- Home

- »

- Next Generation Technologies

- »

-

STATCOM Market Size And Share, Industry Report, 2033GVR Report cover

![STATCOM Market Size, Share & Trends Report]()

STATCOM Market (2026 - 2033) Size, Share & Trends Analysis Report By Rated Capacity (0-20 MVAR, 20-100 MVAR, More Than 100 MVAR), By End Use (Utility, Steel Manufacturing, Mining, Renewable Energy, Hydrogen Power Plant), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-805-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

STATCOM Market Summary

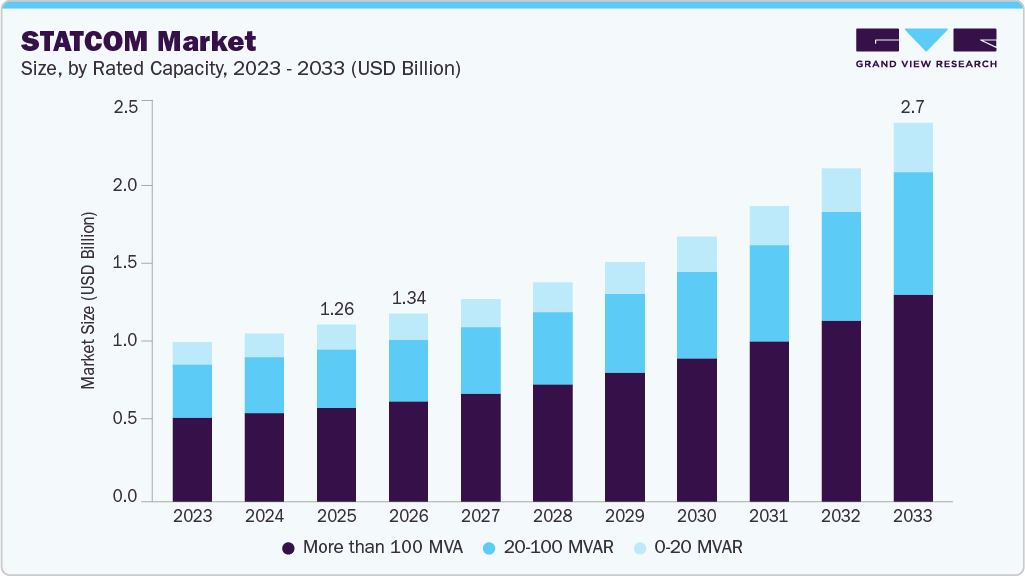

The global STATCOM market size was estimated at USD 1.26 billion in 2025, and is projected to reach USD 2.69 billion by 2033, growing at a CAGR of 10.5% from 2026 to 2033. The market is being significantly driven by the rapid integration of renewable energy sources into global power grids.

Key Market Trends & Insights

- Asia Pacific STATCOM Market accounted for a 32.8% share of the overall market in 2025.

- The STATCOM industry in the U.S. held a dominant position in 2025.

- By rated capacity, the more than 100 MVAR segment accounted for the largest share of 53.0% in 2025.

- By end use, the utility segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.26 Billion

- 2033 Projected Market Size: USD 2.69 Billion

- CAGR (2026-2033): 10.5%

- Asia Pacific: Largest market in 2025

Increasing dominance of wind and solar power in the global energy mix is creating heightened challenges for utilities, including voltage fluctuations, reduced system inertia, and reactive power imbalances. STATCOM systems play an essential role in addressing these challenges by providing rapid, dynamic voltage regulation and enhancing grid stability under variable operating conditions. Rising investments in grid modernization, renewable interconnection infrastructure, and stricter grid code compliance are further boosting demand for STATCOM solutions across both developed and emerging markets. STATCOMs play a critical role in mitigating these challenges by providing fast, dynamic reactive power support, ensuring grid code compliance such as Low Voltage Ride Through (LVRT), and maintaining power quality. Countries such as India, China, and Germany are leading in the adoption of STATCOMs in solar and wind projects, reflecting a broader global shift toward grid-connected renewable energy stabilization.Another major trend is the ongoing modernization of aging transmission and distribution infrastructure. Utilities across North America, Europe, and parts of Asia-Pacific are investing in grid resiliency and smart grid technologies to cope with growing demand, distributed generation, and changing load profiles. STATCOMs are increasingly deployed at substations and critical grid nodes to ensure voltage stability, minimize transmission losses, and enhance the overall reliability of the grid. These devices are especially valuable in weak grids or remote areas where voltage regulation is critical but challenging through traditional mechanical systems.

