- Home

- »

- Plastics, Polymers & Resins

- »

-

Sterile Medical Packaging Market Size & Share Report, 2030GVR Report cover

![Sterile Medical Packaging Market Size, Share & Trends Report]()

Sterile Medical Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Glass, Metal, Paper & Paperboard, Others (Rubber)), By Product, By Sterilization Method, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-334-5

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sterile Medical Packaging Market Summary

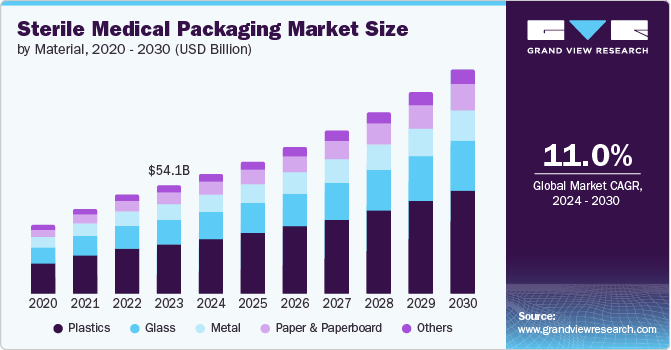

The global sterile medical packaging market size was estimated at USD 54.09 billion in 2023 and is projected to reach USD 111.98 billion by 2030, growing at a CAGR of 11% from 2024 to 2030. One of the key growth drivers of the market is the tremendous growth in the pharmaceutical industry.

Key Market Trends & Insights

- Asia Pacific sterile medical packaging market is the fastest-growing region of the market expanding at a CAGR of 14.3%.

- India sterile medical packaging market is expected to grow at the fastest CAGR of 15.3%.

- Sterile medical packaging market of North America is projected to grow at a significant rate.

- Based on material, the plastic segment dominated market with a share of over 45.5% in 2023.

- In terms of product, thermoform trays accounted for the highest revenue share of 26.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 54.09 Billion

- 2030 Projected Market Size: USD 111.98 Billion

- CAGR (2024-2030): 11%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Owing to advances in science and technology, pharmaceutical industry has been growing at a rapid pace over the past few years, and this trend is anticipated to continue over the forecast period, especially in emerging countries such as China, India, and Brazil. The pharmaceutical industry is primarily driven by the progress in the field of medicine and bioscience. In addition, pharmaceutical industry is the major pillar European economy as it is one of Europe’s top-performing, high-technology sectors. This, in turn, is anticipated to boost the market for Sterile Medical Packaging in Europe over the forecast period.

Drivers, Opportunities & Restraints

Growing demand for drug delivery devices along with blister packaging in developing countries is anticipated to be another key factor driving pharmaceutical industry. These aforementioned factors are likely to fuel the growth of the global drug delivery devices market, which, in turn, is likely to boost market over the projected period.

Ban on counterfeit packaging products is another driving factor contributing to market growth. Anti-counterfeit packaged materials have already been well-established in developed countries. This practice is also being followed in the Asia Pacific region. The banning of counterfeit packaging products has encouraged big companies to continuously introduce new packaging materials for various medicines, such as blister packaging, that are properly labeled and cannot be tampered with. This is anticipated to boost the growth of the global sterile medical packaging market.

The major restraint the sterile medical packaging industry faces is increasing packaging cost. Pharmaceutical manufacturing as well as pharmaceutical packaging are cost-extensive practices, which, in turn, raise the overall retail cost of the drug. Pharmaceutical manufacturers have to follow stringent requirements in order to ensure consumer safety and regulations associated with various agencies. Increasing cost pressure on pharmaceutical manufacturers has been forcing them to pass on this cost to the consumer. This is anticipated to restrain the market over the forecast period.

Key opportunities include the expansion into emerging markets, where there is a growing demand for advanced medical solutions and a need for reliable packaging solutions to maintain the sterility of medical devices and pharmaceutical products. Overall, the market is expected to continue its upward trajectory in the coming years, driven by the growing emphasis on infection control and patient safety, as well as the need for reliable packaging solutions to maintain the sterility of medical devices and pharmaceutical products.

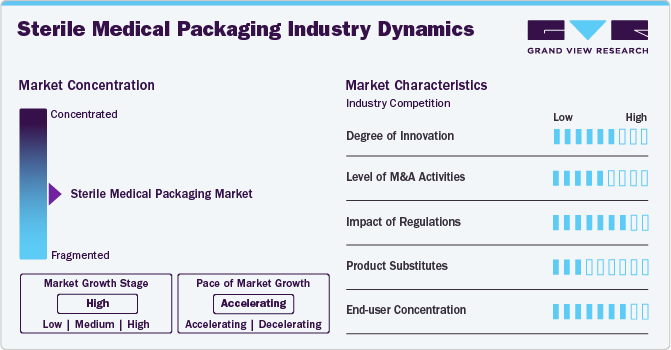

Industry Dynamics

The increasing awareness about infections and the rising demand for single-use medical equipment to mitigate the risk of communicable diseases among patients and healthcare professionals are major drivers of this market. The growing emphasis on maintaining sterility and the surge in the incidence of chronic diseases worldwide are fueling the demand for medical drugs and devices, which in turn is boosting the need for reliable and sophisticated sterile packaging solutions.

