- Home

- »

- Pharmaceuticals

- »

-

Stomach Cancer Treatment Market Size & Share Report, 2030GVR Report cover

![Stomach Cancer Treatment Market Size, Share & Trends Report]()

Stomach Cancer Treatment Market Size, Share & Trends Analysis Report By Treatment Type, By Disease Indication, By Route Of Administration, By Drug Class, By Distribution Channel, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-973-9

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

The global stomach cancer treatment market size was valued at USD 3.83 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.9% from 2022 to 2030. Gastric cancer is one of the leading causes of cancer-related deaths and the fifth most common malignancy worldwide. According to Globocan, around 1.1 million new cases of the disease were diagnosed worldwide in 2020. The increase in disease burden and approval of pipeline candidates are anticipated to propel the growth of the market during the forecast period.

COVID-19 had a detrimental impact on cancer care. According to the National Center for Biotechnology Information (NCBI), the COVID-19 pandemic led to delays in diagnosis. Most hospitals and centers de-prioritized non-COVID-19 treatments during the initial phases of the pandemic. For instance, hospitalization for chemotherapy declined by 60% in England in the second and third quarters of 2020. However, increased adoption of recently launched products such as Enhertu and Opdivo in several countries and increased diagnosis rate beyond the COVID-19 pandemic are anticipated to fuel market growth.

Lifestyle changes such as smoking and alcoholism, an increase in obesity, and an increasing prevalence of gastroesophageal reflux disease all act as risk factors for gastric cancer. The incidence of the disease is the highest in the Asia Pacific, followed by Europe.

Targeted drugs such as Herceptin and Cyramza are frequently used for treating gastric cancer in developed countries such as the U.S., whereas chemotherapy is still the standard of care in developing countries such as China and India. There are few agents approved for treating advanced metastatic stages of the disease. However, the approval of PD-1 inhibitors such as Opdivo and Keytruda is expected to change the management of advanced metastatic stages of the disease.

The approval of new targeted and immunotherapy drugs is expected to fuel the market growth during the forecast period. For instance, in April 2021, the U.S. FDA approved Opdivo (nivolumab) for the initial treatment of patients with metastatic or advanced GC/GEJC. Similarly, in January 2021, the U.S. FDA approved Enhertu, an antibody-drug conjugate product for treating HER-2-positive metastatic gastric cancers.

However, the launch of biosimilars for Herceptin is expected to restrain the market growth. Biosimilars such as Biocon/Mylan’s Ogivri were approved in December 2017 in the U.S., followed by Celltrion/Teva’s Herzuma in December 2018. In addition, Samsung Bioepis’s trastuzumab biosimilar, Ontruzant, was approved in January 2019, and Trazimera was approved in March 2019 in the U.S. As a result of the launch of biosimilars, Herceptin sales declined by 14% in 2019 and 49% in 2020 for all indications combined.

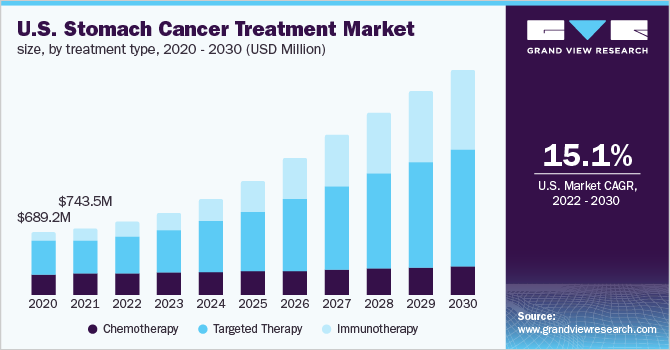

Treatment Type Insights

The chemotherapy segment held the largest revenue share of the gastric cancer therapy market at over 40.0% in 2021 due to a high prescription rate. First-line therapy for patients diagnosed in early stages is generally surgery with adjuvant chemotherapy or neoadjuvant chemotherapy. An article suggests that around 65% of patients with advanced cancers, 85% with lymph node metastases, and 40% with metastatic disease undergo surgical procedures. Chemotherapy can be given either as neoadjuvant chemotherapy or adjuvant chemotherapy to shrink the tumor or kill the cancerous cells. Based on treatment type, the market is segmented into chemotherapy, immunotherapy, and targeted therapy.