The market is also experiencing growth due to the expansion of industrial applications, particularly in sectors such as steel manufacturing, mining, and cement. Heavy industrial processes are known for causing significant voltage dips and harmonic distortion due to their large, fluctuating power demands. STATCOMs, especially medium-power systems, are being deployed to provide flicker mitigation, power factor correction, and voltage stabilization, resulting in improved operational efficiency and reduced energy costs. As industrial automation and electrification intensify in emerging economies, demand for STATCOM solutions in these sectors is expected to rise steadily.

Another trend driving the expansion of the STATCOM market is the rise of green hydrogen and energy storage projects. As governments and companies invest in hydrogen electrolyzer plants and hybrid systems (e.g., STATCOM + BESS), there is a growing need for power electronics devices that can stabilize load and supply-side fluctuations. STATCOMs are well-positioned to support the power quality needs of electrolyzers and help integrate them into the grid without creating instability. This emerging use case, although currently small in volume, is projected to grow significantly, especially in Europe, Japan, and the Middle East.

The market is also benefiting from technological advancements in STATCOM design, including the adoption of modular multilevel converters (MMC) and compact containerized systems. These innovations are making STATCOMs more flexible, scalable, and suitable for deployment in space-constrained or mobile environments such as offshore wind platforms or mining sites. The integration of digital monitoring and predictive maintenance tools is also enhancing system performance and uptime.

Rated Capacity Insights

The more than 100 MVA segment accounted for the largest revenue share of 53.0% in 2025 and is expected to register the fastest CAGR during the forecast period, driven by large-scale transmission expansion projects, rising deployment of ultra-high-voltage substations, and the increasing need to stabilize long-distance power transfer and renewable-rich corridors. High-power STATCOM systems are critical for maintaining voltage stability, enhancing power quality, and improving system reliability in bulk power networks and cross-border interconnections. For instance, utilities are increasingly deploying high-capacity STATCOM installations to support grid reinforcement initiatives associated with offshore wind integration and high-voltage transmission upgrades.

The 20-100 MVAR segment is expected to grow at a significant CAGR during the forecast period, driven by rising grid congestion, increasing integration of renewable energy sources, expanding transmission and distribution infrastructure, and the growing need for fast-acting voltage regulation across medium- to high-capacity power networks. Medium-power STATCOM systems are increasingly deployed at renewable energy interconnection points, regional substations, and industrial grids due to their ability to provide dynamic reactive power compensation while maintaining cost efficiency and operational flexibility.

For instance, in August 2024, Hitachi Energy launched its Grid-enSure solution portfolio, which integrates STATCOM and Enhanced STATCOM technologies to address voltage instability, reduced system inertia, and grid bottlenecks resulting from high penetration of wind and solar power. This development underscores the increasing adoption of medium-rated STATCOM solutions as utilities and renewable energy developers prioritize scalable, high-performance power electronics to support grid modernization and the global energy transition.

End Use Insights

The utility segment held the dominating share in the market in 2025. This dominance is driven by the growing need for grid stability, voltage regulation, and reactive power compensation across transmission and distribution networks. Utilities are increasingly deploying high-power STATCOMs at substations and along long-distance transmission corridors to mitigate voltage fluctuations, improve power quality, and reduce losses. The push for grid modernization, especially in North America, Europe, and parts of the Asia Pacific, is reinforcing the demand for STATCOMs as utilities upgrade aging infrastructure and prepare for higher loads and decentralized generation.