Additionally, the expansion into emerging markets, where there is a growing demand for advanced medical solutions and a need for sterile packaging, offers significant opportunities for market growth. The integration of smart packaging technologies, such as RFID tracking and temperature monitoring, is also expected to drive innovation and differentiation in the sterile medical packaging market.

Material Insights & Trends

The plastic segment dominated market with a share of over 45.5% in 2023. Plastic is light in weight, easy to mold, and considerably cheaper than metal and glass. Therefore, end-use companies mainly prefer plastic-based packaging products. Increasing demand for convenience, lightweight, and travel-friendly packaged pharmaceutical products from the pharmaceutical industry is expected to augment the growth of the plastic & polymers material segment in the coming years.

The paper & paperboard segment is expected to grow with the fastest CAGR of 12.3% over the forecast period. The paper & paperboard segment is also expected to be the fastest-growing segment in the sterile medical packaging market, driven by the increasing adoption of paper-based packaging solutions in the pharmaceutical and biologics industry.

Product Insights & Trends

Thermoform trays accounted for the highest revenue share of 26.9% in 2023. The growing demand for single-use medical devices and the increasing emphasis on infection control in healthcare are major drivers fueling the adoption of thermoform trays in the sterile medical packaging market. Based on product, the market is further segmented into Thermoform Trays, Sterile Bottles & Containers, Sterile Closures, Pre-fillable Inhalers, Pre-fillable Syringes, Vials & Ampoules, Blisters & Clamshells, Bags & Pouches, Wraps and others (strip packs).

Blisters & Clamshells is expected to grow at the highest CAGR of 10.6% in coming years. The rising preference for blister packs and clamshells in the medical industry is driven by their ability to reduce packaging costs, eliminate the need for additional cartons, and enhance the overall visual appeal of the packaged product.

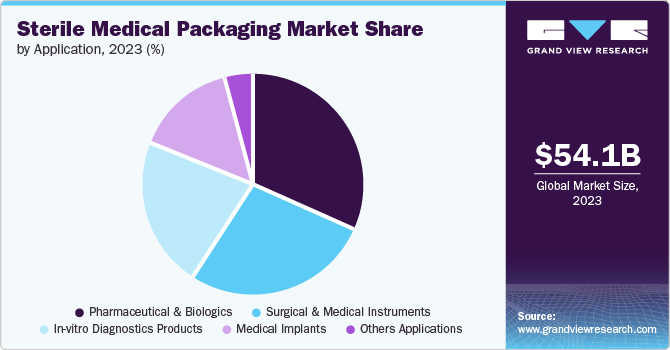

Application Insights & Trends

Based on Application, Market is segmented into Pharmaceutical & Biologics, Surgical & Medical Instruments, In-vitro Diagnostics Products, Medical Implants, and other applications. Among these pharmaceutical & biologics dominated market in 2023 and accounted for a share of over 31.5%. The Pharmaceutical & Biologics segment is a significant and growing part of the Sterile Medical Packaging Market. This segment is expected to continue to dominate the market due to the increasing demand for safe and effective medical treatments.

The In-vitro Diagnostics (IVD) Products segment is a significant and growing part of the Sterile Medical Packaging Market. IVD products are used to diagnose and monitor various diseases and conditions, and they require sterile packaging to ensure the integrity and safety of the products. The demand for sterile packaging in the IVD industry is driven by the increasing need for accurate and reliable diagnostic tests, as well as the growing awareness of the importance of infection control in healthcare industry.

Sterilization Method Insights & Trends

The chemical sterilization accounts for the highest share of over 45% in 2023. The Chemical Sterilization segment is expected to experience significant growth in the Sterile Medical Packaging Market. Chemical sterilization is a widely used method in the healthcare industry, and its demand is expected to rise due to the increasing awareness about infection control and the growing need for sterile packaging solutions. Overall, the chemical sterilization method is expected to play a significant role in the growth of the Sterile Medical Packaging Market, driven by its effectiveness in countering microorganisms and its wide range of applications in the healthcare industry.

Gamma irradiation employs radiation from Cobalt 60 for sterilizing purposes. It is effective for penetrating dense items, making it ideally suited for a wide range of materials and types of packaging. A distinct feature of this technique is its remarkable ability to penetrate deeply, ensuring that even areas within denser products receive the necessary radiation dose. This method is highly efficient in treating diverse products, irrespective of their material composition, density variations, shapes, and positioning.

