- Home

- »

- Food Additives & Nutricosmetics

- »

-

Steviol Glycoside Market Size & Share, Industry Report, 2030GVR Report cover

![Steviol Glycoside Market Size, Share & Trends Report]()

Steviol Glycoside Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Stevioside, Rebaudioside A, Rebaudioside C, Dulcoside A ), By End Use (Beverage, Food, Medicine, Chemicals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-608-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Steviol Glycoside Market Summary

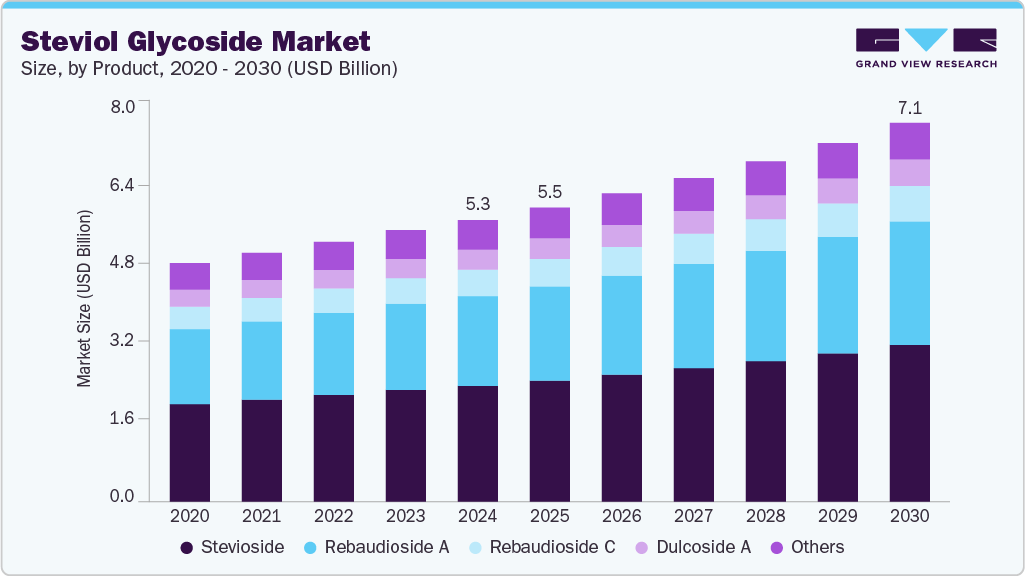

The global steviol glycoside market was estimated at USD 5,312.6 million in 2024 and is projected to reach USD 7,150.6 million by 2030, growing at a CAGR of 5.2% from 2025 to 2030. The steviol glycoside market growth is primarily driven by increasing consumer preference for natural, plant-based sweeteners amid growing health and wellness trends.

Key Market Trends & Insights

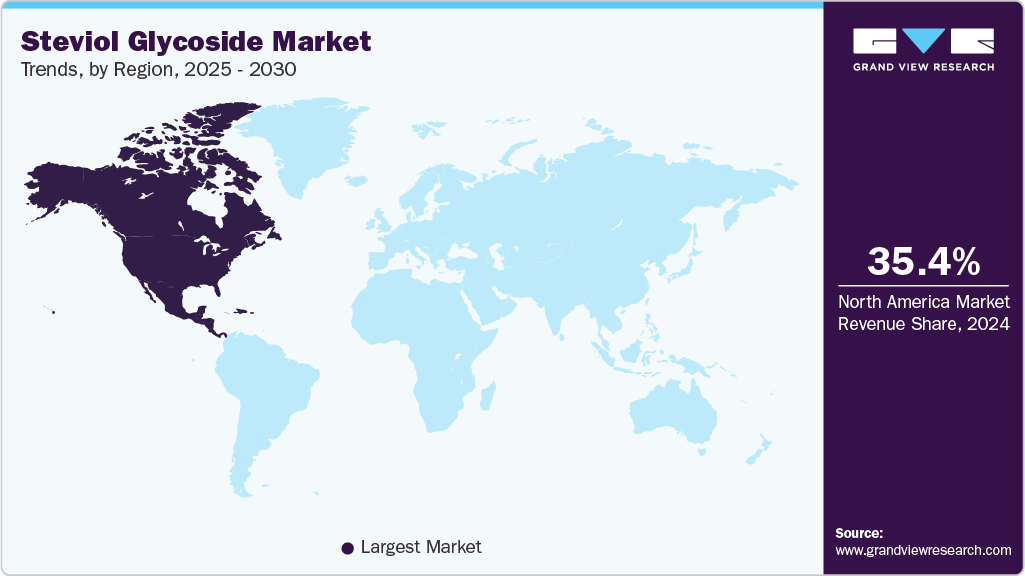

- North America steviol glycoside market dominated the global landscape with a revenue share of 35.4% in 2024.