The renewable energy segment is expected to grow at a significant CAGR during the forecast period, emerging as one of the most dynamic and high-growth end-use segments within the STATCOM market. The accelerating global shift toward wind and solar power is intensifying the need for advanced grid-stabilization solutions to manage variability, intermittency, and reduced system inertia associated with renewable generation. STATCOMs play a critical role in providing fast, dynamic reactive power compensation, enabling renewable energy projects to comply with stringent grid code requirements, including Low Voltage Ride Through (LVRT) and fault ride-through capabilities. This trend is particularly pronounced in India, China, Germany, and the U.S., where large-scale solar and wind installations are being rapidly deployed and must be integrated into existing transmission networks without compromising voltage stability or overall grid reliability. The rising focus on strengthening renewable interconnection infrastructure is expected to further accelerate STATCOM adoption across utility-scale renewable projects.

Regional Insights

The STATCOM industry in the Asia Pacific accounted for the largest revenue share of 32.8% in 2025, driven by rapid industrialization, expansion of power transmission infrastructure, and large-scale integration of renewable energy sources across the region. Countries including China, India, Japan, and South Korea are making substantial investments in grid modernization to address rising electricity demand, transmission congestion, and the variability associated with solar and wind power generation.

The increasing deployment of STATCOM systems is crucial for maintaining voltage stability, enabling rapid reactive power compensation, and mitigating power quality challenges in expanding industrial clusters and densely populated urban centers. Continued policy support for the integration of renewable energy and grid resilience is expected to further reinforce the adoption of STATCOMs throughout the Asia Pacific region.

The Japan STATCOM industry is expected to grow at a robust pace, driven by an increasing focus on supporting distributed generation, enhancing grid reliability in remote and islanded areas, and accelerating renewable energy integration. The country’s gradual phase-out of conventional energy sources, coupled with expanding solar and offshore wind capacity, is increasing the demand for dynamic reactive power compensation to manage voltage fluctuations and reduced system inertia. Also, Japan’s strong emphasis on disaster-resilient power infrastructure, particularly in earthquake- and typhoon-prone regions, is supporting the deployment of STATCOM systems across both rural and urban grids. The growing need for precise frequency regulation and fast grid response capabilities is further reinforcing STATCOM adoption as utilities modernize transmission and distribution networks.

The STATCOM industry in China is expected to witness strong growth, supported by large-scale renewable energy deployment, rapid expansion of ultra-high-voltage (UHV) transmission networks, and ongoing grid modernization initiatives. The country’s aggressive investments in wind and solar power, particularly in western and northern regions, are driving demand for high-capacity and medium-capacity STATCOM systems to stabilize long-distance power transmission and manage voltage variability. Also, increasing electrification of industrial sectors, rising cross-regional power transfers, and stringent grid code requirements are accelerating the adoption of STATCOM solutions across substations and renewable energy interconnection points. Continued government support for smart grid development and energy transition objectives is expected to further strengthen STATCOM demand across China’s power infrastructure.

North America STATCOM Market Trends

The STATCOM industry in North America is expected to grow at the significant CAGR over the forecast period. STATCOM deployments, particularly in areas experiencing grid congestion and aging infrastructure. The demand is further supported by the widespread expansion of wind and solar farms, especially in Canada and parts of the U.S., where utilities are integrating FACTS solutions to ensure voltage control and system reliability. The presence of key technology providers and transmission operators continues to drive innovation and project execution efficiency in the region.

U.S. STATCOM Market Trends

The U.S. STATCOM industry held a dominant position in 2025, driven by federal and state-level initiatives focused on improving power quality, expanding clean energy infrastructure, and strengthening long-distance transmission networks. Rising investments in grid hardening, renewable energy interconnections, and high-capacity transmission corridors are accelerating STATCOM adoption to manage voltage fluctuations and enhance grid resilience. The increasing focus on integrating utility-scale wind and solar projects while meeting stringent grid code requirements is expected to further sustain STATCOM demand across the U.S. power sector.