Regional Insights & Trends

Sterile medical packaging market of North America is projected to grow at a significant rate. The increased production of branded drugs, which demand larger volumes of packaging materials to protect the drug from the external environment stimulus, has further boosted the market.

U.S. Sterile Medical Packaging Market Trends

The U.S. sterile medical packaging market held a significant share in 2023. The growing importance of generic drugs and access to better healthcare services are anticipated to provide lucrative opportunities for the pharmaceutical packaging market in the coming years.

Sterile medical packaging market of Mexico is attributed to the increasing awareness about infection control, the growing demand for single-use medical devices, and the increasing adoption of advanced packaging technologies. Key players in the market include Amcor Group GmbH, Dupont De Nemours Inc., Steripack Group Limited, Wipak Group, and Placon Corporation.

Asia Pacific Sterile Medical Packaging Market Trends

Asia Pacific sterile medical packaging market is the fastest-growing region of the market expanding at a CAGR of 14.3%. The market growth is directly equated with the rise in pharmaceutical consumption in the region. An increase in the establishment of government regulations for drug safety has boosted the pharmaceutical packaging market growth as packaging is an integral element of the drug and is used for maintaining its quality and safety.

The sterile medical packaging market of China dominated the Asia Pacific region. The growth is attributed to the increasing awareness about infection control, the growing demand for single-use medical devices, and the increasing adoption of advanced packaging technologies. The market is also driven by the growing demand for sustainable and eco-friendly packaging solutions

India sterile medical packaging market is expected to grow at the fastest CAGR of 15.3% driven by the increasing demand for sterile medical packaging solutions.

Europe Sterile Medical Packaging Market Trends

The sterile medical packaging market of Europe is majorly driven by increasing demand for safe and effective medical treatments in the region. The growing and aging population in Europe is leading to a surge in the need for pharmaceutical products, medical devices, and other healthcare solutions.

Germany sterile medical packaging market benefits from the latest technology employed in R&D, a long production tradition, and immediate market access to pharmaceuticals. These essential factors are expected to drive the pharmaceutical packaging market in the country over the forecast period.

The sterile medical packaging market of the UK is increasing demand for safe and effective medical treatments is a major driver. The UK's aging population and the growing prevalence of chronic diseases are leading to a surge in the need for pharmaceutical products, medical devices, and other healthcare solutions.

Central & South America Sterile Medical Packaging Market Trends

Central & South America sterile medical packaging market is projected to grow at a significant rate over the forecast period. The increasing demand for safe and effective medical treatments and increasing need for pharmaceutical products, medical devices, and other healthcare solutions is fueling the demand for sterile packaging to ensure the integrity and safety of these critical products.

The sterile medical packaging market of Brazil is growing owing to the prevailing financial constraints in the economy of Brazil, the government is striving toward cost-effective management of the healthcare sector. Various government initiatives are providing a positive scope for preventive medicines and mobile clinics which is anticipated to drive the product demand over the forecast period.

Middle East & Africa Sterile Medical Packaging Market Trends

Middle East & Africa sterile medical packaging market is experiencing growth on the rising awareness about infection control and the importance of maintaining sterile environments in healthcare settings is propelling the market forward. The market is also benefiting from the growing adoption of advanced packaging technologies, such as RFID tracking and temperature monitoring, which enhance supply chain visibility and product traceability.

Key Sterile Medical Packaging Company Insights

The industry is a highly competitive industry with several key players operating globally.

-

US chemicals firm DuPont is the largest material provider for sterile packaging, and it provides packaging for medical equipment and pharmaceutical products through Tyvek. It is a bacteria-resistant, recyclable material that is compatible with most sterilization methods. Through its various subsidiaries and spin-offs, the company has also been responsible for developing several well-known materials including Teflon, Kevlar, Lycra, and Orlon.

-

Australian packaging giant Amcor manufacture in-hospital barrier packaging, and packaging for medical devices, injectables, intravenous fluids, and oral, dermal, ophthalmic, and pulmonary applications. In June 2019, Amcor also completed the biggest acquisition in its 160-year history, merging with US plastic packaging manufacturer Bemis.

Key Sterile Medical Packaging Companies:

The following are the leading companies in the sterile medical packaging market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont De Numors Inc.

- Amcor Plc

- Berry Global Inc.

- Sonoco Products Company

- West Pharmaceutical Services, Inc.

- Billerud AB

- SteriPack Group

- Wipak Oy

- Placon Corporation

- Riverside Medical Packaging Co., Ltd.

