tools across the Business Process Outsourcing industry (BPO). Further, the introduction of advanced technological tools to enhance customer experiences is anticipated to propel the speech analytics demand.

Regional Insights

North America accounted for over 20% of the total share in 2015 owing to the presence of a large number of vendors in the region, particularly in the U.S. However, the region is expected to witness slow growth over the forecast period, owing to the higher adoption of technology resulting in maturation.

Asia Pacific is expected to witness the fastest growth over the forecast period at a CAGR of over 7%. Moreover, recently, the Asia Pacific contact center outsourcing is witnessing a higher growth rate, thereby leading the industry participants to eventually offer companies with innovative solutions.

Key Companies & Market Share Insights

The market is consolidated owing to the presence of a few industry players. The major companies include Nice Systems, Verint Systems, Call Miner, Nexidia, Genesys, and Avaya Inc. Industry players are investing a huge amount in research and development to enhance their product accuracy and technological capability.

Furthermore, they are involved in strategic alliances to gain a competitive advantage over the other. For instance, Nice Systems acquired Nexidia, a major provider of advanced customer analytics, in order to expand its usage in critical business use cases.

Recent Developments

-

In October 2021, OrecX, an audio and screen capture service for analytics, machine-based learning, and recording, has been acquired by CallMiner, a leading supplier of conversation analytics to promote business improvement

-

In September, 2021, CallMiner, a global leader of conversation analytics for business improvement, announced that the CallMiner Eureka Platform combined with Microsoft Azure Speech to Text is expected to deliver a powerful and unified solution

-

In October 2021, VoiceBase and Tenfo were acquired by LivePerson in order to power scaled Voice AI innovation. Customers are anticipated to be in charge of their experiences owing to a unified widely integrated Voice and Conversational AI system

-

In November 2022, Startek® used Verint Speech Analytics™ to obtain information from Verint’s interaction with more than 500 million customers. This helped Startek improve their problem resolution at first contact by 4 percent.

-

In March 2023, CallMiner collaborated with Microsoft to improve its AI expertise with Azure Cognitive Services. This collaboration helped CallMiner to augment its AI proficiency with Azure Cognitive Services to support Data-driven businesses.

Speech Analytics Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1,001.5 million

Revenue forecast in 2025

USD 1,640.5 million

Growth Rate

CAGR of 10.0% from 2018 to 2025

Base year for estimation

2015

Historical data

2014 - 2015

Forecast period

2018 - 2025

Quantitative units

Revenue in USD million and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Japan; China; Brazil; Mexico; South Africa

Key companies profiled

Nice Systems; Verint Systems; Call Miner; Nexidia; Genesys; and Avaya Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Speech Analytics Market Segmentation

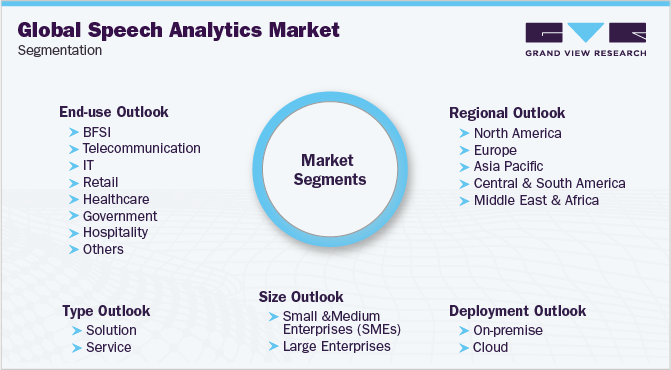

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2014 to 2025 For the purpose of this study, Grand View Research has segmented the speech analytics market on the basis of solution, deployment, enterprise size, end-use, and region:

-

Type Outlook (Revenue, USD Million; 2014 - 2025)

-

Solution

-

Service

-

-

Deployment Outlook (Revenue, USD Million; 2014 - 2025)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million; 2014 - 2025)

-

Small &Medium Enterprises (SMEs)

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Million; 2014 - 2025)

-

BFSI

-

Telecommunication

-

IT

-

Retail

-

Healthcare

-

Government

-

Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."