- Home

- »

- Medical Devices

- »

-

Spinal Implants And Devices Market Size Report, 2030GVR Report cover

![Spinal Implants And Devices Market Size, Share & Trends Report]()

Spinal Implants And Devices Market Size, Share & Trends Analysis Report By Product (Spinal Fusion Devices, Spinal Biologics), By Technology, By Surgery Type, By Procedure Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-031-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Spinal Implants And Devices Market Trends

The global spinal implants and devices market size was estimated at USD 13.3 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. The market growth is driven by the rise in spinal cord injuries (SCIs) globally. According to WHO estimates, in April 2024, there are approximately 15.4 million individuals diagnosed/suffering from spinal cord injuries across the globe in 2021. The compression of spinal nerve or damage results in injury to the external side of the vertebral column. The main causes of this compression include spine degeneration, bone fractures, or abnormalities like hematomas or herniated discs.

The rising prevalence of spinal disorders, fractures & injuries and the growing demand for advanced medical technology & implants is estimated to boost the market's growth over the forecast period. According to Cleveland in the U.S., there are approximately 18,000 new cases of traumatic spinal cord injury annually; of these, over 75% are males. Approximately 250,000 to 500,000 SCI cases are reported worldwide annually. Preventable causes such as falls, auto mishaps, and violence cause most SCIs. The majority of these injuries result from traumatic events such as falls, vehicle accidents, or acts of violence, indicating they could potentially be prevented.

Furthermore, the growing elderly population, along with a rising incidence of obesity, frequently leads to conditions affecting the spine, such as spinal stenosis. This escalates the demand for spinal surgeries, thereby driving the expansion of the market. For instance, as per the JAMA Network study published in May 2022, lumbar spinal stenosis is a prevalent condition, impacting around 11% of the elderly population in the U.S. Research indicates that around 20% of individuals over 60 years old show signs of spinal stenosis on imaging tests. However, over 80% of these cases are asymptomatic and, thus, do not require any intervention. Obesity often leads to significant lower back problems and heightens the likelihood of recurrence, thereby prompting a higher utilization of spinal devices in medical care. The elderly are predominantly affected by spine-related conditions such as degenerative disc diseases, vertebral compression fractures, spondylolisthesis, and spinal stenosis.

The number of SCIs has considerably increased due to an increase in traffic accidents. For instance, according to the National Spinal Cord Injury Statistical Center (NSCSC), some of the causes of spinal cord injury (SCI) include motor vehicle accidents involving cars and bulldozers, steam rollers, forklifts, and other vehicles. According to Indian Spinal Injuries Centre’s (ISIC) data recorded between 2012 to 2022, the prevalence of spinal cord injuries caused due to road traffic accidents is approximately 44%. As per the NCBI study, the lumbosacral spine was the most affected area in research that included all patients with vertebral column fractures following auto accidents. According to the Spinal Injuries Association stated that nearly 2,500 individuals are diagnosed with SCI in the UK every year. While the total number of people living with spinal cord injury in the UK is 50,000.

The existence of renowned market players, accompanied by funding generated by government organizations for R&D, encourages technological advancement. One of the key technological trends expanding the market is the adoption of computerized navigation systems and titanium implants, which offer real-time spinal cord images and clear MRI images. These expanded the range of minimally invasive surgeries compared to open-back surgeries. The introduction of NuVasive's Pulse integrating platform marked a major development in the spine surgery sector. It is the initial singular platform with various technologies for all spine procedures that allow doctors to use safer, more efficient, and less disruptive surgical techniques. The platform was awarded FDA clearance in July 2021.

Market Concentration & Characteristics

The spinal implants and devices industry exhibits a moderate level of concentration. Characteristics include rapid technological advancements, such as robotics & navigation systems, personalized & biodegradable implants, and remote monitoring & connectivity. The market is driven by increasing demand for minimally invasive procedures, particularly in developed regions. The industry showcases continuous innovation and expansion fueled by rising healthcare expenditure and the growing prevalence of spinal injuries requiring surgical interventions.

The spinal implants and devices industry is characterized by a moderate to high degree of innovation, with technological advancements and companies consistently developing products that enhance efficiency and safety. Some of the latest trends include the adoption of computerized navigation systems and titanium implants, which offer real-time spinal cord images and clear MRI images, expanding the range of minimally invasive surgeries compared to open-back surgeries.