Europe STATCOM Market Trends

The STATCOM industry in Europe was identified as a lucrative region in 2025. Countries such as Germany, the UK, and France are investing in FACTS technologies to manage grid congestion and support renewable energy corridors. Regulatory frameworks that support grid flexibility, combined with the increasing adoption of high-voltage direct current (HVDC) systems, are further fueling STATCOM deployments across both onshore and offshore transmission networks.

The UK STATCOM industry is expected to grow rapidly over the forecast period, driven by National Grid’s emphasis on decarbonization, frequency stability, and the management of non-synchronous generation. The rapid expansion of offshore wind capacity in the North Sea is increasing the need for STATCOM systems to support voltage control at coastal substations and offshore grid connection points. Also, the UK’s transition toward a zero-carbon electricity system is resulting in tighter grid code requirements and increased reliance on power electronics-based solutions to replace conventional inertia, supporting sustained STATCOM adoption.

The STATCOM industry in Germany is expected to witness strong growth, supported by the country’s Energiewende policy framework and accelerated phase-out of coal and nuclear power plants. The increasing share of decentralized renewable generation, particularly onshore wind and utility-scale solar, is creating localized voltage instability and reverse power flow challenges within transmission and distribution networks.

Germany’s ongoing investments in north-to-south transmission corridors and renewable integration infrastructure are driving demand for STATCOM systems to stabilize power flows, enhance grid reliability, and mitigate congestion across industrial and urban demand centers.

Key STATCOM Company Insights

Some of the key companies market include Siemens, Hitachi Energy Ltd, Oracle Corporation, Mitsubishi Electric Corporation, and GE Grid Solutions, LLC, among others. Leading players are actively focused on expanding their project footprint and customer base to gain a competitive edge. As a result, major companies are pursuing strategic initiatives such as technology upgrades, regional partnerships, and mergers and acquisitions. These efforts aim to enhance system performance, reduce deployment time, and align with evolving grid requirements, particularly in regions prioritizing renewable energy integration, transmission stability, and grid modernization.

-

Siemens Energy AG is a global leader in grid stabilization technologies, offering advanced STATCOM solutions under its SVC PLUS portfolio. With operations spanning more than 90 countries, the company leverages deep expertise in FACTS and power electronics to support utilities in managing voltage fluctuations, improving power quality, and integrating large-scale renewable energy into transmission networks. In addition, Siemens Energy benefits from strong system integration capabilities and a broad service network, enabling faster project execution and long-term asset optimization. The company’s continuous investments in digital grid technologies further strengthen its ability to deliver flexible, future-ready STATCOM solutions aligned with evolving grid codes.

-

Hitachi Energy Ltd. is a prominent provider of power transmission and grid automation solutions, maintaining a strong presence in the global STATCOM market through its PCS 6000 product line. The company integrates advanced power electronics with real-time digital control systems to deliver scalable, high-reliability reactive power solutions tailored for utility, renewable energy, and industrial applications. Hitachi Energy’s vertically integrated value chain and strong R&D capabilities support customized system designs for complex grid environments. Furthermore, its growing focus on integrated portfolios combining STATCOM, HVDC, and energy storage enhances its competitive positioning in grid modernization and renewable integration projects.

Key STATCOM Companies:

The following are the leading companies in the STATCOM market. These companies collectively hold the largest market share and dictate industry trends.

- GE Grid Solutions, LLC

- Ingeteam

- ABB

- Siemens

- Nidec Conversion

- Hitachi Energy Ltd

- Mitsubishi Electric Corporation

- JEMA Energy

- American Superconductor

- HYOSUNG HEAVY INDUSTRIES

Recent Developments

-

In December 2025, Transelectrica commissioned Romania’s first STATCOM system at the Sibiu Sud substation, delivered by a Siemens Energy-Electromontaj consortium. The project strengthens voltage stability, increases transmission reliability, and supports large-scale renewable energy integration under the EU Modernization Fund.

