- Home

- »

- Medical Devices

- »

-

Spinal Implants And Devices Market, Industry Report, 2033GVR Report cover

![Spinal Implants And Devices Market Size, Share & Trends Report]()

Spinal Implants And Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Spinal Fusion Devices, Spinal Biologics,, By Technology, By Surgery Type, By Procedure Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-031-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Spinal Implants And Devices Market Summary

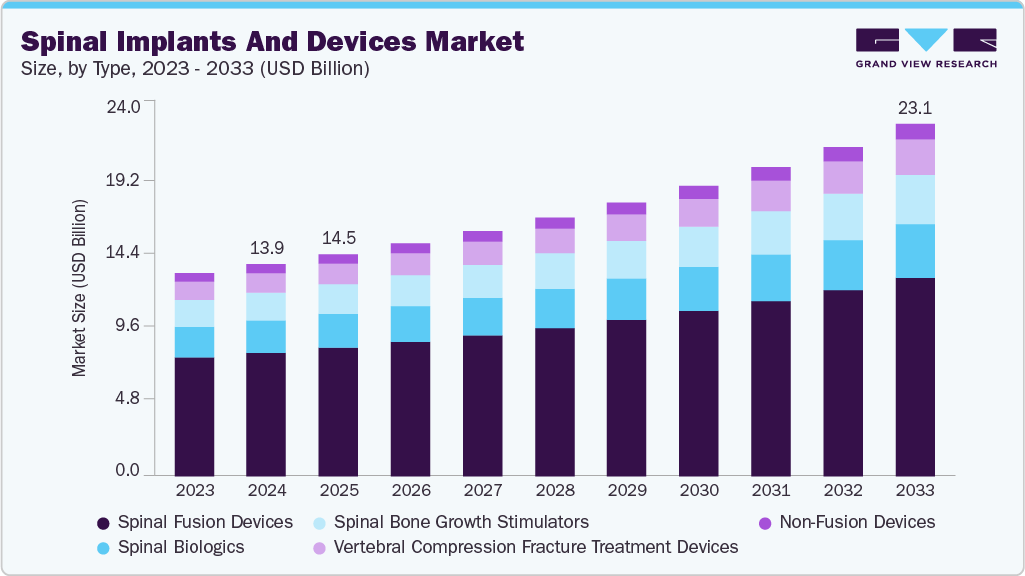

The global spinal implants and devices market size was estimated at USD 13.91 billion in 2024 and is projected to reach USD 23.13 billion by 2033, growing at a CAGR of 6.0% from 2025 to 2033. The spinal implants and devices market is propelled by a rising burden of spinal disorders, rapid technological advancements improving surgical outcomes, and strategic expansion efforts into high-growth emerging regions.