The targeted therapy segment is expected to account for the largest share of the gastric cancer drugs market by the end of the forecast period, owing to product launches, recent advancements in the field of targeted therapy, and a robust clinical pipeline. On the other hand, the patent expiry of Herceptin is restraining the growth of this segment.

The immunotherapy segment is expected to witness the fastest growth during the forecast period due to increasing product launches. For instance, in March 2020, Bristol-Myers Squibb Company’s drug for Opdivo received approval for stomach cancer treatment in China. Another key immunotherapy drug approved is Keytruda. Immunotherapy in combination with chemotherapy is generally used as a third-line or fourth-line treatment option.

Route of Administration Insights

The injectable segment dominated the gastric cancer therapy market with a revenue share of over 90.0% in 2021. Most of the chemotherapy drugs, targeted drugs, and immunotherapy drugs are available in injectable form, leading to the dominance of this segment.

The oral segment is expected to expand at the highest rate during the forecast period. In order to overcome the cumbersome IV administration, many companies are developing oral chemotherapy agents for treatment. For instance, Ascelia Pharma is currently conducting Phase II clinical trials for the use of Oncoral (oral irinotecan) for the treatment of gastric cancer.

Drug Class Insights

The other drug classes segment accounted for the largest share of the gastric cancer drugs market of over 60.0% in 2021. Chemotherapy currently accounts for the largest share in this segment. Chemotherapy is still widely used as a first-line treatment in countries such as China and India, which have the highest prevalence of gastric cancer.

The PD-1/PD-L1 inhibitors segment is expected to expand at the fastest CAGR during the forecast period. The approval and increasing uptake of Keytruda and Opdivo for gastric cancer therapy are driving this segment. In addition to this, the NMPA approved TYVYT (sintilimab) for the treatment of gastric cancer in China in June 2021.

Distribution Channel Insights

The specialty and retail pharmacies segment dominated the gastric cancer therapy market in 2021 with a revenue share of over 65.0%. Most of the drugs used for the treatment of gastric cancer are distributed via specialty pharmacies as they have to be stored and distributed under specific conditions. For instance, in June 2021, Blueprint Medicines recently selected PANTHERx Rare Pharmacy and Biologics, by McKesson, for the distribution of its GIST treatment drug AYVAKIT. Based on the distribution channel, the market has been segmented into hospital pharmacies, specialty and retail pharmacies, and others.

The hospital pharmacies segment accounted for the second-largest share in 2021. Most patients with gastric cancer undergo inpatient administration of treatment in developing nations. This is one of the major factors fueling the growth of this segment.

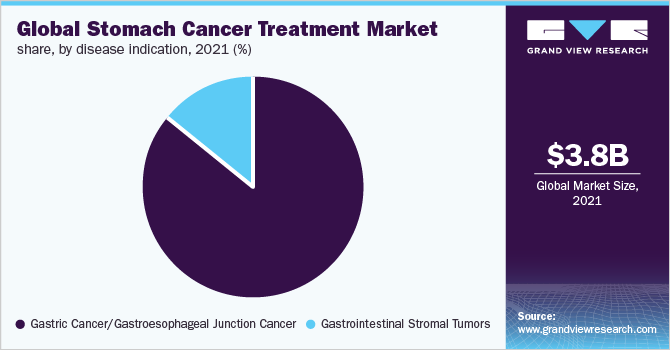

Disease Indication Insights

The GC/GEJC segment held the largest revenue share of over 85.0% in 2021. The high disease burden coupled with a large number of approved products for this indication is contributing to the growth of this segment. According to Globocan, the 5-year prevalence of stomach cancer was around 1.8 million in 2020. Based on disease indication, the market is segmented into gastric cancer/gastroesophageal junction cancer (GC/GEJC) and gastrointestinal stromal tumors.

The gastrointestinal stromal tumors (GISTs) segment is estimated to witness moderate growth during the forecast period. GISTs are rare cancers and around 4,000 to 6,000 new cases are diagnosed every year in the U.S. Targeted drugs such as Ayvakit, Gleevec, Stivarga, and Qinlock are used for the treatment of GISTs.

