- Home

- »

- Medical Devices

- »

-

Stoma Care Market Size, Share And Trends Report, 2030GVR Report cover

![Stoma Care Market Size, Share & Trends Report]()

Stoma Care Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Closed Bags, Open/Drainable Bags, One-piece Bags. Two-piece Bags), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-488-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stoma Care Market Summary

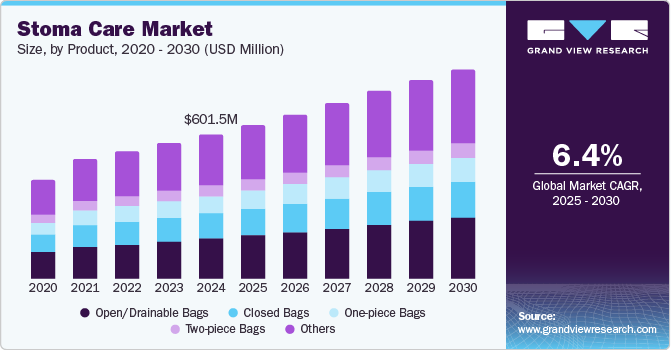

The global stoma care market size was estimated at USD 601.5 million in 2024 and is projected to reach USD 873.2 million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The growing awareness of ostomy care coupled with favorable reimbursement policies in developed nations has created a conducive environment for the industry.

Key Market Trends & Insights

- The stoma care market in the U.S. dominated the North America stoma care market with a revenue share of 75.2% in 2024.

- Europe stoma care market dominated the global market with a revenue share of 47.2% in 2024.

- Asia Pacific stoma care market is expected to register the fastest CAGR of 6.1% in the forecast period.

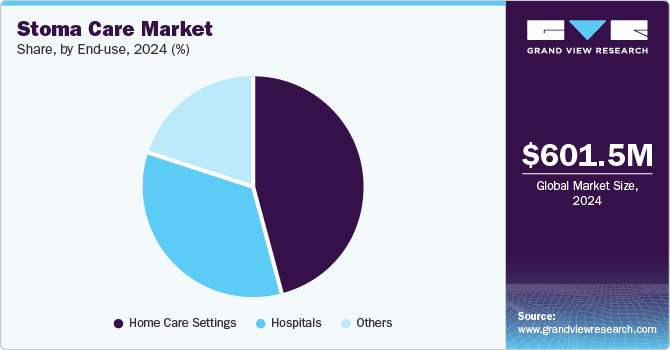

- Based on end-use, home care settings held the largest revenue share of 46.2% in 2024.

- In terms of application, the colostomy segment dominated the market and accounted for a share of 44.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 601.5 Million

- 2030 Projected Market Size: USD 873.2 Million

- CAGR (2025-2030): 6.4%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Enhanced awareness and support programs encourage more patients to pursue treatment solutions, while attractive reimbursement structures facilitate access to essential stoma care products. According to the CDC, the estimated prevalence of IBD in the U.S. ranges between 2.4 and 3.1 million, reflecting a diverse burden across different demographic groups. As of 2023, Canada reports an IBD prevalence of 825 per 100,000 population (410 per 100,000 for Crohn’s disease and 414 per 100,000 for ulcerative colitis). The increasing incidence of these conditions directly correlates with an elevated demand for ostomy procedures and associated care products, positioning this market for sustained growth.

In tandem with the rising IBD prevalence, the aging population is another significant factor contributing to the demand for stoma care products. Individuals become more susceptible to conditions that necessitate ostomy surgeries as they age. This demographic shift not only increases the overall patient population requiring stoma care but also creates an opportunity for market players to tailor products and services to meet the unique needs of elderly patients, further driving market expansion.

Technological advancements in stoma care products are also key to market growth. Innovations such as enhanced pouching systems, improved accessories, and user-friendly designs lead to greater patient comfort and satisfaction. As these products continue to evolve, they offer patients and healthcare providers improved functionality and reliability, thereby increasing adoption rates within the market. This emphasis on technology enhances the overall patient experience and sets the stage for further market development.