- The U.S market growth is driven by increasing health concerns related to sugar consumption.

- By product, the stevioside segment led the market and accounted for the largest revenue share of 41.2% in 2024.

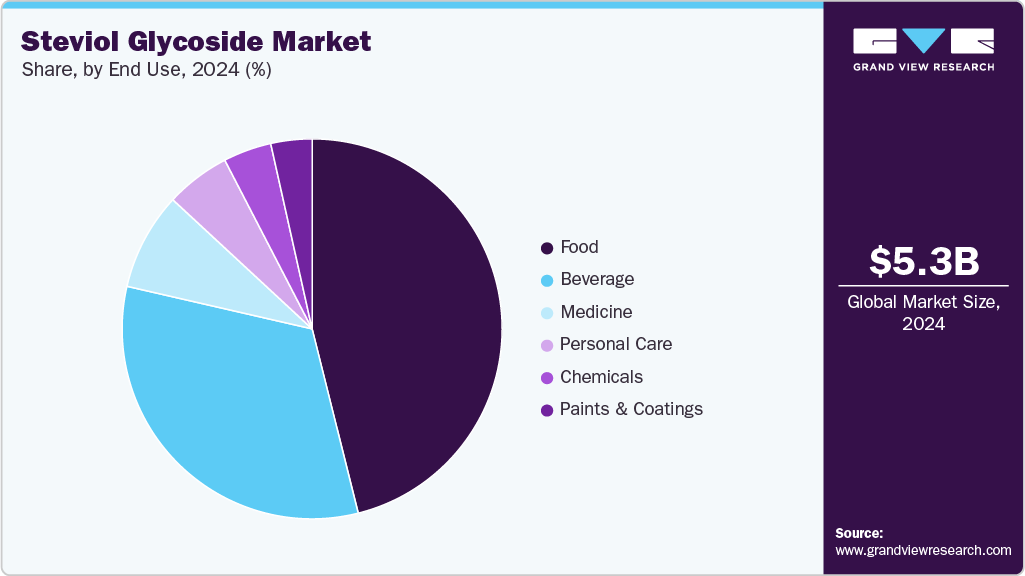

- By end use, the food segment dominated the market with a revenue share of 46.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,312.6 Million

- 2030 Projected Market Size: USD 7,150.6 Million

- CAGR (2025-2030): 5.2%

- North America: Largest market in 2024

- Europe: Fastest growing market

Rising concerns over obesity, diabetes, and excessive sugar intake have prompted a shift toward low-calorie alternatives. In addition, the increasing use of steviol glycosides in food, beverages, and pharmaceuticals significantly contributes to the market’s sustained expansion. Increasing awareness of natural sweeteners over synthetic options is crucial in promoting health-conscious diets, leading to a rise in demand for steviol glycosides, which are naturally derived compounds from the stevia plant. As zero-calorie, non-glycemic sweeteners, steviol glycosides offer a compelling alternative to artificial sweeteners and sugar, appealing to consumers seeking to manage blood sugar levels, reduce caloric intake, and address health concerns such as diabetes and obesity. With the increasing prevalence of these conditions globally, consumers are gravitating toward functional foods, beverages, and supplements that incorporate steviol glycosides to support healthier lifestyles.In response to rising health consciousness, food and beverage manufacturers are increasingly incorporating steviol glycosides into a diverse range of products, including soft drinks, baked goods, dairy items, and dietary supplements. This shift aligns with the robust growth of the global natural sweeteners market, fueled by consumer demand for clean-label, plant-based ingredients, positioning steviol glycosides as a pivotal component in innovative product formulations.

Technological advancements in the extraction and purification of steviol glycosides enhance their taste profile and cost-effectiveness, making them more attractive to manufacturers and consumers. The market for steviol glycosides is also expanding in emerging regions such as Asia-Pacific and South America, where growing health awareness and rising disposable incomes fuel demand for natural, plant-based sweeteners.

