- Home

- »

- Specialty Polymers

- »

-

Fluoropolymers Market Size & Share, Industry Report, 2030GVR Report cover

![Fluoropolymers Market Size, Share & Trends Report]()

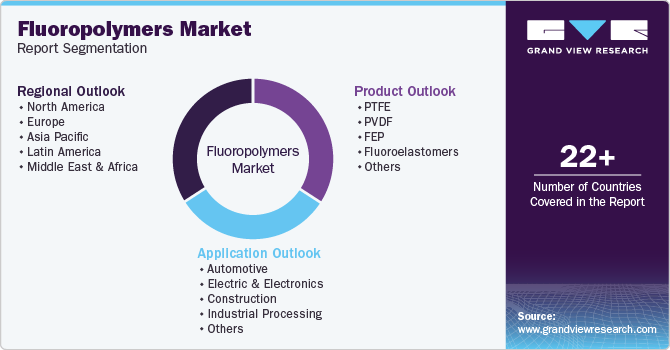

Fluoropolymers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (PTFE, PVDF, FEP), By Application (Automotive, Electrical & Electronics, Construction, Industrial Equipment), By Region, And Segment Forecasts

- Report ID: 978-1-68038-486-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fluoropolymers Market Summary

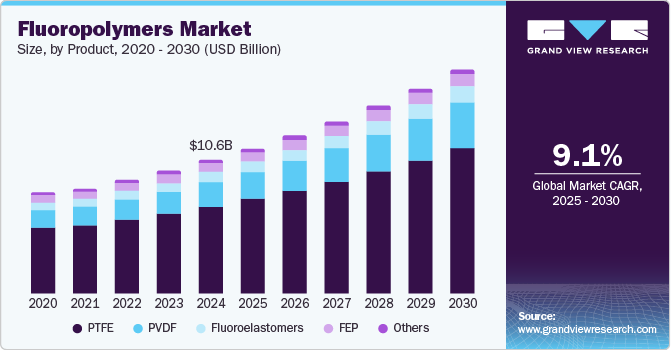

The global fluoropolymers market size was valued at USD 10.64 billion in 2024 and is projected to reach USD 17.85 billion by 2030, growing at a CAGR of 9.1% from 2025 to 2030. The market growth is driven by robust growth in the electronics sector has augmented demand for fluoropolymers.

Key Market Trends & Insights

- The fluoropolymers market in Asia Pacific region secured the dominant market share with 42.93% in 2024.

- The fluoropolymers market in China held the dominant share in the APAC region.

- By product, Polytetrafluoroethylene (PTFE) led the segment with 65.05% of the market share in 2024.

- By application, construction has emerged as the fastest-growing segment at a CAGR of 9.9% during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 10.64 Billion

- 2030 Projected Market Size: USD 17.85 Billion

- CAGR (2025-2030): 9.1%

- Asia Pacific: Largest market in 2024

Furthermore, robust growth in the electronics sector has augmented demand for fluoropolymers. Components such as fuel cells, photovoltaics, and batteries benefit from their exceptional properties. Fluoropolymers such as polytetrafluoroethylene (PTFE) exhibit non-stick and low friction characteristics. These properties make them ideal for electrical components and semiconductors as they prevent dust, dirt, and contaminants from adhering to components like insulators, connectors, and switches. Moreover, non-stick surfaces reduce the risk of short circuits, improve insulation performance, and enhance overall reliability. This has further fueled the market demand.

Another significant market driver is the shift from conventional to renewable energy sources. Solar panels, wind turbines, and lithium-ion batteries rely on fluoropolymers due to their chemical abrasion and corrosion resistance. These materials are also utilized in automotive fuel systems and engine components for energy efficiency while minimizing the environmental impact. Their ability to withstand extreme conditions contributes to improved performance and longevity.

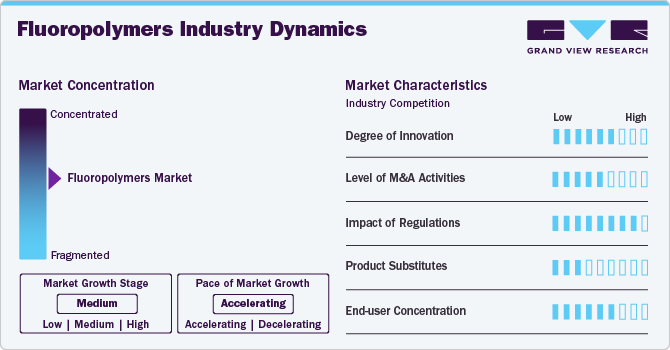

Market Concentration & Characteristics

The market is moderately fragmented, with key participants involved in R&D and technological innovations. Notable companies include Chemours; Daikin Industries; 3M; Solvay; Arkema; AGC Chemicals; Dongyue Group; Gujarat Fluorochemicals; Halopolymer; and Kureha Corporation. Several players are engaged in framework development to improve their market share.