Product Insights

Open/drainable bags dominated the market and accounted for a share of 27.9% in 2024. Open and drainable bags are engineered for convenient collection and disposal of bodily waste, enhancing user-friendliness for patients. Their affordability and superior accessibility compared to closed systems further drive their popularity. Moreover, the increasing prevalence of conditions such as bladder cancer, urinary incontinence, and spinal cord injuries underscores the need for effective waste collection solutions.

The closed bags segment is expected to grow significantly over the forecast period. Closed bags are designed for discretion and odor-proof performance, instilling confidence in patients during social interactions. Enhanced with built-in filters to neutralize odors, these products prioritize user comfort. Technological advancements have further optimized their design, driving demand amid the rising prevalence of conditions such as colorectal cancer and inflammatory bowel diseases.

Application Insights

The colostomy segment dominated the market and accounted for a share of 44.9% in 2024. The WHO projects that by 2040, the incidence of colorectal cancer will rise to 3.2 million new cases annually, representing a 63% increase, while deaths will reach 1.6 million, marking a 73% increase. This trend, combined with an aging population more susceptible to conditions necessitating colostomies, significantly boosts market demand. Technological advancements in colostomy products further enhance patient comfort and usability.

Ileaostomies are expected to register the fastest CAGR of 7.0% over the forecast period, aided by the rising prevalence of IBDs such as Crohn’s disease and ulcerative colitis, which often require ostomy surgeries for effective management. As more patients undergo ileostomy procedures, the need for reliable ostomy care products and accessories with secure seals will significantly grow.

End-use Insights

Home care settings held the largest revenue share of 46.2% in 2024. Home care facilitates personalized attention, empowering patients to engage in their care plans and achieve improved health outcomes. This trend enhances patient-centered care, satisfaction, and healthcare efficiency. Moreover, home care minimizes ostomy-related complications and emergency hospital visits, offering cost-effectiveness while allowing patients to recover comfortably with ongoing professional support.

Hospitals are projected to grow rapidly over the forecast period, owing to the rising prevalence of chronic conditions, particularly inflammatory bowel diseases and colorectal cancer, which often require ostomy procedures. Enhanced stoma care products, favorable reimbursement policies, and comprehensive training for healthcare professionals contribute to improved patient outcomes and service appeal.

Regional Insights

North America stoma care market held substantial market share in 2024, owing to the rising prevalence of chronic conditions necessitating ostomy surgeries, including colorectal cancer and inflammatory bowel diseases. Factors such as advanced healthcare infrastructure, heightened awareness of ostomy care, an expanding geriatric population, and technological innovations in stoma care products significantly enhance patient comfort and outcomes.

U.S. Stoma Care Market Trends

The stoma care market in the U.S. dominated the North America stoma care market with a revenue share of 75.2% in 2024. The increasing prevalence of chronic conditions, including colorectal cancer and inflammatory bowel diseases, necessitates more ostomy surgeries. Contributing factors such as advanced healthcare infrastructure, heightened awareness of ostomy care, and an expanding geriatric population further amplify demand. Technological innovations in stoma care products enhance patient comfort and outcomes nationwide.

Europe Stoma Care Market Trends

Europe stoma care market dominated the global market with a revenue share of 47.2% in 2024. The increasing incidence of inflammatory bowel diseases and colorectal cancer is driving the frequency of ostomy procedures. Strong healthcare systems and favorable reimbursement policies further support market expansion. Moreover, heightened public awareness campaigns regarding ostomy care have significantly contributed to the region’s popularity.

The stoma care market in Germany dominated the Europe stoma care market in 2024. Germany’s high incidence of inflammatory bowel diseases and colorectal cancer significantly drives market growth, resulting in more ostomy procedures. The nation features a robust healthcare system that supports advanced stoma care solutions, alongside public health initiatives and supportive reimbursement policies. Furthermore, rising disposable incomes facilitate improved access to ostomy products and services.

