- Home

- »

- Communications Infrastructure

- »

-

Spring Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Spring Market Size, Share & Trends Report]()

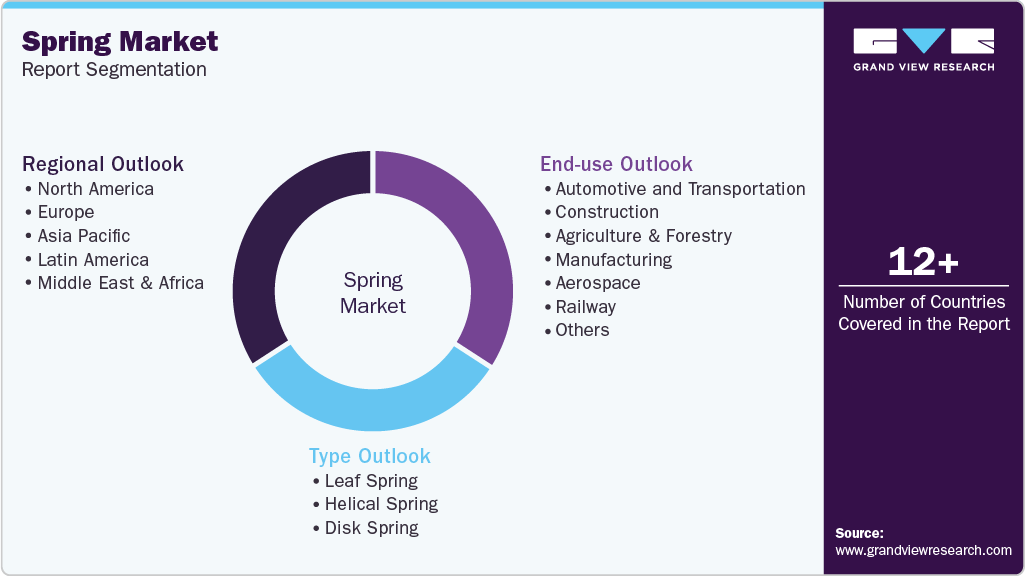

Spring Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Leaf Spring, Helical Spring, Disk Spring), By Industry End Use (Construction, Manufacturing, Aerospace, Railway), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68038-200-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Spring Market Summary

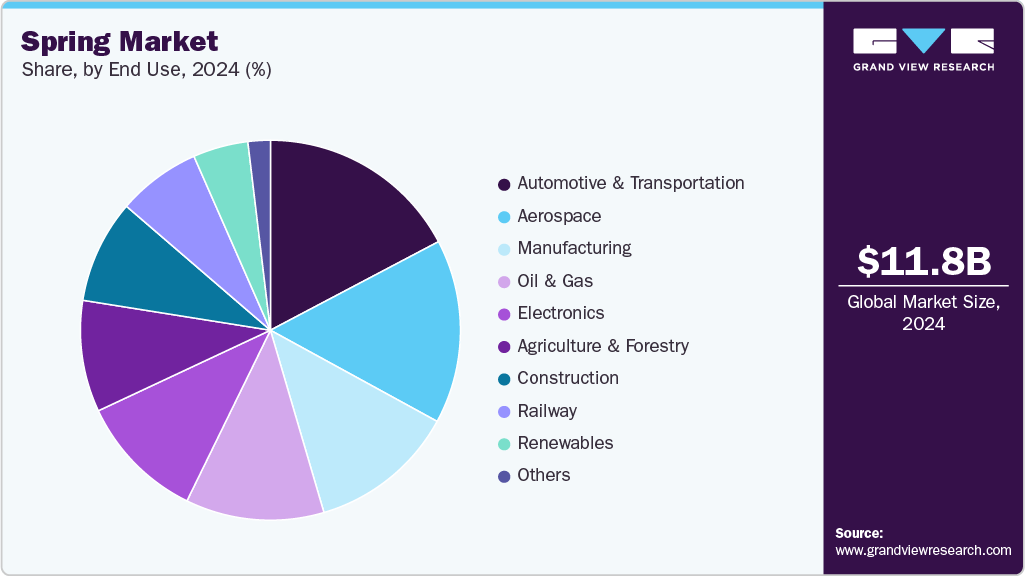

The global spring market size was estimated at USD 11,796.6 million in 2024 and is projected to reach USD 16,278.8 million by 2030, growing at a CAGR of 5.6% from 2025 to 2030. The market growth is primarily driven by increasing demand for springs across various end-use verticals, such as automotive, manufacturing, agriculture, and forestry, which will drive the market over the forecast period.