Key Market Trends & Insights

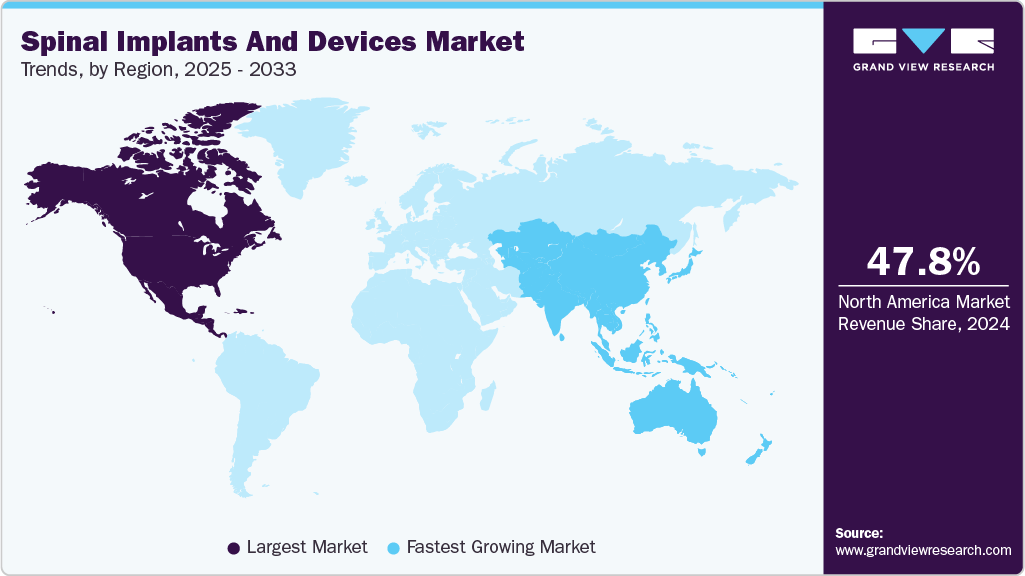

- North America spinal implants and devices market dominated global market in 2024 and accounted for the largest revenue share of 47.82%.

- The U.S. dominated the spinal implants and devices market in North America region in 2024.

- By product, the spinal fusion devices segment dominated the market with the largest revenue share of 58.23% in 2024.

- By technology, the spinal fusion and fixation technologies segment dominated the market with the largest revenue share of 67.02% in 2024.

- By surgery type, the open surgery segment dominated the market with a revenue share of 58.81% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.91 Billion

- 2033 Projected Market Size: USD 23.13 Billion

- CAGR (2025-2033): 6.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market players leveraging innovation and expanding their geographical footprint are well-positioned to capitalize on the growing demand for advanced spinal care solutions.According to WHO estimates, in April 2024, there are approximately 15.4 million individuals diagnosed/suffering from spinal cord injuries across the globe in 2021. The compression of the spinal nerve or damage results in injury to the external side of the vertebral column.

The rising prevalence of spinal disorders, including degenerative disc diseases, spinal stenosis, and vertebral fractures, is a primary driver of the spinal implants and devices market. An aging global population, coupled with lifestyle-related factors such as poor posture, obesity, and sedentary habits, has led to a surge in spinal ailments requiring surgical intervention. This growing patient pool is driving demand for a wide range of spinal implants, including fusion devices, non-fusion implants, and motion-preserving technologies to improve mobility and reduce chronic pain.In April 2025, according to Medscape, the global prevalence of low back pain (LBP) was estimated at 619 million in 2020 and is projected to rise to 843 million by 2050. Between 1990 and 2020, age-standardized prevalence and years lived with disability (YLDs) for LBP decreased by approximately 10%. In 2020, LBP accounted for 832 YLDs per 100,000 population worldwide.

Technological advancements in spinal implants and surgical techniques are significantly boosting market growth. Innovations such as 3D-printed patient-specific implants, minimally invasive surgical approaches, and the integration of navigation and robotic-assisted systems are enhancing surgical precision and outcomes. These advancements are reducing operative time, lowering complication rates, and facilitating faster patient recovery, making them increasingly preferred by both healthcare providers and patients. In November 2024, Carlsmed introduced a digital production line to improve the delivery timeline of its aprevo personalized spinal fusion implants. The new process is designed to reduce lead times to under ten days, supporting hospitals with shorter surgical scheduling windows.

Expanding healthcare infrastructure in emerging economies, coupled with rising investments from global medical device manufacturers, is driving geographical expansion of spinal implants and devices. Companies increasingly focus on underserved regions in Asia Pacific, Latin America, and the Middle East to tap into unmet clinical needs. Efforts to localize manufacturing, establish distribution networks, and provide surgeon training programs are making advanced spinal treatments more accessible and affordable in these regions, thereby accelerating market penetration. In April 2025, Spinal Simplicity expanded the commercial availability of its Minuteman G5 minimally invasive spinal implant to the UAE, marking a strategic geographic expansion to strengthen its global presence in the spinal implants and devices market.