Asia Pacific Stoma Care Market Trends

Asia Pacific stoma care market is expected to register the fastest CAGR of 6.1% in the forecast period. Countries such as China and India are experiencing rising demand for stoma care solutions, driven by elevated rates of bladder and colorectal conditions. The enhancement of healthcare infrastructure and government initiatives to improve access to ostomy care further accelerate market growth in this region.

The stoma care market in China dominated the Asia Pacific stoma care market in 2024. The growing geriatric population is increasingly vulnerable to conditions necessitating ostomy surgeries. Heightened awareness of ostomy care products fuels demand, particularly for colostomy and ileostomy solutions. Government initiatives aimed at enhancing healthcare access further stimulate market growth. As patients seek effective management for bladder and colorectal issues, China’s focus on stoma care is anticipated to expand during the forecast period.

Key Stoma Care Company Insights

Some key companies operating in the market include ALCARE Co., Ltd.; B. Braun Medical Inc.; Coloplast Group; Cymed; ConvaTec Group PLC; Hollister Incorporated; among others. Strategic initiatives encompass mergers and acquisitions, collaborative research and development partnerships, and the launch of innovative stoma care products to enhance market competitiveness.

-

ALCARE offers the development and manufacturing of stoma care products such as ostomy bags and accessories, prioritizing patient comfort and quality with their designs, materials, and effective stoma management.

-

Coloplast provides varied ostomy products, including bags, skin barriers, and accessories. The company is recognized for its SenSura Mio line, enhancing fitness and comfort.

Key Stoma Care Companies:

The following are the leading companies in the stoma care market. These companies collectively hold the largest market share and dictate industry trends.

- ALCARE Co., Ltd.

- B. Braun Medical Inc.

- Coloplast Group

- Cymed

- ConvaTec Group PLC

- Hollister Incorporated

- Marlen Manufacturing & Development Company

- Nu-Hope Laboratories, Inc.

- Perma-Type Company, Inc.

- Salts Healthcare

- Welland Medical Limited

- Torbot Group, Inc.

Recent Developments

-

In September 2024, B. Braun Medical received FDA 510(k) clearance for the Introcan Safety 2 Deep Access IV Catheter, featuring enhanced dwell time, automatic needlestick protection, and multi-access blood control.

-

In February 2024, Convatec launched the Esteem Body with Leak Defense in Italy, introducing a one-piece soft convexity ostomy system designed for diverse body types and enhanced patient care.

Stoma Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 641.2 million

Revenue forecast in 2030

USD 873.2 million

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ALCARE Co., Ltd.; B. Braun Medical Inc.; Coloplast Group; Cymed; ConvaTec Group PLC; Hollister Incorporated; Marlen Manufacturing & Development Company; Nu-Hope Laboratories, Inc.; Perma-Type Company, Inc.; Salts Healthcare; Welland Medical Limited; Torbot Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

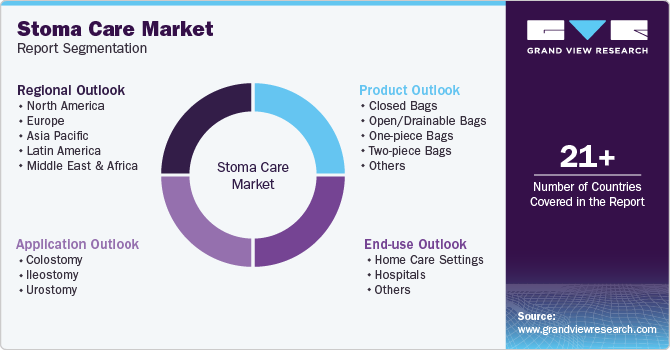

Global Stoma Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global stoma care market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Closed Bags

-

Open/Drainable Bags

-

One-piece Bags

-

Two-piece Bags

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Colostomy

-

Ileostomy

-

Urostomy

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Care Settings

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.