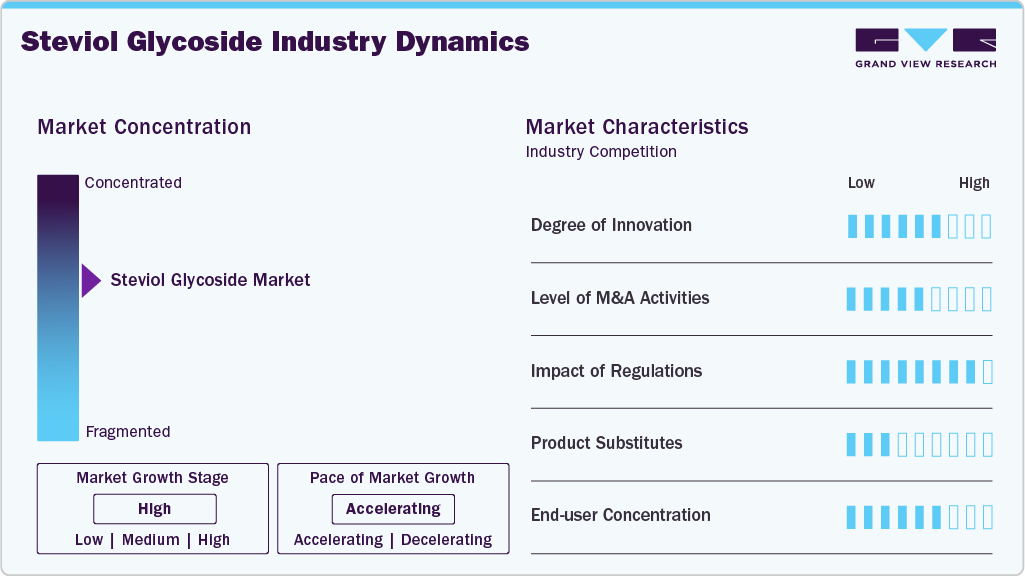

Market Concentration & Characteristics

The steviol glycoside market is moderately consolidated, with a few dominant players such as PureCircle, Cargill, Incorporated, Tate & Lyle, ADM (Archer Daniels Midland), and GLG Life Tech Corp. holding substantial market shares. These key players benefit from integrated supply chains, proprietary extraction and purification technologies, and strong relationships with food and beverage manufacturers. Their established distribution networks and investments in product innovation (e.g., next-gen compounds like Reb M and Reb D) further reinforce their market positions.

The market is witnessing increasing participation from regional and niche players, particularly in Asia-Pacific and Latin America. These entrants often leverage cost-efficient production methods and access to abundant Stevia leaf cultivation in countries like China, India, and Paraguay. These dynamics foster price competition, especially in the bulk or commodity-grade segment of steviol glycosides such as Reb A.

The market is technology-intensive, with ongoing R&D in fermentation-based production aiming to produce rare steviol glycosides at scale with better taste profiles. Innovation in blended sweetener systems, combining stevia with monk fruit, erythritol, or allulose, is also reshaping competitive dynamics and product development strategies.

Product Insights

The stevioside segment led the market and accounted for the largest revenue share of 41.2% in 2024.This growth is driven by the rising demand for natural, zero-calorie sweeteners amid increasing health consciousness and growing diabetes prevalence worldwide. Stevioside, derived from Stevia rebaudiana, is widely used as a sugar substitute in food and beverage formulations. Its regulatory approvals across major markets, such as the U.S., EU, and Asia-Pacific, coupled with the shift toward clean-label products, have further accelerated its adoption.

The Rebaudioside A segment is rising due to its superior sweetness profile and minimal bitter aftertaste compared to other steviol glycosides. Its high purity and stability make it a preferred choice in beverages, dairy, and tabletop sweeteners. The growing demand for sugar reduction in processed foods, especially in North America and Europe, has fueled its adoption. Additionally, increasing regulatory approvals and consumer preference for clean-label, plant-derived ingredients are key drivers of Rebaudioside A’s market growth.

End Use Insights

The food segment dominated the market with a revenue share of 46.1% in 2024. This growth is driven by the rising popularity of natural and functional ingredients, which has bolstered demand for steviol glycosides in food products ranging from baked goods to dairy alternatives. Urbanization, improved purchasing power, and growing health awareness have shifted consumer preferences toward naturally sweetened, convenient food choices. As access to nutrition education expands, steviol glycosides are set to accelerate to meet evolving dietary trends.

The beverage segment accounted for the market revenue share of 32.5% in 2024 and is projected to grow rapidly during the forecast period. The escalating demand for clean-label and low-calorie drink options drives this growth. As global consumers become more health-conscious and seek to reduce sugar intake, beverages sweetened with steviol glycosides have gained strong traction. This trend has encouraged manufacturers to expand their product lines with stevia-based formulations, leading to greater market demand and increased consumption.

Regional Insights

North America steviol glycoside market dominated the global landscape with a revenue share of 35.4% in 2024. This growth is due to the increasing consumer awareness about health and wellness. The rise of sugar taxes, clean-eating movements, and keto or diabetic diets influence product reformulation using natural alternatives. Key regional players are expanding their offerings, and multi-national beverage and food brands are boosting visibility and availability of steviol glycoside-sweetened products.