-

In June 2025, Siemens Energy expanded deployments of STATCOM and synchronous condenser (SynCon) technologies to address voltage and frequency instability caused by rising renewable energy penetration. The combined solutions provide dynamic reactive power support and synthetic inertia, strengthening grid resilience in low-inertia power systems.

-

In May 2025, KEC International Limited secured its first STATCOM project in India from a global OEM, marking its entry into the STATCOM segment. The order strengthens KEC’s substation capabilities and reflects growing demand for advanced reactive power solutions in grid modernization projects.

-

In August 2024, GE Grid Solutions, LLC, launched FACTSFLEX GFMe, a next-generation STATCOM system that integrates supercapacitor-based energy storage to provide both reactive and active power support. The solution enhances grid stability and reliability, particularly in areas with weak infrastructure or high renewable energy penetration, by offering virtual inertia and grid-forming capabilities. With a modular and scalable design, GFMe delivers rapid response to voltage and frequency disturbances and is globally available. It complements GE Vernova’s broader FACTSFLEX STATCOM portfolio, which includes the proven FACTSFLEX Classic and grid-forming FACTSFLEX GFM models.

-

In May 2024, GE Vernova and TECO Electric & Machinery Co. partnered to deploy advanced ±200 Mvar STATCOM systems at key substations in Changhua County, Taiwan, to support renewable energy integration and enhance grid stability. GE Vernova will supply the STATCOM and transformer technology, while TECO will manage civil works and site operations. These STATCOM systems will stabilize voltage fluctuations and support intermittent solar and wind energy, ensuring reliable power supply in a region central to Taiwan's industrial and renewable efforts. The project aligns with Taiwan's national sustainability goals and showcases GE Vernova’s commitment to global energy transition.

-

In April 2023, GE Grid Solutions secured multiple FACTS contracts, including a STATCOM project in Saudi Arabia, reinforcing its leadership in grid stabilization technologies. The projects support voltage regulation, increased power transfer capacity, and renewable energy integration across complex transmission networks.

STATCOM Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.34 billion

Revenue forecast in 2033

USD 2.69 billion

Growth rate

CAGR of 10.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Rated capacity, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

GE Grid Solutions, LLC; Ingeteam; ABB ; Siemens; Nidec Conversion; Hitachi Energy Ltd ; Mitsubishi Electric Corporation; JEMA Energy; American Superconductor; HYOSUNG HEAVY INDUSTRIES

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global STATCOM Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global STATCOM market report based on rated capacity, end use, and region.

-

Rated Capacity Outlook (Revenue, USD Billion, 2021 - 2033)

-

0-20 MVAR

-

20-100 MVAR

-

More than 100 MVAR

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Utility

-

Steel Manufacturing

-

Mining

-

Renewable Energy

-

Hydrogen Power Plant

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global STATCOM market size was valued at USD 1.26 billion in 2025, and is projected to reach USD 2.69 billion by 2033.

b. The global STATCOM market is expected to grow at a compound annual growth rate of 10.5% from 2026 to 2033 to reach USD 2.69 billion by 2033.

b. The more than 100 MVA segment accounted for the largest revenue share of 53.0% in 2025 and is expected to register the fastest CAGR during the forecast period, driven by large-scale transmission expansion projects, rising deployment of ultra-high-voltage substations, and the increasing need to stabilize long-distance power transfer and renewable-rich corridors.

b. Some of the players in the STATCOM market are GE Grid Solutions, LLC, Ingeteam, ABB, Siemens, Nidec Conversion , Hitachi Energy Ltd, Mitsubishi Electric Corporation, JEMA Energy, American Superconductor, and HYOSUNG HEAVY INDUSTRIES.

b. The growth of the market can be attributed to the rising integration of renewable energy sources into power grids, coupled with the growing need for voltage stability and reactive power compensation. Additionally, grid modernization initiatives and increasing electricity consumption in emerging economies are accelerating market adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.