Regulatory approvals and technological advancements are driving significant changes in the global spinal implants market, with manufacturers prioritizing adaptive implant designs to enhance surgical precision and patient outcomes. Expansion into emerging markets has become a strategic focus, as companies navigate complex regulatory environments and respond to growing demand for advanced spinal fusion systems. These shifts reflect broader industry trends emphasizing minimally invasive techniques, innovative biomaterials, and cost-efficiency in spine surgeries.

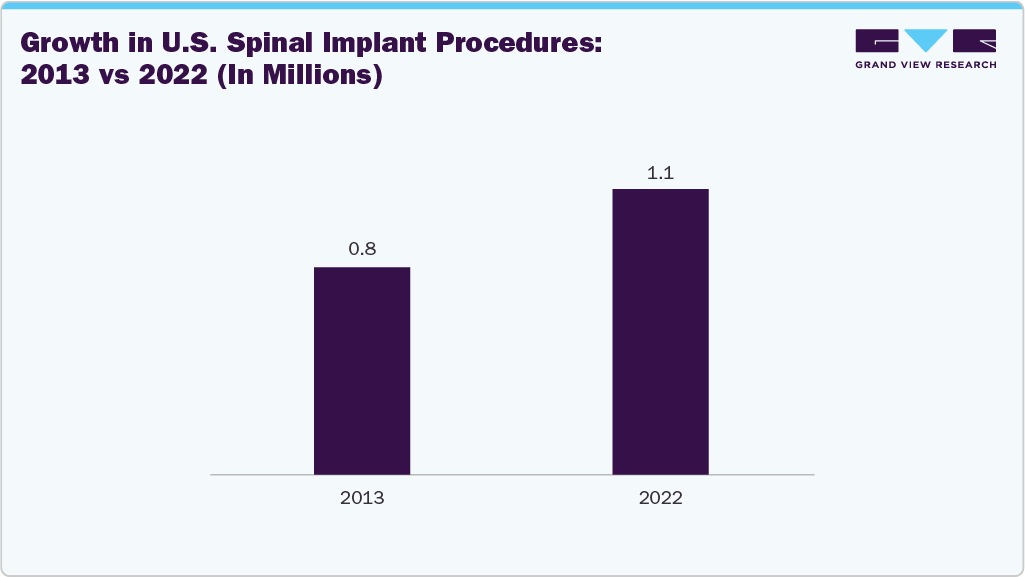

In January 2025, according to the Journal of Craniovertebral Junction and Spine, U.S. spine procedure volume rose from 800,000 in 2013 to over 1.1 million in 2022. Lumbar and cervical fusions made up 73% of these surgeries. The proportion of patients over 64 years old significantly increased, with metal interbody devices replacing PEEK and allografts as preferred materials. Despite rising volumes, the average price of pedicle screws decreased to USD 923, reflecting cost optimization trends in spinal implant utilization.