The fluoropolymer market is anticipated to experience consistent growth due to its distinct performance features and wide-ranging applications in industries such as automotive, electronics, construction, and chemical processing.

A significant factor contributing to this growth is the strong emphasis on innovation, especially in the creation of next-generation grades that offer improved thermal stability, chemical resistance, and mechanical strength, making them suitable for rigorous applications like electric vehicle batteries, 5G components, and advanced medical devices.

Additionally, the market is likely to see benefits from a moderate to high level of merger and acquisition activity, as leading companies seek to strengthen their market positions, broaden their geographical presence, and gain access to specialized fluoropolymer technologies.

Product Insights

Polytetrafluoroethylene (PTFE) led the segment with 65.05% of the market share in 2024. This can be attributed to its chemical inertness which makes it highly resistant to aggressive chemicals and corrosive substances. In addition, PTFE is extensively applied in chemical processing equipment, gaskets, and seals as it can withstand extreme temperatures without losing its mechanical properties. It remains stable from cryogenic conditions to elevated temperatures, thereby becoming an ideal option across industries. PTFE has a low coefficient of friction, high dielectric strength, and low dissipation factor which makes it an ideal choice of bearings, seals, and sliding components. It is widely used in electrical insulation, cable insulation, and connectors.

Polyvinylidene fluoride (PVDF) is expected to grow substantially during the forecast period. The market was propelled due to the increasing demand for architectural coatings, photovoltaic modules, lithium-ion batteries, and special films, used in architectural and automotive glazing. The material exhibits exceptional chemical resistance, weather durability, and UV stability which enhances components’ lifetime in applications such as fuel cells and photovoltaics. Moreover, robust industrial sectors, such as aerospace, automotive, and electronics, rely on PVDF to improve engine performance and ensure durability.

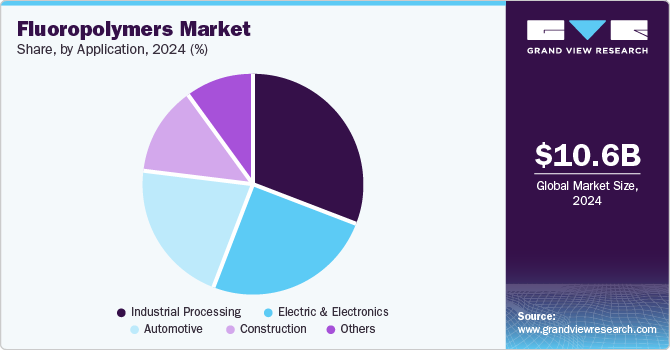

Application Insights

The industrial processing sector has accounted for the dominant market share in 2024 owing to its robust expansion. Fluoropolymers are applied in heavy physical and mechanical components owing to their chemical inertness, high-temperature stability, and low friction properties. They play a critical role in manufacturing coatings for PCBs, dielectric materials for antennas, and heat-resistant components. Furthermore, the growth of electric vehicles (EVs) in the automotive industry has resulted in significant demand for fluoropolymers for battery components, wiring insulation, and thermal management.

Construction has emerged as the fastest-growing segment at a CAGR of 9.9% during the forecast period. This anticipated growth can be attributed to the demand for fluoropolymer-based paints and protective layers in architectural coatings, used in construction. These coatings are used to enhance wall durability, weather resistance, and aesthetics of buildings, bridges, and infrastructure. In addition, PVDF which can withstand harsh environmental conditions, is utilized in roofing membranes, pipes, and fittings - essential for construction industries.

Regional Insights

The fluoropolymers market in Asia Pacific region secured the dominant market share with 42.93% in 2024. The market demand was primarily driven by the expansion of aviation and aerospace sectors. Fluoropolymers are extensively applied to aircraft components due to their chemical resistance, lightweight properties, and durability. Furthermore, the increasing digitalization led to a higher demand for low-weight, high-resistant fluoropolymers for industrial maintenance and equipment longevity.