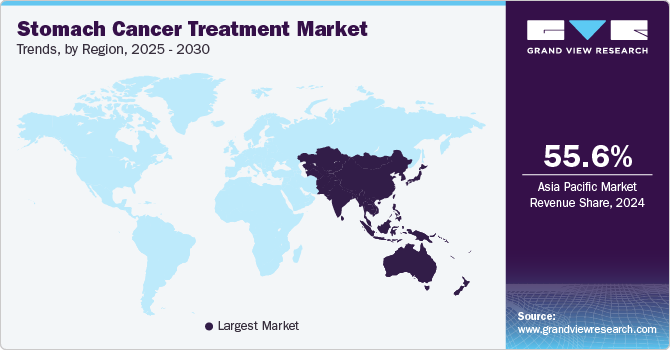

Regional Insights

Asia Pacific dominated the gastric cancer therapy market in 2021 with a revenue share of over 55.0%. This is mainly due to the higher prevalence of gastric cancer in this region. For instance, in 2020, the number of new cases in Japan was around 138,000, and in China, it was around 479,000. In countries such as China, chemotherapy is still the most preferred treatment option; however, the presence of a strong product pipeline and the expected approval of the products will boost regional growth during the forecast period. For instance, in September 2021, AstraZeneca and Daiichi Sankyo Company dosed the first HER-2 positive gastric cancer patient in Phase II trials of Enhertuin China.

Europe is estimated to witness considerable growth during the forecast period due to increasing investments in the development of advanced treatment options and the rising target patient population. For instance, in October 2021, the European Commission approved Bristol Myers Squibb’s Opdivo for the treatment of gastrointestinal junction cancer.

Key Companies & Market Share Insights

Companies in the gastric cancer therapy market are engaging in strategic initiatives such as partnerships and new product launches to increase and retain market share. For instance, in April 2021, the U.S. FDA approved Bristol-Myers Squibb Company’s product Opdivo in combination with fluoropyrimidine- and platinum-containing chemotherapy for the treatment of metastatic gastric cancer. Some prominent players in the global stomach cancer treatment market include:

-

Novartis AG

-

Pfizer, Inc.

-

Mylan N.V.

-

F. Hoffmann La Roche Ltd.

-

Eli Lilly And Company

-

Merck & Co., Inc.

-

Teva Pharmaceutical Industries Ltd.

-

Celltrion Healthcare Co., Ltd.

-

Samsung Bioepis

-

Bristol Myers Squibb Company

Stomach Cancer Treatment Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.25 billion

Revenue forecast in 2030

USD 11.2 billion

Growth Rate

CAGR of 12.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, patient share (%), and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment type, disease indication, route of administration, drug class, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Novartis AG; Pfizer, Inc.; Mylan N.V.; F. Hoffmann La Roche Ltd.; Eli Lilly and Company; Merck & Co., Inc.; Teva Pharmaceutical Industries Ltd.; Celltrion Healthcare Co., Ltd; Samsung Bioepis; Bristol Myers Squibb Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stomach Cancer Treatment Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global stomach cancer treatment market report on the basis of treatment type, disease indication, route of administration, drug class, distribution channel, and region:

-

Treatment Type Outlook (Patient Share (%); Revenue, USD Million, 2018 - 2030)

-

Immunotherapy

-

Targeted Therapy

-

Chemotherapy

-

Radiation Therapy And Surgery (Qualitative Analysis Only)

-

-

Disease Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Gastric Cancer/Gastroesophageal Junction Cancer

-

Gastrointestinal Stromal Tumors

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

-

Drug Class Outlook (Patient Share, (%); Revenue, USD Million, 2018 - 2030)

-

PD-1/PD-L1 Inhibitors

-

HER2 Antagonists

-

VEGFR2 Antagonists

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Specialty & Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global stomach cancer treatment market size was estimated at USD 3.83 billion in 2021 and is expected to reach USD 4.25 billion in 2022.

b. The global stomach cancer treatment market is expected to witness a compound annual growth rate of 12.86% from 2022 to 2030 to reach USD 11.2 billion in 2030.

b. Based on disease indication, the gastric cancer & gastroesophageal junction cancer segment held the largest share of 85.47% in 2021 owing to high prevalence of the disease.

b. Some key players operating in the stomach cancer treatment market include Novartis AG; Pfizer, Inc.; Mylan N.V.; F. Hoffmann La Roche Ltd.; Eli Lilly and Company; Merck & Co., Inc.; Teva Pharmaceutical Industries Ltd.; Celltrion Inc.; Samsung Bioepis; and Bristol Myers Squibb Company.

b. The major factors driving the market growth are the rising incidence of stomach cancer and the launch & adoption of targeted and immunotherapy drugs for the treatment of stomach cancer.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."