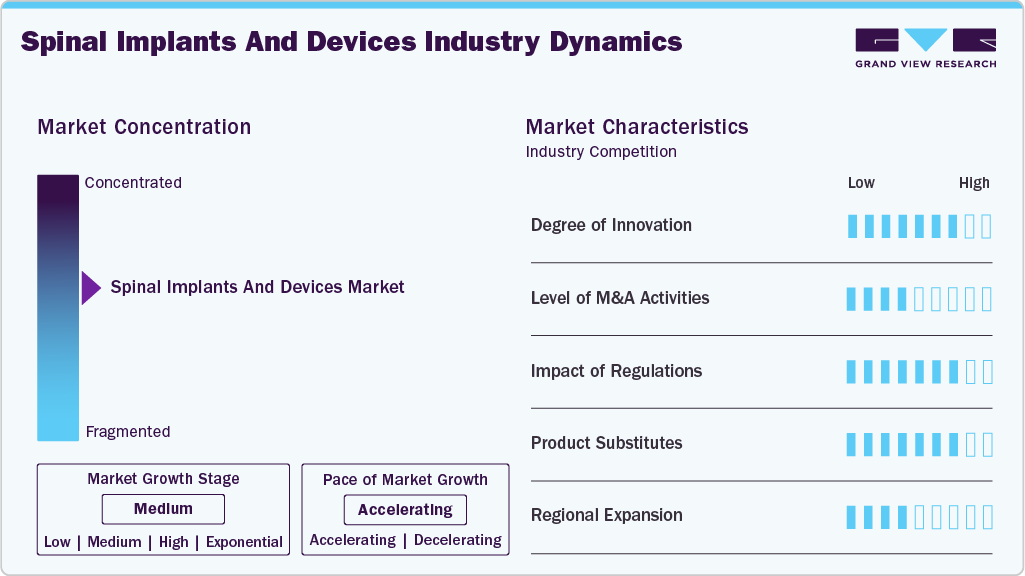

Market Concentration & Characteristics

The spinal implants and devices market shows high innovation, driven by advanced materials, implant designs, and minimally invasive techniques. Companies invest in next-generation solutions to improve outcomes, reduce surgery time, and enable faster recovery. Robotic-assisted surgeries and navigation systems enhance precision, reducing intraoperative errors. Innovations in biomaterials, such as bioresorbable polymers and surface-modified titanium, are enhancing implant biocompatibility and reducing revision surgeries. In April 2025, according to an article in eHealth Network, minimally invasive spine surgery (MISS) was highlighted as a transformative approach reducing tissue damage, postoperative pain, and recovery time compared to traditional open procedures.

Mergers and acquisitions help companies enhance technological capabilities and diversify product portfolios. Strategic collaborations provide access to specialized technologies and strengthen market positions. Consolidations improve economies of scale and accelerate entry into underpenetrated regions. In March 2023, Xtant Medical acquired the Coflex and Cofix product lines from Surgalign for USD 17 million, enhancing its portfolio with the only FDA PMA-approved interlaminar stabilization device for lumbar spinal stenosis (LSS). The acquisition is expected to contribute approximately USD 14 million in annual revenue while expanding Xtant’s presence in ambulatory surgery centers and outpatient spine procedures.

Regulatory frameworks shape product development and market entry strategies. Companies must meet strict safety, efficacy, and quality standards imposed by authorities such as the FDA, EMA, and regional regulatory bodies. Streamlined approval pathways for breakthrough devices reduce time-to-market for innovative technologies, encouraging faster clinical adoption. Harmonization of regulatory standards across regions is improving market access for globally manufactured devices.

Companies expand into high-growth regions through partnerships with local healthcare providers, distributors, and hospital networks. Regional manufacturing hubs optimize supply chains and reduce costs, making advanced implants accessible in price-sensitive markets. Establishing local training centers and skill-development programs for surgeons is accelerating the adoption of advanced spinal implants. Expansion strategies also focus on tapping into the growing medical tourism sector in countries such as India, Thailand, and UAE.

Product Insights

The spinal fusion devices segment dominated the market with the largest revenue share of 58.23% in 2024.Significant progress in spine fusion surgery, both with and without internal fixation devices, has resulted in substantial growth in this market segment. For instance, in November 2023, Orthofix Medical Inc. launched its WaveForm L Lateral Lumbar Interbody System in the U.S. designed for lateral lumbar interbody fusion (LLIF) operations, the WaveForm L System features an innovative 3D-printed design. Due to its porous architecture, its design focuses on creating a conducive environment for strong fusion.

The vertebral compression fracture treatment devices segment is anticipated to grow at the fastest CAGR over the forecast period.Driven by the rising incidence of spinal disorders and a growing patient shift toward minimally invasive procedures, the segment is expected to grow steadily. Several key companies are expanding their geographic reach through regulatory approvals, clinical trials, and new product launches. For example, in October 2023, Amber Implants began human clinical trials for its VCFix Spinal Systems, designed to treat vertebral compression fractures without using bone cement. The implant comes with a sterile, single-use surgical kit to ensure precise placement and lower infection risks.