- Oracle Packaging

- Nelipak Corporation

- Oliver Healthcare Packaging Company

- Orchid Mps Holdings, Llc

- Technipaq Inc.

- Multivac Sepp Haggenmüller Se & Co. Kg

- Janco, Inc.

- Eagle Flexible Packaging

- Proampac Holdings, Inc.

- Selenium Medical

- PPC Flexible Packaging LLC

- Paxxus, Inc.

- Printpack, Inc.

- Beacon Converters, Inc.

- S.P. Enterprises

- Shanghai Jianzhong Medical Packaging Co., Ltd.

- Sterilmedipac

- Cretex Medical

Recent Developments

-

On May 9, 2024, Berry Global Group invested in additional assets and manufacturing capabilities to increase its healthcare production capacity by up to 30% across three of its European sites. Berry’s Offranville site specializes in the manufacture of best-in-class standard and custom solutions for pharmaceutical packaging and drug delivery devices, such as ophthalmic & nasal products, and Rispharm multi-dose eye dropper. Investments at the Osnago site, which manufactures throat spray actuators, and Sirone site, which manufactures accompanying bottles, will support a growing demand for prescription and over-the-counter orally administered solutions for the prevention and treatment of infections and respiratory diseases driven by rising air pollution levels.

-

In February 2024, Eris Lifesciences acquired Swiss Parenteral to expand in the sterile injectable industry. The Swiss Parenteral has a portfolio of over 100 dossiers across 190 molecules to offer across Asia Pacific, Latin America, and Africa.

-

In November 2023, Coveris launched thermoforming film for medical packaging which is a recyclable and flexible thermoforming film solution called Formpeel P

-

In January 2023, Amcor announced an agreement to acquire Shanghai-based MDK to strengthen its presence in the Asia Pacific medical packaging market mainly in China, India, and Southeast Asian countries.

-

In January 2023, Amcor it has entered into an agreement to acquire Shanghai-based MDK. MDK generates annual sales of approximately USD 50 million and is a leading provider of medical device packaging. The addition of MDK strengthens leadership in the Asia Pacific medical packaging segment, which now comprises four manufacturing sites serving China, India, and Southeast Asia markets.

Sterile Medical Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 59.81 billion

Revenue forecast in 2030

USD 111.98 billion

Growth rate

CAGR of 11% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Million Units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, sterilization method, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

DuPont De Numors Inc.; Amcor Plc. Berry Global Inc.; Sonoco Products Company; West Pharmaceutical Services, Inc.; Billerud AB; SteriPack Group; Wipak Oy; Placon Corporation; Riverside Medical Packaging Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sterile Medical Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the sterile medical packaging market report based on material, product, sterilization method, application, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

High Density Polyethylene (HDPE)

-

Polyester

-

Polypropylene (PP)

-

Polyvinyl Chloride (PVC)

-

Polycarbonate (PC)

-

Polystyrene (PS)

-

Others

-

-

Glass

-

Metal

-

Aluminum Foil

-

Stainless Steel

-

-

Paper & Paperboard

-

Others

-

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Thermoform Trays

-

Sterile Bottles & Containers

-

Sterile Closures

-

Pre-fillable Inhalers

-

Pre-fillable Syringes

-

Vials & Ampoules

-

Blisters & Clamshells

-

Bags & Pouches

-

Wraps

-

Others

-

-

Sterilization Method Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Chemical Sterilization

-

Ethylene Oxide (ETO)

-

Hydrogen Peroxide

-

Others

-

-

Radiation Sterilization

-

Gamma Radiation

-

E-beam

-

Others

-

-

High Temperature/Pressure Sterilization

-

Steam Autoclave

-

Dry Heat

-

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biologics

-

Surgical & Medical Instruments

-

In-vitro Diagnostics Products

-

Medical Implants

-

Other applications

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sterile medical packaging market size was estimated at USD 54.09 billion in 2023 and is expected to reach USD 59.81 billion in 2024.

b. The global sterile medical packaging market is expected to grow at a compound annual growth rate of 11% from 2024 to 2030, reaching USD 111.98 billion by 2030.

b. Thermoform trays had the highest revenue share, 26.9%, in 2023. The growing demand for single-use medical devices and the increasing emphasis on infection control in healthcare are major drivers fueling the adoption of thermoform trays in the sterile medical packaging market.

b. Key Players in the market include DuPont De Numors Inc., Amcor Plc, Berry Global Inc., Sonoco Products Company, West Pharmaceutical Services, Inc., Billerud AB, SteriPack Group, Wipak Oy, Placon Corporation, and Riverside Medical Packaging Co., Ltd.

b. With rapid advances in science and technology, the pharmaceutical industry has been increasing over the past few years, and this trend is anticipated to continue over the forecast period, especially in emerging countries such as China, India, and Brazil.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.