China Fluoropolymers Market Trends

The fluoropolymers market in China held the dominant share in the APAC region owing to the increasing demand for applications such as photovoltaic modules, lithium-ion batteries, water filtration systems, and special films. Additionally, these materials are used for automotive fuel systems, engine components, and electrical insulation.

North America Fluoropolymers Market Trends

The fluoropolymers market in North America held 21.23% of the market share in 2024 due to the growing demand from automotive components such as fuel cells, aerospace applications, and electronic semiconductors. Furthermore, the region’s focus on civil aviation and defense sectors led to higher utilization of fluoropolymers as they enhance performance, durability, and safety in critical applications.

The U.S. fluoropolymers market was propelled by the automotive and aerospace sectors. These materials enhance performance, durability, and safety in critical applications such as fuel cells, engine components, and aircraft parts. The country’s electronics industry also played a pivotal role in the market growth with components such as printed circuit boards (PCBs), connectors, and insulating materials. Furthermore, the material’s chemical resistance and high-temperature stability make them valuable in engine components.

Europe Fluoropolymers Market Trends

The Europe fluoropolymers market held 25.73% of the global share in 2024. The market growth was augmented with the industrial development initiatives led by regional governments. These initiatives were aimed at creating eco-friendly fluoropolymers. However, heightened regulations on per- and polyfluoroalkyl substances (PFAS) impacted the market.

Key Fluoropolymers Company Insights

The fluoropolymers market is dominated by major players such as Chemours, Daikin Industries, and Solvay which have a wide regional presence. These companies have increasingly adopted growth strategies including product launches, investments, acquisitions, and expansions to continue their dominance in the market.

-

Chemours is a chemistry company that emerged as a spin-off from DuPont in 2015. Their portfolio provides solutions across diverse industries, including automotive, paints, laminates, advanced electronics, construction, energy, and telecommunications.

-

Daikin Industries, Ltd., based in Japan, provides advanced, high-quality air conditioning solutions for residential, commercial, and industrial applications worldwide. The company focuses on technology to develop advanced products and designs.

Key Fluoropolymers Companies:

The following are the leading companies in the fluoropolymers market. These companies collectively hold the largest market share and dictate industry trends.

- Chemours

- Daikin Industries

- 3M

- Solvay

- Arkema

- AGC Chemicals

- Dongyue Group

- Gujarat Fluorochemicals

- Halopolymer

- Kureha Corporation

Recent Development

-

In August 2024, AGC, a manufacturer of glass, chemicals, and advanced materials, introduced a groundbreaking method for producing fluoropolymers without relying on surfactants. With this new technology, AGC intends to ensure a consistent and reliable supply of fluoropolymers, which are essential for the development of a carbon-neutral and digital society.

Fluoropolymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.55 billion

Revenue forecast in 2030

USD 17.85 billion

Growth rate

CAGR 9.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Indonesia, Vietnam, Brazil, Argentina, Saudi Arabia, UAE, South Africa, Kuwait

Key companies profiled

Chemours; Daikin Industries; 3M; Solvay; Arkema; AGC Chemicals; Dongyue Group; Gujarat Fluorochemicals; Halopolymer; Kureha Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluoropolymers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fluoropolymers market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

PTFE

-

PVDF

-

FEP

-

Fluoroelastomers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Automotive

-

Electric & Electronics

-

Construction

-

Industrial Processing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fluoropolymers market size was estimated at USD 10.64 billion in 2024 and is expected to reach USD 11.55 billion in 2025.

b. The global fluoropolymers market is expected to grow at a compound annual growth rate of 9.1% from 2025 to 2030 to reach USD 17.85 billion by 2030.

b. Polytetrafluoroethylene segment dominated the fluoropolymers market with a share of over 65.05% in 2024. This is attributable to the rising demand in gaskets, linings, washers, pump interiors, seals on account of enhanced wear resistance and chemical stability properties.

b. Some key players operating in the fluoropolymers market include Daikin, Chemours (DuPont), Asahi Glass Company, Solvay Solexis, 3M (Dyneon GmbH), Arkema SA, Halopolymer Ojsc, Kureha Corporation, Saint-Gobain and Honeywell International Inc.

b. Key factors that are driving the market growth include rising demand for the polymer for manufacturing semiconductors which are used in electrical appliances and growing demand from construction and automotive application.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.