U.S. Steviol Glycoside Market Trends

The U.S market growth is driven by increasing health concerns related to sugar consumption, which are accelerating the shift toward natural sweeteners like steviol glycosides. The market is particularly strong in the beverage segment, including carbonated drinks, flavored waters, and sports drinks. Rising healthcare costs, obesity rates, and growing demand for label transparency have positioned steviol glycosides as a key ingredient in health-focused product formulations.

Asia Pacific Steviol Glycoside Market Trends

Thesteviol glycoside market growth in this region is highly diverse and dynamic, driven by robust agricultural production in China, rising health awareness in India, and advanced product adoption in Japan and South Korea. Rising health consciousness, rapid urbanization, and increasing demand for natural sweeteners in functional foods and beverages are also key contributors to the market’s growth. Strong government support, clean-label trends, and continuous regional innovation further accelerate market expansion and broaden application across multiple industries.

The China steviol glycoside market continues to expand due to growing consumer demand for plant-based, low-calorie sweeteners. The rapid growth of China's food and beverage sector, especially in RTD (ready-to-drink) teas, functional drinks, and low-sugar snacks, is a significant growth driver. Favorable government policies, expanding stevia cultivation, and the country’s position as the largest global exporter of steviol glycosides further strengthen market potential.

Europe Steviol Glycoside Market Trends

Europe’s steviol glycoside market is expected to grow at a CAGR of 5.2% during the forecast period. This growth is primarily driven by increasing consumer demand for natural, low-calorie sweeteners and clean-label products. Health-conscious trends, sugar reduction initiatives, and ongoing innovation in food and beverage formulations are accelerating adoption across major European countries. European food manufacturers rely heavily on imported stevia leaves, which are processed into high-purity glycosides like Reb M and Reb D, impacting regional pricing dynamics and stimulating product innovation throughout the continent.

The Germany steviol glycosides market growth is driven by consumer demand for organic, clean-label foods. The country’s advanced food processing sector-particularly in dairy products, soft drinks, and baked goods-is integrating these natural sweeteners in reformulated product lines. Regulatory support, health-conscious food trends, and ongoing innovation in formulations also contribute to its growth.

Latin America Steviol Glycoside Market Trends

Latin America’s steviol glycoside market benefits from the region’s long-standing familiarity with stevia, especially in countries like Paraguay and Brazil, where the plant is native. Increasing consumer interest in natural and low-calorie sweeteners, along with growing concerns about sugar intake and diabetes, is driving demand. The food and beverage sector is actively reformulating products to meet health-conscious preferences. Regulatory support and rising exports are also contributing to market expansion. However, pricing fluctuations and limited awareness in some areas still pose challenges. Overall, Latin America presents significant growth potential for steviol glycosides across mainstream and niche product categories.

Middle East & Africa Steviol Glycoside Market Trends

The Middle East & Africa steviol glycoside market is gradually growing, driven by rising awareness of lifestyle-related health issues such as obesity and diabetes. Urbanization and the growing middle class are increasing demand for healthier food and beverage alternatives. Government-led health initiatives and an expanding retail sector support the adoption of natural sweeteners. However, market penetration remains uneven due to limited local production and high import dependency. As multinational brands introduce stevia-based products and consumer education improves, the region is expected to see steady growth in demand for clean-label and low-calorie sweetener solutions.

Key Steviol Glycoside Company Insights

Some of the key players operating in the market include PureCircle (a part of Ingredion), Cargill, Incorporated, and Tate & Lyle.

-

PureCircle, a stevia ingredient manufacturer, is headquartered in Malaysia and operates globally as a part of Ingredion Incorporated (USA). The company focuses on sustainability, vertical integration, and innovation in steviol glycoside extraction and application. It has partnered with major global food and beverage brands to deliver natural, zero-calorie sweetening solutions. It is renowned for its proprietary technologies that extract and purify high-intensity sweeteners like Reb M and Reb D from stevia leaves. With an extensive supply chain and R&D capabilities, it offers tailored solutions for clean-label and sugar-reduced product lines, making it a preferred supplier for multinational manufacturers.

-

Cargill,Incorporated, established in 1865, is a global food and agribusiness conglomerate with operations in more than 70 countries. Its broad product portfolio spans sweeteners, oils, proteins, and specialty ingredients. Its ingredient offerings emphasize sustainability, innovation, and health-focused solutions. Cargill’s steviol glycoside business, especially through its EverSweet™ range, is at the forefront of fermentation-derived sweetener innovation. Partnering with DSM under the Avansya joint venture, it produces Reb M and Reb D commercially using non-GMO yeast fermentation. Its technology offers better taste and consistency, making it a major supplier to beverage and food giants worldwide.