Regulations significantly impact the spinal implants and devices industry by ensuring patient safety, product quality, and efficacy. Compliance with regulatory standards, such as recent guidance including MDCG 2021 - 24 has reclassified many spinal fusion devices from Class IIb to Class III in the European Union Medical Device Regulation (EU MDR). The shift in classification from Class IIb to Class III imposes additional requirements on manufacturers. They now need to conduct a full review of technical documentation instead of sampling representative devices per group. Moreover, the regulatory framework set forth by organizations such as the FDA in the U.S. and the EU MDR in Europe plays a crucial role in ensuring the safety, efficacy, and quality of these medical devices.

Mergers and acquisitions in the spinal implants and devices industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in February 2023, Xtant Medical and Surgalign announced an agreement in which Xtant acquired the Coflex and Cofix product lines from Surgalign for a total of USD 17 million.

Companies have developed personalized devices that cater to specific patient needs, improving outcomes in spinal surgeries. Many companies are adopting various strategies, which include collaboration, product expansion, and partnerships, to strengthen their market position. For instance, in November 2023, Nevro Corp. acquired Vyrsa Technologies, a company specializing in minimally invasive treatment options for chronic sacroiliac joint pain. This acquisition allowed Nevro to expand its offerings to include differentiated implants for addressing chronic low back pain associated with the SI joint. By incorporating Vyrsa’s products into its portfolio, Nevro aimed to provide long-term pain relief to a significant portion of patients suffering from this condition.

The spinal implants and devices industry is experiencing significant global expansion due to increasing healthcare expenditure, technological advancements, and growing awareness about spinal health. For instance, World Spine Day, observed on October 16th annually, is the largest public health campaign aimed at increasing awareness of the global impact of spinal pain and disability. The 2024 initiative encourages individuals to raise awareness about the global impact of spinal pain and disability. Its goal is to empower people worldwide, regardless of age or nationality, to embrace evidence-based practices for preserving spinal.

Product Insights

The spinal fusion devices segment accounted for the largest market share of 58.4% in 2023. Significant progress in spine fusion surgery, both with and without internal fixation devices, has resulted in substantial growth in this market segment. For instance, in November 2023, Orthofix Medical Inc. launched its WaveForm L Lateral Lumbar Interbody System in the U.S. designed for lateral lumbar interbody fusion (LLIF) operations, the WaveForm L System features an innovative 3D-printed design. Due to its porous architecture, its design focuses on creating a conducive environment for strong fusion.

The vertebral compression fracture treatment devices segment registered the fastest CAGR over the forecast period due to increased spine disorders and growing patients' preference for minimally invasive surgery. Furthermore, several key players are anticipated to fuel segment growth by seeking approvals from various regulatory bodies and clinical trials and engaging in product launches to expand their geographical presence. For instance, in October 2023, Amber Implants, a company specializing in next-generation implants for spinal injuries, officially commenced clinical trials for the VCFix Spinal Systems. The first human clinical trial aims to assess the safety and effectiveness of the VCFix implant in treating vertebral compression fractures, specifically without employing bone cement. This implant is provided with a single-use, sterile surgical kit designed to facilitate accurate placement and reduce infection risks.

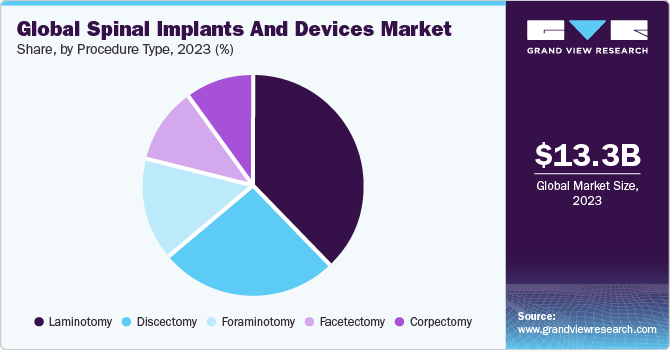

Procedure Type Insights

The laminotomy segment accounted for the largest revenue share in 2023. Laminotomy is frequently performed in combination with other spinal surgeries such as discectomy or spinal fusion. These decompressive surgeries are frequently are performed, as these surgeries are prevalent due to the high incidence of conditions like spinal stenosis, which often require surgical intervention to alleviate symptoms and improve quality of life for patients. The effectiveness and safety of laminotomy procedures have been well-established through research and clinical practice, contributing to their widespread use in the country. Laminotomy procedures in spinal implants are primarily driven by the need to address specific conditions such as spinal stenosis or narrowing of the spinal canal.