Technology Insights

The spinal fusion and fixation technologies segment dominated the market with the largest revenue share of 67.02% in 2024. The growth is attributed to their coverage of a wide range of techniques, including both posterior and anterior approaches. Furthermore, the segment is experiencing growth due to the increasing need to address various spinal conditions that cause pain, instability, and neurological symptoms. These technologies aim to provide structural support, stability, and pain relief by fusing vertebrae or stabilizing the spine. In July 2025, Globus Medical launched the HILINE posterior band fixation system designed for cervical and thoracolumbar spine surgeries. The system offers versatile implant and instrumentation options to address scoliosis correction and spinal stabilization.

The motion preservation technologies segment is anticipated to grow at the fastest CAGR over the forecast periodsince they offer individuals suffering from lumbar spinal stenosis, degenerative disc disease, and facet pain a better option for spinal fusion. This technology is subdivided into total disc replacement (TDR), posterior dynamic devices, prosthetic nucleus, and facet replacement.In November 2024, Foundation Surgical received FDA 510(k) clearance for its Vertiwedge Intraosseous Device, a motion-preserving vertebral body replacement. The VBO procedure corrects partially collapsed vertebrae while maintaining natural spinal motion. This innovation marks a significant advancement in lateral and oblique spinal surgeries.

Surgery Type Insights

The open surgery segment dominated the market with a revenue share of 58.81% in 2024. This is attributed toincreasing cases of completed medical conditions that require intricate and precise interventions that are best achieved through open surgical methods. The familiarity and established success rates of open surgical procedures in treating a wide range of conditions contribute to its continued utilization. Open surgery allows surgeons to have a clear view of the spine and surrounding structures, enabling them to perform intricate procedures with precision. Open surgery provides greater flexibility in addressing complex spinal conditions that require extensive intervention or correction.

The minimally invasive surgery segment is anticipated to grow at the fastest CAGR over the forecast period. The growing R&D, technological advancements, and introduction of innovative products and facilities are driving the growth of the segment globally. For instance, growing awareness & adoption of robotic surgery and the introduction of needlescopic surgery, single-site laparoscopic surgery, natural orifice transluminal endoscopic surgery (NOTES), endoscopic assisted laparoscopy, and robotic surgery have upsurged the demand for MIS among the people across the world. In February 2022, Aurora Spine received a U.S. “Notice of Allowance” for its patent covering the ZIPFlex spinal implant designed for motion preservation or fusion. The minimally invasive device offers a convertible design, enabling surgeons to switch between fusion and non-fusion applications post-implantation.