Key Market Trends & Insights

- Asia Pacific spring market dominated the market with a market share of 37% in 2024.

- The U.S. spring market is expected to grow, driven by the country’s robust automotive and aerospace industries.

- By type, the helical spring segment dominated the market with the largest market share of over 43% in 2024.

- By industry end use, the automotive and transportation segment dominated the market with the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11,796.6 Million

- 2030 Projected Market Size: USD 16,278.8 Million

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

No other components are available to replace the utility of springs, and hence, the springs are widely used across all verticals. The growing development and adoption of manufacturing methods, such as the shift from manual manufacturing to automated drive and robotic arms, is also expected to support the growth of the spring market. The increasing use of lightweight and high-strength alloys is significantly influencing the growth of the spring market. Manufacturers are leveraging advanced materials to reduce the overall weight of springs while enhancing durability and load-carrying capacity, making them ideal for aerospace, automotive, and satellite applications. This transition towards lightweight materials is increasing demand in industries focused on fuel efficiency and structural optimization, thereby improving the overall spring industry.

Additionally, the growing integration of springs in critical automotive systems such as suspension, braking, and interior components is propelling the market. With no practical replacement for springs in many automotive applications, the ongoing expansion of the automotive sector directly fuels the demand for various spring types, including helical, coil, and leaf springs. This trend underscores the essential role of springs in ensuring ride quality, safety, and structural support.

Furthermore, the rising adoption of automation and advanced manufacturing technologies such as CAD and CAM is reshaping the spring production landscape. These innovations enable the creation of complex geometries with higher precision and consistency, allowing manufacturers to meet diverse and evolving end user requirements. Enhanced production methods also support higher output levels, catering to increasing global demand while reducing material waste and production errors.

Moreover, the relatively low initial capital investment and high return potential have made spring manufacturing attractive to new entrants. The market’s competitive nature, with a mix of domestic and international players, also promotes continuous innovation and efficiency improvements. As export remains a significant component of the market, global economic trends and foreign demand continue to impact the spring industry performance.

Type Insights

The helical spring segment dominated the market with the largest market share of over 43% in 2024. The high demand for helical springs is attributed to their advantages, such as coil structure. These springs enable energy storage when pressed because of resilient force, and then this energy is subsequently released, providing comfort to the passenger riding the automobile even on uneven surfaces. Helical springs are known for their excellent absorption of shocks and sudden impacts, which are crucial for the automotive, aerospace, and railway industries, thereby solidifying the dominance of this segment.

The disk spring segment is expected to witness a significant CAGR of over 5% from 2025 to 2030, driven by its widespread adoption across high-load industrial applications and compact mechanical systems. The growing focus on lightweight and high-performance automotive components, especially in electric vehicles, is propelling the demand for advanced spring solutions like disk springs. This trend, combined with advancements in material technology and design optimization, is expected to significantly accelerate the growth of the disk spring segment in the coming years.

Industry End Use Insights

The automotive and transportation segment dominated the market with the largest market share in 2024. The growing demand for lightweight, durable, and high-performance components in vehicles is driving the adoption of advanced spring technologies across this sector. The integration of springs in critical systems such as suspension and engine components further underscores their importance. The increasing emphasis on ride comfort, load management, and structural durability continues to fuel demand for advanced springs, positioning the automotive and transportation segment as key growth driver within the spring industry.

The renewables segment is expected to witness the fastest CAGR from 2025 to 2030, owing to increasing global investments in sustainable energy infrastructure and advanced mechanical components. Springs are critical in applications such as load balancing, vibration dampening, and motion control within renewable energy equipment. The transition to clean energy, driven by government policies, climate change goals, and energy security concerns, is pushing manufacturers to innovate spring designs. This growing reliance on high-durability, customized spring components is propelling the rapid expansion of the renewables segment in the global spring market.

Regional Insights

North America spring market accounted for a share of over 22% in 2024, primarily driven by the region’s well-established automotive, aerospace, and industrial machinery sectors. The growing demand for lightweight and high-strength springs in electric vehicles (EVs), aircraft, and industrial automation systems is significantly contributing to market growth. The growing focus on reshoring manufacturing activities and the expansion of renewable energy projects are also creating new opportunities for specialized spring applications, reinforcing North America's dominant position in the spring industry.

U.S. Spring Market Trends

The U.S. spring market is expected to grow, driven by the country’s robust automotive and aerospace industries. The resurgence of domestic manufacturing, supported by favorable government policies and incentives, is further fueling demand across various industrial sectors. The rising adoption of advanced manufacturing technologies such as 3D printing and automated machining enables the production of lightweight, high-performance springs tailored to diverse applications, making U.S.-manufactured springs more competitive in global markets.