Foraminotomy is expected to experience the highest CAGR over the forecast period. The growth is attributed to the growing incidence of compressed nerves in the spinal column, particularly due to blockages or narrowing of the intervertebral foramen. These conditions include spinal stenosis, which can result from various factors such as degenerative diseases including spondylosis causing bony spurs, degeneration of intervertebral disks. Furthermore, the increasing adoption of MIS surgery by patients is projected to propel the market during the forecast period.

Technology Insights

The spinal fusion and fixation technologies segment accounted for the largest market share in 2023. The growth is attributed to their coverage of a wide range of techniques, including both posterior and anterior approaches. Furthermore, the segment is experiencing growth due to the increasing need to address various spinal conditions that cause pain, instability, and neurological symptoms. These technologies aim to provide structural support, stability, and pain relief by fusing vertebrae or stabilizing the spine. Additionally, growing FDA approvals for spinal fusion and fixation systems aided segment growth. For instance, in December 2023, The FDA cleared ZimVie’s spinal fixation system, Vital, for utilization alongside BrainLAB’s navigation tools, surgical imaging, and planning.

Motion preservation technologies are anticipated to experience the fastest CAGR during the forecast period since they offer individuals suffering from lumbar spinal stenosis, degenerative disc disease, and facet pain a better option for spinal fusion. This technology is subdivided into total disc replacement (TDR), posterior dynamic devices, prosthetic nucleus, and facet replacement.

Surgery Type Insights

The open surgery segment accounted for the largest revenue share in 2023. The growth is attributed to the increasing cases of completed medical conditions that require intricate and precise interventions that are best achieved through open surgical methods. Additionally, the familiarity and established success rates of open surgical procedures in treating a wide range of conditions contribute to its continued utilization. Open surgery allows surgeons to have a clear view of the spine and surrounding structures, enabling them to perform intricate procedures with precision. Additionally, open surgery provides greater flexibility in addressing complex spinal conditions that may require extensive intervention or correction.

Minimally invasive surgery (MIS) is anticipated to experience the fastest CAGR over the forecast period. The growing R&D, technological advancements, and introduction of innovative products and facilities are together driving the growth of the segment globally. For instance, growing awareness & adoption of robotic surgery and the introduction of needlescopic surgery, single-site laparoscopic surgery, natural orifice transluminal endoscopic surgery (NOTES), endoscopic assisted laparoscopy, and robotic surgery have upsurged the demand for MIS among the people across the world. Moreover, MIS is computer-based, guided by cutting-edge navigation systems, and ensures a higher degree of accuracy, and thus expected to grow significantly in coming years.

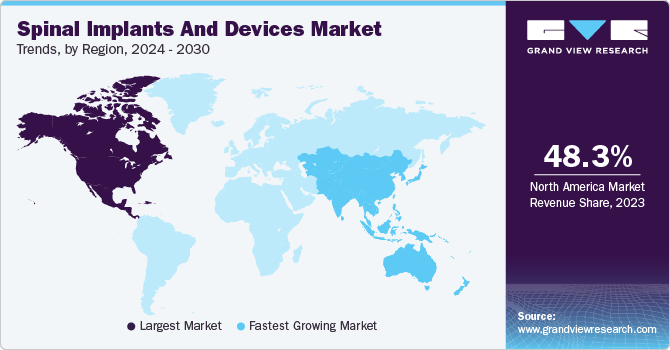

Regional Insights

North America spinal implants and devices market dominated the overall global market and accounted for the 48.3% revenue share in 2023 due to rise in SCIs in the U.S. Moreover, the market is also expected to grow with technological advances, increased FDA approvals, an aging population, and the high prevalence of spinal disorders. Moreover, key players have experienced a substantial increase in market revenue in the U.S. For instance, in January 2022, the U.S. Food and Drug Administration (FDA) granted 510(k) approval for VUZE Medical's VIZE device, used to perform spine surgery. VUZE Medical specializes in visualization and verification for surgical procedures such as minimally invasive spine surgery. Furthermore, healthcare reimbursement has greatly influenced the country's need for spinal implants.