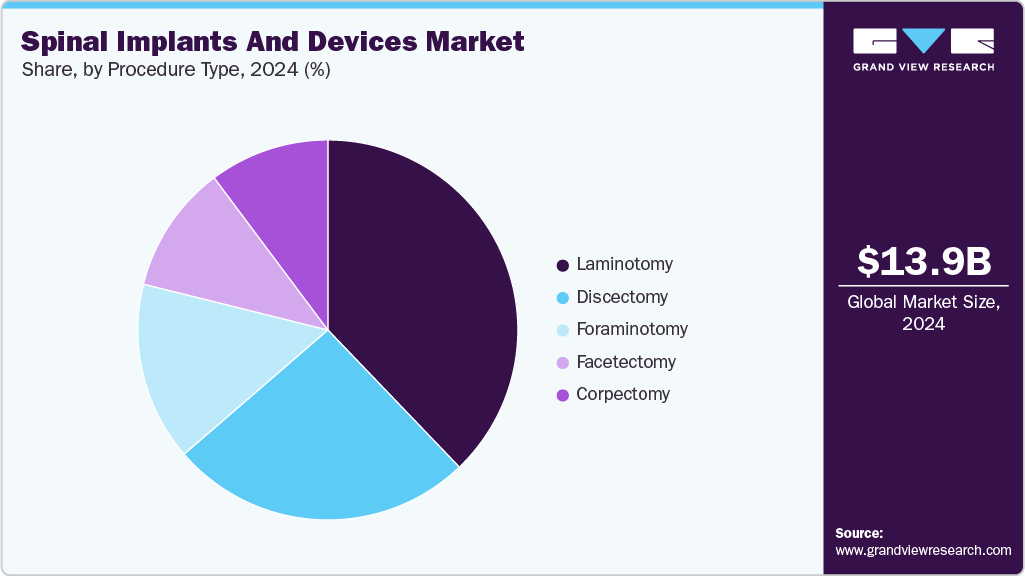

Procedure Type Insights

The laminotomy segment dominated the market with a revenue share of 37.84% in 2024. Laminotomy is frequently performed in combination with other spinal surgeries such as discectomy or spinal fusion. These decompressive surgeries are frequently performed, as these surgeries are prevalent due to the high incidence of conditions like spinal stenosis, which often require surgical intervention to alleviate symptoms and improve quality of life for patients. In August 2023, according to an article in StatPearls, laminectomy was highlighted as one of the most common procedures for spinal canal decompression in cases of degenerative stenosis, fractures, tumors, and deformities. The technique involves removing the spinous process and lamina to decompress the central canal, lateral recesses, and neural foramina, aiming to relieve neurogenic claudication and prevent failed back surgery syndrome.

The foraminotomy segment is expected to grow at the fastest rate during the forecast period. The major driver for market growth is the growing incidence of compressed nerves in the spinal column, particularly due to blockages or narrowing of the intervertebral foramen. These conditions include spinal stenosis, which can result from various factors such as degenerative diseases including spondylosis causing bony spurs, degeneration of intervertebral disks. In February 2024, according to an article in Frontiers in Surgery, transforaminal endoscopic lumbar foraminotomy (TELF) was shown to be a safe and effective alternative to open surgery for octogenarian patients with lumbar foraminal stenosis. The procedure, performed under local anesthesia, achieved a 93.75% clinical improvement rate without systemic complications.

Regional Insights

North America spinal implants and devices market dominated the spinal implants and devices market with a revenue share of 47.82% in 2024. The region’s leadership is driven by the high prevalence of spinal disorders, advanced healthcare infrastructure, and early adoption of innovative technologies such as 3D-printed implants and motion preservation devices. Favorable reimbursement policies and a strong presence of key market players further support the market dominance.For instance, in March 2024, the FDA granted breakthrough device designation to Bioretec’s RemeOs Spinal Interbody Cage implant, representing a significant advancement in spinal surgery technology.

U.S. Spinal Implants And Devices Market Trends

The U.S. dominated the spinal implants and devices market in North America region in 2024, due to rising incidences of degenerative disc diseases and traumatic spinal injuries. Increasing demand for minimally invasive surgical procedures and robust investments in R&D for next-generation spinal devices are key contributors. In February 2025, Centinel Spine surpassed 10,000 U.S. procedures with its Match-the-Disc prodisc Cervical Total Disc Replacement System, doubling its milestone count within months. The system’s ability to intraoperatively match implants to patient anatomy drove rapid surgeon adoption and repeat usage.

Europe Spinal Implants And Devices Market Trends

The spinal implants and devices market in Europe is expected to grow significantly over the forecast period. The growth is attributed to the increasing geriatric population, a rising burden of osteoporosis-related spinal fractures, and technological advancements in implant materials and design. Regulatory support for innovative medical devices, combined with expanding access to specialized spine care centers, is expected to drive adoption rates across key European countries. In June 2023, Implanet launched its MIS range, a minimally invasive pedicle screw system developed with Sanyou Medical. The system aims to reduce trauma associated with open spinal surgeries by offering advanced implants and streamlined instrumentation for treating degenerative, traumatic, or tumoral spinal pathologies.

The spinal implants and devices industry in the UK is expected to grow significantly during the forecast period, as the National Health Service (NHS) expands its focus on orthopedic and spinal care services. The increasing number of sports-related spinal injuries and rising demand for minimally invasive procedures is expected to accelerate product uptake. In August 2025, Paradigm Spine GmbH partnered with RIWOspine UK to distribute its eFuse expandable interbody cages in the UK The collaboration aims to advance minimally invasive TLIF, PLIF, and endoscopic spine surgeries.