Europe Spring Market Trends

The Europe spring is expected to grow at a CAGR of over 5% from 2025 to 2030. In Europe, the spring market is driven by robust demand from key industries such as industrial machinery and renewable energy. The region’s emphasis on sustainability and the circular economy is prompting manufacturers to develop lightweight, corrosion-resistant, and recyclable spring materials. The widespread adoption of Industry 4.0 technologies, including smart manufacturing, automation, and predictive maintenance is accelerating the use of precision-engineered springs in next-generation machinery and vehicles.

The UK spring market is expected to grow at a significant rate in the coming years. The country benefits from a robust manufacturing infrastructure, strong engineering expertise, and a renewed focus on sustainable and lightweight components across key sectors. Additionally, the UK government’s push toward net-zero emissions and energy-efficient manufacturing is encouraging the adoption of advanced materials and innovative spring designs. These trends collectively position the UK as a key contributor to the expanding global spring industry.

The spring market in Germany is fueled by the country’s robust automotive manufacturing base, advanced engineering capabilities. As a global leader in precision engineering and high-performance manufacturing, Germany continues to drive demand for technologically advanced and application-specific springs. Stringent environmental regulations and the national focus on energy-efficient, lightweight components are prompting the adoption of innovative materials and sustainable spring designs. These factors collectively contribute to the growth and evolution of the spring industry in Germany.

Asia Pacific Spring Market Trends

Asia Pacific spring market dominated the market with a market share of 37% in 2024 and is expected to grow at a CAGR of over 6% from 2025 to 2030, driven by the growing demand for commercial vehicles, expansion of high-speed rail networks, and rising adoption of renewable energy systems. Rising exports of automotive parts and machinery from ASEAN countries are boosting the region’s spring production capabilities. The ongoing shift toward energy-efficient and sustainable components is also prompting manufacturers to invest in corrosion-resistant and lightweight spring materials, solidifying Asia Pacific’s position as a key growth engine for the global spring market.

The Japan spring market is gaining traction fueled by the country's advanced manufacturing capabilities and strong presence in key industries such as automotive. Japan’s global leadership in automotive production is driving the demand for high-performance springs used in suspension systems and engines. The nation’s focus on miniaturization and high-precision engineering in electronics and robotics also supports the growth of micro springs and custom spring solutions.

The spring market in China is rapidly expanding due to the rapid industrialization and emphasis on advanced manufacturing technologies are major drivers fueling this growth. Rising investments in infrastructure development and the growing electric vehicle market are boosting the need for lightweight and corrosion-resistant spring solutions. China’s focus on sustainability and adoption of international quality standards is encouraging manufacturers to innovate and improve product reliability, further strengthening the competitive landscape and market expansion.

Key Spring Company Insights

Some of the key players operating in the market include Lee Spring Company and Barnes among others

-

Lee Spring Company is a globally recognized manufacturer specializing in the design and production of precision springs, wire forms, and related components. With a vast catalog of stock and custom springs, the company serves industries such as automotive, medical, electronics, and aerospace. Lee Spring is known for its commitment to high-quality engineering, compliance with international standards, and rapid delivery. Its investment in innovation, material science, and automated production processes continues to strengthen its leadership in the global spring market.

-

Barnes is a major player in the global spring market, offering engineered spring and stamping solutions for critical applications. With decades of experience and a global footprint, Barnes serves sectors like transportation, aerospace, medical, and industrial. The company emphasizes high-performance materials, precision design, and R&D capabilities to deliver innovative, application-specific solutions. Its strong focus on customization and quality makes it a trusted supplier for complex spring assemblies worldwide.

Torquesprings and GALA GROUP GmbH are some of the emerging market participants in the spring market.

-

Torquesprings is an emerging company gaining recognition in the spring market for its focus on custom torsion and helical spring solutions. Known for its agility and customer-centric approach, the company caters to specialized industrial and mechanical applications. Torquesprings leverages advanced manufacturing technologies and design tools to offer high-performance products tailored to unique client specifications. Its ability to quickly adapt to industry trends and offer cost-effective, durable solutions positions it as a fast-growing innovator in the market.

-

GALA GROUP GmbH is a rising player in the spring manufacturing space, especially within the European market. The company offers a wide range of precision springs and metal components for applications in automotive, electronics, and industrial machinery. With a strong focus on quality control, material innovation, and efficient production systems, GALA GROUP is expanding its market presence. Its adoption of automated processes and sustainability initiatives adds to its appeal as a forward-thinking and competitive emerging brand

Key Spring Companies:

The following are the leading companies in the spring market. These companies collectively hold the largest market share and dictate industry trends.