GLG Life Tech Corp. and HOWTIAN are some of the emerging market participants in the steviol glycoside market industry.

-

GLG Life Tech Corp. is a Canadian-based company that produces high-purity stevia and monk fruit extracts for use in food, beverage, and nutraceutical products. With vertically integrated operations in China, GLG controls every production stage-from leaf cultivation to final ingredient processing-ensuring traceability, quality, and sustainability. The company offers a wide range of steviol glycosides, including Reb A, Reb M, and custom blends tailored to meet specific taste and performance requirements. GLG supplies global brands with natural, calorie-free sweetening solutions and is recognized for its innovation in agricultural practices, extraction technologies, and cost-efficient formulation development.

-

HOWTIAN is a global producer of natural sweeteners and plant-based ingredients. Established in 1999, the company has evolved from a small inositol manufacturer into a global stevia producer, operating in over 80 countries. HOWTIAN's vertically integrated operations encompass stevia cultivation, extraction, and formulation, ensuring quality control and sustainability throughout the supply chain. The company's flagship product line, SoPure™, offers a range of high-purity steviol glycosides, including Reb A, Reb D, and Reb M.

Key Steviol Glycoside Companies:

The following are the leading companies in the steviol glycoside market. These companies collectively hold the largest market share and dictate industry trends.

- PureCircle (a part of Ingredion)

- Cargill, Incorporated

- Tate & Lyle

- ADM (Archer Daniels Midland)

- GLG Life Tech Corp.

- HOWTIAN

- Evolva Holding SA

- Stevia First Corp.

- Sunwin Stevia International Inc

- Kerry Group plc.

- FUJIFILM Wako Pure Chemical Corporation

- GLSTEVIA

- MORITA KAGAKU KOGYO CO., LTD.

- Zydus Wellness.com

- Whole Earth Brands

- Daepyung Co., Ltd.

Recent Development

-

In June 2024, Ingredion Incorporated announced that UK food safety regulators have approved using PureCircle by Ingredion’s steviol glycosides, produced through bioconversion, expanding access to the most flavorful stevia molecules for food and beverage applications.

-

In May 2024, HOWTIAN introduced SoPure Andromeda, a new addition to its top-rated SoPure line of stevia products, featuring exclusive stevia combinations specially formulated and improved for various beverage applications.

Steviol Glycoside Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,550.5 million

Revenue forecast in 2030

USD 7,150.6 million

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

PureCircle (a part of Ingredion); Cargill, Incorporated; Tate & Lyle; ADM (Archer Daniels Midland); GLG Life Tech Corp.; HOWTIAN; Evolva Holding SA; Stevia First Corp.; Sunwin Stevia International Inc.; Kerry Group plc.; FUJIFILM Wako Pure Chemical Corporation; GLSTEVIA; MORITA KAGAKU KOGYO CO., LTD.; Zydus Wellness.com; Whole Earth Brands; Daepyung Co.,Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steviol Glycoside Market Report Segmentation

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global steviol glycoside market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Stevioside

-

Rebaudioside A

-

Rebaudioside C

-

Dulcoside A

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Beverage

-

Food

-

Medicine

-

Chemicals

-

Paints & Coatings

-

Personal Care

-

- Region Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global steviol glycoside market size was estimated at USD 5,312.6 million in 2024 and is expected to reach USD 5,550.5 million in 2025.

b. The global steviol glycoside market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 7,150.6 million in 2030.

b. North America steviol glycoside market dominated the global landscape with a revenue share of 35.4% in 2024. This growth is due to the increasing consumer awareness about health and wellness. The rise of sugar taxes, clean-eating movements, and keto or diabetic diets are influencing product reformulation using natural alternatives.

b. Some key players operating in the steviol glycoside market include PureCircle (a part of Ingredion), Cargill, Incorporated, Tate & Lyle, ADM (Archer Daniels Midland), GLG Life Tech Corp., HOWTIAN, Evolva Holding SA, Stevia First Corp., Sunwin Stevia International Inc, Kerry Group plc., FUJIFILM Wako Pure Chemical Corporation, GLSTEVIA, MORITA KAGAKU KOGYO CO., LTD., Zydus Wellness.com, Whole Earth Brands, Daepyung Co.,Ltd.

b. Market growth of steviol glycoside is driven by increasing consumer preference for natural, plant-based sweeteners amid growing health and wellness trends. Rising concerns over obesity, diabetes, and excessive sugar intake have prompted a shift toward low-calorie alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.