Asia Pacific Spinal Implants And Devices Market Trends

The Asia Pacific spinal implants and devices market is expected to register the fastest growth rate over the forecast period owing to rapidly improving healthcare infrastructure, increasing awareness about spinal health, and growing medical tourism in countries like India, China, and South Korea. In June 2025, CGBio announced the launch of its Novomax Fusion, a ceramic-based cervical fusion cage, into the Japanese spinal implant market. This marks CGBio's first spinal implant product introduction in Japan, leveraging its proprietary BGS-7 bioactive glass-ceramic material that offers enhanced biocompatibility and osteoconductivity compared to traditional titanium or PEEK cages.

China spinal implants and devices market is anticipated to register considerable growth during the forecast period. Growth is driven by rising spinal disorders due to an aging population and lifestyle-related conditions such as obesity and sedentary habits. In June 2025, IMPLANET received CFDA approval for its JAZZ spinal fixation system in China. The approval enables its partner Sanyou Medical to distribute JAZZ in the world’s largest spine market. This milestone strengthens IMPLANET’s global expansion strategy and hybrid fixation portfolio.

Latin America Spinal Implants And Devices Market Trends

The Latin America spinal implants and devices market is anticipated to witness considerable growth over the forecast period. Increasing spinal injuries from road accidents and sports-related trauma are driving demand for advanced spinal devices. Investments in healthcare modernization and the expansion of private hospital networks are enhancing access to specialized spinal surgeries. In February 2025, Accelus announced that its FlareHawk7 and FlareHawk9 spinal implants received regulatory approval from Brazil’s ANVISA. The FlareHawk Interbody Fusion System, featuring Adaptive Geometry technology, allows implants to expand in width, height, and lordosis post-insertion while maintaining a minimal profile to optimize spinal alignment.

Argentina spinal implants and devices market is anticipated to register considerable growth during the forecast period. Rising spinal deformities and degenerative disc diseases, along with improving diagnostics, are fueling demand for spinal implants. In September 2023, a study published in Frontiers in Neurology analyzed data from Argentina’s FAME registry, detailing the clinical and sociodemographic profile of 332 spinal muscular atrophy (SMA) patients. The research highlighted diagnostic delays, regional disparities in care access, and that only 68% of patients received specific pharmacological treatments. The findings underscored the urgent need for national newborn screening programs and improved access to SMA therapies across Argentina.

Middle East And Africa Spinal Implants And Devices Market Trends

The Middle East and Africa spinal implants and devices market is anticipated to witness considerable growth over the forecast period. Healthcare investments, especially in Gulf Cooperation Council (GCC) countries, are enhancing access to advanced orthopedic care. In January 2025, a Saudi medical team performed the first surgery using a new spinal implant for cervical spine conditions. The device simplifies spinal stenosis surgeries by eliminating complex anterior and posterior approaches, reducing surgical risks and recovery time.

UAE spinal implants and devices market is anticipated to register considerable growth during the forecast period. Development of a world-class healthcare system is driving adoption of advanced spinal implant technologies. In February 2024, NGMedical launched its MOVE-C artificial cervical disc in the UAE, marking its first implantation in Abu Dhabi. This expansion follows product approval in Mexico and is part of NGMedical’s global commercialization strategy. The MOVE-C device combines viscoelastic motion preservation with a simplified implantation technique, offering a non-PE design with titanium endplates.

Key Spinal Implants and And Devices Company Insights

Key participants in the spinal implants and devices industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Spinal Implants And Devices Companies:

The following are the leading companies in the spinal implants and devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Johnson & Johnson

- VB Spine, LLC

- NuVasive

- Zimmer Biomet

- Globus Medical, Inc.

- Alphatec Spine, Inc

- Orthofix Holdings, Inc

- RTI Surgical Holdings

- Ulrich GmbH & Co. KG

- B. Braun Melsungen AG

- Seaspine Holdings Corporation.