- Ace Wire Spring & Form Company, Inc.

- Bal Seal Engineering.

- Lee Spring Company

- Barnes

- Bansbach Easylift GmbH

- GALA GROUP GmbH

- Torquesprings

- Tufcot Engineering Ltd

- Hendrickson USA, L.L.C.

- John Evans' Sons LLC

Recent Developments

-

In April 2025, Hendrickson USA, L.L.C. announced a strategic partnership with Voith US Inc. aimed at accelerating innovation in the spring and suspension systems segment for electric and zero-emission commercial vehicles. The collaboration combines Hendrickson’s legacy of over 110 years in manufacturing advanced ride solutions with Voith’s expertise in electric-drive systems, targeting the development of next-generation spring-integrated suspension technologies. This initiative is part of Hendrickson’s broader commitment to sustainability and future mobility and is expected to significantly influence the design and efficiency of spring-based systems in commercial transportation.

-

In March 2025, Ace Wire Spring & Form Co., Inc. participated in the 2025 National Association of Trailer Manufacturers (NATM) Trade Show held in Nashville, Tennessee. The event served as a platform for the company to showcase its spring and wire form products, engage with industry professionals, and explore emerging opportunities in the trailer manufacturing sector. The participation reinforced Ace Wire Spring’s commitment to addressing the evolving needs of the spring market, particularly in the light-to-medium duty trailer industry. Through networking and market insights gained at the show, the company aims to strengthen its position as a critical supplier of spring components within this competitive segment.

-

In January 2025, Barnes Group Inc., a major player in the global spring market, announced the completion of its acquisition by Apollo Funds in an all-cash transaction valued at approximately USD 3.6 Million. The acquisition marks a significant milestone in Barnes' evolution, enabling the company to accelerate its transformation strategy, expand its spring product offerings, and enhance its industrial capabilities. With Apollo’s backing, Barnes aims to drive innovation and achieve sustained growth across key industries including automotive, aerospace, and industrial manufacturing.

Spring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12,375.1 million

Revenue forecast in 2030

USD 16,278.8 million

Growth Rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, industry end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Ace WIre Spring & Form Company Inc.; Bal Seal Engineering.; Lee Spring Company; Barnes; Bansbach Easylift GmbH; GALA GROUP GmbH; Torquesprings; Tufcot Engineering Ltd; Hendrickson USA, L.L.C.; John Evans' Sons LLC

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Spring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the spring market report based on type, industry end use, and region:

-

Spring Market Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Leaf Spring

-

Elliptical Leaf Spring

-

Semi Elliptical Leaf Spring

-

Quarter Elliptical Leaf Spring

-

Three-quarter Elliptical Leaf Spring

-

Transverse Leaf Spring

-

-

Helical Spring

-

Compression Spring

-

Extension Spring

-

Torsion Spring

-

Spiral Spring

-

-

Disk Spring

-

Belleville Disk Spring

-

Curved Disk Spring

-

Slotted Disk Spring

-

Wave Disk Spring

-

-

-

Spring Market Industry End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive and Transportation

-

Construction

-

Agriculture & Forestry

-

Manufacturing

-

Aerospace

-

Railway

-

Electronics

-

Oil and Gas

-

Renewables

-

Wind Turbines

-

Hydropower Plants

-

Solar Power Mounting Systems

-

Energy Storage Systems

-

Others

-

-

Others

-

-

Spring Market Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global spring market size was estimated at USD 11,796.6 million in 2024 and is expected to reach USD 12,375.1 million in 2025.

b. The global spring market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 16,278.8 million by 2030.

b. Asia Pacific dominated the spring market with a share of 37% in 2024. This is attributable to the increased demand for spring from the automobile, transportation, and manufacturing sectors.

b. Some key players operating in the spring market include GALA GROUP; Ace Wire Spring and Form Co., Inc.; Bal Seal Engineering, Inc.; Barnes Group Inc. (Associated Spring); CARL HAAS GmbH; EBSCO Spring Co.; Frauenthal Holding AG; Hendrickson Usa L.L.C.; Ifc Composite Gmbh; Jamna Auto Industries Ltd.; John Evans Sons Incorporated; Mubea Tellerfedern GmbH; Rassini SAB de CV; and Sogefi SpA.

b. Key factors that are driving the market growth include the increasing demand for springs across various end-use verticals such as automotive, manufacturing, agriculture, and forestry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.