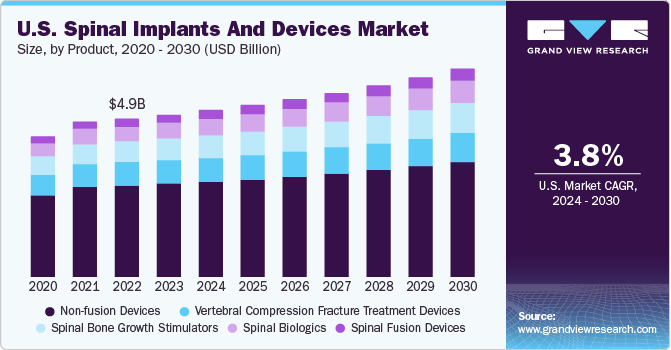

U.S. Spinal Implants and Devices Market Trends

The spinal implants and devices market in the U.S. held a significant share of the North American market in 2023. Companies in the U.S. are continuously engaged in FDA clearance for their spinal fixation systems to meet stringent safety and efficacy standards set by the regulatory body and global reach which is driving the market growth in the country. For instance, in March 2024, the FDA granted breakthrough device designation to Bioretec’s RemeOs Spinal Interbody Cage implant, representing a significant advancement in spinal surgery technology.

Europe Spinal Implants And Devices Market Trends

The spinal implants and devices market in Europe is witnessing growth fueled by the increasing incidence of road accidents leading to spinal injuries. Additionally, the aging population in Europe is experiencing a rise in spinal deformities such as disc compression, further driving the need for advanced spinal surgery solutions. Furthermore, Germany has a lucrative environment for technologically innovative startups. Around 80% of the surgical device manufacturers, including companies of spinal surgical devices in the country are SMEs. The presence of major market players, such as Medtronic, Ulrich GmbH & Co. KG; is anticipated to create lucrative opportunities in Germany.

Technological advancements in spinal surgical devices have improved the efficacy and safety of procedures, leading to increased demand for these devices in the UK. The rising preference for minimally invasive spine surgeries, which offer advantages such as smaller incisions, less tissue damage, outpatient options, reduced post-operative pain, and faster recovery times, has driven the adoption of spinal implants and devices. As per the Hospital of St. John's & St. Elizabeth update, January 2022, Minimally Invasive Spine Surgery (MISS) presents numerous potential benefits, including the utilization of small incisions, reduced disruption to soft tissues, outpatient treatment options, decreased post-operative discomfort, and expedited recovery times.

The spinal implants and devices market in France is expected to grow significantly over the forecast period. The French government is undertaking initiatives to improve the healthcare structure in France. The government recently promised a fund of USD 1.60 billion (Euro1.5 billion) over 3 years for staffing services, which is expected to improve the country’s healthcare industry. Moreover, there is a growing prevalence of rheumatoid arthritis (RA) among the people in France. As per the BMC Primary Care Journal, rheumatoid arthritis (RA) is highlighted as one of the most common chronic and inflammatory conditions in the field of rheumatology. The annual estimated prevalence of RA in France is 0.35%, making a significant contribution to the disease burden in the country.

Asia Pacific Spinal Implants And Devices Market Trends

The spinal implants and devices market in Asia Pacific region is expected to grow at a significant rate during the forecast period. This can be attributed to the growing SCI cases in India and China. Furthermore, Japan has also added to the rapid development of its highly sophisticated spine-related procedures. The rising elderly population and increased traffic accidents are also significantly driving regional growth.

The Japan spinal implants and devices market is expected to grow at the fastest rate during the forecast period due to the aging population and the ongoing need for advanced medical technologies in Japan. According to the National Institute of Population and Social Security Research study 2023, in Japan the population aged 65 and over is anticipated to increase from 36.0 million as of 2020 to 37.0 million by 2032. Moreover, the government's initiatives to support the healthcare industry are anticipated to sustain market growth.

