- Home

- »

- Advanced Interior Materials

- »

-

Spiral Membranes Market Size, Industry Report, 2020-2027GVR Report cover

![Spiral Membranes Market Size, Share & Trends Report]()

Spiral Membranes Market Size, Share & Trends Analysis Report By Polymer Type (Polyamide, Fluoropolymers), By Technology (Reverse Osmosis, Ultrafiltration), By End-use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-150-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

Report Overview

The global spiral membranes market size was valued at USD 5.8 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 10.9% from 2020 to 2027. Rising product demand across various end-use industries including food & beverage, water & wastewater treatment, industrial processing, and others is likely to augment the market growth. Rapid urbanization across the globe has led to the development of slums where there is a lack or absence of basic water and sanitation services. However, the local governments and international institutions, such as the World Bank and the United Nations, are making considerable investments to improve the access to basic sanitation and water, which will support market growth.

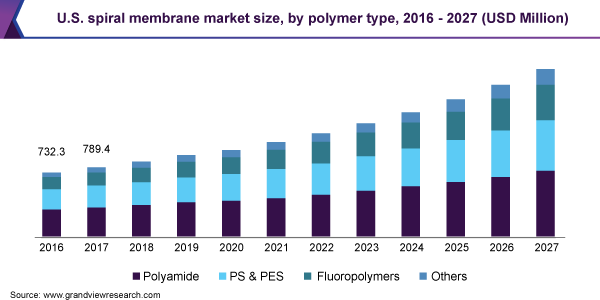

The market in the U.S. is expected to exhibit high growth due to growing product demand from end-use industries and environmental regulations laid down by the Environmental Protection Agency (EPA). Moreover, economic revival and government initiatives to promote environmental protection are expected to drive the market in the U.S.

A shortage of pure water is expected to result in high demand for water filters and filtration systems. Rising population growth and industrialization are promoting the usage of water treatment processes. This is also projected to boost market growth over the forecast period.

Product manufacturers distribute their products through third-party distributors or often opt for direct distribution. As the product has a wide range of applications in the industrial sector, manufacturers often cater to this sector through filtration equipment manufacturers and system integrators through direct distribution.

Polymer Type Insights

Polyamide was the largest polymer type segment in 2019 and accounted for over 41% of the overall market share. Abundant availability and low cost of this polymer are anticipated to promote its demand in applications including water & wastewater treatment, industrial processing, and food & beverage processing.

Polyamide nanofiltration and reverse osmosis membranes are widely used in industrial applications, such as water purification, wastewater treatment, desalination, food processing, and bio-separation. PS & PES polymers exhibit superior strength and high resistance to oxidation. In addition, they are primarily used in ultrafiltration and microfiltration technologies.

Rising demand for the PS & PES-based spiral membranes from food & dairy applications is projected to benefit the industry growth over the forecast period. The fluoropolymers segment is estimated to register the fastest CAGR from 2020 to 2027. These polymers have high mechanical strength and excellent chemical stability, thus can be used in water purification and energy applications implementing technology, such as ultrafiltration and microfiltration.

Technology Insights

The reverse osmosis technology segment accounted for the largest market share of over 40% in 2019 and is estimated to expand further at a steady CAGR from 2020 to 2027. Reverse osmosis is mainly used for the purification of water and wastewater. It is also used in the production of Ultrapure Water (UPW), landfill leachates treatment, and seawater & brine water desalination.

Reverse osmosis technology exhibits a considerably higher recovery rate than the traditional thermal desalination processes, such as Multistage Flash Distillation (MSF) and Multiple Effect Distillation (MED). As a result, this technology is rapidly replacing the thermal desalination process in the saltwater desalination plants across the world.

Microfiltration membranes are made of organic materials such as polymer-based membranes. However, the membranes made from inorganic materials, such as ceramic or stainless steel, are also used as they offer higher operating temperatures and durability compared to the membranes made from organic materials.

The key application areas of microfiltration technology include municipal water treatment plants and pre-treatment desalination plants. Microfiltration technology is also used in combination with other membrane technologies, such as reverse osmosis, nanofiltration, and ultrafiltration for pre-treating liquids. This is projected to further benefit the segment growth.

End-use Insights

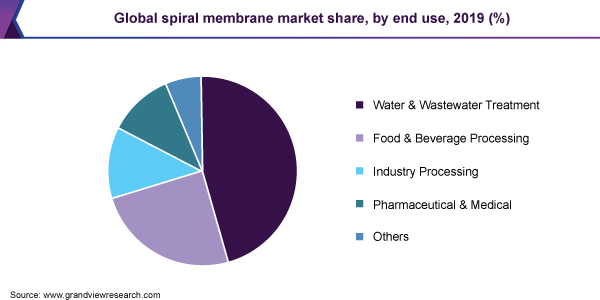

The water & wastewater end-use segment accounted for the highest market share of over 45% in 2019 and is projected to maintain its dominance throughout the forecast years. Changing rainfall patterns and overexploitation of groundwater resources are expected to have an adverse impact on the availability of water, which is projected to propel the demand for water & wastewater treatment.