Recent Developments

-

In August 2025, Carlsmed raised USD 100.5 million through its IPO to support the scaling of its 3D printed personalized spinal implants platform, aprevo. The company also received CMS approval for New Technology Add-On Payment (NTAP) reimbursement for cervical fusion procedures, with hospitals eligible for up to USD 21,125 per case starting October 2025.

-

In July 2025, Osteotec signed an exclusive UK distribution agreement with Ulrich Medical for its advanced spinal implant systems. The partnership enhances Osteotec’s spine portfolio, bringing Ulrich’s vertebral body replacement and dynamic stabilization solutions to NHS and private sectors. This collaboration aims to improve surgical outcomes for complex spinal procedures across the UK.

-

In January 2025, Stryker revealed an agreement to transfer its U.S. spinal implants division to Viscogliosi Brothers, LLC, which intends to launch a new company named VB Spine to manage these assets. As part of the arrangement, VB Spine will receive exclusive usage rights for Stryker’s Mako Spine and Copilot systems in its implant surgeries.

-

In January 2024, Accelus introduced the LineSider modular-cortical system for spinal implant surgeries, designed to enhance procedural flexibility by allowing early screw placement and customizable construct assembly. The system is available in open and cortical modular configurations, supporting various surgical approaches while streamlining operating room setup.

Spinal Implants And Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.55 billion

Revenue forecast in 2033

USD 23.13 billion

Growth rate

CAGR of 6.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, surgery type, procedure type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Johnson & Johnson; VB Spine, LLC; NuVasive; Zimmer Biomet; Globus Medical; Inc.; Alphatec Spine Inc.; Orthofix Holdings Inc; RTI Surgical Holdings; Ulrich GmbH & Co. KG; B. Braun Melsungen AG; Seaspine Holdings Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spinal Implants And Devices Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global spinal implants and devices market report based on product, technology, surgery type, procedure type, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Spinal Fusion Devices

-

Thoracic & Lumbar Fusion Devices

-

Cervical Fusion Devices

-

-

Spinal Biologics

-

Allografts

-

Xenografts

-

DBM

-

BMP

-

Synthetic Bone Grafts

-

-

Vertebral Compression Fracture Treatment Devices

-

Non-fusion Devices

-

Spinal Bone Growth Stimulators

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Spinal Fusion and Fixation Technologies

-

Vertebral Compression Fracture Treatment

-

Vertebroplasty

-

Kyphoplasty/Vertebral Augmentation

-

Motion Preservation Technologies

-

-

-

Surgery Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Open Surgery

-

Minimally Invasive Surgery

-

-

Procedure Type Outlook (Revenue USD Million, 2021 - 2033)

-

Discectomy

-

Laminotomy

-

Foraminotomy

-

Corpectomy

-

Facetectomy

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global spinal implants and devices market size was estimated at USD 13.91 billion in 2024 and is expected to reach USD 14.55 billion in 2025.

b. The global spinal implants and devices market is expected to grow at a compound annual growth rate of 5.97% from 2025 to 2033 to reach USD 23.13 billion by 2033.

b. Spinal fusion devices segment dominated the spinal implants & devices market with a share of 58.23% in 2024. Significant progress in spine fusion surgery, both with and without internal fixation devices, has resulted in substantial growth in this market segment.

b. Some key players operating in the spinal implants and devices market include Medtronic; Johnson & Johnson; Stryker; NuVasive; Zimmer Biomet; Globus Medical, Inc.; Alphatec Spine, Inc.; Orthofix Holdings, Inc; RTI Surgical Holdings; Ulrich GmbH & Co. KG; B. Braun Melsungen AG; Seaspine Holdings Corporation

b. Key factors that are driving the spinal implants & devices market growth include the increasing prevalence and subsequent increase in the treatment rates of degenerative spine disorders, advancements in medical technology, increasing demand for minimally invasive procedures, and the growing incidence of spinal cord injuries (SCIs) across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.