The spinal implants and devices market in India is expected to grow over the forecast period. Spinal implants and device manufacturers are getting involved in setting up a new manufacturing facility in India owing to favorable regulatory climate and significant population. Presence of several local players in India also aids in securing the market position. India also has some world-class technologies, doctors, and clinics, which subsequently drives the demand for spinal implants and devices.

Latin America Spinal Implants And Devices Market Trends

The spinal implants and devices market in Latin America is experiencing significant growth attributed to various factors. The increasing awareness in the region about spinal implants has led to a substantial number of diagnosed cases, boosting the demand for early diagnosis of spinal issues. Furthermore, clinical education through conferences, symposiums, and webinars is becoming crucial in improving the adoption rate of spinal implants and devices. For instance, the 4th Congress of the Latin American Society of Neuromuscular Diseases (SOLANE) was scheduled in June 2023, in Bogota, Colombia. The conference covered a wide range of topics related to neuromuscular diseases, including clinical aspects, diagnosis, treatment, and discussions on the implementation of new high-cost therapies. The event featured plenary sessions, thematic workshops, poster sessions for original papers, and pharmaceutical industry symposia.

The Mexico spinal implants and devices market is experiencing significant growth attributed to various factors. The introduction of products in spinal implant technology is propelling the market growth in the country. For instance, in March 2024, NGMedical GmbH, a specialized medical device manufacturer dedicated to developing cutting-edge technologies for spinal applications, has successfully completed the initial implantation of its MOVE-C cervical artificial disc replacement in Mexico. MOVE-C integrates the characteristics of a second-generation viscoelastic disc prosthesis with the straightforward implantation method of a cervical cage. This prosthesis provides natural movement in all six directions, including axial cushioning with gradual resistance to movement. It is the initial prosthesis to feature titanium endplates produced through additive manufacturing and eliminates the need for polyethylene.

MEA Spinal Implants And Devices Market Trends

The spinal implants and devices market in MEA is experiencing significant growth over the forecast period. The rise in spinal cord injuries (SCIs) including preventable causes such as falls, and vehicle accidents, has led to a higher demand for advanced medical technology and implants in the MEA market. Growing applications of spine surgery technologies, such as computerized navigation systems and titanium implants, have enhanced the range of minimally invasive procedures available in the region, driving market growth. For instance, in November 2023, the neurosurgical team at Hamad General Hospital in Qatar successfully utilized technology known as “Augmented Reality with Electronic Navigation”. The surgery was performed with a precise surgical procedure on a patient aged 60, removing a cancerous spinal tumor.

The Saudi Arabia spinal implants and devices market is anticipated to expand over the forecast period due to technological innovation. The country is focusing on the digitalization of healthcare by leveraging innovative technologies, such as AI, big data, and cloud computing for 3D imaging of spinal implants. There are currently 150 health-tech startups in the country. Such advancements are resulting in shorter hospital stays and a rise in the number of surgical procedures, which, in turn, is driving down the demand for spinal implants and devices.

The spinal implants and devices market in Kuwait is expected to grow over the forecast period due to favorable investment outlook, with the country focusing on investments in the private sector. Moreover, the country offers spinal implants and devices at subsidized rates in the public sector, owing to the plans of Kuwait’s Ministry of Health. This is expected to drive the demand for the spinal implants and devices market and provide significant growth opportunities for players in the country.

Key Spinal Implants And Devices Company Insights

The competitive scenario in the spinal implants and devices market is highly competitive, with key players such as Medtronic; Johnson & Johnson; Stryker; NuVasive; Zimmer Biomet holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Spinal Implants And Devices Companies:

The following are the leading companies in the spinal implants and devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Johnson & Johnson

- Stryker

- NuVasive

- Zimmer Biomet

- Globus Medical, Inc.

- Alphatec Spine, Inc

- Orthofix Holdings, Inc

- RTI Surgical Holdings

- Ulrich GmbH & Co. KG

- B. Braun Melsungen AG

- Seaspine Holdings Corporation

Recent Developments

-

In January 2024, Accelus, a medical technology firm headquartered in the U.S., launched the Linesider Modular-Cortical System, a solution for spinal implant operations designed to improve the accuracy and effectiveness of spinal implant surgeries. It allows for the early insertion of screw shanks during the surgical process and provides the flexibility to tailor the surgical construct with modular tulips and rods. The system is adaptable to various surgical techniques in both cortical and open modular configurations.