Increasing disposable income in regions such as North America is expected to promote the growth of the food & beverage industry. Spiral membranes are used in the food & beverage industry to eliminate contaminants from water, milk, wine, and others. In addition, government regulations related to food safety and pollution control are expected to propel the segment growth.

Rapid industrialization in emerging economies, such as China, India, Vietnam, and Brazil, is expected to drive the demand for spiral membranes. In addition, rising technological innovations coupled with increasing R&D initiatives are anticipated to have a positive impact on the product demand in the industrial processing segment.

Filtration is an essential process in pharmaceutical and biopharmaceutical industries owing to the constant requirement for separating particles and fluids in suspension. Growing investments in the development of healthcare facilities, improvement in diagnostic technology, and increasing prevalence of chronic diseases are likely to benefit the market growth.

Regional Insights

Asia Pacific led the global market in 2019 accounting for over 36% of the global revenue share in 2019. The region is estimated to expand further at the fastest CAGR from 2020 to 2027 on account of rapid industrialization and rising environmental concerns in the emerging economies of the region. Furthermore, increasing government initiatives to develop water and wastewater treatment plants are expected to propel the market growth

The presence of multiple manufacturers in Europe has resulted in a significant market share of the region. Development of industries including pharmaceutical, food & beverage, and water & wastewater treatment in Europe is anticipated to augment the product demand over the forecast period. In addition, the industry players are collaborating with distributors to serve the larger customer base.

The growth of industries, such as chemicals, mining, and metal processing, is expected to result in increased discharge of pollutants into the environment. Thus, increasing water pollution and growing environmental concerns are anticipated to promote the implementation of wastewater treatment processes, thereby, propelling market growth.

Key Companies & Market Share Insights

The market is highly competitive. Major companies are focusing on achieving optimal operational costs, enhancing the product quality, and maximizing production output to sustain the competition. Companies are also increasingly focusing on mergers & acquisitions, joint ventures, and agreements. Market participants are investing more in R&D for the development of spiral membranes with enhanced durability and higher flow rates. Some of the prominent players in the global spiral membranes market include:

-

DowDuPont Inc.

-

Toray Industries, Inc.

-

Hydranautics

-

LG Water Solutions

-

SUEZ Water Technologies and Solutions

-

Merck Group

-

Pentair plc

-

Koch Membrane Systems

-

Pall Corporation

-

Alfa Laval

-

Applied Membranes

-

Aquabio

-

Axeon Water Technologies

-

Fileder

-

GEA Group

Spiral Membranes Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 6.2 billion

Revenue forecast in 2027

USD 13.3 billion

Growth rate

CAGR of 10.9% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Polymer type, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

DowDuPont Inc.; Toray Industries, Inc.; Hydranautics; LG Water Solutions; SUEZ Water Technologies and Solutions; Merck Group; Pentair plc; Koch Membrane Systems; Pall Corporation; Alfa Laval; Applied Membranes; Aquabio; Axeon Water Technologies; Fileder; GEA Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global spiral membranes market report on the basis of polymer type, technology, end-use, and region:

-

Polymer Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Polyamide

-

PS & PES

-

Fluoropolymers

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2016 - 2027)

-

Reverse Osmosis

-

Microfiltration

-

Ultrafiltration

-

Nanofiltration

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Water & Wastewater Treatment

-

Industry Processing

-

Food & Beverage Processing

-

Pharmaceutical & Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global spiral membranes market size was estimated at USD 5,830.7 million in 2019 and is expected to reach USD 6,244.7 million in 2020.

b. The spiral membranes market is expected to grow at a compound annual growth rate of 10.9% from 2020 to 2027 to reach USD 13,342.3 million by 2027.

b. Polyamide polymer type dominated the spiral membranes market with a share of 41.98% in 2019, owing to the low cost and durability of the polymer.

b. Some of the key players operating in the spiral membranes market include DowDuPont Inc., Toray Industries, Inc., Hydranautics, LG Water Solutions, SUEZ Water Technologies and Solutions, Merck Group, Pentair plc, Koch Membrane Systems, Pall Corporation, Alfa Laval, Applied Membranes, Aquabio, Axeon Water Technologies, Fileder, GEA Group.

b. The key factors that are driving the spiral membranes market include growing demand for water treatment and growing preference for reverse osmosis in desalination applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."