-

In April 2024, Proprio introduced a multi-phase partnership with the Biedermann Group, a distinguished innovator in cutting-edge spinal procedural solutions and implant systems. The partnership aims to combine Biedermann’s innovative spinal implants with Proprio’s Paradigm system, which utilizes artificial intelligence, computer vision, and augmented reality to offer exceptional real-time visualization and guidance during surgical procedures.

-

In October 2023, Johnson & Johnson MedTech announced that DePuy Synthes, a division of Johnson & Johnson specializing in orthopedic products, has obtained 510(k) clearances from the U.S. FDA for both the TriALTIS Spine System and the TriALTIS Navigation Enabled Instruments. The TriALTIS Spine System is an advanced system of pedicle screws designed for the posterior thoracolumbar region, offering a wide array of implant choices and sophisticated instrumentation.

-

In September 2023, Silony Medical International AG acquired Centinel Spine’s Global Fusion Business. This strategic move combined Silony’s existing posterior screw & rod fusion systems with Centinel Spine’s Fusion Products, including cervical stand-alone cages, lateral stand-alone cages, anterior cervical plates, and ALIF devices. The acquisition improved Silony’s technological capabilities and geographic footprint, enabling the company to offer a comprehensive range of spinal fusion solutions for both open and minimally invasive procedures.

-

In January 2023, Companion Spine acquired Backbone SAS. With the addition of Backbone's primary medical device, the LISA implant, the acquisition expanded companies offering medical implant solutions. Due to this acquisition, Companion Spine can provide a full range of therapy options for spine diseases, including lumbar stenosis and degenerative disc disease, by matching implants to the disease's severity.

Spinal Implants And Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.9 billion

Revenue forecast in 2030

USD 19.0 billion

Growth Rate

CAGR of 5.4% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, surgery type, procedure type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; ; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Johnson & Johnson; Stryker; NuVasive; Zimmer Biomet; Globus Medical; Inc.; Alphatec Spine; Inc.; Orthofix Holdings; Inc; RTI Surgical Holdings; Ulrich GmbH & Co. KG; B. Braun Melsungen AG; Seaspine Holdings Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spinal Implants And Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spinal implants and devices market report based on product, technology, surgery type, procedure type:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Spinal Fusion Devices

-

Thoracic & Lumbar Fusion Devices

-

Cervical Fusion Devices

-

-

Spinal Biologics

-

Allografts

-

Xenografts

-

DBM

-

BMP

-

Synthetic Bone Grafts

-

-

Vertebral Compression Fracture Treatment Devices

-

Non-fusion Devices

-

Spinal Bone Growth Stimulators

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Spinal Fusion and Fixation Technologies

-

Vertebral Compression Fracture Treatment

-

Vertebroplasty

-

Kyphoplasty/Vertebral Augmentation

-

-

Motion Preservation Technologies

-

-

Surgery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Surgery

-

Minimally Invasive Surgery

-

-

Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Discectomy

-

Laminotomy

-

Foraminotomy

-

Corpectomy

-

Facetectomy

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global spinal implants and devices market size was estimated at USD 13.3 billion in 2023 and is expected to reach USD 13.9 billion in 2024.

b. The global spinal implants and devices market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 19.0 billion by 2030.

b. Spinal fusion devices segment dominated the spinal implants & devices market with a share of 58.4% in 2023. This is attributable to the increasing number of spinal fusion surgeries and technological innovations in spine fusion procedures with or without internal fixation.

b. Some key players operating in the spinal implants and devices market include Medtronic; Johnson & Johnson; Stryker; NuVasive; Zimmer Biomet; Globus Medical, Inc.; Alphatec Spine, Inc.; Orthofix Holdings, Inc; RTI Surgical Holdings; Ulrich GmbH & Co. KG; B. Braun Melsungen AG; Seaspine Holdings Corporation

b. Key factors that are driving the spinal implants & devices market growth include the increasing prevalence and subsequent increase in the treatment rates of degenerative spine disorders, advancements in medical technology, increasing demand for minimally invasive procedures, and the growing incidence of spinal cord injuries (SCIs) across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."